Practices to streamline Sanctions Compliance and the FFR and PNMR Reporting on goAML

Compliance with Targeted Financial Sanctions is an inevitable aspect of AML regulations. So are the reporting obligations.

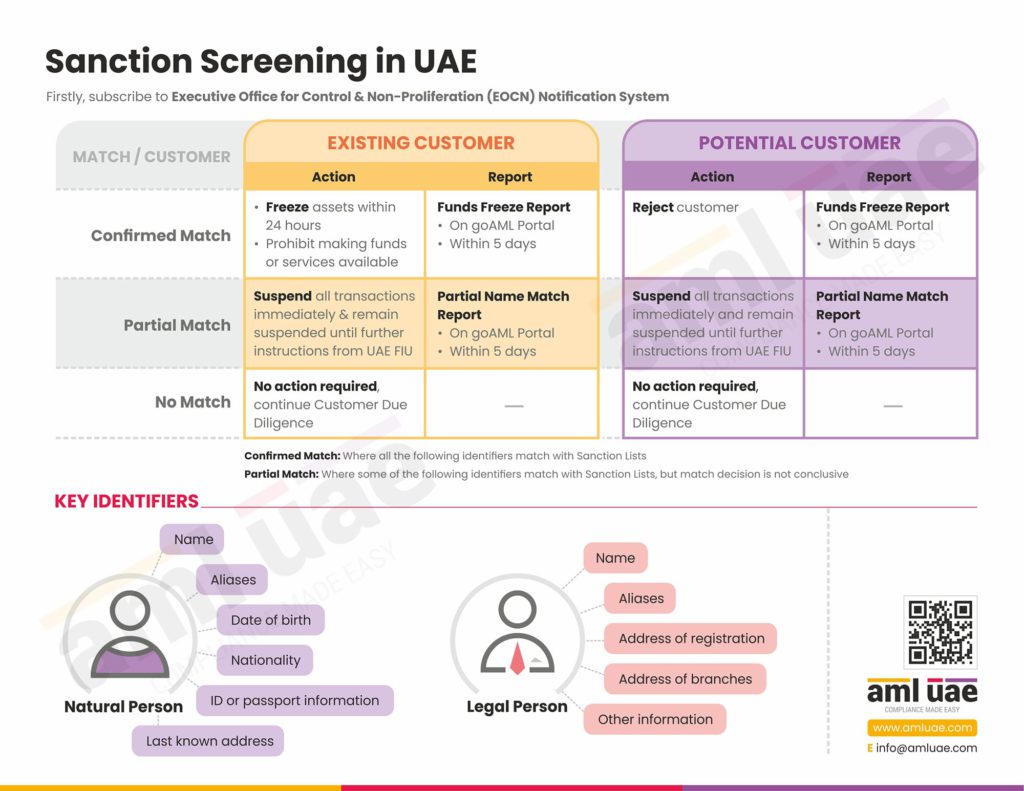

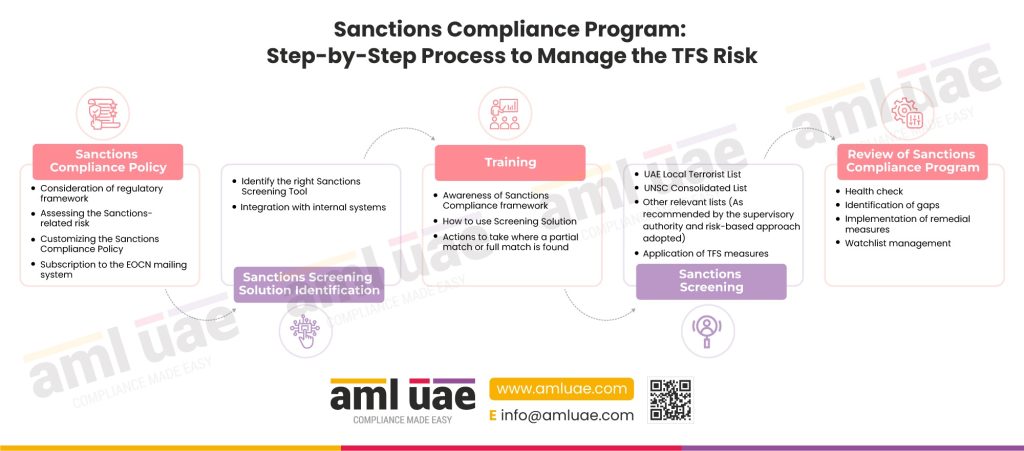

The regulated entities in UAE must comply with the Targeted Financial Sanctions (TFS) regulation as prescribed under Cabinet Decision No. (74) of 2020, mandating the entities to conduct screening of all parties of a transaction to check their relationship with any persons on the UAE’s Local Terrorist List or UNSC Consolidated List.

