The Vital Role of an AML Compliance Officer in Safeguarding VASPs in the UAE

With the increasing acceptance of virtual assets, Virtual Asset Service Providers (VASPs) also continue to grow around the globe, including in the UAE. However, given the nature of the virtual assets – anonymity involved and easy transferability – criminals misuse them for money laundering and terrorism financing activities.

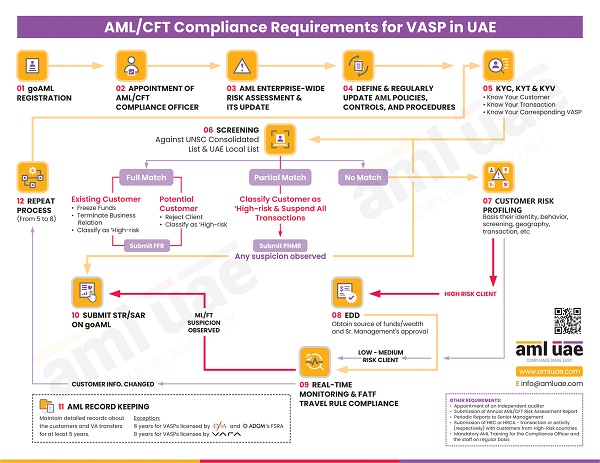

To manage the exploitation of virtual assets, the countries have implemented stringent regulations and have entrusted VASPs with compliance obligations to identify and prevent the ML/FT risk. To effectively implement the AML compliance program and adhere to the regulatory requirements, the role of the anti-money laundering (AML) Compliance Officer is important for VASP.

In this article, we will discuss the role of AML Compliance Officers in ensuring AML Compliance for VASPs in the UAE.

Introduction to AML Compliance in the UAE

The UAE government intends to develop the country as an international virtual assets centre. To promote this, robust AML compliance regulations around mitigating the risk of money laundering and terrorism financing have been introduced.

To manage the activities of the virtual asset in Dubai, the government has formed a supervisory authority – the Virtual Assets Regulatory Authority (VARA) of Dubai. At the same time, there are other authorities designated to supervise the activities of the virtual asset across the UAE, such as the Financial Services Regulatory Authority for VASPs registered in Abu Dhabi Global Market (ADGM), Dubai Financial Services Authority for VASPs operating from Dubai International Financial Centre (DIFC) and Securities and Commodities Authority of UAE for rest of the 6 Emirates and free zones.

These authorities have developed and implemented comprehensive AML regulatory guidelines and rulebooks for VASPs, mandating VASPs to design solid AML frameworks and ensure compliance with international best practices and FATF recommendations around managing ML/FT risks associated with virtual assets.

The Importance of AML Compliance

Compliance with AML regulations is mandatory for various regulated organizations, including Virtual Assets Services Providers in the UAE. A robust AML compliance program will safeguard virtual asset activities against being exploited for money laundering or terrorism financing activities. Further, non-compliance with any AML obligation will lead to severe adverse consequences for the VASP, such as substantial administrative fines, reputational damage and even termination of the license to conduct virtual asset activities.

Adequate AML compliance will help VASP create customer loyalty and seek respect from various stakeholders and market players worldwide, looking at its efforts towards combating money laundering and financing terrorism.

UAE's Regulatory Framework for AML Compliance

The UAE has established a comprehensive AML regulatory framework for financial institutions, VASPs and other Designated Non-Financial Businesses and Professions (DNFBPs). The legislative framework includes the Federal Decree-Law and the implementing Cabinet Decision, specific guidance issued by the relevant supervisory authorities like the Central Bank of UAE, Securities and Commodities Authority of UAE, Ministry of Economy, Ministry of Law, etc.

These AML regulations lay down comprehensive AML requirements for regulated entities operating in the UAE, including customer due diligence measures that must be adopted before establishing a business relationship, ongoing transaction monitoring requirements, procedures for identifying and reporting suspicious transactions, etc.

The UAE government is committed to fighting financial crimes and developing UAE as a safe and secure internal financial centre. Violating the UAE’s AML regulations requires heavy penalties and a long-term impact on the reputation.

Defining Virtual Asset Service Providers (VASPs) in UAE

In simple language, the business organization providing virtual assets-related services to its customer is a Virtual Asset Service Provider. For instance, the company operating a cryptocurrency exchange or services of converting eth fiat currency into virtual assets or vice versa.

