The idea of money laundering is simple in principle. The person who has received some illicit gains or funds will try to ensure they can use these funds freely without people realizing that such proceeds are the results of some criminal activities. To do this exercise, the source of illegal funds is disguised, so make such proceeds appear to have been generated from legitimate sources.

What is Layering in Money Laundering?

Layering is a term that is often used when talking about how criminals use it to prevent the detection of money laundering activities. Layering refers to moving money from one account to another and from one banking and financial institution to add layers of legitimate owners and avoid detection of the actual source of the funds and make it harder for authorities to track the initial source of the money. Layering is a financial crime.

Layering in Money Laundering: Definition

Layering is considered the second stage of money laundering. Layering is defined as the process of adding multiple layers to the proceeds of crime to avoid the detection of its actual source.

There are three Stages in Money Laundering:

1. Placement in Money Laundering

It is the first step when the criminals receive money from unlawful activities. Now they move the money into the legitimate business accounts of the partners-in-crime- the criminals and their family, friends, and associates.

The trick is to break down the large volumes into smaller transactions that won’t attract much attention as the criminals ensure that the transaction remains within the cash limit threshold.

In this way, they can avoid deposit alerts. The standard procedure adopted by the criminals is to move money from these companies and use fake invoices. In this way, the money ultimately is run through the legal system avoiding scrutiny.

2. Layering in Money Laundering

Layering is the second stage of money laundering wherein illegally obtained funds are placed into the financial system and moved to other banks and financial institutions to distance them from the criminal source. The purpose of layering in money laundering is to make the detection of source of illegal money as difficult as possible.

It is called layering when money launderers buy other liquid investment instruments using the illegally placed funds. Such funds are then transferred to other forms such as negotiable instruments or used to purchase goods and services to make their detection nearly impossible.

It is worthwhile to note over here that structuring and layering in the money laundering mean one and the same thing.

The layering stage of money laundering makes the entire process of detecting money laundering complex, and it’s essential that money laundering is detected at the early stage of layering.

3. Integration in Money Laundering

Integration is the third stage of money laundering. Here the illegitimate funds are integrated into the legitimate economy.

Money launderers buy real estate, stocks, securities, jewellery, precious metals, or other luxury goods to integrate their laundered money into the financial system.

When it comes to terrorist financing, the integration is accomplished by distributing funds to terrorists and terrorist organizations.

