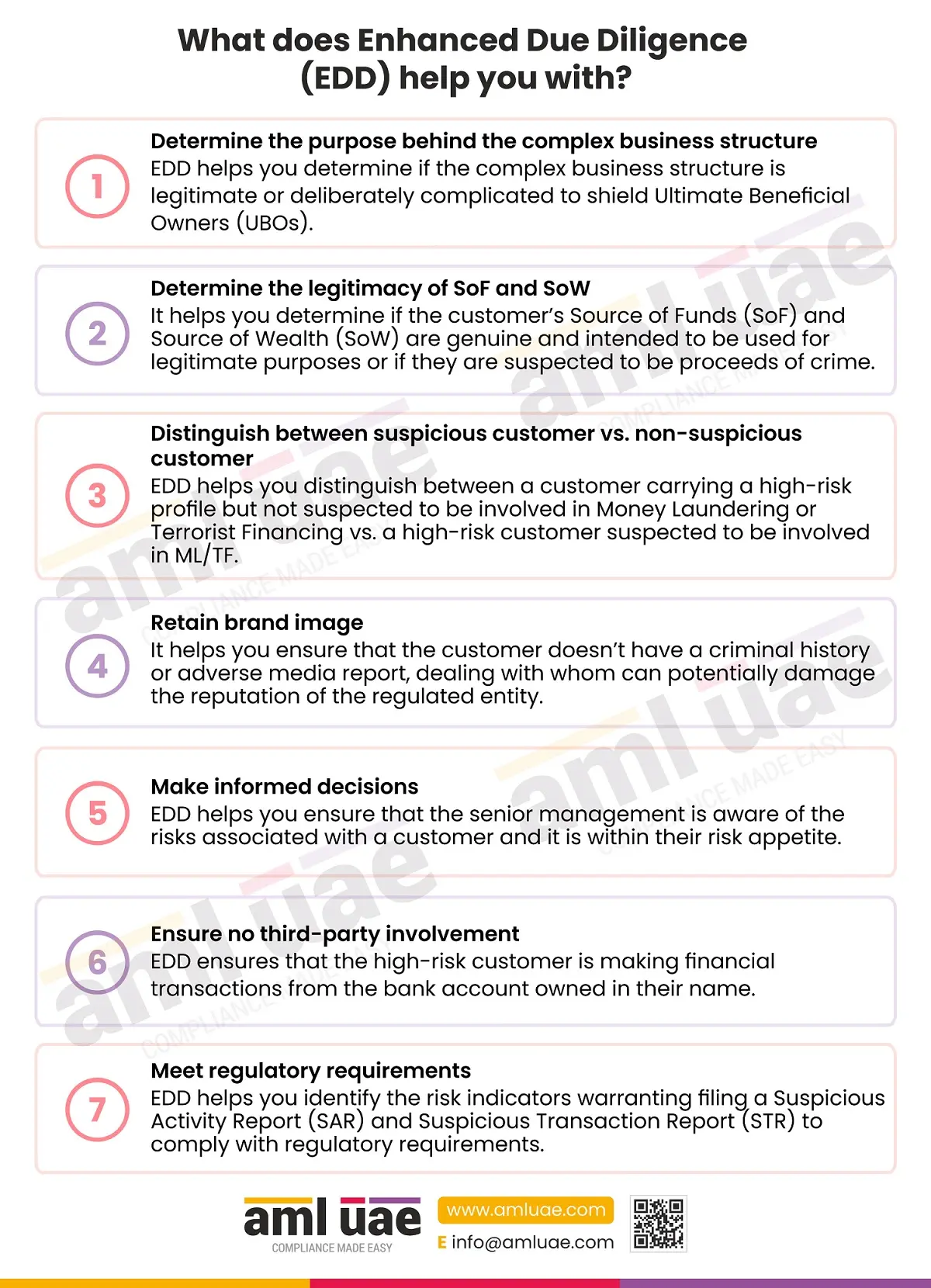

What does Enhanced Due Diligence (EDD) help you with?

What does Enhanced Due Diligence (EDD) help you with?