Virtual assets are digital representations of value that can be transferred or traded using distributed ledger technology. The virtual assets include cryptocurrencies like Bitcoin and Ethereum, Non-Fungible Tokens (NFTs) and other digital assets like stablecoins. VASPs are essential in facilitating virtual asset trade, transfer and use.

Types of VASP in UAE

The different types of virtual assets-related services that qualify as VASP include:

- an exchange between virtual assets and fiat currencies or between one or more forms of virtual assets,

- transfer of virtual assets between wallets by way of virtual asset transactions on behalf of another person,

- safekeeping and administration of virtual assets owned by other persons or instruments, enabling control over virtual assets,

- Facilitating and providing financial services related to virtual assets issuer’s offer or sale of a virtual asset into the primary or secondary market.

VASP Regulation in the UAE

To safeguard virtual assets from financial crime, the UAE has developed a robust AML regulatory framework for VASPs, including stringent licensing requirements and ongoing regulatory oversight of virtual asset activities. Along with Federal Decree-Law and the implementing guidelines, the regulatory authorities have also issued guidance and AML rulebooks for monitoring the VASP in their respective jurisdictions, such as ADGM’s FSRA, VARA, DIFC’s Dubai Financial Services Authority, etc.

The UAE’s AML regulations for VASPs are based on international best practices and the FATF recommendations around virtual assets and VASPs. The regulatory framework mandates that VASPs in the UAE comply with customer due diligence processes and sanctions screening requirements, implement transaction monitoring systems and procedures, ensure timely reporting of suspicious transactions to the Financial Intelligence Unit (FIU) and the regulatory authority, etc.

The Role of an AML Compliance Officer in VASP

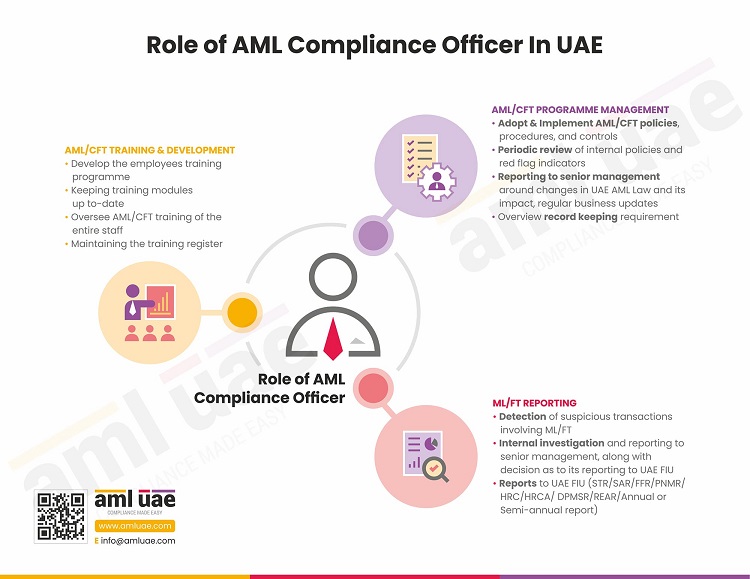

To ensure effective compliance with AML obligations, the VASP must appoint a competent AML Compliance Officer or a Money Laundering Reporting Officer (MLRO). The AML compliance officer’s role is pivotal in ensuring 100% AML compliance by VASPs, including safeguarding the VASP against the evil of money laundering and terrorism financing and preventing these financial crimes.

The overall responsibility of implementing and overseeing the effectiveness of the AML compliance framework lies with the AML Compliance Officer.

Key roles and responsibilities of AML Compliance Officer

The AML compliance officer in VASP is entrusted with several key responsibilities around AML compliance, such as:

1. Conducting overall business risk assessments or enterprise-wide risk assessments of the VASP, considering all the relevant risk factors posing a risk to the business

2. Designing and implementing a robust AML compliance framework aligned with the overall business risks and regulatory requirements, including policies, procedures, and controls.

3. Developing and implementing a comprehensive customer onboarding process, including Know Your Customer, Know Your Transactions, and sanctions screening.