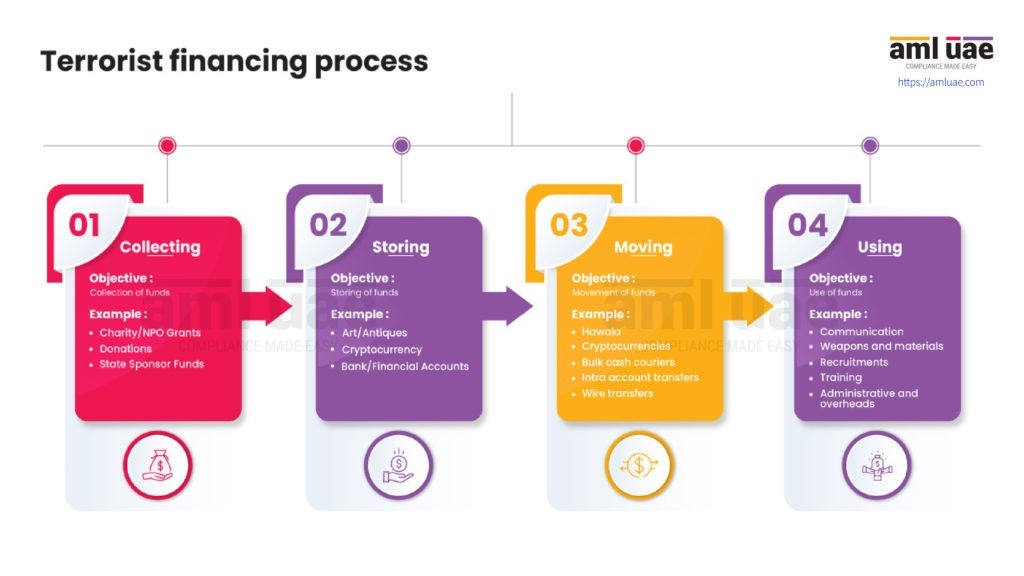

Terrorist Financing Process

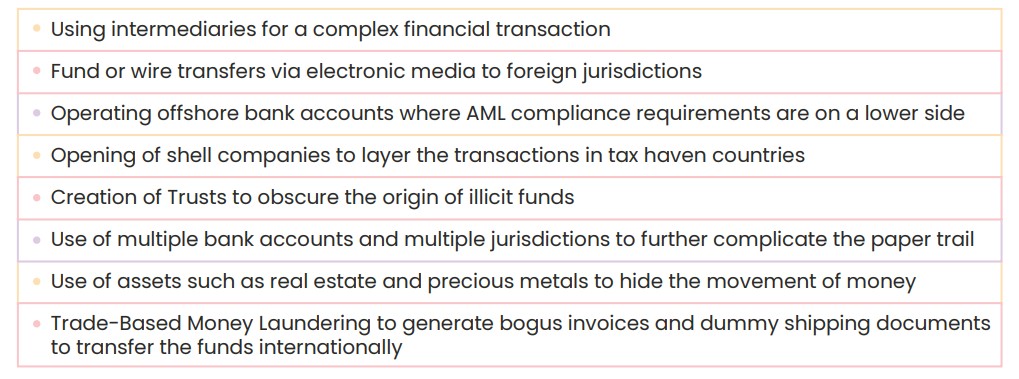

What are the common layering techniques used in the money laundering?

Some of the common layering techniques used in money laundering are:

- Using intermediaries for a complex financial transaction

- Fund or wire transfers via electronic media to foreign jurisdictions

- Operating offshore bank accounts where AML compliance requirements are on a lower side

- Opening of shell companies to layer the transactions in tax haven countries

- Creation of Trusts to obscure the origin of illicit funds

- Use of multiple bank accounts and multiple jurisdictions to further complicate the paper trail

- Use of assets such as real estate and precious metals to hide the movement of money

- Trade-Based Money Laundering to generate bogus invoices and dummy shipping documents to transfer the funds internationally

Money Laundering is a global concern. It is estimated that 2-5 % of global GDP, which ranges between USD 800 billion to USD 2 trillion, is laundered every year. Criminals try to hide the source of the illegal money used to fund criminal activities such as the trade of banned drugs, human trafficking, kidnapping, extortion, and even purchasing arms and ammunition for terrorism. So, they launder the illegally obtained money, try to run it through the legal, regulated financial system, and use layering to avoid detection.

Criminal activities are on the rise as the criminals are misusing the financial system, taking advantage of the loopholes, and becoming successful in money laundering. It’s essential to report any transactions or account discrepancies and prevent financial crimes.

AML – Anti-money laundering rules and regulations have been implemented to combat money laundering and terrorist activities. These laws require financial institutions and other regulated entities to follow stringent AML compliance processes such as KYC– Know Your Customer, CDD– Customer Due Diligence, EDD- Enhanced Due Diligence, UBO identification, etc. The rules enable the institutions to detect and deter criminals from misusing their organisations to launder money.

Criminals are using the layering method to hide their black money, which means they keep moving the cash from one account to another and transferring it from one company’s account to another. Check our infographic on stages of money laundering.

By moving the money, it is transferred to several legit accounts, so during an investigation, the names of several account holders crop up, making it harder to locate the origin of the illegal money. It makes identifying the source of the funds difficult for the authorities.

