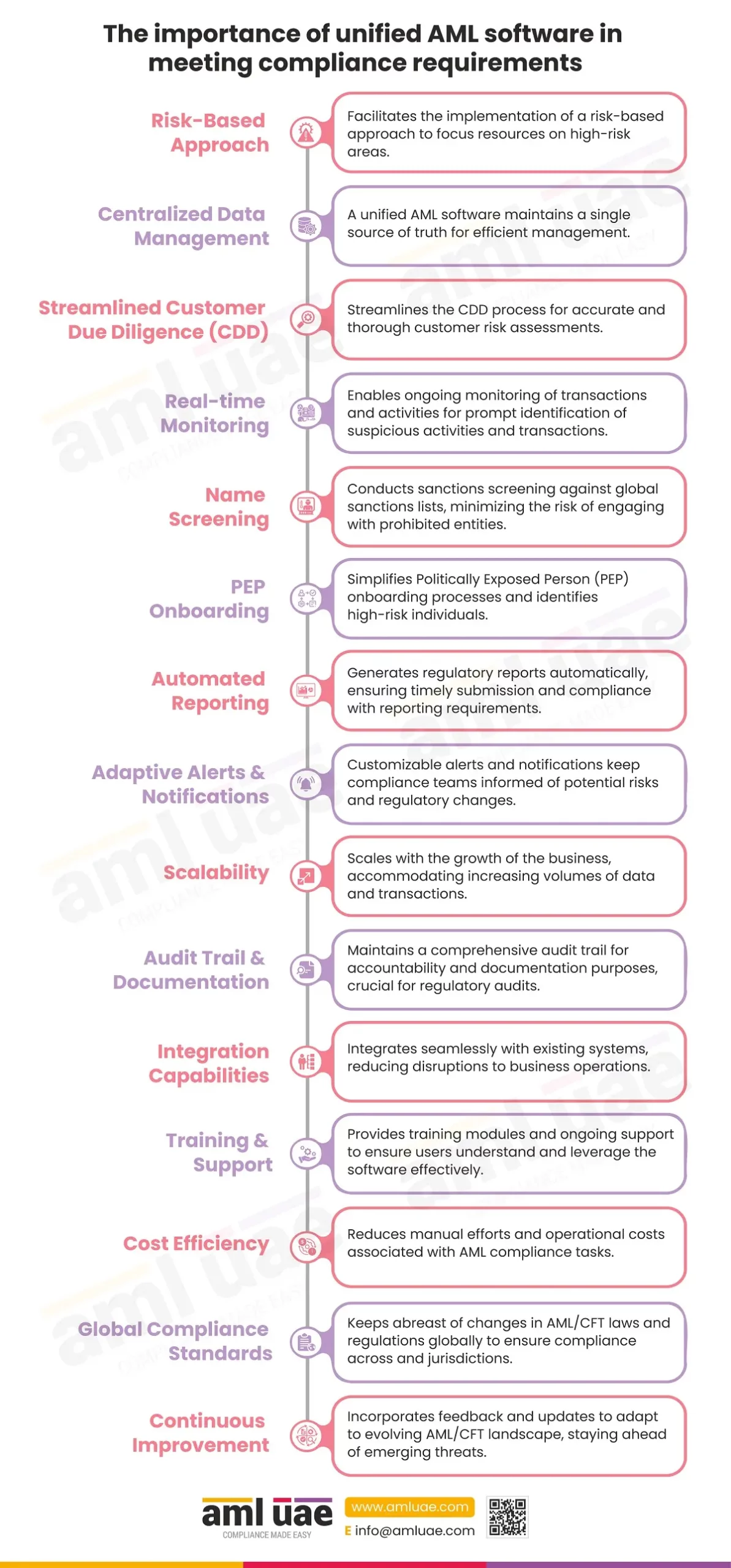

The importance of unified AML software in meeting compliance requirements

The importance of Unified AML Software in meeting compliance requirements

Be it lawyers, accountants, auditors, TCSPs, DPMS, VASP, real estate brokers, financial institutions, money exchange businesses, or insurance companies, a unified AML software goes a long way in meeting the regulatory obligations of the reporting entities.

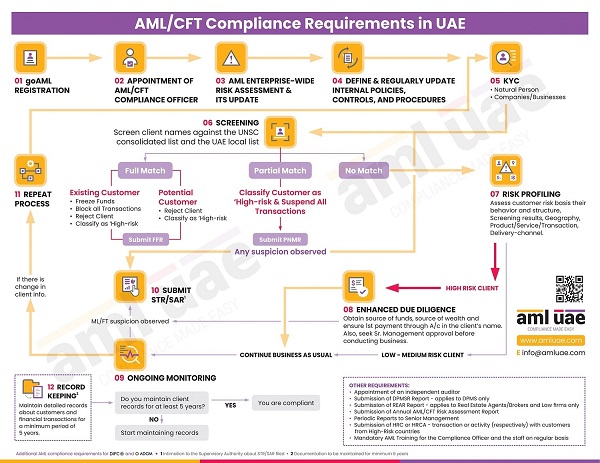

A unified AML software helps perform Enterprise-Wide Risk Assessment, Maintain AML/CFT Policy and Procedures, maintain KYC records, perform sanctions screening, carry out customer risk assessment, submit regulatory reports like SAR, STR, PNMR, FFR, DPMSR, REAR, HRC, HRCA, and maintain a complete audit trail of events.

Since there’s only a single source of truth, duplication is avoided, significantly saving time and effort. Moreover, the ML/FT risks can be mitigated, and the organisation always remains compliant and audit-ready.

The regulatory requirements for semi-annual or annual returns can be met, and timely submission of survey responses can be ensured.

The mandatory record-keeping requirements can be effectively met, and paper-based inefficient processes can be avoided. The company can adopt a risk-based approach and utilise the resources most effectively to fight against financial crimes.

The importance of unified AML software in meeting compliance requirements