What is smurfing in money laundering? Smurfing Technique, Risks, and Protective Measures

One of the widely used money laundering techniques, smurfing, poses a high risk to Financial Institutions worldwide. Smurfing meaning: smurfing is breaking down large amounts of cash into smaller amounts deposited with financial institutions to avoid detection and reporting thresholds. Owing to its characteristics of manipulating the transaction values, the technique is also known as “Structuring.” However, smurfing is more complex than the conventional way of structuring a transaction where in a single individual is involved. In contrast, in the case of Smurfing, more than one individual is involved.

Laundering of illegal money using the smurfing method can be carried out by individuals or organized crime groups, which leaves devastating consequences on financial institutions and society.

This article will provide insights into identifying smurfing instances and how financial institutions can safeguard themselves against them and prevent the same.

Before discussing how to prevent smurfing, it is important to understand what it is and how it affects financial institutions.

What is smurfing in financial institutions?

Smurfing involves splitting a large sum of cash into smaller amounts of multiple transactions below the AML reporting threshold to avoid the applicability of AML measures and detection by financial institutions and regulatory authorities.

Smurfing is often used to facilitate the placement of illegal funds into the valid financial system of the economy.

How does smurfing affect financial institutions?

As smurfing is used to launder funds by facilitating the entry of proceeds of criminal activities into financial institutions, it is a significant risk to the security and integrity of the financial institution. When financial institutions allow criminals to use the smurfing technique, knowingly or unknowingly, the financial institutions face legal consequences for aiding in money laundering activities and the breach of regulatory obligation of reporting the money laundering-related suspicious activities. Further, smurfing damages the reputation of financial institutions and adversely impacts public trust.

Thus, to avoid the loss of public trust and heavy fines for AML non-compliance, it is pertinent that the financial institutions design and implement robust procedures and controls to identify, report and prevent exploitation by smurfing.

What are the commonly used smurfing techniques in Money laundering?

Smurfing or the structuring of transactions can be conducted in many forms, and thus, awareness about the most common smurfing techniques is essential. The most frequently used smurfing technique is to divide the large cash amount into multiple smaller value transactions to deposit or withdraw cash from different financial institution locations or branches.

Other methods include using multiple accounts in the name of multiple individuals to conduct transactions and making payments using wire transfers or other electronic means of fund transfer to avoid AML scrutiny.

Financial institutions must monitor transactions and look for suspicious patterns or customer behaviour suggesting using smurfing. E.g., multiple withdrawals of the same amount through different accounts simultaneously but with the same beneficiary.

Cuckoo Smurfing in Money Laundering

One of the popular methods of money laundering is Cuckoo Smurfing. Let’s understand what Cuckoo Smurfing is, what are the elements of Cuckoo Smurfing, the Step-by-step process of Cuckoo Smurfing, and Cuckoo Smurfing indicators.

What is the Cuckoo Smurfing method in money laundering?

Cuckoo Smurfing is a money laundering method where criminals target bank accounts of legitimate customers expecting to receive funds from overseas. They split large transactions into smaller amounts of less than the regulatory threshold to avoid reporting to the FIU. Cuckoo smurfing is the comingling of criminals with money transfer agents to disguise the illicit proceeds and make them look like they have come from a legitimate source. This method is called Cuckoo Smurfing because it is like how Cuckoos lay their eggs in the nests of other species of birds and make them believe it’s their own. Here, the person receiving the funds is unaware that they are proceeds of crime and the source does not belong to them.

What are the elements of the Cuckoo Smurfing method of money laundering?

Here are the common elements of Cuckoo Smurfing in Money Laundering:

- No physical transfer

There is no physical transfer of funds in cross-border transactions. - Structuring

Large amounts of funds are split into smaller amounts to avoid reporting thresholds. - Involvement of Smurfs

Multiple Smurfs deposit cash into the bank account of a legitimate customer. - Cross-border transaction

Cross-border transactions wherein the transferor and the beneficiary are located in two different countries. - Illicit Money

Cuckoo smurfing involves cash derived from illegal activities.

