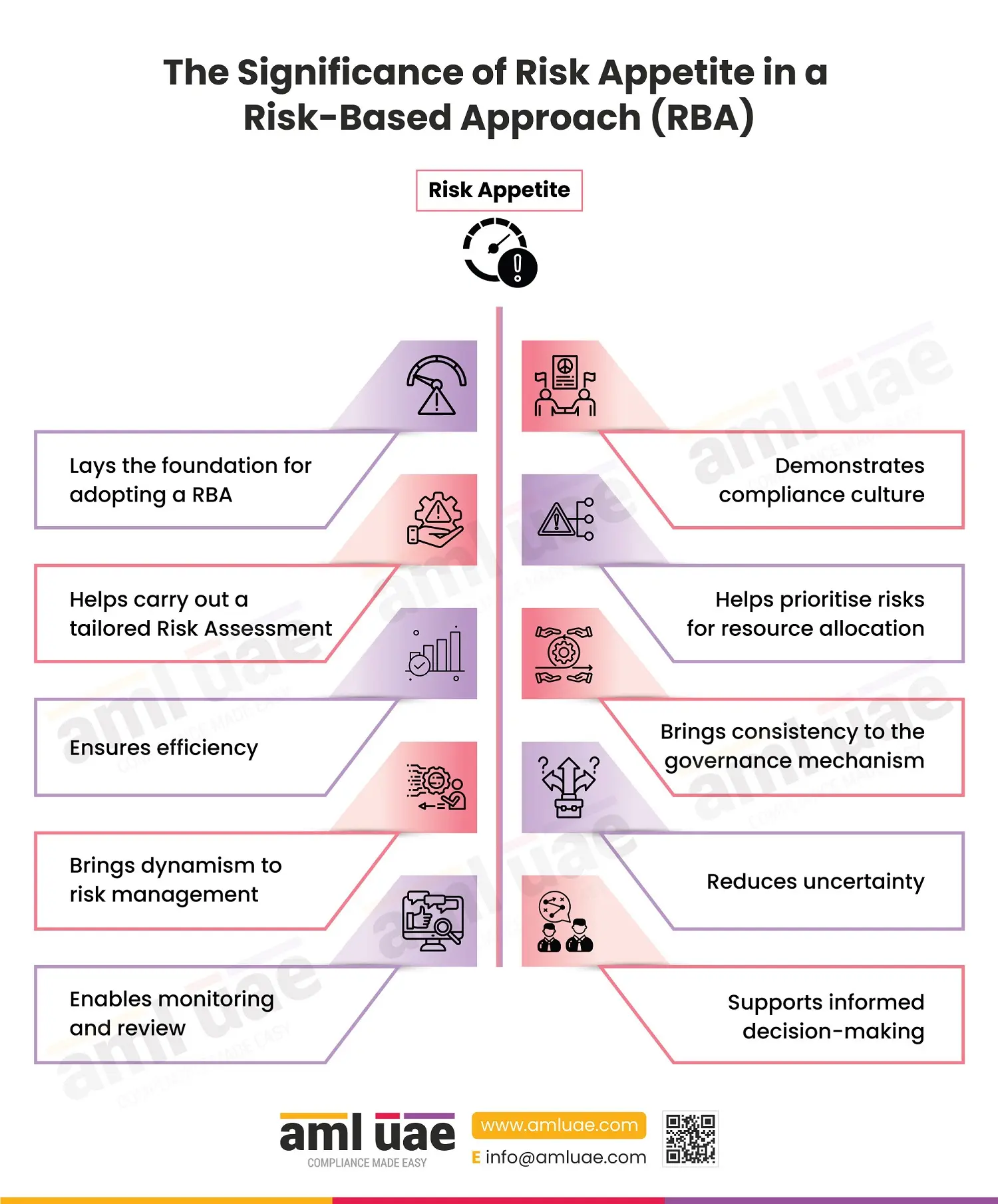

The Significance of Risk Appetite in a Risk-Based Approach (RBA)

The Significance of Risk Appetite in a Risk-Based Approach (RBA)

Risk appetite is the amount of risk a firm will take to fulfil its strategic goals and objectives. When countering Money Laundering and Terrorist Financing, reporting entities are advised to take a Risk-Based Approach (RBA). One of the most important aspects to assess and document is the firm’s risk appetite under the RBA. The infographic provides the significance of risk appetite in effectively adopting the Risk-Based Approach.

1. Risk Appetite lays the foundation for adopting a Risk-Based Approach (RBA)

Risk Appetite lays the foundation for adopting a Risk-Based Approach. It helps identify the boundary around which the firm must operate and see that it is well-protected. Anything beyond the risk appetite will not help the firm meet its strategic objectives and may have a negative effect on its financials and reputation. The policies, procedures, controls and the overall AML/CFT framework are drafted considering the firm’s risk appetite. If the firm is willing to take risks, a more aggressive approach is taken and vice versa.

2. Risk Appetite helps carry out a tailored Risk Assessment

Risk Appetite helps carry out a tailored risk assessment of the firm. Every business has some inherent risks. It deploys policies, procedures, and controls to counter and keep them within a specific limit. Risk Appetite provides that limit and helps determine whether a firm has to deploy more controls to keep risks within an acceptable limit.

3. Risk Appetite ensures efficiency

4. Risk Appetite brings dynamism to risk management

Risk Assessment without considering the risk appetite becomes a static document. It’s the risk appetite that requires the risks to be managed and hence adds the element of dynamism to the overall risk management of the entity.

5. Risk Appetite enables monitoring and review

Risk Appetite requires that the controls are deployed and monitored and their effectiveness is reviewed. It provides a measure against which the overall risk carried by the company is measured, and if there’s any change, it immediately gets reflected.

6. Risk Appetite demonstrates compliance culture

Having a formal Risk Appetite statement demonstrates the compliance culture of the company. The actual implementation of the same is reflected in the action taken by the company in terms of countering ML/TF.

7. Helps prioritise risks for resource allocation

8. Brings consistency to the governance mechanism

The overall governance of the compliance function will be wayward without the knowledge of the company’s risk appetite. It could differ from person to person and compliance officer to compliance officer, creating chaos. Without risk appetite, the firm couldn’t implement procedures, and everyone would decide what works best for them.

9. Risk Appetite reduces uncertainty

Risk Appetite enhances certainty in dealing with various risks. The uniform approach across the organisation provides assurance that identified risks will be countered and appropriately managed.