What is a Sanctions List?

Along with government officials, international authorities publish sanction lists to combat individuals engaged in illegal activities. A Sanctions list incorporates sanctioned individuals, governments, or commercial organizations. Firms, government officials, and individual entities are enlisted into this category as these individuals or organizations pose a high risk to the business or the economy of the country or world as a whole.

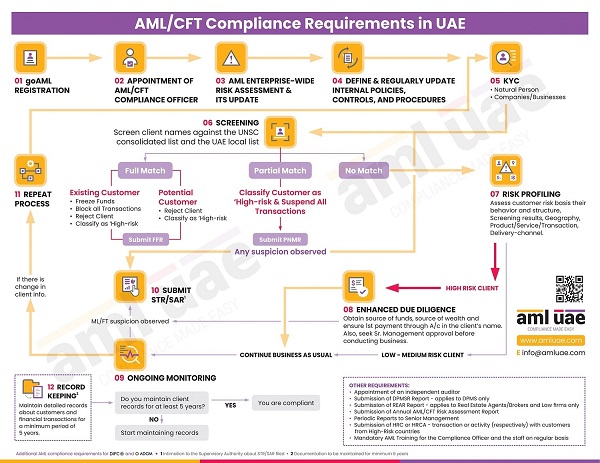

Economic sanctions are undoubtedly an essential tool to fight against financial crime such as anti-money laundering. If such sanction lists are not followed or are breached, one may face severe consequences under AML/CFT regulations. Hence, business organizations must apply sanction control to their clients while establishing business relationships with any customer. The process of screening the sanctioned list is one of the steps in the customer due diligence (CDD) procedures.

Sanctions List Meaning

Sanctions List flags certain individuals, entities, and countries to fight against financial crime. Governments maintain a Sanction List across the globe to prohibit business transactions with such individuals, entities, and countries.

Such individuals and entities are added to the sanction list for various reasons, including terrorism, war crimes, and the proliferation of weapons of mass destruction.

Sanction List meaning in simplest terms is, a publicly listed directory of entities and individuals upon whom economic or legal restrictions have been imposed.

What is Sanctions in AML? - Anti-Money Laundering Sanction list

- UN consolidated sanctions list

- UAE Local Terrorist List

- OFAC - Specially Designated Nationals (SDN)

- US consolidated sanctions (Sanction list of the united states)

- Office of the superintendent of financial institutions (Canada)

- Bureau of industry and security (The United States of America)

- Switzerland consolidated list

- Turkish terror wanted list

- Interpol UN wanted list

- Department of state, nonproliferation sanctions (US)

- US Department of state, Statutorily Debarred Parties

- UK Sanctions List

- Singapore List of Designated Individuals and Entities

- Sanctions List Malaysia

- Sanctions List Qatar

- DFAT Consolidated Sanction List Australia

- EU Financial Sanctions List

- World Bank Listing of Ineligible Firms and Individuals

Who are all on a sanctions list?

Sanctions might be leveled as a result of explicit or illegal activities or in order to achieve a foreign policy or a diplomatic aim. These sanctioned lists are usually passed by the act of an international authority or by governments—for instance, the United Nations Security Council Resolution.

Several international sanctions lists incorporate targets involved in the financing of criminal or terrorist activities. Sanctions screening lists basically include organizations, individuals, or the entire nation engaged in severe crimes like terrorist financing.

Here are a few activities that a sanction list claims to counter.

- Terrorism and terrorist financing

- Violation of human rights

- Narcotics trafficking

- Weapons proliferation

- Money laundering activities

- Violation of international treaties

- Violation of international contracts

Compliance. Trust. Transparancy

Customized and cost-effective AML compliance services to support your business always

What is the purpose of AML sanction lists?

Financial crimes exponentially reduce the stability of all the countries’ economies and confidence in the economic systems. Governments of several countries impose sanctions on several individuals and nations who are more prone to risk to their country’s economy and organizations.

Sanction lists have been emphasized under anti-money laundering laws or regulations. Enterprises that have to comply with various international laws follow this list on a regular basis. People who have been mentioned in the sanctions lists are prohibited from entering into any financial transactions. Sanctions that are imposed accurately aim to increase financial stability and confidence.

The other principle upon which such Sanction List is based is the “conflict of interest.” While every country wants to be successful in implementing its foreign policies, it might experience hardships with many other countries. Some of these problems or difficulties cannot be solved; countries have to get on the middle ground and find a solution by imposing international sanctions on the corresponding countries. Restrictions on trade are one of the classic examples of this. As a result of these sanctions, companies and citizens are restricted in cooperating with the respective country. Here are a few sanctions imposed by many countries.

- The United States of America imposed political and economic sanctions against Iran in 1979.

