Trade-based money laundering is one of the most common forms of money laundering. It is an easy way exploited by criminals to launder money between different countries, wherein they misrepresent the quality, value, or amount of goods traded through various channels.

Trade financing processes are misused to facilitate the flow of illicit funds. Trade is conducted across different jurisdictions subject to different regulations, making detecting suspicious transactions difficult. Also, the complexity of trade transactions and the volume of goods traded are the loopholes these launderers exploit to their advantage.

Let’s understand trade-based money laundering, related red flags, and how businesses can mitigate the risk arising from trade-based money laundering.

What is trade-based money laundering?

Trade-based money laundering (TBML) cleans dirty money through trade transactions and activities. The trade transactions are exploited to transfer and convert illicit money into legitimate cash or commodity, avoiding the suspicion from regulatory authorities disguising the process as legitimate trade.

For example, importing and exporting goods is just a cover for the movement of illegal funds, making the trade transaction appear legal between two countries.

It is also a way to evade taxes. Companies show different amounts in invoices, thereby reporting reduced profits and taxes decrease. Alternatively, they show multiple payments for only one set of goods received from the exporter, increasing their procurement expenses.

Why do criminals engage in trade-based money laundering?

Lack of regulations

There are no standard regulations for trading transactions. Import and export of goods are regulated by the agreement between a buyer and seller and the respective countries’ regulations. No global regulator controls these transactions; the two parties entering the contract govern the trade terms.

A rise in the amount and volume of trade

Globalization has resulted in increased trade activities across the world. Countries engage in multiple import and export transactions with several countries. These transactions have increased in number and value over the years. It allows criminals to bypass commercial rules during these humongous trade transactions, avoiding the attention of the authorities.

Increase in free trade zones

Businesses are attracted to free trade zones for their ease of conducting business, as there are fewer regulatory constraints in these zones. The absence of rules is better than circumventing rules. The number of TBML transactions has also increased with a rise in free trade zones.

Use of open account payment method

Open account transactions are the ones where payment is due after a specified time of the occurrence of the trading activity, i.e., the goods are delivered to the party, and the payment is made after 30/90 days. This time gap minimizes the connection between the actual trade and the related payment. These transactions are subject to less oversight from financial institutions; hence, criminals increasingly use these methods.

How is trade-based money laundering conducted?

Understanding the standard techniques of conducting trade-based money laundering is essential to combat the same. The following are the most used TBML techniques:

Over-invoicing of goods

The exporter inflates the price of the goods in the invoice compared to their market value. In this case, exporters receive higher payments from the importer, allowing the importer to launder money and convert/transfer through import/export transactions.

Under-invoicing of goods

The exporter prepares the invoice for the goods at a price lower than the fair market value. Importers get goods at a lower value, resulting in the evasion of import duties.

Multi-invoicing

Exporters create multiple invoices for the same set of goods to be shipped. They can receive multiple payments for the same shipment, using different payment methods adding layers of complexity. Thus, launderers legitimize their illicit money through multiple invoicing.

Changing the quantity of goods

Launderers can also change the quantity or weight of goods being traded. They may report the quantity as more than the actual or less than the actual. In the case of over-quantity, they receive illicit money as payment and convert it to legitimate money. While in the case of under-quantity, they launder money by avoiding the payment of actual import duties.

Alternatively, they might report a specific quantity of goods while there is no shipment done. It is called phantom shipping or ghost shipping. Importers and exporters collaborate to create false invoices and other documentation without the actual shipping of goods. The illicit money is moved from the importer to the exporter without actual trade transactions.

Misrepresentation of goods

The exporters may represent the goods as expensive, though in reality, the goods are cheap. Thus, the invoice and customs documents show a high price while the actual value is less.

It is common in the gems and jewellery sector, where the invoice says raw diamonds and the shipment is of polished diamonds or artificial ones.

Non-documentary trade

For some trading transactions, there are no documents available for investigation. It is not that no documents are prepared for the transaction, but these are not accessible. The regulators have access to only the name, account number, and address of the buyer and seller.

In non-documentary trade transactions, regulators are unaware of the underlying flow of goods and trade activities. It is difficult for them to validate transactions. The absence of due diligence on the volume, type, quantity, and value of goods makes it easier for launderers to launder money.

What are the red flag indicators of trade-based money laundering?

The best option for individuals, companies, and countries is to observe the red flags of trading transactions. With the identification of suspicious transactions, you can investigate them further. Following is an illustrative list of TBML indicators:

- Differences in the descriptions of items to be traded in the invoice and the shipping bill.

- Differences in the market value of the items and the value mentioned on the invoice.

