What are Virtual Asset Activities & who can carry out VA Activities in Dubai?

What are Virtual Asset Activities & who can carry out VA Activities in Dubai?

The Virtual Assets Regulatory Authority (VARA) enacted the Virtual Assets and Related Activities Regulations 2023 (Regulations), considering the ever-evolving scope of Virtual Assets and related services and the need for its effective regulation in Dubai.

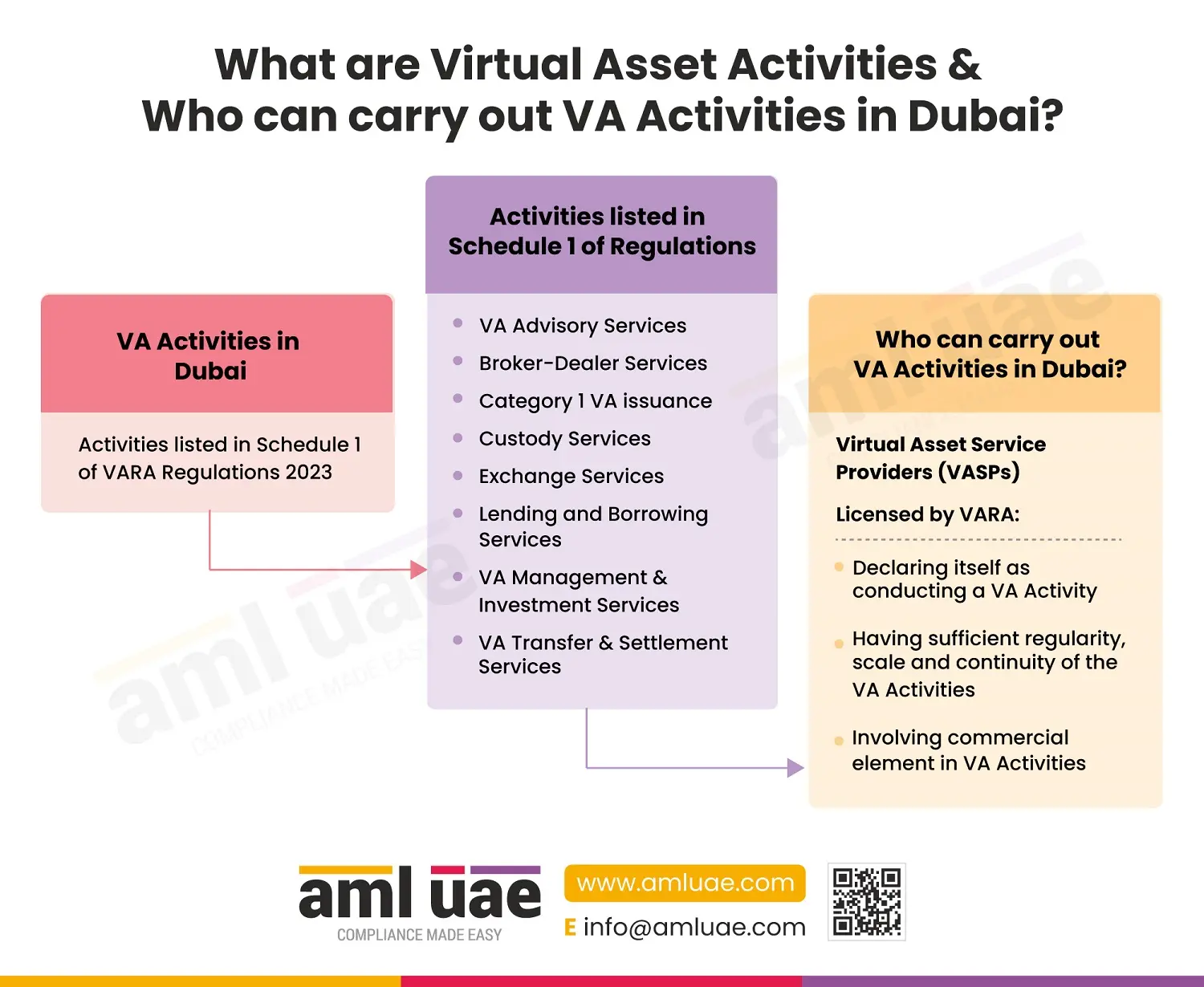

Here is an infographic discussing the specific VA activities permitted to be carried out in Dubai by the licensed and duly VARA-authorised VASPs.

What are VA Activities?

The VARA has defined what “Virtual Asset (VA) Activities” mean, as detailed under Schedule 1 of the Regulations:

- VA Advisory Services:- Offering, providing or agreeing to provide a personal recommendation to a client in respect of one or more actions or transactions relating to any virtual assets

- Broker-Dealer Services:- Provision of any of the following services:

- arranging orders for the purchase and sale of VAs between two entities,

- soliciting or accepting orders for VAs and accepting fiat currency, or other VAs, for such orders,

- facilitating the matching of transactions in VAs between buyers and sellers,

- entering into VA transactions as a dealer on behalf of the entity for its own account,

- making a market in virtual assets using client assets,

- providing placement, distribution or other issuance-related services to clients issuing virtual assets.

- Category 1 VA issuance:- Services in relation to the issuance of:

- Fiat-Referenced Virtual Assets [FRVAs] that purport to maintain a stable value in relation to the value of one or more fiat currencies but do not have legal tender status in any jurisdiction,

- Other VAs as may be determined by VARA.

- Custody Services:- Safekeeping of VAs for or on behalf of another entity and acting only on instructions from or on behalf of such entity.

- Exchange Services:- Provision of any of the following services:

- conducting an exchange, trade or conversion between VAs and fiat currency,

- conducting an exchange, trade or conversion between one or more VAs,

- matching orders between buyers and sellers and conducting an exchange, trade or conversion between VA and fiat currency or one or more VAs,

- maintaining an order book in relation to the above activities.

- Lending and Borrowing Services:- Conducting transaction where VA shall be transferred or lent from one or more parties (known as the Lender) to one or more other parties (known as the Borrower) against the Borrower commitment to return the same upon the Lender’s request at any time before or at the end of the period agreed upon.

- VA Management and Investment Services:- Acting on behalf of an entity as an agent or fiduciary or taking responsibility for the management, administration or disposition of that entity’s virtual assets.

- VA Transfer and Settlement Services:- The transmission, transfer, or settlement of VAs from one entity to another entity or another VA wallet, address or location.

Who can carry out VA Activities in Dubai?

The entity carrying out or intending to carry out virtual asset activities or its employee carrying on or otherwise facilitating a virtual asset activity on behalf of the entity must ensure that it is authorised and licensed by VARA for the said activities.

VARA considers the following factors when granting a license.

Before authorising and licensing the VA activities, the VARA shall consider the following factors to determine whether an entity is carrying out VA Activities “by way of business”:

- Whether the entity holds itself out as conducting a VA Activity by way of business,

- The regularity, scale and continuity of the VA Activity carried out by the entity, and

- Whether there is any commercial element in how the VA Activity is being conducted, such as whether the entity receives remuneration or other commercial benefits or value for carrying out the VA Activity.