Cuckoo Smurfing Methodology: Step-by-step

Overseas Transferor

1. Overseas transferor wants to make a cross-border money transfer, and he deposits funds with a remitter

2. The remitter does not transfer funds to the cross-border beneficiary

3. The remitter asks a professional money laundering syndicate in the beneficiary’s country to deposit cash in the beneficiary’s bank account

4. Once the cash is deposited into the Beneficiary’s account, the funds are transferred by the remitter to the money laundering syndicate

Beneficiary

1. Professional money laundering syndicate deposits cash into the beneficiary’s bank account in small amounts to avoid reporting threshold (Structuring)

2. Beneficiary thinks funds have legitimately arrived from the overseas transferor (Cuckoo’s Nest)

Red flags indicating Cuckoo Smurfing

Reporting entities are under legal obligations to maintain red flags indicating suspicious transactions and activities and submit a Suspicious Activity Report or Suspicious Transaction Report in case of suspicion. Here are some red flags that indicate cuckoo smurfing:

1. Cuckoo Smurfing: Demographic Red Flags

- Cash Deposits across multiple bank branches and ATMs on the same day.

- Cash Deposits from a different location than the home location of the beneficiary

- Multiple cash deposits in quick succession at the same location

- Cash deposits in the bank branch and ATMs

- Cash deposits at remote ATMs with less surveillance

2. Cuckoo Smurfing: Account Indicators

- The beneficiary is an unemployed person, a student, or a retired person

- Multiple cash deposits in quick succession

- Multiple cash deposits for an amount less than the reporting threshold

- Cash deposits not matching the customer’s profile

- Cash deposits via ATMs using a single card favouring multiple beneficiaries

- Cash deposit into a beneficiary’s account matching with an international fund transfer instruction

3. Cuckoo Smurfing: Depositor Indicators

- Cash deposits into multiple beneficiary accounts by the same person

- Depositor initiating cash deposits into a beneficiary account from a distant location

- Multiple depositors using the same beneficiary details and making frequent cash deposits

- The depositor’s name appears to be fictitious

How to detect Cuckoo smurfing?

1. Check if there’s a relationship between the depositor and the beneficiary

2. Check if the beneficiary is aware of the cash deposits made into his account

3. Check if the beneficiary is aware of the fund transfer from the overseas account

4. Check with the remitter for the source of funds

5. Check video footage to identify suspicious third-party depositors

How can entities protect themselves from Cuckoo Smurfing?

Business entities can protect themselves from cuckoo smurfing by utilising the services of legitimate financial institutions and money exchange houses. Further, they should monitor their bank account for suspicious bank deposits.

What are the regulatory measures against smurfing in money laundering?

The AML regulatory framework is important to detect and prevent money laundering through smurfing. Financial institutions must understand the risk associated with smurfing and, accordingly, implement the guidelines in the regulations to prevent financial crimes and stay compliant.

