Virtual Assets Regulatory Authorities in UAE

Virtual Assets Regulatory Authorities in UAE

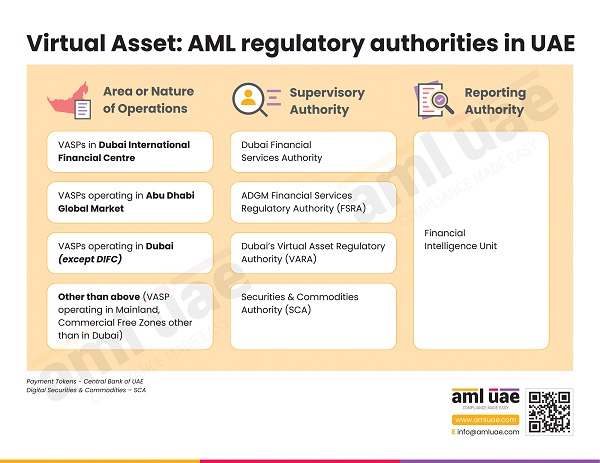

With the virtual asset sector booming in the UAE, including the acceptance of digital securities and payment tokens, various authorities have been designated to oversee and supervise the licensing and operations of the Virtual Asset Service Providers (VASP). This bifurcation of the authorities for managing VASP activities is mainly based on the location of the VASP and the nature of the activities.

VASPs based in Dubai, except those operating in or from Dubai International Financial Centre (DIFC), are subject to supervision by Dubai’s Virtual Assets Regulatory Authority (VARA). For DIFC-based VASPs, the governing authority is the Dubai Financial Service Authority. Similarly, for VASPs operating from the financial free zone of the Abu Dhabi Global Market (ADGM), the concerned supervisory authority is the Financial Service Regulatory Authority (FSRA).

For other VASPs (not operating from Dubai or the DIFC/ADGM financial free zones), the governing AML supervisory authority is the UAE’s Securities and Commodities Authority (SCA).

Monitoring of the payment tokens is under the purview of the Central Bank of UAE, while digital securities and commodities are under SCA.

Here is an infographic discussing the AML Supervisory Authorities in UAE to oversee the level and nature of the AML compliance program implemented by the VASPs operating within their jurisdictions.

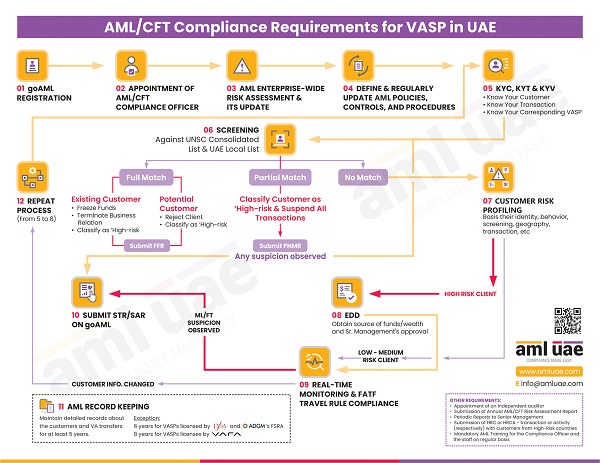

With AML UAE‘s years of experience and subject knowledge (on AML as well as virtual asset space), we have been assisting the VASP in UAE in assessing the financial crime risks and customizing the AML/CFT program in line with local regulations and FATF best practices recommended to protect the exploitation of the virtual assets by financial criminals.