What is Integration in Money Laundering?

We all understand that the instances of money laundering are increasing day by day. This warrants the development and implementation of strong measures to combat these crimes and minimize their adverse impact on the business as well as the economy at large. To deploy anti-money laundering measures, businesses must understand the concept and functioning of the process and its three stages – Placement, Layering, and Integration.

What is Money Laundering?

Money laundering is a complex process wherein the launderer brings in multiple persons and accounts to conceal the origin of the illegally obtained money and make it look as if it is generated from proven legitimate sources. Money laundering is all about disguising the identity of the illicit source and the owner of such illicit funds.

The money laundering process involves three stages – placement, layering, and integration, through which the dirty money is processed or routed to make it appear clean at the end of the laundering process, making it difficult for the authorities to trace its true origin. During the integration stage of the process, the criminal proceeds are mixed with the legitimately obtained funds to erase the distinction of the funds as clean or black.

To detect and prevent money laundering, authorities worldwide have introduced regulations designating certain classes of businesses and professions to implement Anti-Money Laundering processes. The effectiveness of the measures and controls is highly dependent on the understanding of the concept, i.e., if the regulated entity is aware of the working or operating cycle of the money laundering process and the associated risk indicators, then only can the controls be customized to harp on the money laundering attempt precisely.

Understanding the stages involved in the money laundering process

The money laundering process comprises three stages, which are as follows:

Placement: Putting the funds in the system

The criminals begin the money laundering process with the placement stage, i.e., by placing or introducing the illegally obtained money into the legal financial systems of the country of origin or any other jurisdiction. The standard placement techniques used by the launderers are smurfing or structuring vast amounts of cash into smaller denominations, which are deposited into multiple accounts using different names or locations. Further, criminal proceeds are also placed in the economy using other methods like buying properties or luxurious items using cash.

Layering: Hiding the illegal origin

As the name indicates, in the layering stage, the illegal money placed in the economy is transferred through various layers of complex transactions – involving various parties, accounts, legal structures, and cross-border transactions, to create as much distance as possible between the illegally obtained funds and its illegal source. Some commonly used layering forms are shell and shelf companies, converting the funds into complex financial instruments, etc.

Integration: Merging the funds

It is the last stage of the process where the criminal proceeds are integrated with the legitimate funds, mingling the two to make it difficult for the authorities to carve out the illegal amount from the legally generated income. Once the funds are integrated with regular funds, the criminals can utilize these funds for personal benefits or divert them back to criminal activities without drawing any inquiry from the authorities.

It is essential to understand the intricacies of the integration stage of the money laundering process to prevent the completion of the laundering process and criminals from mingling the dirty funds into the clean economy.

What is the Integration stage of money laundering and the common techniques?

During this stage, the money laundering process concludes with the seamless blending of the criminal proceeds with the legitimate earnings, making it difficult for authorities to segregate the illegal funds and move them back to their origin. Once the dirty money is blended with the regular funds, the criminals use these funds in routine courses without inviting any suspicion about its source.

What is the purpose of Integration in the money laundering process?

When the launderer thinks enough layering has been done to conceal the origin of the criminal activities through which the funds were generated, they move towards integration from when the funds can be freely used. The primary purpose of the integration stage of the money laundering process is to enable the launderers to mix illegal funds with their legitimate funds, from where they can use this dirty money for personal benefits without drawing the attention of the regulatory authorities.

What are the common methods used for Integration in money laundering?

As part of the integration, the launderers create a complex structure of transactions involving multiple parties and bank accounts and generating a complicated chain of documentation, making the funds appear as if obtained from legal sources. Some of the common techniques used by launderers to integrate the funds into the legally generated income are:

Investing in legitimate business ventures

Launderers often invest the illegally obtained funds into legitimate business activities. Once put in the business, the funds generated from these activities would be named “business profits” without attracting many inquiries about the source of such business capital.

