Suspicious Transaction Reports (STRs) filing with goAML portal of FIU UAE

The UAE government has implemented several laws to combat money laundering and prevent financing of terrorism. As per the UAE Anti-money laundering law, Financial institutions and Designated Non-Financial Business Professionals known as DNFBPs must identify and file suspicious transaction reports (STRs) with goAML Portal of FIU UAE.

As per the Law, DNFBPs are categorised as firms involved in one or more of the following activities- the Real Estate agent, Dealer of precious metals and stones, Company Service Providers, Auditors and accountants, and Law firms. They have to report transactions that they deem suspicious as they have reasonable grounds to suspect that the transactions might be related to money laundering or terrorism financing.

Also check guidelines for financial institutions on suspicious transaction reporting.

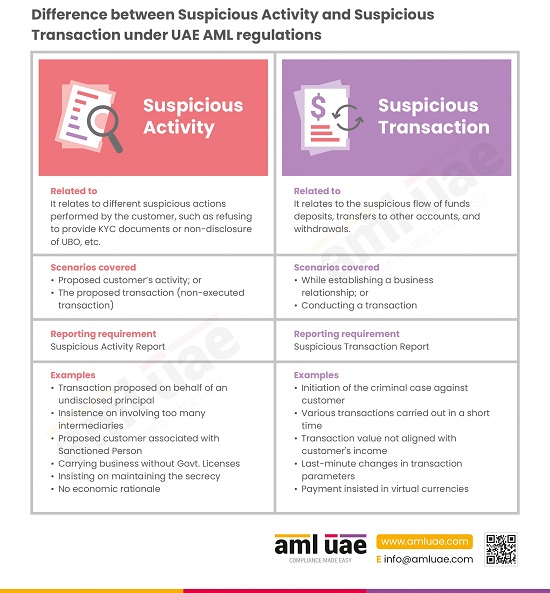

What are Suspicious Transactions under the UAE AML?

The UAE Anti-Money Laundering Law has described Suspicious Transactions as those transactions related to money. The entities have reasonable grounds to suspect that the money has been obtained from criminal proceeds- from crimes associated with the financing of terrorism or criminal organisations, whether they have been committed or attempted.

Funds in the description mentioned above refer to tangible and intangible assets, movable and immovable. It includes national currency, foreign currencies, documents, or notes that provide proof of ownership of the assets or associated rights. The rights can be in any form- electronic or digital forms or any interests, profits, or income stemming or earned from these assets.

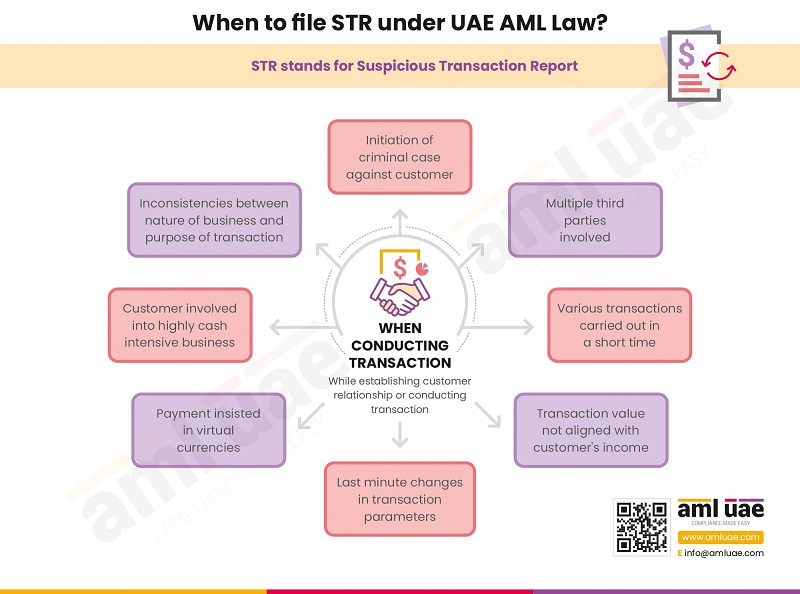

When do the entities report the Suspicious Transactions under the UAE AML?

If the DNFNPs suspect the transaction or attempted transaction involves criminal proceeds, and they have reasonable grounds to believe that the transactions are suspicious, they must report the transactions to the FIU. The suspicion might arise due to the unusual nature of the transactions or doubt about the person or group involved in the transaction.

How to detect Suspicious Transactions?

Today AML software is being increasingly relied upon to generate alerts for suspicious transactions that immediately identify doubtful transactions/accounts. The financial institutions, DNFBPs, and other regulated entities need to rely on alerts or red flags that categorise a transaction as a suspicious transaction. They let the business know about the legitimacy of the accounts and the money involved in the transaction.

Entities need to choose the best AML software based on their unique business requirements, which will help them notice the red flags and take immediate steps to combat money laundering and terrorism financing activities.

Who Receives the Suspicious Transaction Reports (STRs) under the UAE AML?

