Tax Evasion red flags, typologies, and control measures

Tax Evasion red flags, typologies, and control measures

Tax evasion is a global issue that is closely associated with money laundering. Tax evasion has been criminalized globally, and the undisclosed proceeds are considered the proceeds of crime. The criminals try to legitimize such illicit money, and such attempts are nothing but money laundering. Tax evasion typologies are techniques employed by criminals to legitimize money. Red flags are warning signals indicating the possibility of money laundering or terrorist financing. Regulated entities are required to implement various measures to counter tax evasion and potential money laundering or terrorist financing.

Tax evasion definition

Tax evasion is a financial crime involving misrepresentation of the taxpayer’s financial position with a motive to avoid taxation.

Tax evasion red flags: Indicators for tax evasion and potential ML/TF

- Unreasonable business expenses

- Frequent amendments in tax returns

- Formation of an offshore company without a sound business rationale

- Inconsistent information – different accounting information in VAT, customs, and corporate tax returns

- Sustained business losses

- Consistently late submission of regulatory requirements

- Multiple Tax Identification Numbers

- Transactions inconsistent with customer profile

- Overly complex business structure without justification

- International bank account with no local footprint

- Cash-intensive business

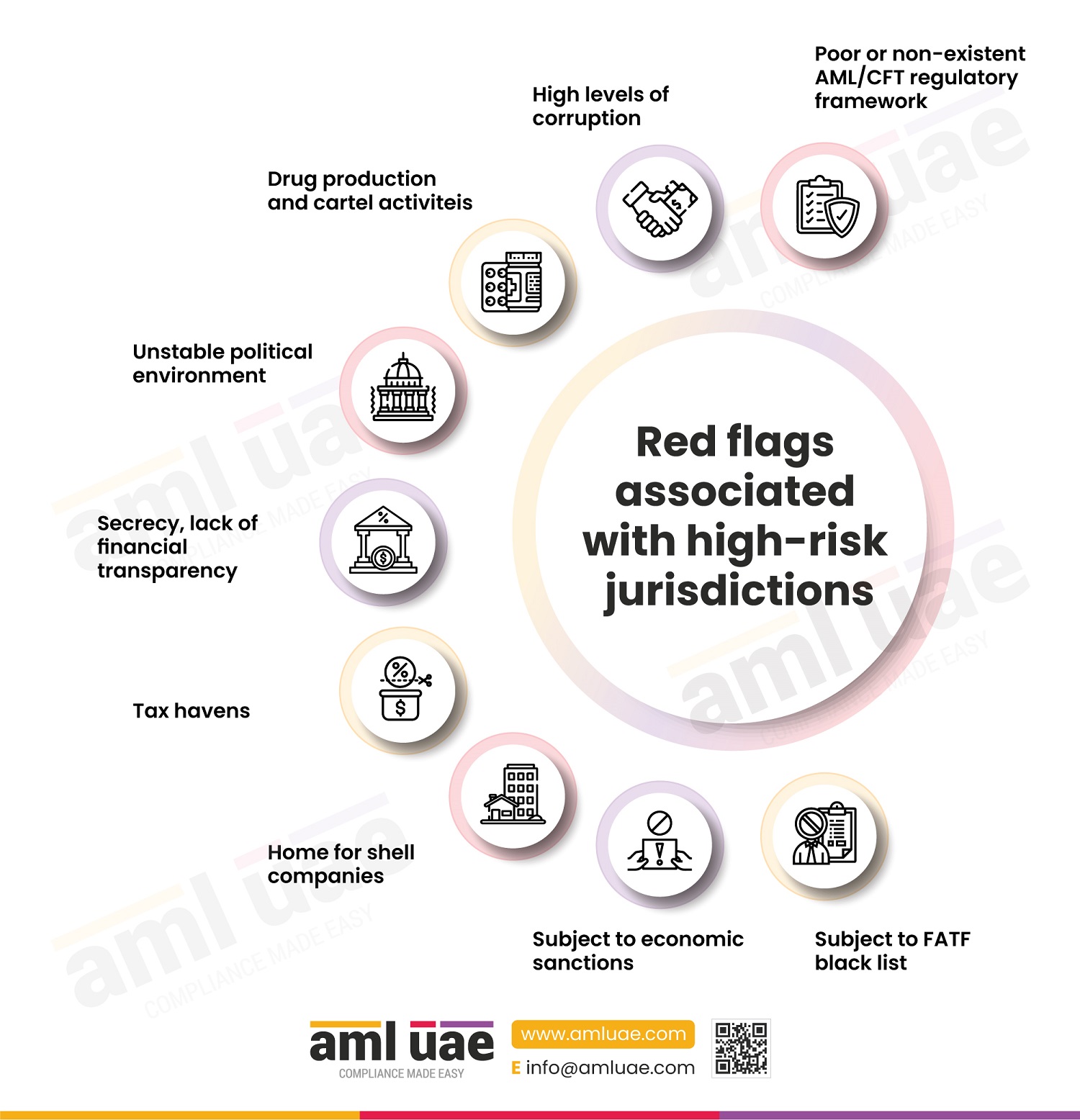

- Transactions with high-risk jurisdictions

- Customers demanding a high level of secrecy and confidentiality

- The customer does not cooperate with the KYC and CDD requirements

- Sudden closure of a business after completing a few high-value transactions

- Frequent changes in auditors, lawyers, and business advisors

- A sudden increase in revenues of a company

- Bearer shares

- Source of Wealth and Source of Fund documents cannot be obtained