As a regulated entity, you must conduct such screening before onboarding a new customer. It is also essential to conduct such screenings on an ongoing basis. It allows you to check for individual or business status changes. Also, if there are updates to these lists, you must conduct a screening again. Based on the results of the screening procedure, you can decide to take actions, such as:

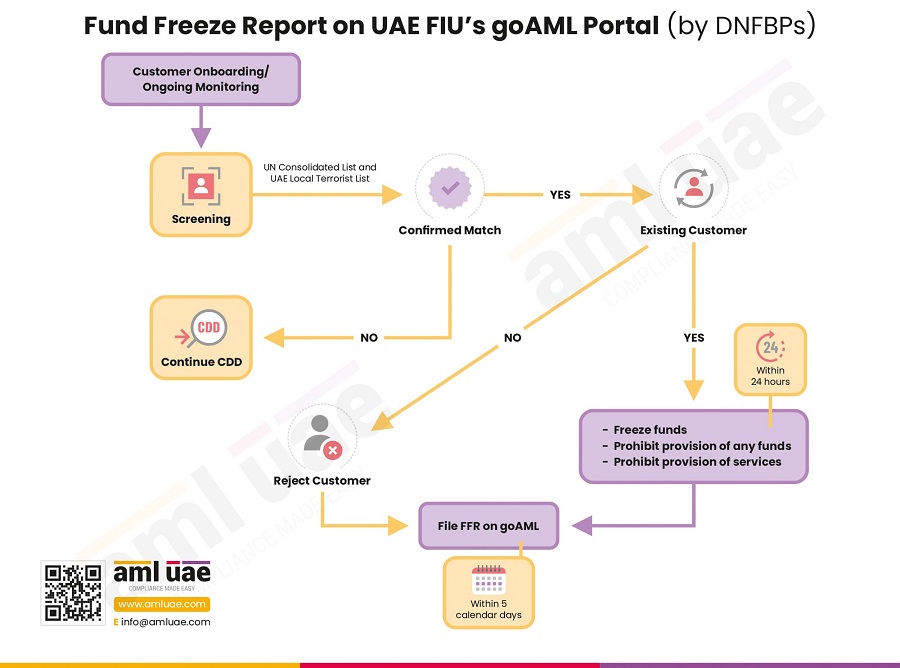

If you find confirmed matches, you must:

- Freeze their funds within 24 hours.

- If it is a new customer, don’t onboard; if it’s an existing customer, terminate the relationship within 24 hours.