- The United States of America imposed diplomatic sanctions on North Korea because of its nuclear program of North Korea in the year 1950.

Impact of being on a sanctioned list:

Restrictions on financial transactions and business dealings: After addition to the sanction list, an individual/entity/economy is forbidden to have any financial or business relations with the rest of the economies.

Travel bans and visa restrictions: As per UN Sanctions measures in the Travel ban, All the member countries are required to prevent entry into or transit through their territories by designated individuals. This process, in turn, will restrict the physical movements of the sanctioned.

Reputation and perception of individuals and entities on the list: The sanctioned do carry a reputational risk as they are infamous for certain activities which they have committed and are on the list in the first place. Other entities and economies are bound to cut ties with the sanctioned.

United Arab Emirates AML Sanctions List

The UAE is a member of three main regional bodies that issue sanctions – the Arab League, the Terrorist Financing Targeting Centre (‘TFTC’), and the Gulf Cooperation Council (‘GCC’).

Additionally, the UAE maintains two main lists of sanctioned individuals and entities –

a. The local list – This list consists of a local terrorism list issued pursuant to the Anti-Terrorism Law. It is also called the UAE Sanction List.

b. UN Sanctions list – This consists of a sanction list issued by the UN Security Council.

Such international and national sanction list can be accessed through

https://www.un.org/securitycouncil/content/un-sc-consolidated-list

UAE Sanctions List

Download UAE Local Sanction List/Terrorist List 2023 in PDF Format

Download UAE Local Terrorist List 2023 in Excel Format

UNSC Sanctions List

Search for Individuals and Entities on UNSC Consolidated Sanctions List

Sanction lists screening for AML compliance

Sanctions list screening is again one of the essential aspects of Customer Due Diligence (CDD) under Anti-money Laundering regulations. Business houses have to implement AML risk assessment throughout the client onboarding and client monitoring processes. Anti-money laundering regulators impose heavy AML fines on organizations that fail miserably to comply with all the CDD Processes.

AML UAE provides Anti-Money Laundering Consulting Services to help companies adhere to the requirements of the AML Laws in UAE.

sanctions Screening in UAE

Final words

Hope this article has helped you to understand the meaning, need, and importance of Sanction Lists for any business organization. However, you may need an expert's help, like us, to implement the process for screening the Sanction List to adhere to the AML/CFT regulations.

Our recent blogs

side bar form

Share via :

FAQs About Sanctions List

A sanction means a ban or restriction of specific individuals, countries, or entities directly or indirectly engaged in crimes and illegal activities.

The types of sanctions include sanctions for activities of:

- Terrorism

- Narcotics trafficking

- Money laundering

- Violation of human rights

- Weapons production

- Violation of international contracts and treaties

Businesses in UAE have to follow two sanctions lists. One is the local list that contains lists of local terrorists under the Anti-Terrorism law. The second one is the Sanctions list by the UN Security Council.

AML sanctions list is a list of individuals, entities, or countries engaged in terrorism financing, money laundering, bribery, corruption, and other financial crimes.

Sanctions check means trying all ways and measures to avoid engaging in business transactions with persons, entities, or countries featuring on the Sanctions List.

Sanctions Check involves name screening customers against the UAE local terrorist list and UNSC sanctions list.

A sanctioned individual is an individual mentioned in a Sanctions list and so barred or prohibited from engaging in specific transactions.

The Office of Foreign Assets Control (OFAC), United States of America, issues the sanction list. The OFAC list aims to safeguard US foreign policy objectives and protect international trade from terrorist activities and illegal trading in arms and drugs. The individuals and entities listed in the OFAC list are called Specially Designated Nationals (SDNs). Check OFAC Website for the current SDN List.

If an individual or entity fails to comply with the Targeted Financial Sanctions (TFS) obligations in UAE, such a natural or legal person will be subject to Imprisonment or a fine of no less than AED 50,000 (fifty thousand dirhams) and no more than AED 5,000,000 (five million dirhams).

TFS regimes must be complied with by individuals and entities located in the UAE, and such UAE persons must comply with the targeted financial sanctions restrictions when they are located or engaged in activities abroad.

If a current or former customer is listed on a Sanctions List, then the financial institution or DNFBP must freeze funds and stop providing services to such customer and must immediately inform the Supervisory Authority and FIU via goAML Portal.

The Federal Cabinet Resolution No. 74 of 2020 establishes the legal framework for the implementation of the UAE local Terrorist List and the UN Consolidated List.

OFAC sanction programs are categorized under four main topics:

- Country-based sanctions

- List-based sanctions

- Secondary sanctions

- Sectoral sanctions

Executive Office for Control & Non-Proliferation (EOCN) is the focal authority in the UAE to coordinate the implementations of all UN-imposed resolutions & Sanctions by combating Terrorism Financing (TF) and Proliferation Financing (PF).

