Significance of KYC remediation in AML compliance

Significance of KYC remediation in AML compliance

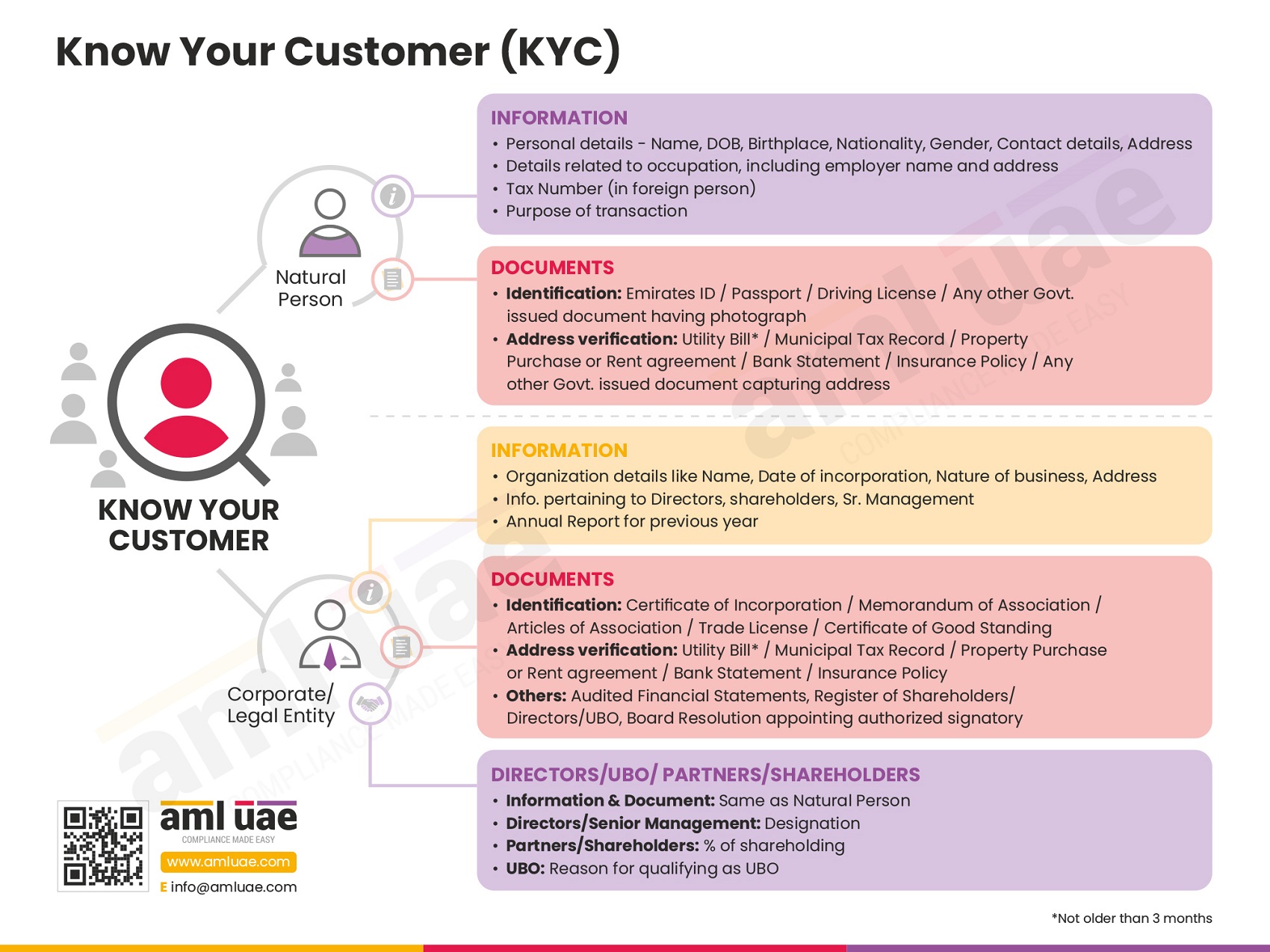

Anti-money laundering (AML) policies and procedures require the regulated entity to undertake Know Your Customer, or what we all know as “KYC”, to determine a customer’s true identity by collecting information and verifying it using reliable sources.

As part of AML compliance, the regulated entity must review the existing customer’s identification details and documents and ensure that the same are valid and relevant for customer identification purposes and assessing the risk the customer poses to the business related to financial crimes, including money laundering, terrorist financing, and proliferation financing (ML/FT and PF). This process of ensuring customer details is up-to-date and relevant is known as “KYC remediation.”

KYC remediation is an extension of the KYC process and is an essential element of the Customer Due Diligence (CDD) program. It involves checking the validity of existing customers’ details and updating them, if necessary, by seeking additional information or documents. Through the KYC remediation process, the regulated entity improves and organises the customer’s data to find inconsistencies and further determines appropriate steps to prevent ML/FT risks.

The regulated entity must undertake the KYC remediation process to identify and mitigate ML/FT and PF risks, ensure the accuracy of customer data, and enhance regulatory compliance.