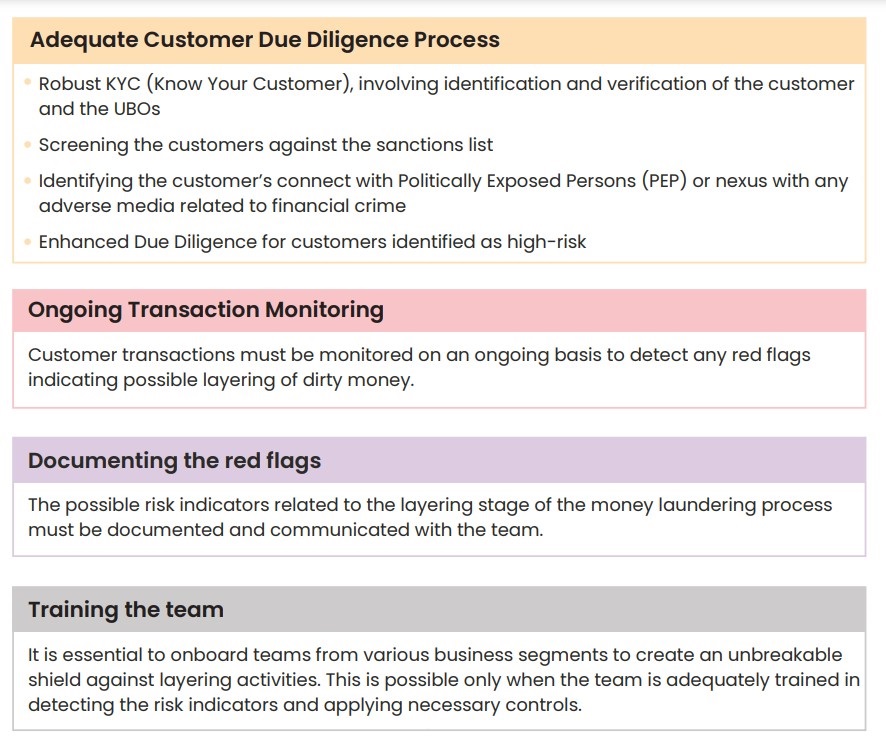

Measures for Identifying and Preventing the Layering of Illegal Funds

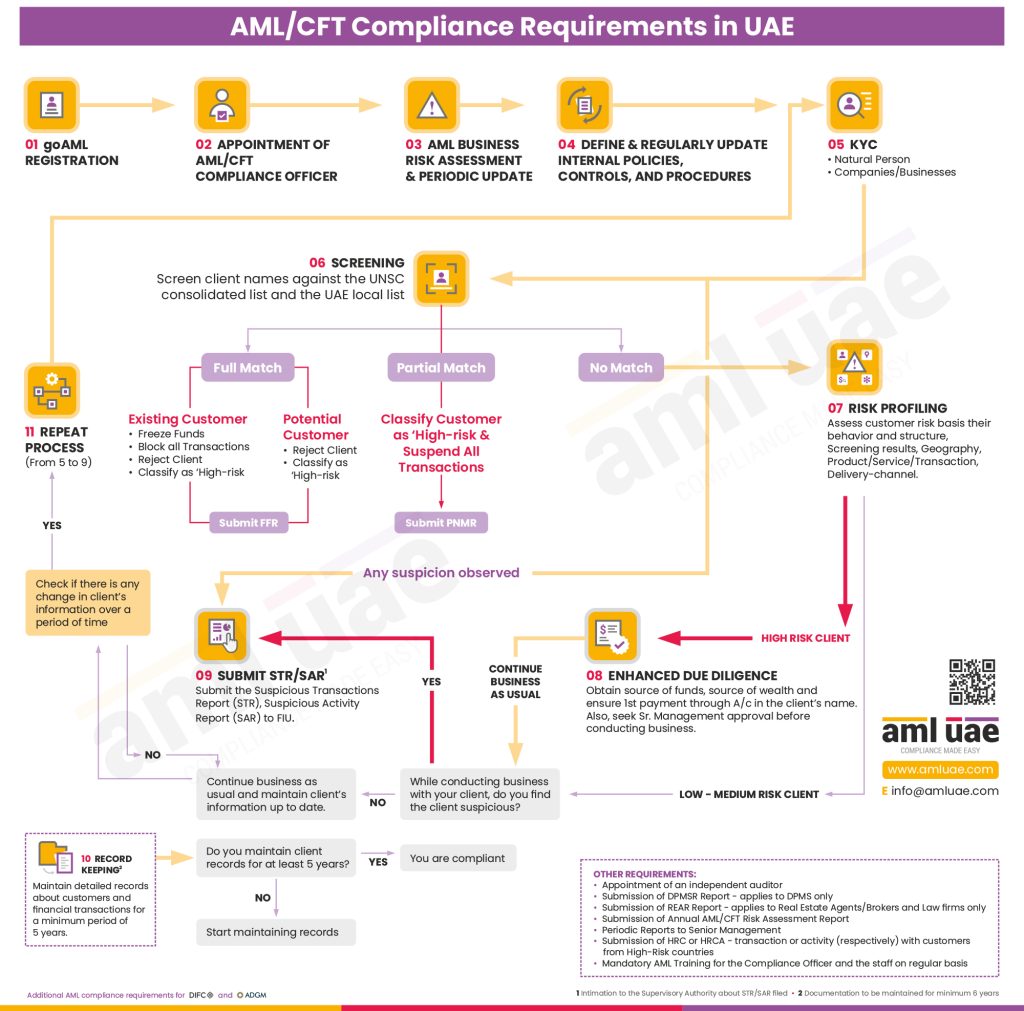

As part of the AML Program, the UAE AML regulations require the entities to follow stringent measures to detect the transactions attempted to artificial layer the criminal proceeds.

These measures include:

Adequate Customer Due Process

- Robust KYC (Know Your Customer), involving identification and verification of the customer and the UBOs