The EOCN circulates the names of designated entities and individuals by the UN sanctions and UAE Terrorist list. It ensures the implementation and compliance of all supervisory authorities to the UN sanctions and UAE Terrorist lists in coordination with the Supreme Council of National Security. It analyses private sector TFS reports and provides feedback in coordination with FIU & Supervisory Authorities. It also works on increasing awareness in the Government and Private sector in regards to Targeted Financial Sanctions (TFS).

The purpose of Targeted Financial Sanctions (TFS) is as follows:

- To deny certain individuals, groups, organizations, and entities the means to support terrorism or finance the proliferation of weapons of mass destruction.

- To ensure no funds, financial assets, or economic resources of any kind are made available to such individuals, groups, organizations, and entities as long as they remain subject to the sanction’s measures.

Sanction regimes mainly seek to support the settlement of political conflicts, non-proliferation of nuclear weapons, and counter-terrorism by enforcing comprehensive economic and trade sanctions or more targeted measures.

The reporting entities in UAE need to implement international sanctions regimes, including OFAC, EU, HMT, etc., as per the guidance and instructions issued by the relevant supervisory authority.

The supervisory authorities in UAE:

- Create awareness about the obligations of FIs, DNFBPs, and VASPs in relation to Targeted Financial Sanctions via several measures like outreach, training, online guidelines, etc.

- Conduct examination and ensure compliance with decisions and regulations in relation to Targeted Financial Sanctions in UAE

- Monitor compliance, prescribe remedial measures, and enforce penalties for Targeted Financial Sanctions non-compliance

The United Nations Consolidated List, and UAE Terrorist List can be downloaded from the EOCN website https://www.uaeiec.gov.ae/en-us/un-page?p=2.

One can download the UAE Local Terrorist List in PDF and Excel format from the above page. UN Sanction list can be downloaded in PDF, HTML, and XML format from the above link.

One can subscribe to the Executive Office for Control & Non-Proliferation (EOCN) mailing list on https://www.uaeiec.gov.ae/en-us/un-page?p=6 and keep track of addition, deletion, and amendments to the sanctions list.

If you ever come across an individual who is a sanctioned individual or entity per the UAE Terrorist List or UNSC Consolidated List, you should immediately (within 24 hours) freeze funds belonging to such designated individual or entity in your custody. A prior intimation to the sanctioned person is not needed in this case.

Further, you should prohibit the transfer, conversion, disposition, alteration, use, or dealing of funds or economic resources which result in Change in their volume, amount, location, ownership, possession, nature, or destination or that would in any way enable the use of such funds or economic resources for any purpose.

To conclude:

- If the sanctioned person is an existing customer, then you should freeze funds within 24 hours and submit Funds Freeze Report (FFR) with the goAML portal of FIU UAE within 5 days.

- If the sanctioned person is a potential customer, you should reject the customer and submit FFR Report within 5 days.

- These FFR reports are then forwarded by the goAML portal to the UAE FIU.

- The freezing of funds shall remain in effect until such designated person is de-listed from the sanctions list.

The main obligations of FIs, DNFBPs, and VASPs in relation to the Targeted Financial Sanctions are as under:

- To register with the EOCN mailing list to keep them updated with the change in local and UN sanction lists.

- To screen customers, potential customers, beneficial owners, and transactions to identify possible matches with the UAE local sanction list and the UN sanction list.

- To implement Targeted Financial Sanctions (TFS) measures and freeze and prohibit funds, and file FFR with the goAML portal of the UAE FIU.

- To prepare and implement internal AML policies and procedures in relation to the targeted financial sanctions.

As a DNFBP, you are supposed to screen the following:

- Existing customer databases. All systems containing customer data and transactions need to

be mapped to the screening system to ensure full compliance. - Potential customers before conducting any transactions or entering a business relationship with

any Person. - Names of parties to any transactions (e.g., buyer, seller, agent, freight forwarder, etc.)

- Ultimate beneficial owners, both natural and legal.

- Names of individuals, entities, or groups with direct or indirect relationships with them.

- Directors and/or agents acting on behalf of customers (including individuals with power of

attorney).

The AML compliance officer is supposed to submit the Partial Name Match Report when a Potential Match to a sanctioned person is identified in the UAE Local Terrorist List or UNSC Consolidated List.

Here is the list of action items for the AML compliance officer for a partial name match:

- Suspend without any delay the transaction and refrain from offering any funds, products, or services

- Submit the Partial Name Match via goAML platform of UAE FIU by selecting the Partial Name Match Report (PNMR) within 5 days

- Submit as much information as possible in relation to the partial name match

- Do not enter into a transaction with the customer until further instructions are obtained from the UAE FIU.

