TFS Implementation Criteria

Targeted Financial Sanctions are restrictions imposed on Designated Persons from the financing of terrorism and proliferation perspective, mandating the business organizations not to make any funds or assets available to such Designated Persons.

Targeted Financial Sanctions Legal Framework in UAE:

Article 16(e) of Federal Decree-Law No. 20 of 2018 (as amended by Federal Decree-Law No. 26 of 2021) requires the prompt application of the directives issued by the UAE’s competent authorities for implementing the decisions of the UN Security Council under Chapter (7) of UN Convention for the Prohibition and Suppression of the Financing of Terrorism and Proliferation of Weapons of Mass Destruction, and other related directives.

UAE Cabinet Decision No. 74 of 2020 establishes the framework regarding Targeted Financial Sanctions (TFS), including the Local Terrorist List and the UN Consolidated List and the procedures to implement TFS.

Any non-compliance with the obligations of Cabinet Decision No. 74 of 2020 or failure to implement procedures to ensure compliance may result in imprisonment for a minimum period of 1 year, up to 7 years, and/or a fine ranging between AED 50,000 and AED 5,000,000. Further, the Supervisory Authorities may impose any other appropriate administrative sanctions, such as issuing a warning letter or canceling the business license for any violation or shortcoming in implementing TFS obligations.

TFS Implementation Criteria 1: Ownership or Majority Interest

While implementing TFS with respect to designated individuals and entities listed on the UAE Local Terrorist List issued by the UAE Cabinet (in line with UNSC 1373) and on the UNSC Consolidated List issued by the United Nations Security Council, it is essential to take into account the following criteria viz., ownership, control and acting on behalf of a Designated Person.

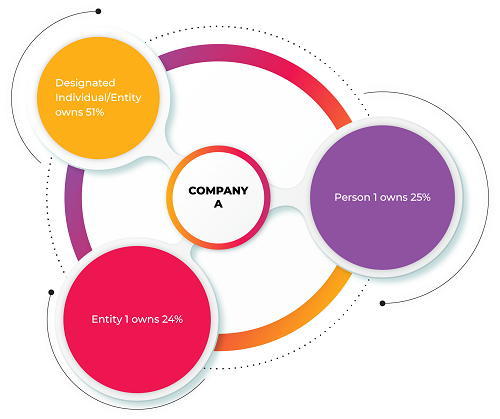

TFS must be implemented on a legal entity if a Designated Person (natural or legal) owns the entity. Suppose the designated individual or entity owns more than 50% of the proprietary rights or has a controlling interest in the entity. In that case, such an entity is considered owned by the Designated Person and is subject to a freezing mechanism.

Since the Designated Individual/Entity owns more than 51% of the non-designated Company A, the funds or other assets of Company A must be frozen immediately.

Since Entity 1 and Person 1 own 24% and 25% shares of Company A, they will not be treated as designated persons, and the freezing mechanism will not be applied to them.

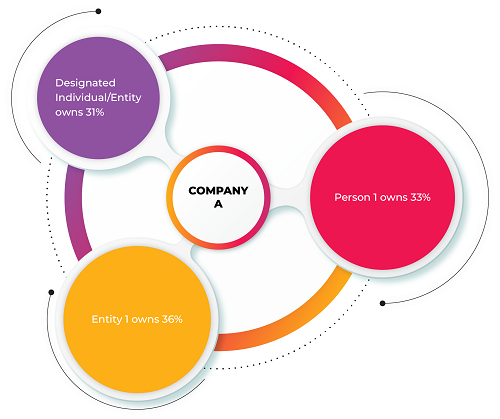

If the Designated Person holds 50% or less of the proprietary rights of a non-designated entity, such an entity is not subjected to the freezing mechanism.

Any funds or other assets due to the designated person’s 31% ownership of proprietary rights in Company A must be subject to a freezing mechanism.

The reporting entities must remain vigilant on the changes in the ownership structures of non-designated entities where the designated person holds 50% or less of the proprietary rights.