Buying real estate or other assets

Another technique used to camouflage illegal funds is to buy real estate or put money into luxurious items like expensive cars, yachts, or antiques and also in cryptocurrencies. These assets are then sold to generate the income in nature of the “sale of assets” or are collateralized to get loans from financial institutions, creating more distance from the illegal source. Here, the final amounts generated are shown as funds from selling assets like real estate property with adequate documentation, without raising questions about how the funds were arranged for buying these high-end properties and assets.

Shell companies and offshore accounts

The launderers also use offshore accounts and shell/shelf companies during the integration stage to create an intricated web of legal structure moving across various jurisdictions, involving countries with lax regulatory disclosure requirements, making it difficult for the authorities to trace the true identity of the funds and their owner.

Trade-based money laundering

The launderers resort to trade-based money laundering methods by over/under-invoicing from their legitimate business to move and mix the illegal proceeds across borders.

With commercial transaction-related documentation at the base, the dirty funds change hands and bank accounts without suspicion.

Using Financial Products or instruments

The criminals may also use financial products like life insurance products to integrate the laundered sum. The launderers buy multiple life insurance policies, which are sold off within a short span, encashing the criminal proceeds in the name of “funds generated from insurance”.

What are the key complexities in tracking the integrated dirty money?

Detecting the money laundering activities during the integration stage of the process is relatively challenging. Once the criminal proceeds are mingled with legit funds, it is difficult to distinguish the two amounts, making it easy for the launderers to use the illegal money for their benefit while making it equally arduous for the authorities to trace it to the source.

The primary reasons causing it difficult to split the funds are:

- During the placement and layering stages of the money laundering process, involving multiple persons and accounts were involved, making it hard to identify the real culprits of laundering during the integration phase.

- Many times, integration occurs across borders, and accessing these foreign systems is challenging without international cooperation.

- Careful planning of the integration stage (such as engaging in limited value transactions), making it look natural and reasonable.

- Using tools like nominee arrangements and shell companies complex the chain, wherein spotting the mastermind of the criminal funds is overwhelming.

What measures must be adopted to identify and prevent money laundering attempts?

To combat money laundering and associated financial crimes, authorities worldwide have laid down the laws and regulations, guiding the regulated entities to implement the necessary controls and mitigation measures.