- One need not obtain any prior approval while freezing funds or suspending a transaction

A person (natural or legal) who, in good faith, freezes funds or refuses to provide services or report information in relation to designated individuals, groups, or entities in the UAE Terrorist List or UN consolidated list shall be exempt from any damages or claims, resulting from such actions.

Violating UAE Cabinet Resolution No. 74 of 2020 can expose the FI or DNFBP to administrative penalties and criminal prosecutions, including:

- Increased scrutiny of future actions from the UAE Government

- The supervisory authority may determine a ban of certain individuals from employment within the relevant sectors for a period of time.

- A suspension, restriction, or prohibition of activity, business, or profession causes either revocation or withdrawal of the business license

- As per Federal Decree Law No. (20) of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism and Illegal Organizations, Article (60), every natural or legal person shall immediately comply with the instructions issued by the Competent Authorities in the State concerning the implementation of the resolutions issued by UN Security Council.

- Any Person, found to violate and/or be in non-compliance with the obligation in the Cabinet Decision No. 74 of 2020 or failing to implement procedures to ensure compliance may face imprisonment of no less than one year and no more than seven years and/or a fine of no less than AED 50,000 (fifty thousand dirham) and no more than AED 5,000,000 (five million dirham).

- The AML Policy Manual must prescribe the appropriate internal controls to ensure compliance with the most recent publication of targeted financial sanctions of the UNSC Consolidated lists and the UAE Local Lists.

- The AML Policy Manual must have a section dealing with internal controls and procedures to ensure compliance with the obligations arising from Cabinet Resolution 74 of 2020.

- The AML Policy Manual must have a clause prohibiting staff from, directly or indirectly, informing the customer or any third party that freezing action or any other measures are going to be implemented as per provisions of Cabinet Resolution 74 of 2020.

Article 16(e) of Federal Law No. 20 of 2018 (amended by Federal Decree No. 26 of 2021) requires the prompt application of the directives when issued by the competent authorities in the state for implementing the decisions issued by the UN Security Council under Chapter (7) of UN Convention for the Prohibition and Suppression of the Financing of Terrorism and Proliferation of Weapons of Mass Destruction, and other related directives.

In addition, the UAE issued the Cabinet Decision No. 74 of 2020, establishing the framework regarding TFS, including the Local Terrorist List and the UN Consolidated List and the procedures to implement TFS.

Targeted Financial Sanctions (TFS) measures must be implemented by any Person (both natural and legal entities), including government authorities and FIs, DNFBPs, and VASPs located in the UAE and operating within the UAE’s jurisdiction.

The Cabinet Decision No. 74 of 2020 deals only with the UAE Local Terrorist List and UN Consolidated List. Other international lists, like OFAC, EU, HMT, etc., are out of the scope of the cabinet decision.

Since you are not a FI, DNFBP, or VASP and therefore, you are not required to register with the goAML portal, If you come across a sanctioned individual or entity, you can send an email to the Executive Office iec@uaeiec.gov.ae with information about the confirmed or potential match.

Yes, supervisory authority checks compliance with the Cabinet Decision No. 74 of 2020 and carries out the onsite inspections of FIs, DNFBPs, and VASPs. The reporting entities should have adequate processes, policies, and procedures to comply with the provisions of the cabinet decision. A failure to comply with the TFS provisions may result in the application of criminal as well as supervisory sanctions.

No. FIs, DNFBPs, and VASPs may notify their customers after the freezing measures have been implemented, and it will not be considered as tipping off. However, FIs, DNFBPs, and VASPs must not inform their customers prior to taking the freezing measures.

The individuals and entities involved in acts of terror, violation of international law, and detrimental to global growth, development, and peace are added to the sanction lists.

Sanctioned lists are widely used as a go-to list by member countries which helps in the identification of the sanctioned. The member countries come together as a group to the identification of unethical wrongdoers.

The individuals and entities in those lists are prohibited from having business relations.

The sanctions list claims to encounter and restrict any individual or entity that disturbs international peace and security.

Individuals and Corporates are added when they pose an international threat to the economy. The process of removal or de-listing involves various requests such as petitions and reviews from the government and their recommendation. After that, the committee makes a final decision on whether to de-list or not.

Individuals and companies can subscribe to both UN Consolidated list and Local Terrorist list from the EOCN website.

Sanctions in money laundering indirectly come under Economic sanctions. Disturbance of international peace by money laundering directly or indirectly will lead to sanctioning.

The period of sanctions depends on the activity status of that person or entity means whether that person is still operating in the same manner. Hence the sanction will last until it is actively involved in harming international peace.

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.