TFS implementation Criteria 2: Control

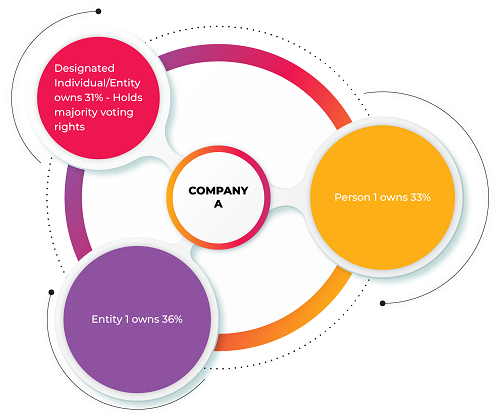

Suppose the Designated Person has control over the non-designated entity despite having a minority interest in such entity. In that case, Financial Institutions (FIs), Virtual Asset Service Providers (VASPs), and Designated Non-Financial Businesses and Professions (DNFBPs) are required to apply freezing measures.

To determine whether the designated person exerts control over the non-designated entity, the following criteria need to be taken into account:

- Check if the Designated Person has the right to appoint or remove a majority of the members of the legal entity’s management,

- Check if the Designated Person is appointed solely as a result of the exercise of his voting rights as a majority of the members of the management body of a legal person who has held office during the present and previous financial year,

- Check if the Designated Person is, alone, controlling the majority of shareholders’ or members’ voting rights in the legal person, pursuant to an agreement with other shareholders in or members of a legal person,

- Check if the Designated Person has the right to exercise a dominant influence over a legal person, pursuant to an agreement entered into with that legal person or to a provision in its Memorandum or Articles of Association, where the law governing that legal person permits its being subject to such agreement or provision,

- Check if the Designated Person has the power to exert the right to exercise a dominant influence referred to in point (d) without being the holder of that right,

- Check if the Designated Person has the right to use all or part of the assets of that legal person, e.g., managing the business of that legal person on a unified basis while publishing consolidated accounts,

- Check if the Designated Person shares jointly and severally the financial liabilities of a legal person or guarantees them,

- Check if the Designated Person has a power of attorney or authorized signatory arrangement over a legal person.

In the above scenario, despite holding the minority interest in the non-designated Company A, the freezing measures must be applied without delay as the Designated Individual/Entity exerts control over Company A by holding the majority of the voting rights.

TFS implementation Criteria 3: Acting on behalf or at the Direction of the Designated Person

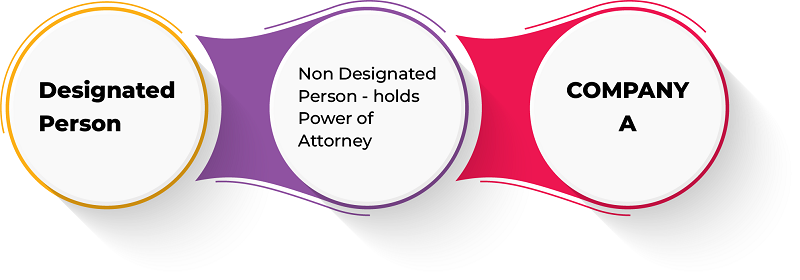

FIs, DNFBPs, and VASPs must apply TFS measures on individuals and entities holding power of attorney or acting as authorized signatories for designated persons.

In the above scenario, the Designated Person exerts control over Company A through a Power of Attorney issued in favor of a Non-Designated Person. Hence the funds and other assets of Company A must be frozen without any delay as it would be treated as being controlled by the Designated Person via Power of Attorney.

About AML UAE

AML UAE is an AML consulting firm assisting FIs, VASPs, and DNFBPs in complying with the AML Laws in UAE. Be it goAML registration, AML/CFT Program design and implementation, AML training, or TFS implementation, AML UAE is your one-stop solution for all your compliance worries. With AML UAE, ensure a robust TFS framework and fight the financing of terrorism and proliferation.

Avail comprehensive, expert, and efficient services for AML compliance matters

Contact our team at AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.