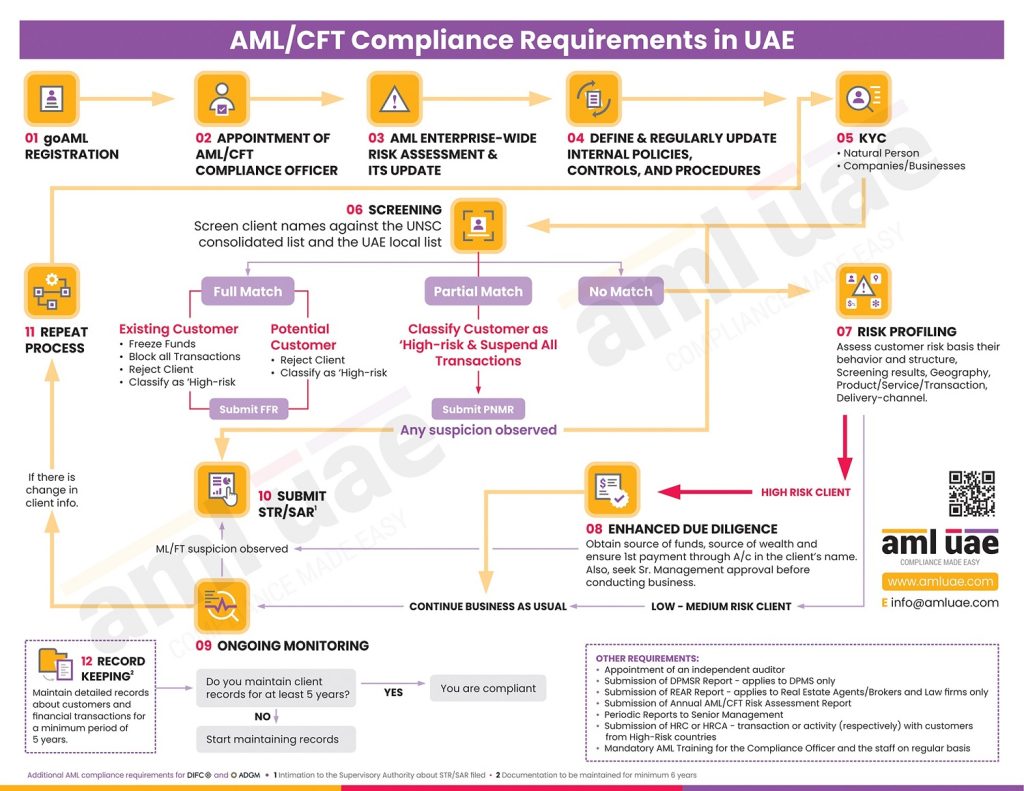

Since the money laundering stages involve exploitation or misuse of the financial sector and other legitimate businesses (designated to comply with AML regulations), these regulated entities must make diligent efforts to detect and prevent the money laundering by adopting robust anti-money laundering Program, covering processes, systems, and controls, such as:

Customer Due Diligence:

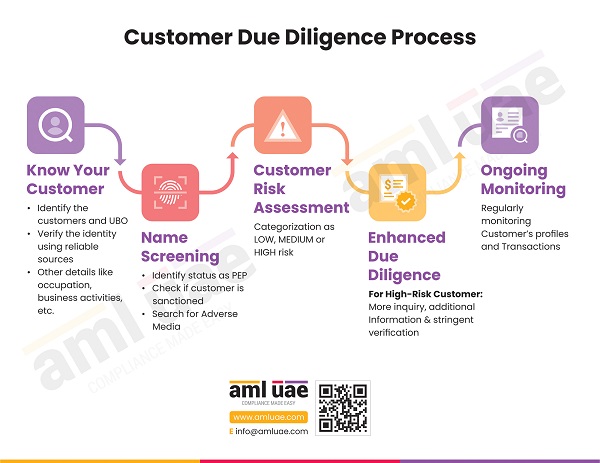

The regulated entities must design and implement comprehensive Customer Due Diligence (CDD) measures to identify the person with whom the business relationship is to be established, verifying the legitimacy of their identities, including identifying the legal structure and the beneficial owners. Further, the prospects and the existing customers must be regularly screened to see if they are sanctioned or Politically Exposed or have some association with criminal activities. Based on the gathered information, the customer’s risk profile must be developed, and the level of risk they pose to the business must be determined. If required, an Enhanced Due Diligence process must be implemented to manage the customers posing a higher risk of money laundering.