- Involvement of trading entities with registered addresses in residential buildings.

- The shipment size does not match the customer’s profile and regular business activities.

- Trading of an item from one jurisdiction to another or from one subsidiary to another, whose business activities are in no way related to each other or without logical economic reason.

- Involvement of trading entities with no physical presence or an online presence that does not align with its business activities.

- The type of goods traded does not align with the regular shipment of customers or the client’s profile and business activities.

- Trading transactions involving a third party with no relation to the transaction (either receiving cash payments or managing documents); offshore front companies or shell companies may be involved in such transactions.

- Trade deals involve complex trade routes that do not make geographical sense.

- Goods are exported from or imported into high-risk jurisdictions or countries with poor AML regulations.

- Missing trade documents or false documents.

- A sudden increase in trade transactions from or to a company that was dormant for a long time.

- Sudden high volumes or value of trade from an entirely new company.

What is the way out for businesses from trade-based money laundering?

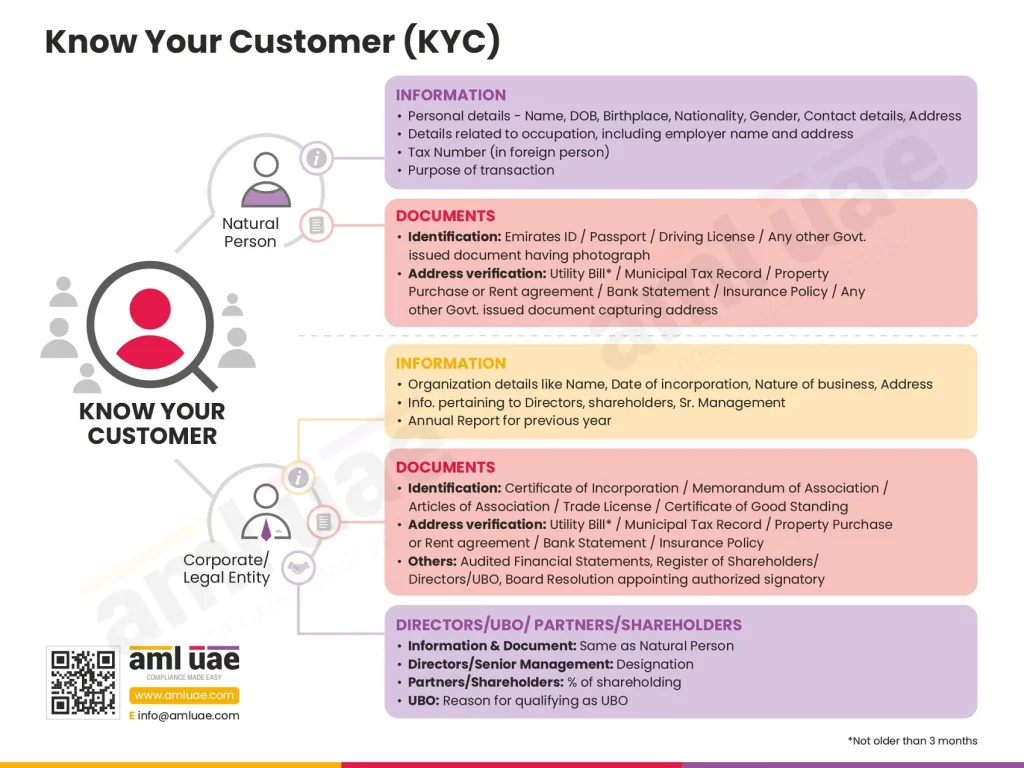

Know Your Customer (KYC) and customer due diligence (CDD) are the best solutions for reducing trade-based money laundering. Businesses must implement policies to collect details on all their customers and transactions. Further, ongoing monitoring of the customer’s profile and the transaction is necessary to identify any unusual patterns. If they see any red flag, deeper scrutiny is essential to identify money laundering risks.

Using advanced technology systems or artificial intelligence is also an excellent solution to reduce money laundering risks. These systems can help businesses identify money laundering threats and send alerts. It allows the entities to report the TBML activities to the authorities promptly.

How AML UAE can help

Associating with AML consultants, like AML UAE, can help you understand the red flags better to identify suspicious transactions and take necessary actions to combat the same.

AML UAE also helps clients form an AML compliance department and conduct employee training. Our AML consultants aid in developing relevant AML policies, selecting appropriate AML software, and managing the reporting requirements. We ensure you comply with applicable AML regulations and stay safe from money laundering threats.

AML UAE helps you safeguard your business from money laundering threats.

Get in touch to know the best preventive and corrective actions.

Our recent blogs

side bar form

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.