- Screening the customers against the sanctions list

- Identifying the customer’s connect with Politically Exposed Persons (PEP) or nexus with any adverse media related to financial crime

- Enhanced Due Diligence for customers identified as high-risk

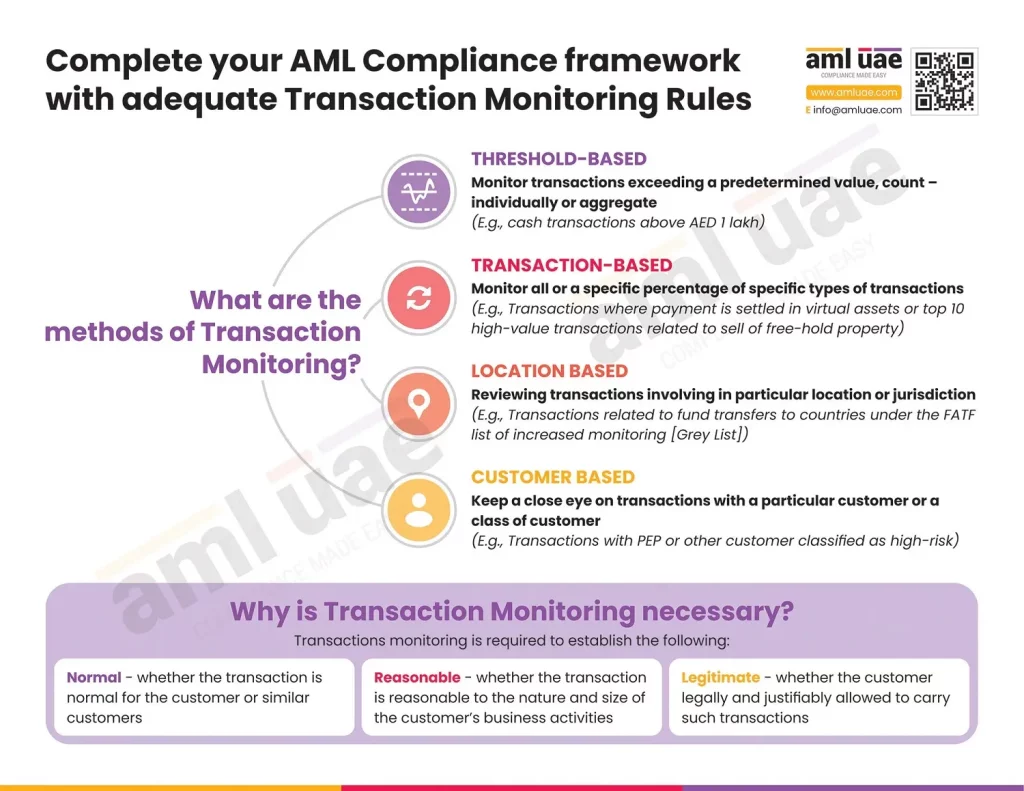

Ongoing Transaction Monitoring

Customer transactions must be monitored on an ongoing basis to detect any red flags indicating possible layering of dirty money.