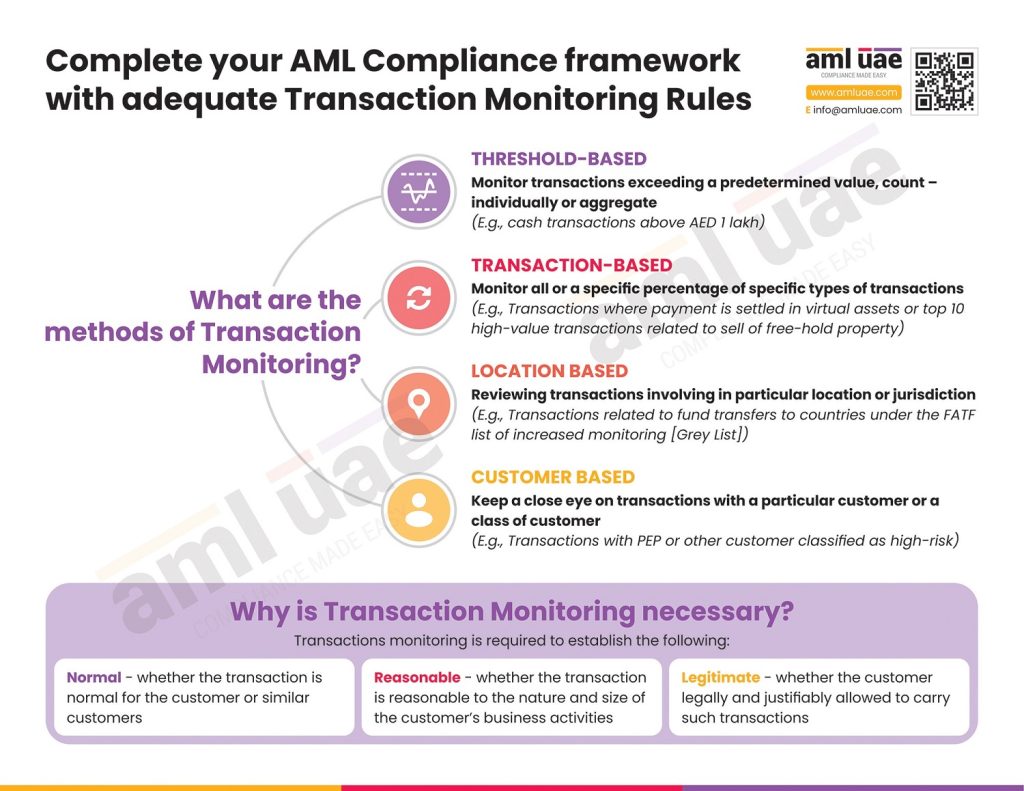

Ongoing Monitoring of Business Relationships:

Once the customer’s risk assessment is done and is onboarded, the AML measures do not end here. The customer’s risk profile is dynamic, changing over time. Thus, regulated entities must monitor the customer’s identification information, the risk profile of the customer, and the transaction executed by the customer to detect any red flags or inconsistencies suggesting the possibility of money laundering. The entities may deploy emerging tools and technologies to analyze the large volume of data on a real-time basis and generate alerts for any suspicion, warranting the inquiry by the AML Compliance Officer.

AML training for the employees:

The exercise of identifying the potential risk indicators cannot be managed solely by the Compliance Officer. The employees at different levels of the organization structure deal with customers, manage the transactions, etc., making the customer information and transaction details available for analysis. Only when these employees are trained on the entity’s AML Program, identification of suspicious activities, and made aware of their duties towards combating money laundering can they contribute towards the prevention of the money laundering instances attempted through the exploitation of the business.

Only with an effective and robust AML framework, including documented AML policies, procedures, and controls, can the regulated entity stay ahead of the money launderers and stop their efforts to merge the ill-gotten funds into the legal financial systems.

What assistance can AML UAE offer in your fight against money laundering?

As you know, the process of money laundering, including its three stages, is an ongoing process, requiring the regulated entities to implement ongoing measures to prevent the same. This AML journey can be paved smoothly with professional assistance from experienced consultants like AML UAE. AML UAE has been assisting the regulated entities in UAE in assessing their business exposure to money laundering by conducting Enterprise-Wide Risk Assessment (EWRA), personalizing the AML policies and processes, and AML training the team on its effective implementation. Further, we also train the compliance officer and the team on identifying suspicious indicators and actions to be taken to manage and report these red flags.

Let’s come together to prevent the integration of illegal funds with our legitimate economy.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

FAQs - Customer Due Diligence

During the integration stage, the dirty money is mingled with the legit sources to make it appear as if generated from such a legit source itself, obscuring the criminal source of such dirty money.

Money laundering attempts are easy to detect during the Placement stage, as the launderers try creating a series of fund movements, possibly involving multiple accounts or parties, which may be triggered as a red flag in the regulated entities’ system.

Some examples the criminals use to integrate the laundered funds are investments in legitimate business ventures, buying real estate property or luxurious items with expensive cars, antiques, or precious stones.

Integration is the third and final stage of the money laundering process, preceded by Placement and Layering.

Once the criminals have introduced the funds into the financial systems (during the Placement stage), in the Layering stage, a complex network of transactions is created to create multiple layers between the criminal proceeds and their origin. During the Integration stage, the movement of funds is almost done, and now the illicit funds are integrated with the legit funds, making its disintegration challenging.

The 3 stages of the money laundering process are:

- Placement

- Layering

- Integration

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.