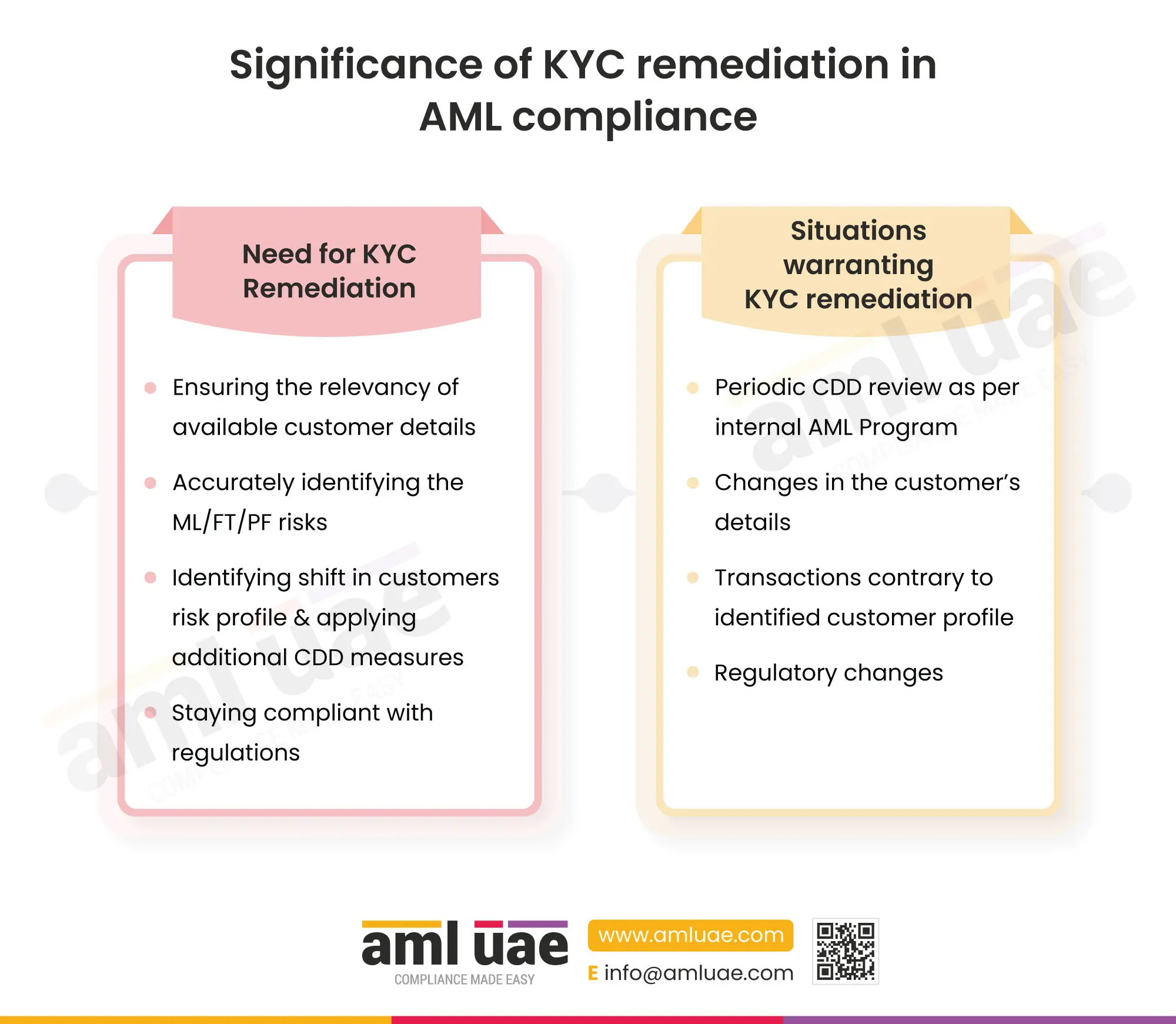

The following is the list of reasons highlighting the need for KYC remediation:

Ensuring the relevancy of customer existing details

With the KYC remediation process, the regulated entity can detect whether customer identification details provided during onboarding remain relevant and valid to maintain the integrity of the KYC process.

Identifying and mitigating the ML/FT and PF risks

It effectively identifies and mitigates the risks associated with ML/FT and PF by regularly updating and reviewing current customer data. With such up-to-date data, the regulated entity can effectively ensure compliance with AML regulations.

Monitoring the shift in customers' risk profiles

Conducting KYC remediation helps to identify any shifts in a customer’s risk profile through examination. This allows for applying appropriate enhanced due diligence (EDD) measures when necessary.

Staying compliant with regulations

Staying regulatory compliant is a cornerstone of KYC remediation efforts to uphold legal obligations around the AML/CFT program. With KYC remediation, the regulated entity reviews the accuracy of its KYC process and rectifies any non-compliance.

List of situations warranting KYC remediation

Acknowledging the triggers that lead to KYC remediation is essential for better risk management and compliance requirements. By knowing when to initiate KYC remediation, regulated entities can quickly respond to changes, strengthening their AML programs.

The following is the list of situations warranting KYC remediation:

1. Mandatory compliance to conduct KYC review

The regulated entity initiates KYC remediation to comply with the KYC review cycle, which is an essential part of the AML’s obligation. In the UAE, the timeline for reviewing profiles differs depending on the ML/FT risk category assigned to customers.

2. Alteration in the customer’s information

The regulated entity, when engaging with the customer, may learn about any changes in the customer’s legal structure or change in correspondence address. This change requires adopting KYC remediation to determine appropriate steps to update the data accurately and assess the impact on the customer’s risk profile.

3. Inconsistency observed between the transactions executed by the customer and the customer profile known to the regulated entity in KYC during the periodic review

The regulated entity needs to ensure that the transactions executed during the business relationship are consistent with the customer’s overall profile known to the entity. If any inconsistency is observed, the regulated entity must review the KYC and customer identification details and understand the changes justifying the transaction pattern. Here, the KYC remediation function will help identify any red flags.

4. Changes in regulatory structure

When the regulatory structure or landscape changes, whether in a particular business sector or the classification of a country as high-risk, the regulated entity must promptly adopt KYC remediation procedures. With such an update, the regulated entity can review and improve the data and ensure effective compliance with AML regulations.

This infographic highlights why KYC remediation is vital for AML compliance and when the regulated entity should undertake it.