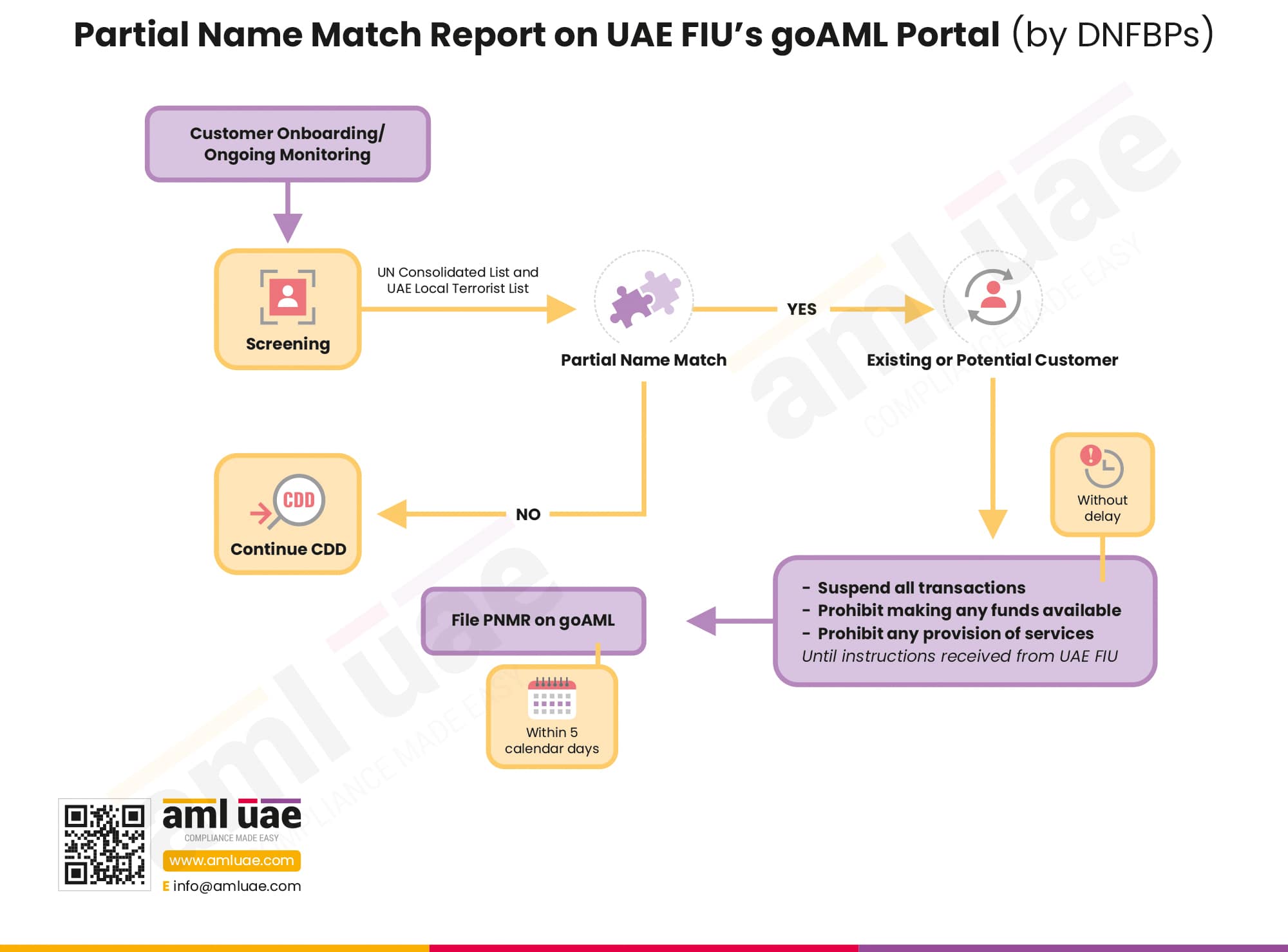

In the case of partial name matches, you cannot determine whether it is confirmed or false. In such cases, you must suspend the business relationship within 24 hours.

In furtherance to this, you are required to comply with reporting requirements provided under the TFS program, which include:

You must file these reports to ensure compliance with the Targeted Financial Sanctions (TFS) regime. While screening the customers, suppliers, or their ultimate beneficial owners (UBOs), if you identify any matches with the UAE Local Terrorist List or the UNSC Consolidated List, you are required to furnish FFR or PNMR on the goAML portal, depending upon the nature of match identified.

Fund Freeze Report will be filed when there is a confirmed match with these sanctions lists. For a partial name match, where you cannot conclude whether the person screened is designated on these lists, then go for PNMR.

While implementing a sanctions program, you must be careful to avoid errors around screening matches or delayed or incomplete filing of FFR or PNMR. You must avoid businesses’ most common mistakes while adhering to TFS requirements and filing these reports.

This blog has enlisted the best practices around sanctions programs and related reporting.

Best practices of sanctions compliance and FFR and PNMR filing on the goAML portal in UAE

FFR and PNMR are your reporting requirements under the UAE’s AML and sanctions compliance regulations. These are easy processes, and you can never go wrong. Still, to avoid blunders, you should imbibe the following best practices while submitting FFR and PNMR to the Executive Officer for Control and Non-Proliferation (EOCN) via the goAML portal.

Stay up-to-date with changes in the UAE Local Terrorist List and UNSC Consolidated List

The UAE’s TFS regime requires you to compare your existing and potential customers with the following two lists:

Suppose you have an outdated list for screening. You compare and find some confirmed and partial matches. And you take relevant measures like fund freezing and relationship termination or suspension. Later, you learn that the new, updated list has some changes related to the matches you observed.

In such cases, you might have frozen a client’s funds while they do not feature in the updated list. Or, you find a client to be clean based on past records and conduct transactions with them, but they are found in the new, updated list. In both these cases, you are at a loss. In the first case, you harm your business relationship with a clean client. In the second case, you transact with a sanctioned or terrorist organization. Thus, your reputation goes for a toss, resulting in substantial non-compliance penalties.

If you don’t have the updated list, the exercise seems futile. Here, you will end up reporting the incorrect parties on the goAML Portal, giving away the quality of your AML and sanctions compliance to the authorities.

To make your sanction compliance a helpful exercise, check for updated lists. You can get these updated lists by subscribing to the EOCN’s Notification System.

Conduct this exercise constantly for your existing customers

Individuals change over time. Similarly, businesses also change. So, you must keep track of these changes.

Assume you found a customer clean during onboarding and started a business relationship with them. You then continue the business relationship without re-checking their background. But they might feature in the updated list of sanctions or terrorists. You will be exposed to higher financial crime risks if you keep transacting with them. It affects you in terms of costs and business reputation.

Regarding reporting, a confirmed or partial name match is to be reported within a specified period on the goAML portal, describing the action you took around these matches. If you do not continuously screen your database against these lists, you are bound to violate the reporting requirements.

So, make it a practice to keep screening your customers continuously.

Screen customers before onboarding, even if it takes time

Generally, you get excited when you acquire a new customer/client. You tend to hurry the onboarding process and start the transactions. Also, you don’t want to give customers a bad experience initially. So, you onboard without screening or identity verifications.