Anti-Money Laundering Regulations against smurfing

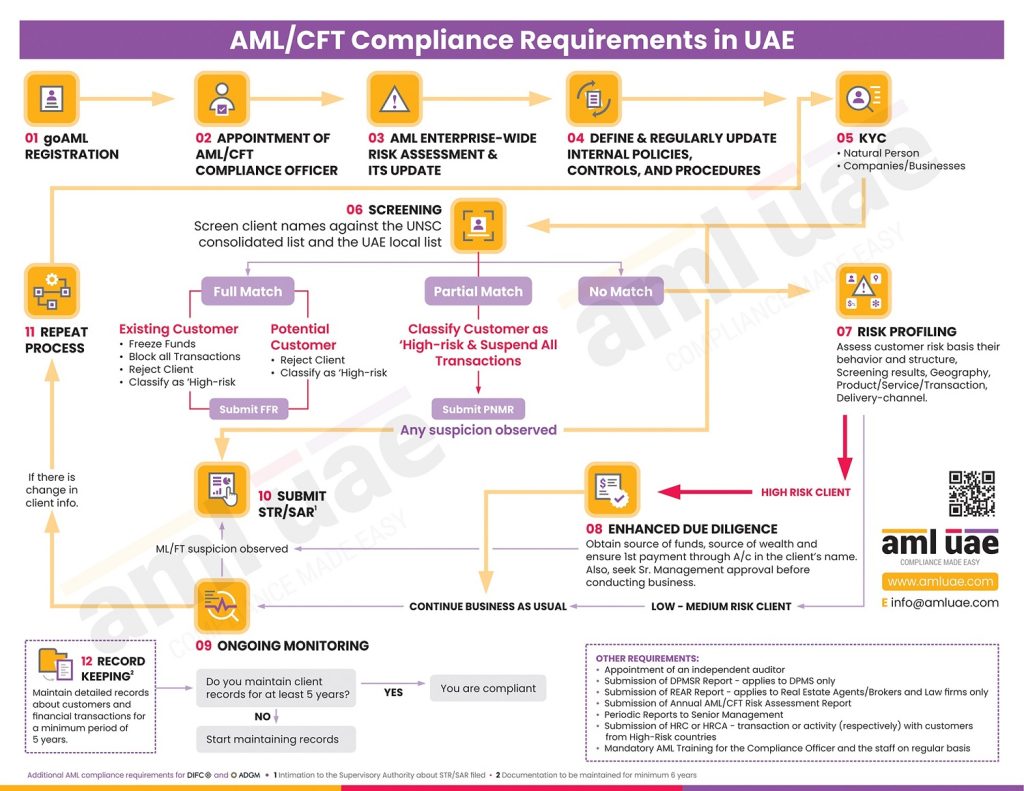

Since smurfing is associated with money laundering typologies, the AML regulations in UAE provide for adopting strong and comprehensive AML procedures, controls, and systems to identify and prevent money laundering activities, including laundering through the smurfing method.

The AML regulations in UAE mandate that financial institutions assess the money laundering risk, including the risk posed by smurfing. Further, the financial institutions must develop and implement a robust AML framework, including policies for performing customer due diligence and regularly monitoring transactions to identify suspicious activities and transactions contrary to the customer profile.

Financial institutions may implement solid transaction monitoring programs to identify the smurfing instances, using advanced algorithms or Artificial Intelligence to identify unusual patterns or suspicious activity. These systems should be able to trigger transactions inconsistent with a customer’s known financial behaviour. Further, the financial institutions should also conduct periodic reviews of customer due diligence files to identify any update to the customer information or risk assessment of the customers that may be considered suspicious.

Know Your Customer (KYC) and Customer Due Diligence (CDD) Policies against Smurfing

