Video on Sanction Screening in UAE

Home

Videos

Video on Sanction Screening in UAE

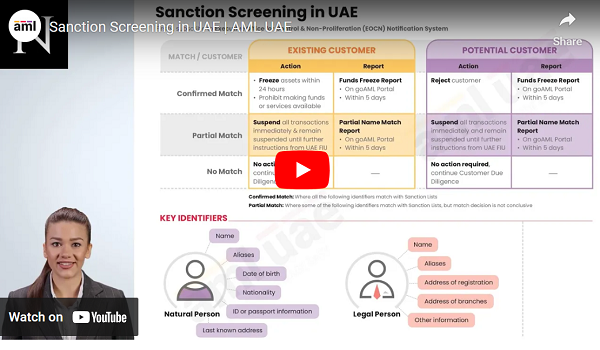

This video will help you understand the basic concepts around sanctions screening, what it is, what sanctions list to include as per UAE AML requirements, how to conduct sanctions screening, and more:

- What is sanctions screening

- UAE Local List and UNSC List

- When to conduct sanctions check

- The requirements around the EOCN mailing list subscription

- Sanctions screening process

- What to while dealing with sanctioned individuals and entities

- Partial Name Match and Fund Freeze Report Submission with the FIU goAML portal

Chapters:

Related Videos

Related Infographics

- Sanctions screening regulatory requirements in UAE

- Countering the Proliferation Financing: Concept and Mitigation Measures

- Filing of Fund Freeze Report (FFR) under UAE AML Laws

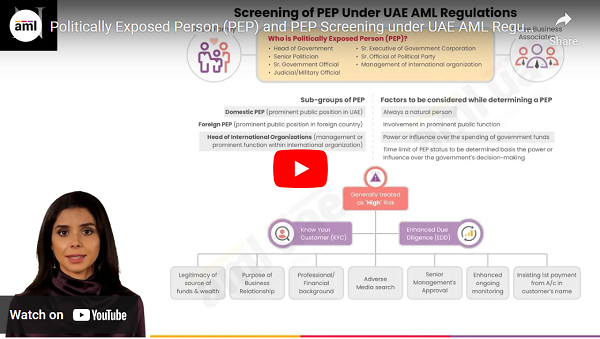

- PEP and PEP Screening under UAE AML Regulations

- PEP Screening Guide

- Filing of Partial Name Match Report (PNMR) under UAE AML Laws

Related Articles

- A Guide to Sanction and PEP Screening in Customer Onboarding Process

- What is a sanction list?

- Targeted Financial Sanctions (TFS): Legal Requirements in UAE

- Sanctions Compliance by VASPs in UAE: Safeguarding the Virtual Asset segment against financial crimes

- TFS Implementation Criteria: Ownership, Control, and Acting on behalf of a Designated Person

- What are Economic Sanctions?

- Choosing an apt AML Software for DPMS

- Updated list of FATF high-risk countries and countries under increased monitoring

- How do you do a Sanction Screening?

- Role of FATF: The Financial Action Task Force

- What are FATF Blacklist and Grey list countries?

- The Challenges of The Sanction Screening Process

- Simple Guide to Subscribe to Sanctioned List

- The Role of Sanctions in Achieving International Peace and Security

- Socio-economic impact of money laundering

- Funds Freeze Report (FFR) and Partial Name Match Report (PNMR) filing with goAML

- What is Proliferation and Proliferation Financing?

- A complete guide to global AML regulations

Share via :

Share on facebook

Share on twitter

Share on linkedin

Share via :

Share on facebook

Share on twitter

Share on linkedin