But that shouldn’t be the case. You must take your time in conducting customer identification and verification. This process involves screening your customers against the lists of sanctions and terrorists. It may be a time-consuming exercise, but it is inevitable before moving ahead with the onboarding process. It ensures you keep the risks of money laundering and terrorism financing at bay.

Regarding FFR and PNMR, its applicability is not restricted to just existing customers. Instead, it becomes more essential to identify matches for the new customers against the sanctions, refrain from establishing business relationships, and immediately report to the EOCN.

If you delay the screening process, you are ultimately postponing the FFR and PNMR submission.

Remember to screen the beneficial owners and associated persons

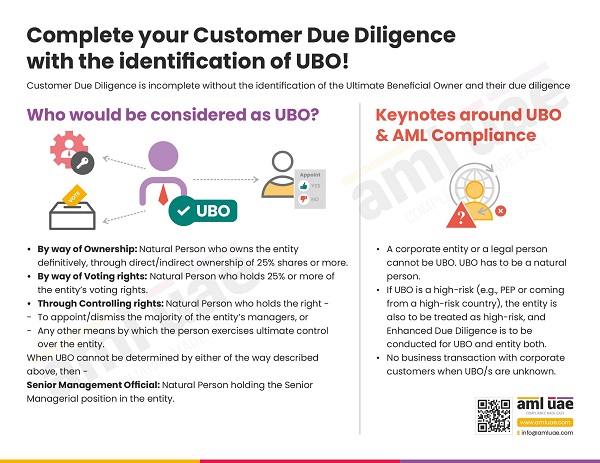

TFS regulations provide for applying the necessary TFS measures on the customer or suppliers when such customer or supplier are associated with a sanctioned or designated person, either by way of controlling or ownership rights or acting on behalf or representing the sanctioned person or entity.

Thus, it’s not only about the individual or business you need to screen. You must also screen their ultimate beneficial owners (UBOs), third parties on whose behalf the client is acting or representing, etc. They might be related to a sanctioned individual or terrorist.

Suppose the business is clean, but the beneficial owner is sanctioned. If you fail to detect this, you are exposed to money laundering risks. But if you check their identities beforehand, you can avoid transacting with such risky businesses and furnish the appropriate report on the goAML Portal in a timely manner.

Use technology for customer screening

Do you want to spend hours screening your customers? Do you want to repeat the process in case the results are uncertain?

If the answer is no, consider using a technology system for customer screening. Such a system can check for matches in an extensive database of customers – individuals or businesses. It can generate alerts for you to find a match, making it easier to identify designated persons in real-time.

Thus, the right software can ensure a fast, error-free, and complete check. You can be sure of the results and move ahead with the next steps.

Further, there are various software available that support automated filing of FFR and PNMR, ensuring you do not miss any essential information and timely submit the sanctions matches related report on the goAML Portal.

Take action immediately

You just get 24 hours to take the appropriate action.

When you find a confirmed match of an existing customer with the UNSC Consolidated List or UAE Local Terrorist List, you must:

- Freeze the funds

- Stay away from providing any products or services to them

- Prohibit providing any new funds to the client

- Terminate the business relationship

In the case of a partial name match of an existing or potential client, you must:

- Suspend all transactions with them

- Ban any availability of funds to them from your side

- Prohibit providing services or products to them unless and until you receive any instructions from EOCN

But all these actions must be quick. They must be your immediate reactions.

After taking TFS action, your deadline for filing FFR or PNMR begins. Timely reporting is a crucial part of any compliance procedure.

Once you take the necessary action after finding a confirmed or partial match, you are responsible for filing relevant reports on these matches with the EOCN. Also, you need to submit these reports on the goAML portal within five calendar days of freezing funds and suspending or cancelling the business relationship.

File the complete and accurate FFR or PNMR on the goAML portal

Ensure that your report is accurate and complete. Accurately fill out the following:

- Details of the customer

- Matches found

- Transactions executed until now

- Action taken by you (fund freezing, suspension of business relationship, etc.)

- Amount and nature of client’s funds frozen

- Any other information relevant and related to these matches

You must also attach the necessary evidence for client information, matches found, and actions taken.

How can AML UAE help you in sanctions compliance and related reporting?

So, these are the best practices to adopt while implementing the sanctions program and submitting FFR and PNMR reports on the goAML Portal.

AML UAE can help you here. We are a trustworthy AML compliance partner for regulated entities subject to compliance with UAE’s AML and sanctions regulations. We help you design customized AML and sanctions policies and procedures. We train and assist you with goAML reporting obligations, ensuring you file accurate, timely, and complete PNMR, FFR, and other relevant reports. We adopt global best practices to avoid the potential mistakes that can occur in this process.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.