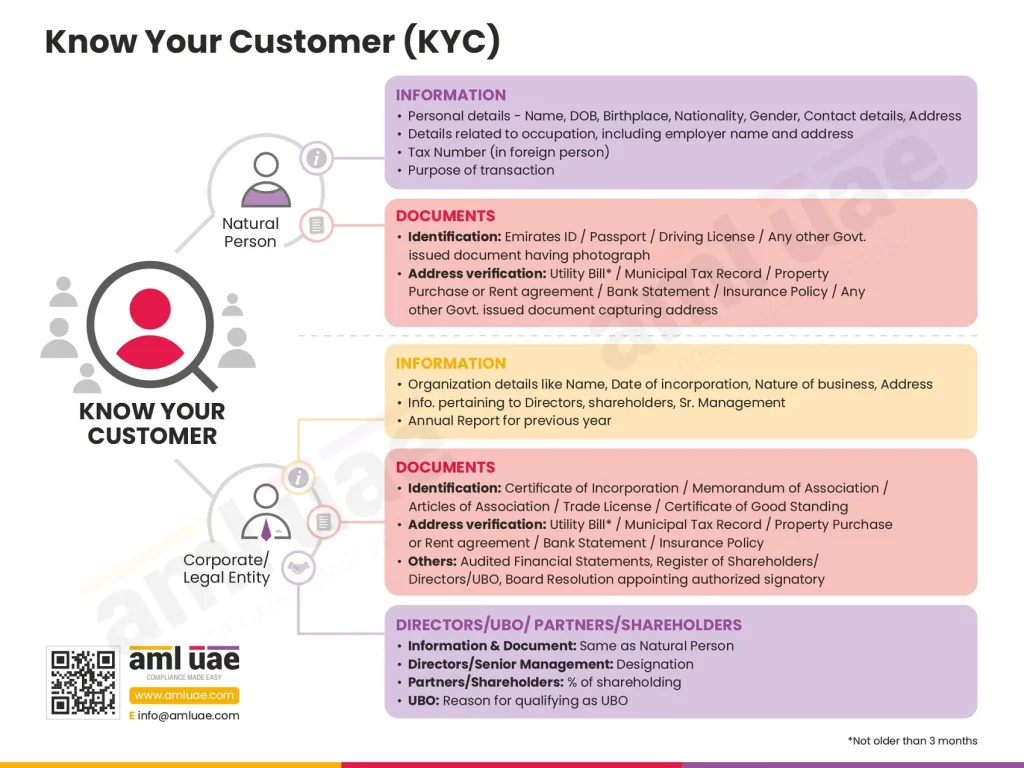

KYC policies include identifying the customer and verifying their identities to ensure that the customer the financial institutions are dealing with is legitimate and has no criminal history or active connection. Financial institutions can reduce the risk of enabling smurfing activities through their activities by implementing an effective KYC process. Please note that KYC is one of the starting measures to identify and prevent smurfing, but it is not sole-sufficient.

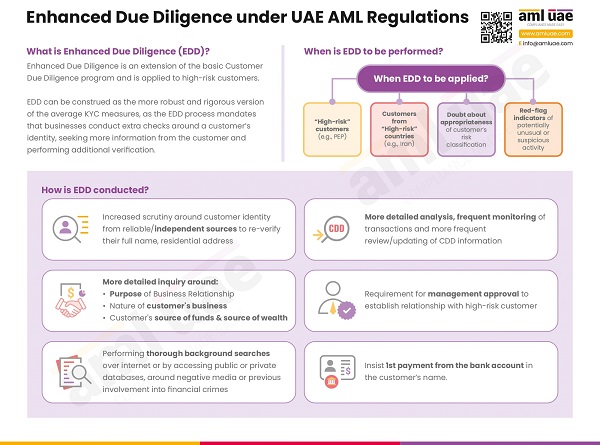

Financial institutions should implement additional Customer Due Diligence measures in case of high-risk customers or where any suspicion has been observed. These additional checks to verify the legitimacy of customer transactions may include understanding the purpose of the transaction, the customer’s source of funds and wealth, etc.

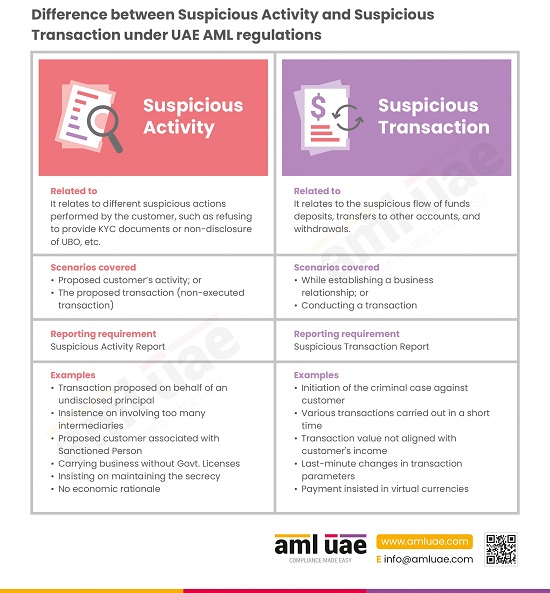

Reporting suspicious activities to UAE’s Financial Intelligence Unit (FIU)

UAE AML regulations mandate that financial institutions identify and report any suspicious activity to FIU by filing a Suspicious Transaction Report (STR) or Suspicious Activity Report (SAR).

