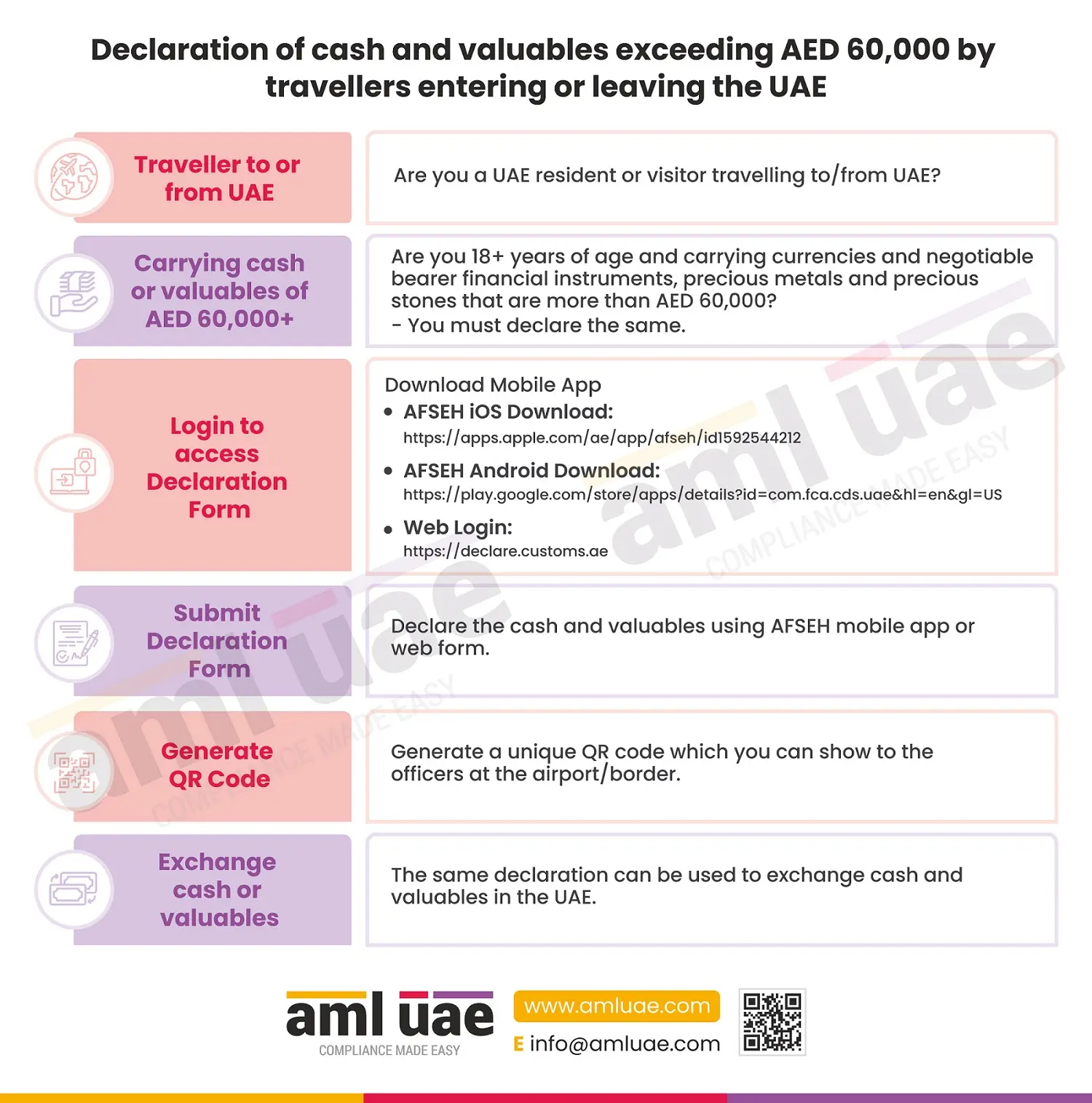

UAE Customs Declaration Form Submission while Carrying Cash and Valuables Exceeding AED 60,000 In or Out from UAE

UAE Customs Declaration Form Submission while Carrying Cash and Valuables Exceeding AED 60,000 In or Out from UAE

UAE travel: Who must furnish a Customs Declaration about cash and valuables?

Travellers entering or leaving UAE carrying currencies, negotiable bearer financial instruments, precious metals, or precious stones of value exceeding AED 60,000 have to submit the declaration form.

Exception:

- When such PMS is for commercial purposes

- When a traveller is engaged in PMS trading activities

- When PMS is transported as a profession by a person frequently visiting the Customs Ports

Note: For a traveller below the age of 18 years, the value of such precious metals and stones shall be counted towards the threshold value of the parent or guardian.

With Whom such a Customs Declaration around cash, precious metals and precious stones is to be filed?

The customs declaration needs to be filed with the Federal Authority for Identity, Citizenship, Customs and Ports Security (ICP) –

- Either through the official website (https://declare.customs.ae) or

- AFSEH application for iOS: https://apps.apple.com/ae/app/afseh/id1592544212

- AFSEH application for Android: https://play.google.com/store/apps/details?id=com.fca.cds.uae&hl=en&gl=US

What information is to be included in such a Customs Declaration?

Customs Declaration – Illustrative list of information to be provided:

- Travel date

- Destination of Arrival and Departure

- Port type: sea, land or air

- Person’s Traveller ID details

- Nationality

- First name, Second name, Family name

- Occupation

- Place of birth

- Date of birth

- Gender

- Ticket number

- Type of declaration (cash, personal goods, jewellery, precious metal, precious stones)

- Amount

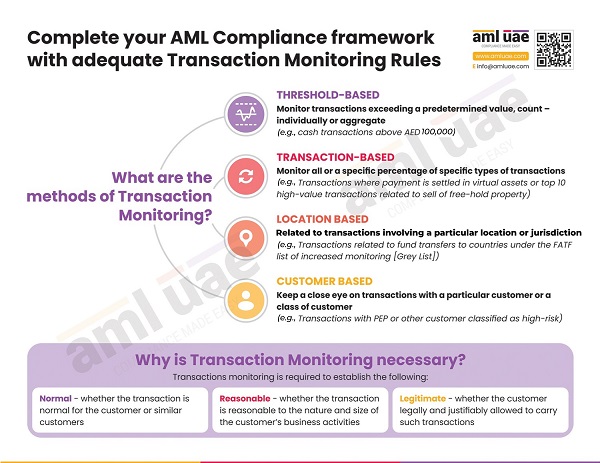

This declaration is an Anti-Money Laundering (AML) effort – to combat the attempts to move illicit money or assets (precious metals and stones) across the border.