Why is AML training critical for your employees?

Awareness of money laundering threats and mitigating measures is essential for any company to safeguard the business from being exploited by financial criminals. Awareness of threats allows people to use the right action plans to combat the same.

AML Compliance Officer cannot single-handedly identify and fight the money laundering threats. He needs support from every single employee of the company. And here comes the need to train the employees. If you train your employees on money laundering threats, they can take steps to manage or reduce ML/FT risks. AML training is crucial to any organization’s overall AM/CFT framework.

The legal requirement of AML training under UAE regulations

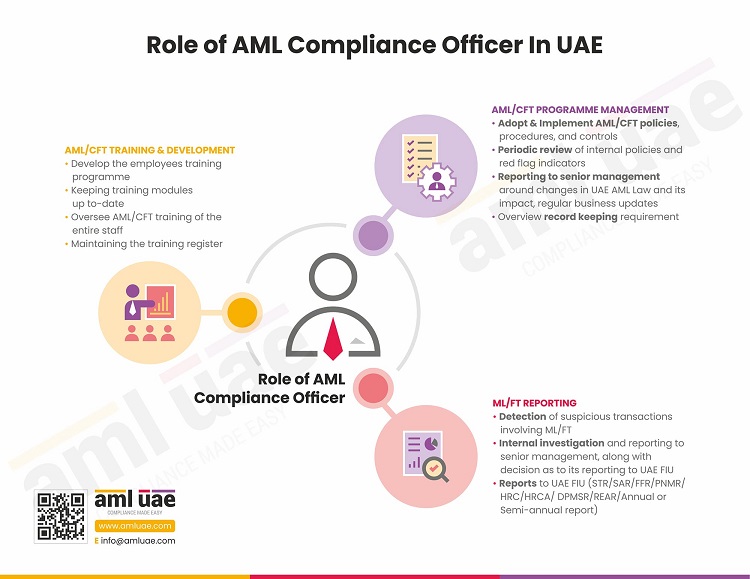

The primary AML law of UAE is Federal Decree-Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Financing of Illegal Organizations. The Cabinet Decision No. (10) of 2019 makes several provisions for implementing the AML law. Article 21 of this Decision lists the requirement of conducting training programs for employees as one of the responsibilities of the AML Compliance Officer.

Significance of AML training

Organized criminals launder dirty money into the financial system, using legit business organizations as their means. Without well-trained employees, business organizations could not detect such crimes being executed through them. An AML-trained employee would act as a line of defense and contribute towards making the company a hostile setting for laundering money.

Some companies say they know all their clients and do not expect any threat from them. Some say that they are too small to conduct training for employees. Whatever the case is, AML training is vital to keep money laundering risks at bay.

Financial criminals do not attack a business based on size or business-client relationship. They keep looking for new tactics to launder small or significant amounts of money through any method, with the only intention of not getting caught. So, every firm to whom AML regulations are applicable must conduct AML training for its employees, making employees capable enough to identify suspicious activities and report the same promptly.

AML training is essential for the following reasons:

To comply with regulatory requirements

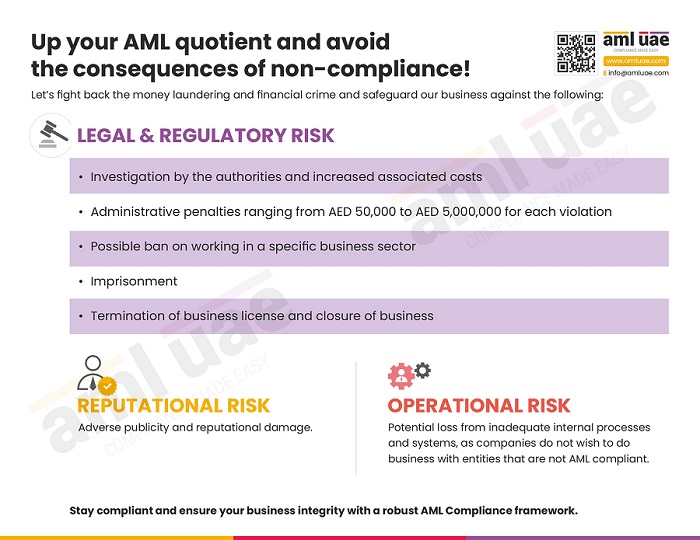

It is mandatory for Financial Institutions, Designated Non-Financial Businesses and Professions (DNFBP), and Virtual Asset Service Providers (VASP) to comply with AML regulations and their requirements. As one of the requirements is to conduct ongoing AML training for the staff, all the obligated entities shall comply with the same to avoid non-compliance penalties and ensure a better AML framework to fight money laundering (ML) and financing of terrorism (FT).

With all these requirements, employees need to know their role in fighting ML/FT and how to do their duties. They must know the trending anti-money laundering typologies to identify the threats in routine business operations quickly.