Documenting the red flags

The possible risk indicators related to the layering stage of the money laundering process must be documented and communicated with the team.

Training the team

Comprehensive AML measures empower entities to detect and deter criminals from misusing their organizations to launder money.

AML Compliance Requirements in UAE

Examples of Layering in Money Laundering

Here are a few examples of Layering in Money Laundering:

- Trade-based Money Laundering

- Investment in Real Estate through intermediaries or shell companies

- Entering into complex financial transactions to make to disguise the trail of proceeds of crime

- Structuring transactions in a way that large amounts of cash can be broken into smaller transactions

- Anonymous transactions in virtual currencies

Challenges in detecting and combating layering in money laundering

The layering stage in money laundering is arguably the most crucial for the launderers. Illicit funds come out of the dark and blend with legitimate instruments. Launderers conclude these multiple transactions to confuse standard money laundering controls, which institutions primarily establish.

After separation from the original source, the crime proceeds enter into the financial system. The funds are dispersed and disguised to reduce the chances of suspicion or detection from law enforcement agencies. These funds are fragmented into smaller transactions and often transferred overseas to keep the money moving internationally, preventing the authorities from tracking the movement easily.

The possibility of transferring money electronically makes the cross-border movement of funds easy without inviting the attention of the authorities.

How to identify money laundering activities?

There are specific activities in which institutions can monitor and identify money laundering:

- A huge volume of cash is deposited into different bank accounts.

- Frequent international transfers.

- Purchasing & reselling high-value goods such as art and jewellery.

- Investing in real estate

- Investing in legitimate companies and using shell companies to layer money – moving money from one account to another.

- Making multiple transactions in different accounts and financial institutions.

What is structuring in money laundering?

Structuring, also known as layering, is the second stage of money laundering. Structuring is the act of splitting a large financial transaction into a series of smaller transactions to avoid the regulatory threshold prescribed by the AML authorities of the country.

As per UAE AML Laws, all cash transactions in precious metals and stones equal to or exceeding AED 55,000/- need to be reported to the goAML portal maintained by the FIU. In order to avoid this reporting threshold, criminals split their purchases of precious metals, stones, and jewellery items in such a way that they avoid this Dealers in Precious Metals and Stores Report (DPMSR) filing requirements.

What is smurfing and layering?

A Smurf is a money launderer who seeks to structure large transactions into smaller ones to avoid monetary thresholds requiring more scrutiny by banks and financial institutions. Smurfing is a layering technique wherein a Smurf resorts to structuring large amounts of cash into multiple small transactions and spreading them across many different accounts. Smurfing is a known money laundering technique adopted by criminals to circumvent the radar of regulatory authorities.

What are the red flags indicating layering in money laundering?

Criminals across the globe use some common methods for layering a transaction. Some of the red flags indicating layering in money laundering are:

– Large number of fund transfers within a single bank

– Large number of transactions with rounded-off amounts

– Multiple fund deposits and immediate withdrawals

– Large number of wire transfers in quick succession

– Fund transfers from high-risk customers or high-risk geographies

Using AI based AML Software to identify layering in money laundering

There are ai powered RegTech AML Software and solutions available which utilise the power of machine learning and big data to detect layering techniques in money laundering. AML Software solutions make it easy to identify red flags in transactions and separate them for further escalation.

AML Compliance: The need of the hour

AML laws in UAE require financial institutions and DNFBPS, VASPs to create a robust AML compliance network and identify money laundering activities to prevent them with timely action. Banks should adopt a proactive approach and rely on technology to get immediate alerts on suspicious accounts and transactions.

Non-financial institutions are also required to identify such financial crimes and report the suspicious activities to the concerned authorities.

