Uncovering the ML/FT red flags associated with Virtual Assets

Uncovering the ML/FT red flags associated with Virtual Assets

With the increasing acceptance of virtual assets – Cryptocurrencies and Non-Fungible Tokens (NFTs), the risk of the domain being exploited by financial criminals is also rising. Understanding the typologies associated with virtual assets is crucial to mitigate the financial crime risk.

The primary characteristics of virtual assets – anonymity and quick pace to conclude the transfer of funds across the border, make them more vulnerable to money laundering and terrorism financing activities.

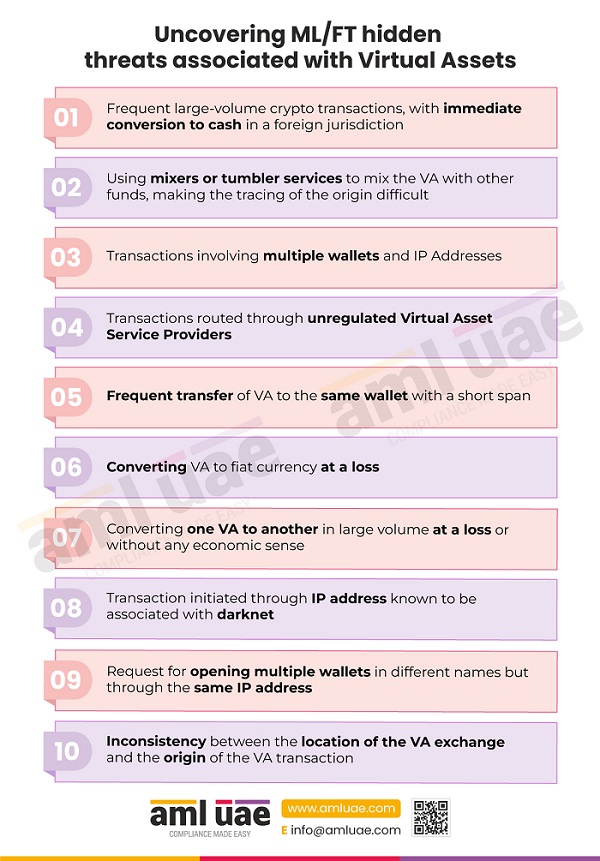

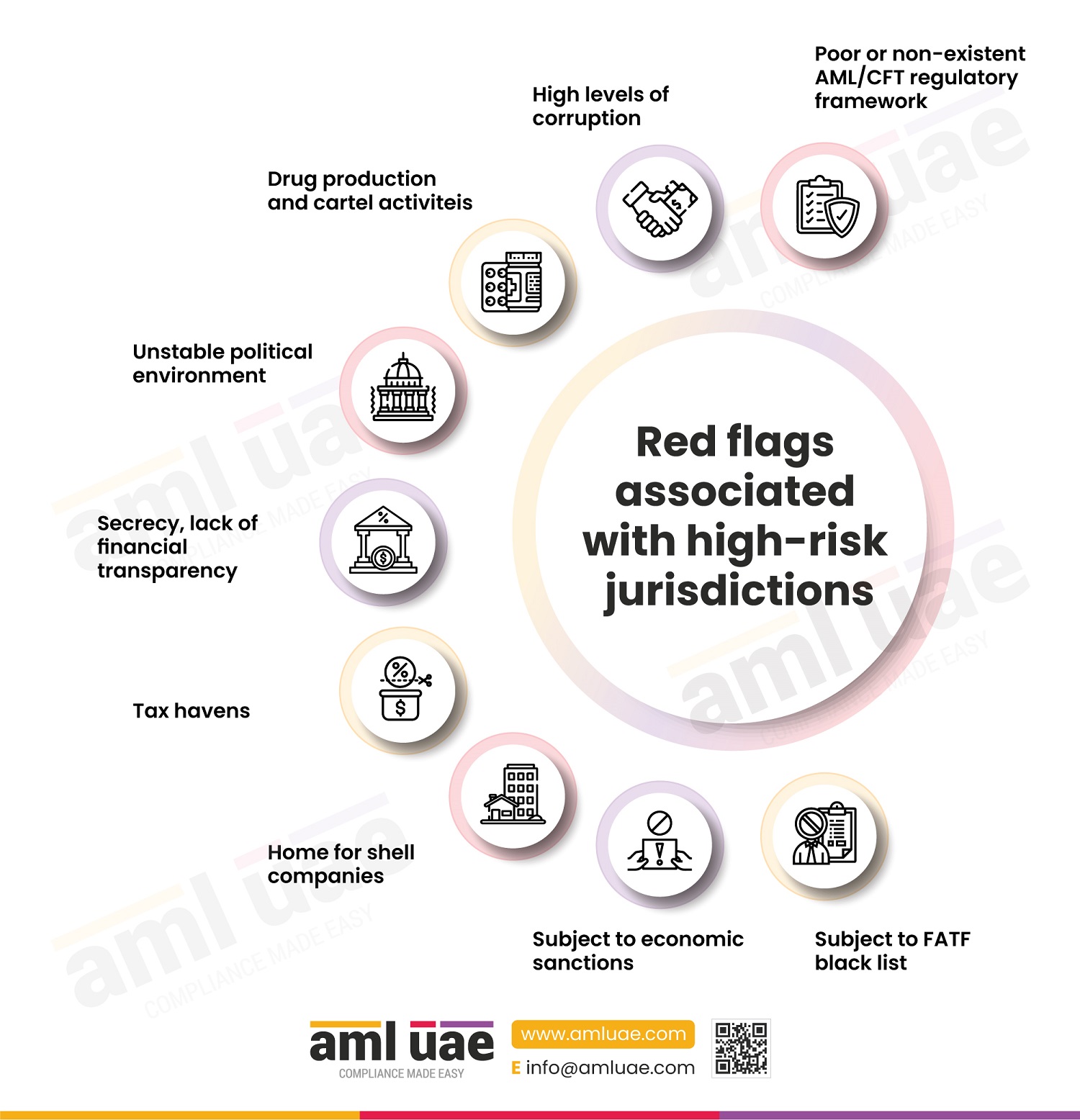

Let us understand the red flags or risk indicators suggesting misuse of virtual assets to disguise the criminal proceeds or funding terrorist activities.

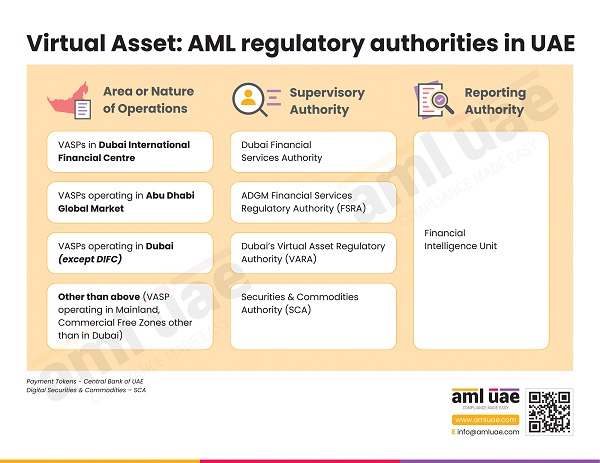

AML UAE is one of the leading AML consultancy firms, assisting regulated entities, including Virtual Asset Service Providers (VASP), in designing and implement a robust AML/CFT framework to detect and manage the ML/FT risks. We also assist the businesses in assessing the overall business risk and imparting comprehensive AML training to the staff to mitigate the risks.

Stay aware, stay compliant!