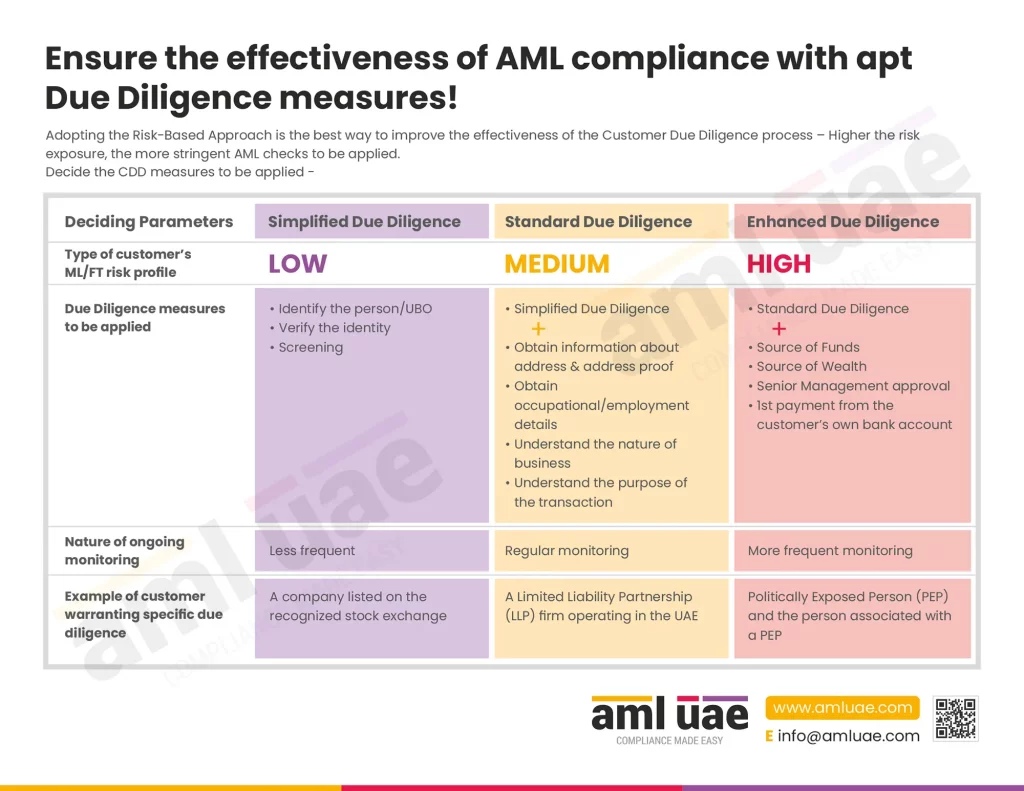

4. Implementing the systems and procedures for assessing customer risk and applying adequate customer due diligence measures, including enhanced due diligence.

5. Defining the rules for ensuring ongoing monitoring of transactions to identify unusual patterns or suspicious activity and ensure relevance and effectiveness.

6. Identifying the potential red flags and making them part of the AML policies. A few red flags related to virtual assets activities are:

- Structuring virtual asset transactions in small amounts,

- Making multiple high-value transactions within 24 hours,

- Transferring virtual assets immediately to multiple VASPs in another country where there are no AML/CFT regulations,

- Depositing virtual assets at an exchange and then immediately withdrawing the same without any further activity,

- Conducting a large deposit to open a new wallet with a VASP, which is inconsistent with the customer’s economic profile,

- Conducting VA-fiat currency exchange at a potential loss,

- The use of decentralized/un-hosted wallets.