Financial institutions must comply with the regulatory framework and implement the necessary controls and systems to detect and prevent smurfing.

What are the risk indicators related to the smurfing in money laundering?

Here is a list of potential red flags that the financial institutions must be cautious of, suggesting possible involvement of smurfing:

- Multiple small cash deposits a person or group makes into the same account but through different branches.

- Regular deposits or withdrawals in amounts exactly matching the AML Compliance cut-off.

- Transactions not matching the customer’s usual patterns, such as sudden large cash deposits or frequent transfers to offshore accounts unrelated to the customer or its business.

- A customer opening multiple accounts with little to no activity to distribute the funds.

- Frequent funds transfers between multiple accounts, specifically to high-risk jurisdictions.

- Unnecessary involvement of intermediaries to facilitate transactions without any business sense.

What measures should a Financial Institution adopt to prevent smurfing in money laundering?

Implementing effective internal controls

Financial institutions must develop and implement internal solid AML policies, procedures, and controls to detect and prevent smurfing timely. The key AML measures to prevent smurfing are:

Employee training and awareness

Awareness among financial institutions’ employees is crucial to identifying smurfing-related red flags. Employees must be trained to understand the risks associated with smurfing, identify smurfing activities attempted through the financial institution, and report suspicious activities.

Employees must be trained in-house by the Compliance Officer, or some third-party expert can be hired to impart the training. The training program should include discussion around risk indicators and case studies based on actual real-life scenarios. Case studies can help employees better understand the technique and related red flags. This helps the employees correlate the training with on-job activities and, thus, helps employees understand their roles and responsibilities in preventing smurfing.

Another important aspect of employee training is ensuring employees stay updated with regulatory amendments and evolving ML typologies, including smurfing methods. Thus, ongoing training of the employees must be ensured through periodic sessions (refreshers course), internal circulars, etc.