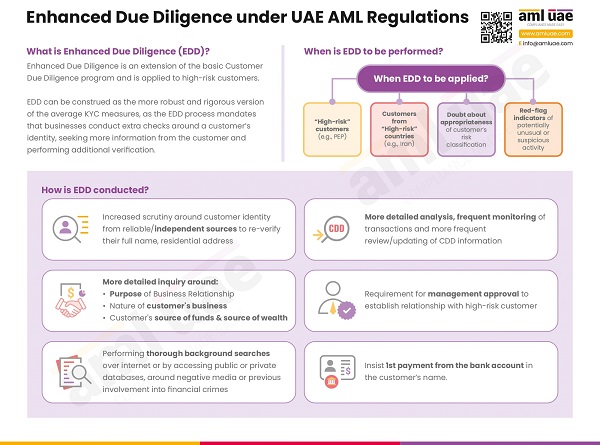

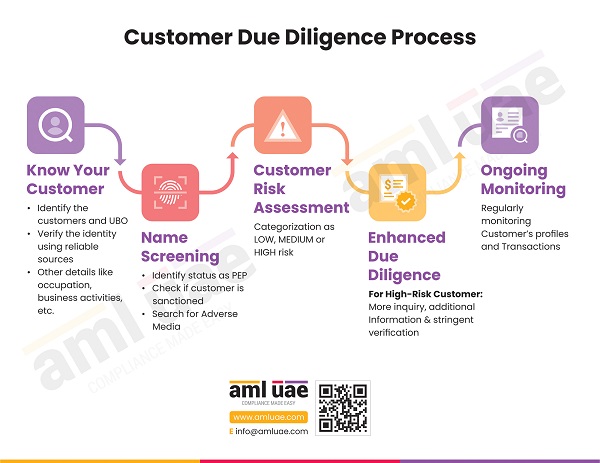

The UAE AML regulations mandate that the regulated entities – DNFBPs, VASPs, and Financial Institutions – assess the money laundering and terrorism financing risk each customer poses to the business and adopt a risk-based approach to mitigate the same. Here, the AML law provides for applying Enhanced Due Diligence (EDD) measures when the customer is identified as exposing high ML/FT risk.

Here is an infographic discussing the key merits that the EDD process has to offer to regulated businesses:

- One of the EDD measures is to make detailed inquiries about the customer’s identity. Thus, EDD helps in understanding the customer’s structure, and if the legal structure of the customer appears to be complex, EDD allows decoding whether the complexity of the structure is legitimate or deliberately created to obscure the identity of the Ultimate Beneficial Owners (UBOs).

- The EDD process involves identifying the customer’s source of funds and source of wealth and establishing the legitimacy of the same based on reliable sources. Here, EDD helps the entity determine whether the funds involved in the transaction and its associated wealth are legitimate or are proceeds of some criminal activities.

- Further inquiry around the customer’s identity and the nature of the business relationship helps the entity assess whether the customer is just carrying higher risk or is actually suspected of being involved in some money laundering or terrorism financing activities.

- Applying appropriate EDD measures ensures that the business does not engage with any criminal or a person charged with some financial crime (adverse media sources), safeguarding the business’s reputation.

- AML regulations require that the regulated entity seek senior management approval when establishing business relationships with high-risk customers. This measure will ensure that management is aware of the increased risk and make an informed decision to deal with such customers.

- One more measure to be applied during EDD is obtaining payment towards the transaction from the customer’s bank account, subject to similar CDD measures. This will help the regulated entities ensure that no third party exploits their business under another name.

- When applying EDD measures, the regulated entity must consider filing a Suspicious Activity Report (SAR) and a Suspicious Transaction Report (STR) if any red flags are detected. This will ensure that the regulated entities safeguard their business against potential threats and timely report the matter to FIU, complying with the regulatory reporting requirements.

Adopt adequate increased controls and risk mitigation measures when high-risk is encountered.

As a leading AML consultancy service provider, AML UAE can assist you in designing customized AML/CFT policies, procedures, and controls in line with the outcome of the Enterprise-Wide Risk Assessment. This will include defining the circumstances when the customer shall be classified as high-risk and what EDD measures shall be applied. Let’s come together to fight the financial crime.