To prevent the occurrence of financial crimes in the country

When financial criminals launder money, they use it for another set of illegal activities. Drug traffickers, human traffickers, terrorists, etc., use this dirty money to expand their activities. Thus, it affects the social structure of the country. It requires the government to take more effective steps to combat this crime. Unless every business organization contributes to the government’s plan to combat these crimes, the country cannot be saved from these crimes. And for every organization to join this effort, employees must be well-trained and well-equipped to fight ML/FT.

Training on AML develops employees’ knowledge about money laundering and the measures required to fight against it. They learn about the working of international, national, and corporate AML compliance strategies. The organization and its staff understand how they can contribute better to prevent financial crimes.

To safeguard the business and its reputation

Companies need skillful and knowledgeable employees to implement a robust AML framework to safeguard the business from being exploited by money launderers.

AML training brings a consistent understanding, across all levels, of the importance of AML compliance and their role in identifying ML/FT threats to save the company and its reputation. All the employees, including the senior management, stay more aligned with AML-related organizational objectives, resulting in the more successful adoption of the AML/CFT compliance program.

To ensure proper AML compliance-related role allocation

AML training for employees helps you determine proper AML roles for employees. With focused training, the organization can identify what role a particular employee is suitable for. If someone is good at identifying ML/FT red flags, you can allocate the task of customer onboarding and ongoing customer/transaction monitoring. If someone is good at documentation and administrative role, you can assign them the task of overall AML record-keeping and reporting requirements.

Through the extensive AML training programs, employees develop skills that help them ensure AML compliance and protect their business organization from being vulnerable to money laundering or terrorism financing.

Participants in AML training

All the relevant employees handling customers, transactions, and delivery channels must receive adequate AML training, whether a full-time employee or a part-time or contractual one. If they, in any way, are involved in activities related to customer-servicing or business partner interactions, they must receive the necessary training around AML and CFT.

As the AML Compliance Officer is the person running the show, he must be well-trained, well-qualified, and well-aware of the basic AML concepts, regulatory obligations, roles, and responsibilities to handle the AML/CFT framework of the company, etc.

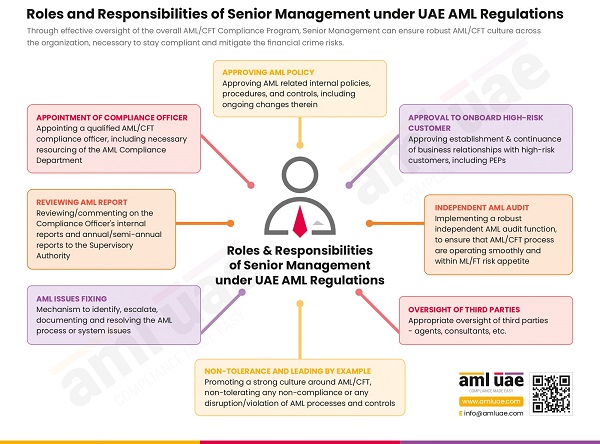

AML Training requirement is not just limited to front-line employees; AML training is also critical for senior management. Senior management is responsible for implementing an effective and comprehensive AML compliance program. They need to understand the basic concepts and regulatory requirements to efficiently manage the AML framework across the organization. Thus, senior management shall also be included in training programs and lead by example.

AML UAE – your partner for AML training requirements

Contact us now, and let's get started.

Topics of AML training

Employees must understand that AML training is essential to tackle financial crime. A solid AML training module shall consist of a basic understanding of ML/FT and sector-specific typologies, the company’s internal AML policy and procedures, regulatory requirements, employee roles and responsibilities, etc.

Ideally, it is recommended to impart training on the following aspects to every core-business employee:

- ML/FT Concepts (meaning, stages, and few illustrations)

- AML Regulations in the country (applicability and obligations)

- International efforts to fight ML/FT (FATF recommendations, etc.)

- goAML registration (goAML registration process, documents required, etc.)

- Business Risk Assessment (methodology and factors to assess business risk)

- Customer Onboarding (KYC, customer due diligence, customer risk profiling, etc.)

- Enhanced Due Diligence (what is EDD, when and how to conduct EDD)

- Suspicious Transactions (how to identify and reporting requirements)

- Record Keeping (documentation tenure and what all to be maintained)

- Ongoing Monitoring (monitoring methods, timelines, etc.)

- Compliance Officer and its roles and responsibilities

- AML Compliance Program & Governance (senior management’s responsibilities, group oversight, etc.)

- Targeted Financial Sanctions Implementation (sanctions implementation)

- Red flags (sector-specific ML/FT risk indicators)

- Reporting with FIU

- Ultimate Beneficial Owner

One of the best practices of AML training includes teaching real-life cases of money laundering transactions. Through such cases, you can teach them:

- How to detect a threat

- Impact of the threat on business

- What steps to take after the detection

- Reporting and recording of the case

After providing the relevant training, you must conduct a test to check if employees have understood whatever is taught. Along with theoretical understanding, you can check their knowledge by giving some practical examples.