Ongoing Monitoring Systems

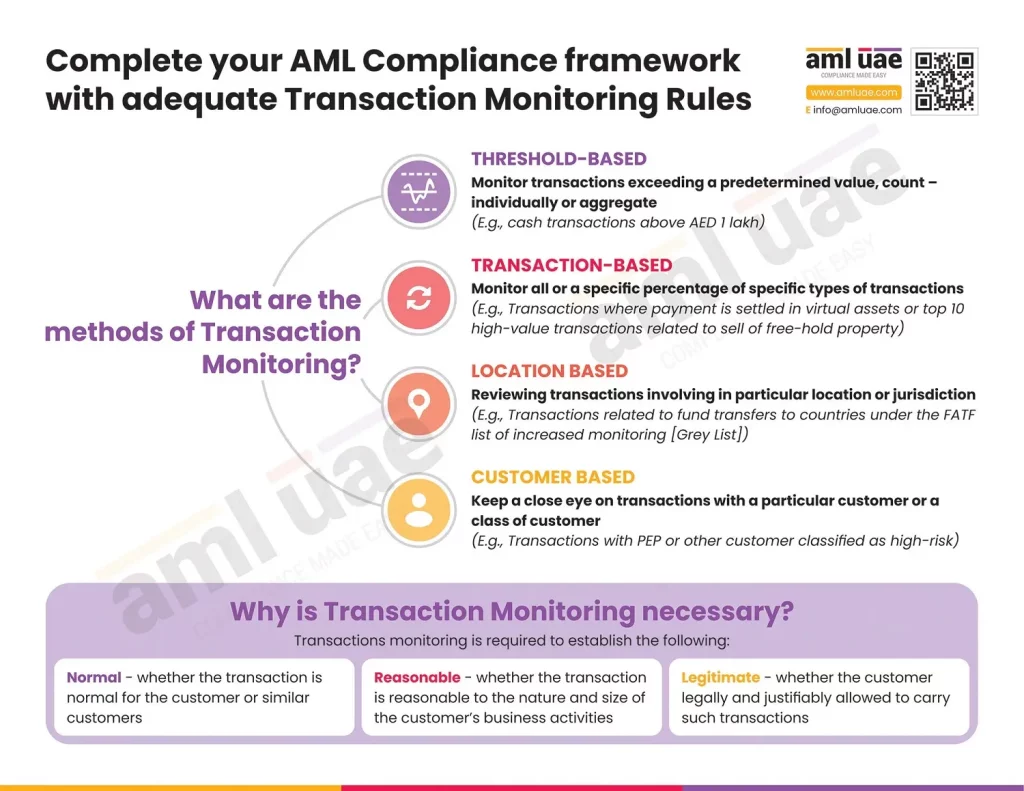

Real-time or Ongoing Monitoring systems help financial institutions detect unusual transactions or suspicious activities. These systems should be based on robust logic and monitoring rules, suggested being fully automated, and intelligent data analytics should be used to ensure their relevance and effectiveness.

Using Artificial Intelligence (AI) can help financial institutions identify inconsistent patterns or trends in large datasets considering the past records, overall business risk, and the customer risk profile, suggesting potential risk indicators. AI can also help financial institutions detect new techniques that criminals may use for laundering illegal money.

Another important aspect of monitoring transactions to identify suspicious activities is to use reliable and independent data sources, such as watchlists and adverse media, to support the internal alerts generated during ongoing monitoring.

Risk assessment and management

To effectively manage the risk, financial institutions must first identify the risk exposure, specifically the vulnerabilities to smurfing. A periodic Enterprise-Wide Risk Assessment must be conducted, and basis the risk assessed, the necessary risk mitigation measures must be deployed.

Moving one step ahead, the finical institutions must also assess the risk each customer poses to the business – customer risk profiling must be conducted using risk scoring models. Considering each customer’s risk profile, the monitoring program can be designed and applied, i.e., high-risk customers should be subject to frequent and increased monitoring.

Designing and implementing effective internal controls is very important for a financial institution to safeguard itself against smurfing. Financial institutions can help reduce risk exposure and avoid reputational damage with adequate employee training, a strong and comprehensive monitoring program, and timely risk assessment of the business and customers.

Enhancing customer due diligence

Financial institutions are critical in preventing money laundering activities, especially smurfing. Financial institutions must adopt additional checks and measures while performing customer due diligence to prevent smurfing.

Customer due diligence involves identifying the customer and verifying the customer’s identity, customer risk classification, and ongoing monitoring of the customer’s information and transactions. Financial institutions can timely identify money laundering activities by implementing effective customer due diligence processes and avoid non-compliance regulatory fines and reputational damage.

Verifying customer identity

Verifying customer identity is the first and most crucial step of the CDD process. Financial institutions must ensure that their customers are genuine and not associated with criminal activities. Customer identity verification includes obtaining customer identification documents such as passports, driver’s licenses, and national identity cards. Financial institutions must also conduct screening against the Sanctions List and perform background verification to ensure the legitimacy of the person and the identity documents.

Verifying customer identity is essential for preventing money laundering activities and exposing the business to the hands of financial criminals.

Monitoring customer transactions

Monitoring customer transactions is another vital aspect of CDD. Financial institutions must regularly monitor customer transactions to detect and report suspicious activities such as depositing or withdrawing vast sums of cash divided into multiple small-value transactions.

Financial institutions can use various tools and technologies to monitor customer transactions, such as transaction monitoring systems built upon AI or machine learning. These tools can analyze customer transactions in real-time and identify inconsistent customer activities.