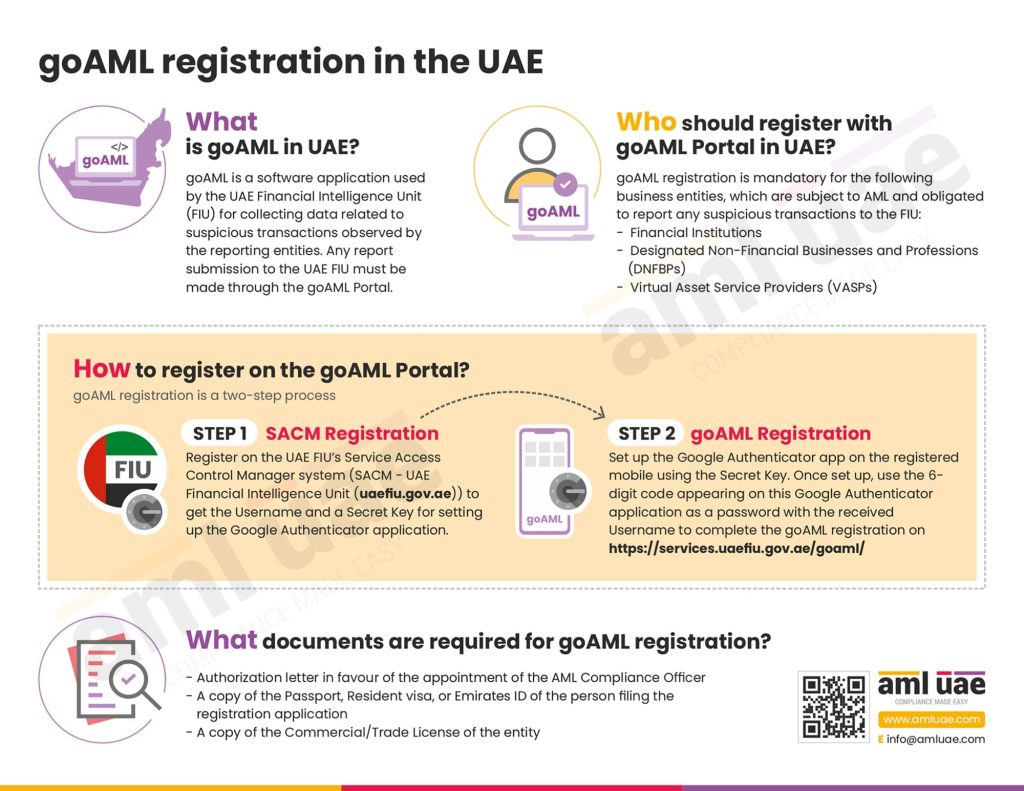

The Financial Intelligence Unit receives the Suspicious Transaction Reports from the entities who have reasonable grounds to believe that a transaction made or attempted is suspicious- might be criminal proceeds. The entities must report such transactions to the FIU on the goAML portal. The FIU analyses the reports received from different entities.

Confidentiality is required on Suspicious Transaction Reports under the UAE AML.

Confidentiality is a critical factor while reporting suspicious transactions to the FIU. Entities need to maintain confidentiality for the information shared. No unauthorised person, including the customer of whom the transaction is being reported, should access the information and know that the information has been shared with the Financial Intelligence Unit.

Duties of FIU- Financial Intelligence Unit under the UAE AML

The (UNODC)-United National Office on Drugs and Crime has developed the goAML portal to prevent money laundering and terrorism financing. The FIU is entrusted with the responsibility of analysing suspicious transactions and money laundering, terrorism financing, and keeping a tab on organisations involved in illegal activities. It analyses the STRs received from any entity on the goAML portal. The suspicious transaction reports must be submitted to the FIU on the goAML platform, which efficiently receives, analyzes, and disseminates the STRs.

It also partners with DNFBPs by sharing information and creating collaborative platforms to deal with money laundering and terrorism financing. If the entities fail to register on the goAML portal, it will be considered that the entity has violated Article 20(2) as it has not followed the mandatory procedure to report the suspicious transactions.

Penalties for non-compliance with the Law on Suspicious Transaction Reports

The Ministry of Economy (MOE) may impose administrative penalties on the DNFBPs for non-compliance with the AML. Non-reporting of suspicious transactions is a criminal offense, and the offenders are subject to heavy fines and imprisonment, including DNFBPs and employees. Failure to report a suspicious transaction will attract a penalty of a minimum of AED 100,000 and not exceeding AED 1,000,000 and/or imprisonment.

What are the exceptions to the Law on the filing of Suspicious Transaction Reports?

The government has announced some exceptions to the Law on Suspicious transactions reports considering the professional secrecy requirements for certain professionals such as notary publics, lawyers, independent legal auditors who have obtained the information while providing consulting services or defending the client in a legal proceeding. They are exempted from the Law on STRs and are not required to report suspicious transactions.

If the information is shared in good faith, the DNFBPs board members, employees, and authorised representatives are not liable for any administrative, civil or criminal liability for reporting to the FIU- Financial Intelligence Unit.

I have filed an STR/SAR with the CBUAE FIU goAML portal. Can I provide additional information pertaining to the transaction that has already been reported?

The Compliance Officer/MLRO can submit the additional information in relation to an STR filed with the CBUAE FIU goAML portal. He needs to submit an Additional Information File (AIF) or Additional Information File with Transactions (AIFT) if additional transactions need to be reported.

The compliance officer must provide a web reference number of the original SAR/STR in the FIU reference field.

Expert AML Consultancy services

If you need expert advice on AML compliance and Suspicious Transactions Reports, you can rely on AML UAE – a leading AML consultant in the UAE. We offer end-to-end AML compliance services such as AML-CFT-policy-controls-and-procedures-documentation, AML software selection, in-house AML compliance department set up, and many more. For the complete range of services, feel free to visit us.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.