- Frequent deposits from unknown and unexplained sources

- Use of common address by several companies

- Purchase or sales invoices not available for verification

- Adverse media matches for tax crimes

- A large number of people on payroll without business justification

- Huge amount of liquid cash and cash equivalents with no clear explanation as to why

Typologies: Techniques used for tax evasion and potential ML/TF

- Structuring/Smurfing

- The intermingling of cash with legitimate business income

- Under/overvaluation of goods and services

- Circular/round-tripping transactions

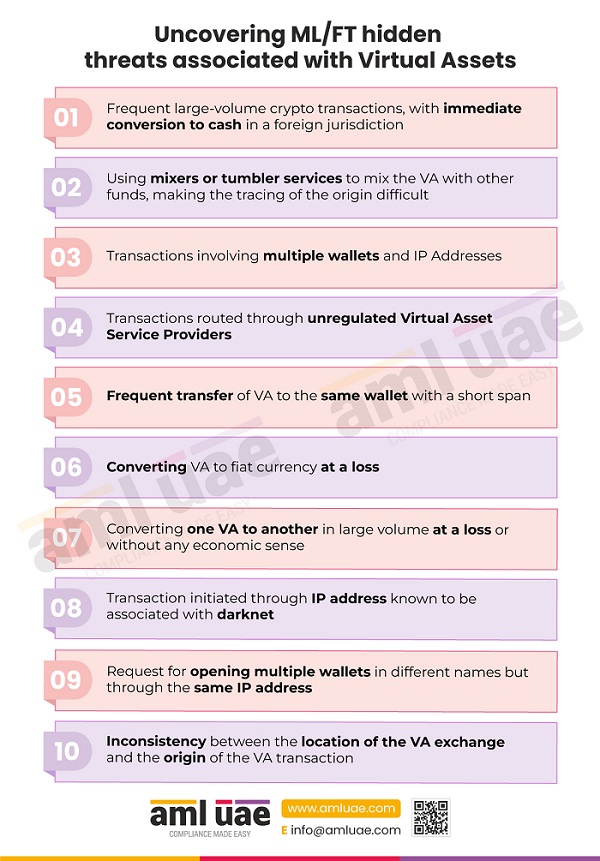

- Crypto transactions

- Personal expenses charges to the business account

- Frequent cash withdrawals

- High level of cash expenses and transactions

- Use of third-party accounts for business transactions

- Operating two different companies with the same name in two different jurisdictions

- False invoices, statements, and documents

- Dual citizenship or tax residence

- Wire transfers to multiple jurisdictions

- Rubber stamping = the company is operated with the direction of an unknown beneficial owner

- Usage of false identities (identity fraud) to make business transactions

- Use of stolen identity to commit VAT/corporate tax fraud

- Use of false identity to open bank accounts

- Creation of shell companies

- Bogus claims

- Underreporting of business income

- Use of offshore tax havens for billing purposes

- Transfer pricing abuse

- Claiming false tax deductions

- Drug trafficking

- Purchase of multiple properties/luxury items to place the proceeds of crime

- Bribery

Control measures to counter tax evasion and potential ML/TF

- Enterprise-Wide Risk Assessment

- AML/CFT program

- Robust KYC and CDD mechanisms

- Enhanced Due Diligence (EDD) for high-risk customers

- Transaction Monitoring

- Submission of SAR/STR in case of a suspicion

- Accepting only bank payments and avoiding cash and cryptocurrencies

- Top management oversight