Identifying high-risk customers

Identifying customers posing the business with higher risk is important to prevent smurfing. High-risk customers include persons whose transactions are inconsistent with the customer’s business activities, persons reluctant to share identity documents, individuals or businesses with active connections with high-risk countries, or politically exposed persons (PEP).

Financial institutions must develop and implement increased checks and verification measures for high-risk customers. Enhanced Due Diligence (EDD) shall be performed, which includes obtaining information about the customer and beneficial owners’ source of funds and wealth, understanding the purpose of the transaction and business relationship, and seeking senior management approval before establishing a business relationship or conducting transactions with high-risk customers.

EDD is one of the important measures to identify and prevent smurfing activities, using adequate customer verification processes, continuous transaction monitoring, and identifying high-risk customers, increasing the financial institution’s overall risk.

Collaborating with regulatory authorities and other financial institutions

Collaboration with other financial institutions and regulatory authorities is essential to prevent smurfing. This involves smooth information of information, best AML practices, conducting joint investigations, and developing industry-wide control standards.

Sharing relevant information and best practices to prevent smurfing

Financial institutions must share information and best practices to identify and prevent smurfing activities. This includes sharing information about known smurfing syndicates, account numbers, and techniques and collaborating on research and development of effective solutions to identify and reduce the impact of smurfing activities.

Financial institutions can also share the best practices for identifying and reporting suspicious activity related to smurfing to the FIU.

Joint investigations and operations

Joint investigations can help to identify and prosecute the individuals and groups involved in smurfing activities. Financial institutions should collaborate with regulatory authorities and other financial institutions to facilitate these investigations, such as providing corroborative evidence to support investigations.

Developing the best industry-wide standards

Collaboration and cooperation between financial institutions are necessary to implement industry-wide best measures and standards to identify and prevent smurfing. This includes developing standard operating procedures, AML framework, and aligning AML regulatory requirements.

Collaboration between financial institutions and regulatory authorities aids in combating smurfing activities. Financial institutions can reduce the impact of smurfing and safeguard the financial system by sharing information on already proven smurfing elements, supporting investigations, and developing the best industry-wide standards.

Leveraging technology to fight smurfing

Smurfing is a common technique used to launder illegal money, given its simple nature of breaking large values into smaller amounts to surpass the AML threshold. Here, financial institutions can deploy technology to detect and prevent smurfing activities.

Advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) can help understand the trends and track customer behaviour to identify smurfing activities. AI and ML algorithms can analyze the massive volume of transactions and customer information to identify unusual or inconsistent activities.

Even emerging technologies – Blockchain and Distributed Ledger Technology (DLT) can also provide a secure transactional trail, reducing the risk of manipulating or structuring the transactions, thus reducing the risk of smurfing activities. By leveraging blockchain and DLT, financial institutions can create a transparent and immutable transactional record, making it difficult for criminals to disguise or conceal their activities or conduit financial crime.

The other technologies that can significantly assist financial institutions in combating smurfing are advanced analytics and data mining that can identify unusual patterns of transactions indicating the possibility of smurfing or other money laundering activities.

Financial institutions can prevent smurfing activities with the right technology and AML solution. With AI and ML, blockchain and DLT, and advanced analytics and data mining, financial institutions can up their AML compliance and safeguard their operations from the risk of smurfing.

How can AML UAE assist financial institutions in developing a robust AML framework to prevent smurfing?

AML UAE is an AML consultancy service provider offering end-to-end AML support to financial institutions, Virtual Asset Service Providers (VASPs), and Designated Non-Financial Businesses and Professions (DNFBPs). AML UAE can assist financial institutions in designing robust AML/CFT policies and procedures, implementing adequate internal controls, enhancing the Customer Due Diligence framework, and training employees to stay vigilant in detecting smurfing instances.

Financial institutions must identify, report, and timely prevent smurfing activities. AML UAE assists financial institutions in identifying the right technology and AML tool to identify the unusual activities suggesting smurfing.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.