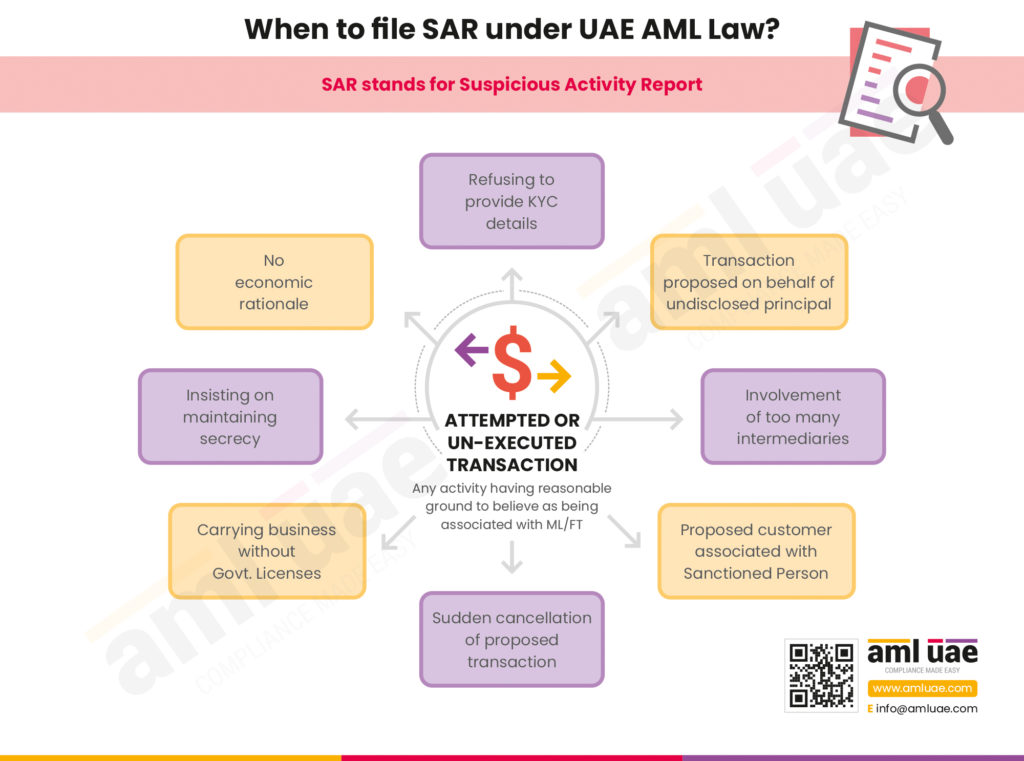

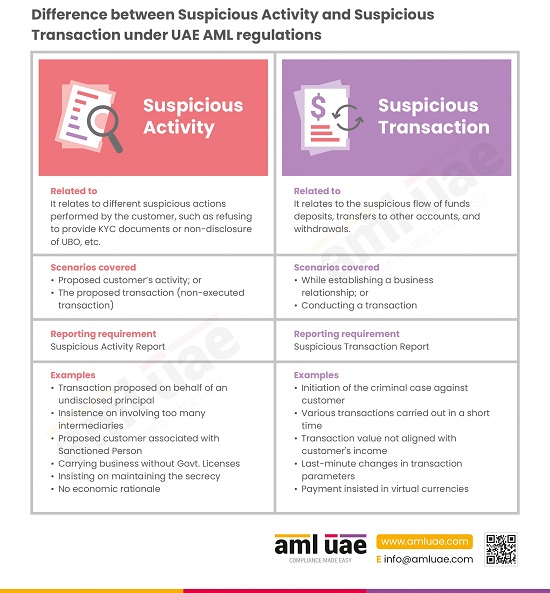

7. Receiving internal reports on observed suspicion, investigating the same and filing the Suspicious Transaction Reports (STR) or Suspicious Activity Reports (SARs) with FIU and regulatory authorities.

8. Designing and conducting AML training programs for the employees, including senior management.

9. Conducting a periodic review of the AML program and submitting a report to the senior management.

10. Ensuring AML-related records are adequately maintained and secured from unauthorized access.

Required Skills and Qualifications

Given the importance of the AML compliance officer’s role in VASP, the designated person must have a strong understanding of AML regulations and industry knowledge and experience.

Moreover, the AML compliance officer must possess excellent communication skills supported by problem-solving approaches. Officers must be competent and independent enough to effectively manage the AML compliance requirements and prevent misuse of virtual assets for money laundering or terrorism financing activities.

Key Challenges Faced by AML Compliance Officers

AML compliance officers in VASP face various challenges in ensuring compliance with AML regulatory requirements. One of the significant challenges is keeping pace with the evolving ML/FT typologies related to virtual assets and amending AML regulations. The Compliance Officer must stay up-to-date with AML compliance obligations to avoid non-compliance penalties and safeguard the business from being exploited by criminals using new money laundering techniques.

Another challenge the AML compliance officers faces is managing the large volume of data about customers and transactions. Such a colossal database makes monitoring and identifying suspicious activity difficult without sophisticated AML software.

The role of the AML Compliance Officer in VASP must be independent of regular business operations and client relationship management. The Compliance Officer must balance the business and AML Compliance without comprising the AML regulatory obligations.

Implementing AML Compliance Programs in VASP

The AML compliance program in VASP must be comprehensive, aligned with the VASP’s overall ML/FT risk and capable of identifying and mitigating the money laundering and terrorist financing risks effectively. The AML compliance framework should include the methodology of conducting enterprise-wide risk assessment, customer due diligence process, ongoing transaction monitoring, compliance with FATF travel rule, AML record keeping, and procedures for identifying and reporting suspicious transactions.