Methods of imparting AML training

You can conduct either offline or online training for your employees.

You must also consider whether you will train them in all aspects in one go. Another option is to design short training modules and spread them over a month to ensure work does not suffer.

Internal or external training is another choice you need to make. You can choose the AML Compliance Officer as the trainer or hire an outside AML expert to conduct these training sessions for your employees.

Frequency of AML training

The AML regulation provides for ongoing AML training programs for the employees. You must impart training to refresh some of the most important concepts. You can organize it on an ongoing basis to ensure your employees are up-to-date. But if you are operating in an industry with high risks of money laundering, you must increase the training frequency.

You can impart training as and when there are updates in AML regulations or the development of new money laundering techniques. Even with a new AML technology or solution, you must train employees on how to use it.

Whenever new employees join positions requiring AML training, you must impart relevant training to the earliest.

Generally, organizations conduct frequent and detailed training for their front-line employees and the Compliance Officer, as they serve as a primary line of AML defense.

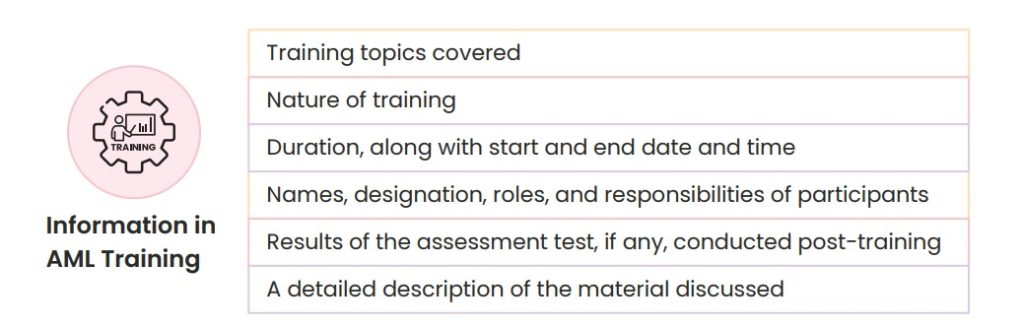

AML training-related record-keeping

Maintaining the AML training logs is one of the AML documentation requirements, which includes the following information:

- Training topics covered

- Nature of training

- Duration, along with start and end date and time

- Names, designation, roles, and responsibilities of participants

- Results of the assessment test, if any, conducted post training

- A detailed description of the material discussed

You must also maintain the materials used for AML training of employees for further reference.

Support from AML UAE

With the best quality AML training, you can save your business from being exposed to money laundering and terrorism financing threats. To meet this AML requirement, you must take the help of an expert AML consultant. The AML consultant will ensure that you comply with all the requirements to avoid non-compliance penalties and safeguard your business.

AML UAE is a leading provider of AML compliance services to its clients in the UAE. We help you understand the importance of AML training and impart training on relevant courses. We help clients:

- Identify the training requirements as per the business size and industry

- Design and develop customized AML training programs

- Execute them with the help of our AML experts

- Provide relevant training materials as resources for future use

- Assess employees’ knowledge post-training with suitable tests and quizzes

So, let’s design a suitable training program for your AML needs.

Besides AML training, we also support you in documenting and implementing an effective AML framework, conducting AML business risk assessment, and managing your customer onboarding process.

All-encompassing AML training for your business just a call away.

Contact us now, and let's get started.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.

FAQs on AML Training

AML Training is very important for employees to ensure that employees understand AML compliance requirements and implement necessary AML measures in course of routine business operations to adhere to laws and safeguard the business. Likewise, AML training is crucial for senior management to set the right AML tone at the top, promote strong compliance culture and make management aware of their roles and responsibilities towards AML program, like approval for AML Program, appointing AML Compliance Officer, approving onboarding of high-risk clients, etc.

The following are the main components of AML training:

- Basic understanding of AML/CFT

- Applicable AML/CFT regulations

- Enterprise-Wide Risk Assessment and Risk-Based Approach

- Internal AML/CFT policies and procedures

- Customer Due Diligence, including Enhanced Due Diligence

- Red flags (ML/FT/PF) – identifying and reporting suspicious transactions

- goAML reporting

- AML governance

- Targeted Financial Sanctions compliance

- Measures to counter proliferation financing

- AML Record Keeping

Generally, the frequency of the AML training depends on the entity’s risk assessment. However, annual AML training for all employees is a must. Further, the new employees must be trained in AML at the time of joining.

The key objectives of the AML training are:

- AML awareness amongst employees

- Promoting employee engagement and contribution around AML

AML training program should typically include understanding of AML regulatory obligations, entity’s internal AML program, discussion on red flags and internal reporting mechanism when any risk indicator is identified. Training program must include job-specific AML courses as well.

AML Compliance Officer is entrusted the function of developing a robust AML training and development program for the employees. The Compliance Officer must evaluate the training needs and ensure adequate learning sessions are conducted.