International bodies like FATF, MENAFATF, and the Egmont Group of FIUs are working together with law enforcement agencies locally and internationally towards the identification & mitigation of these financial crimes. Many countries have joined hands towards stopping these crimes at large.

Financial and non-financial institutions are required to keep a vigilant eye on additional suspicious activities, which include: Prominent transactions indicating layering in ML/FT

Cash deposits into an account are withdrawn immediately. Criminals ensure that they do not cross the transaction and deposit cash limits. If regular transactions barely fall behind the threshold or add up precisely to the prescribed limit, then it’s a red flag.

Implementing AML compliance framework, including AML/CFT Policy, Controls & Documentation, Annual AML/ CFT Risk Assessment Report, and AML/ CFT health check-ups will help businesses understand if they are following the proper procedures to detect the layering of the criminal proceeds and prevent money laundering and financing of terrorist activities.

Let us together fight money laundering by preventing the layering of illicit funds

There are several reasons why illicit money goes unnoticed. The prominent reasons are having insufficient staff trained in AML compliance, false-positive screening results, sanctions compliance, lack of seriousness of the higher management in AML compliance, outdated technology being used for AML compliance.

Financial institutions and other regulated entities face these and several other challenges in AML compliance. It would be best to get a company on board that can streamline the process of AML compliance and helps businesses follow the AML rules without fail.

If you need the services of professional AML consultants, you can always rely on AML UAE- a leading AML consultant in the UAE that provides end-to-end AML compliance services at a nominal fee. We offer a comprehensive range of AML compliance services ranging from AML Training, AML health check, AML/ CFT policy, controls, and procedures documentation, to AML software selection to setting up an in-house AML compliance department set up. Rely on experts to fight money laundering by immediately identifying suspicious transactions and layering.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

FAQs about Layering on money laundering

The three stages of money laundering are:

- Placement

- Layering and

- Integration

Layering is the second stage of money laundering. What makes layering in money laundering difficult to detect is the way it is broken down into smaller transactions and the conversion of money from one form to another.

Money Launderers transfer money from one account to another and split it into smaller amounts amongst countries, individuals, or businesses is the example of layering in money laundering.

Layering, also known as structuring is the second stage of money laundering.

Layering is the second stage in money laundering. It is a structuring process in which criminally derived funds are legalized and their ownership and source is disguised.

Structuring is the another word for layering.

Layering is structuring a transaction in such a way that the orgin of the criminal proceeds is disguised for the purpose of money laundering.

Layering or structuring involves transferring funds around in the legitimate economy. The prime objective here is to conceal the origin of the funds.

Layering in banking includes transactions where financial instruments are exchanged for smaller denominations, wiring of funds from one account to another, using several accounts to buy or sell securities, etc.

Layering is the second stage of money laundering, where money placed in the legitimate economy is transferred to one account from another to make the detection of proceeds of crime as difficult as possible.

Several red flags indicate the layering of funds in money laundering. Banking transactions involving large cash deposits into various banks, international bank transfers, investment and resell of jewellery, art, and other high-value items, fund transfer using shell companies, etc., indicates that the funds are being layered to make the detection of their origin as difficult as possible.

The main goal of the layering stage of money laundering is to make the detection of the source of illicit money as difficult as possible.

The main difference is that placement is the first stage in money laundering, and layering is the second stage.

Placement involves the introduction of illicit gains into the financial system to start the money laundering process. But in layering, the launderer tries to make complex transactions after introduction into the financial system to hide its true origin.

Examples of placement involve purchasing antiques, paintings, etc. Examples of layering involve the creation of Trusts to hide the origin of illicit funds, Fund or wire transfers via electronic media, etc.

Layering is the second stage of money laundering, wherein illegally obtained funds in the financial system are moved to other entities, specifically financial institutions to distance them from the source. The reason of layering in money laundering is to make the detection of the source of illegal money as difficult as possible.

Layering is one of the stages in money laundering where the launderer makes numerous transactions to take the illegal proceeds far from their original source. Launderers layer illicit money with several transactions to hide its source.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.