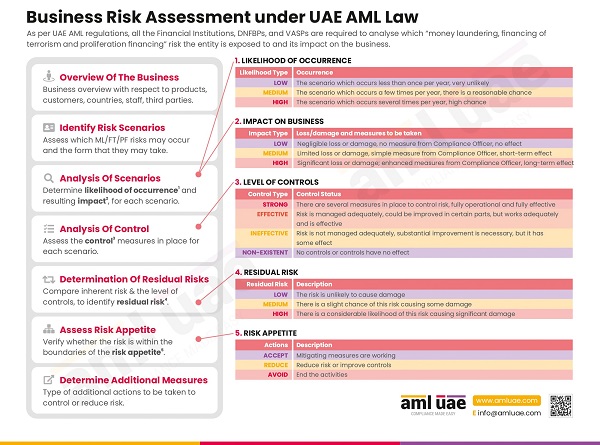

Business Risk Assessment

The risk assessment process involves identifying and evaluating the money laundering and terrorist financing risks the VASP is exposed to. The Compliance Officer should consider various risk factors such as customer base, geographies, products and services, etc.

Risk Mitigation Policies, Procedures and Controls (AML Framework)

Once the overall risk has been identified, it is the role of the AML Compliance Officer to design and implement adequate risk mitigation policies, procedures, and controls. The AML framework must be aligned with the size, nature and complexity of the business activities and must be approved by the management of the VASP.

Customer Due Diligence (CDD), Know Your Customer (KYC) and Know Your Transaction (KYT) Procedures

KYC and KYT procedures are essential to identify and verify the customer’s identity and understand the transactional elements associated with the virtual asset transfer. Further, the framework should include adequate customer risk profiling procedures and implementing the Targeted Financial Sanctions (TFS) and screening requirements.

Effective customer due diligence will ensure that VASPs deal with genuine customers and do not unintentionally aid in money laundering activities by onboarding financial criminals as their customers.

Identifying and Reporting of Suspicious Activities

Adequate procedures and systems must be implemented to monitor the transactions and customer profiles to detect and report suspicion. The Compliance Officer shall ensure that potential suspicious transactions are investigated internally and only reported to the FIU and the supervisory authority if the internal examination confirms the ML/FT suspicion warranting the external reporting.

One of the important roles of the AML Compliance Officer is to ensure the timely filing of the Suspicious Transaction Report (STR) or Suspicious Activity Report on the goAML Portal.

AML Governance

The Compliance Officer must assess the AML training needs of the employees and design a comprehensive AML training program. The AML training program must be included in the AML framework, highlighting the timing, course, and employees involved in this training.

Further, periodic reviews must be conducted of implemented AML program, and a report must be submitted to the senior management of the VASP by the AML Compliance Officer, highlighting the AML compliance gaps and mitigation measures additionally required.

Record Keeping

AML-related records must be maintained adequately for the specified period and in an organised manner.

Collaboration with Regulatory Authorities

AML Compliance Officer, or Money Laundering Reporting Officer (MLRO), is the key contact between the VASP and the regulatory authorities. One of the key roles of the AML Compliance Officer in VASP is to ensure effective correspondence with the authorities, including the following:

Reporting of Suspicious Transactions and Activities

Identifying and reporting suspicious transactions is a crucial responsibility of AML Compliance Officers in VASP. If suspicious activities are observed, the front-line team must immediately intimate to the Compliance Officer, who would investigate the matter and, if reporting is required, should immediately file a SAR or STR with the FIU.

Ongoing Training and Education

The AML Compliance Officer must attend AML training sessions and workshops conducted by the authorities to be updated with evolving AML regulations and practices.

Ensuring Compliance with Evolving AML Regulations

AML Compliance Officer must ensure that VASP’s AML/CFT framework, including policies, procedures, and controls, are up-to-date with the amended regulatory requirements.

How can AML UAE assist AML Compliance Officers in fulfilling their roles in VASPs?

AML Compliance Officer must ensure that its Virtual Asset Service Provider (VASP) complies with UAE local AML regulations and the FATF recommendations around virtual assets transactions. The role of the AML Compliance Officer in VASP is critical to identify and mitigate the financial crimes risks by developing a robust AML compliance framework.

AML UAE is a leading AML consultancy firm, assisting VASPs in assessing the overall risk, designing and implementing an AML compliance program, establishing a competent AML compliance department and imparting adequate AML training to ensure regulatory compliance and avoid administrative fines for AML violations.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.