Responsibilities of Senior Management around AML program under UAE AML Laws

Responsibilities of Senior Management around AML program under UAE AML Laws

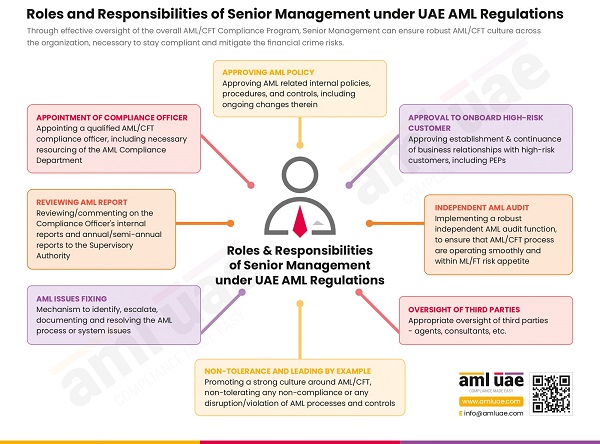

The overall responsibility to ensure the effective implementation of the anti-money laundering (AML) compliance framework lies with the organisation’s senior management. The organizations can establish a robust AML Compliance culture with senior management’s support.

The senior management must define the company’s ML/FT risk appetite and ensure adequate AML policies, procedures and controls are developed and deployed to mitigate the financial crime risks.

Senior management and the board must consider anti-money laundering issues on a regular basis and take necessary actions. There must be a reporting mechanism set in the organisation to keep the senior management updated about the AML/CFT compliance issues and timely action must be taken to counter ML/TF.

Here is an informative graphic to assist all the senior managerial personnel in fulfilling their responsibilities around the AML program and safeguarding the company against financial crimes.

AML UAE is an AML Consultancy service provider, supporting clients with AML business risk assessment and AML Policy documentation, including comprehensive AML training for the Compliance Officer, Senior Management, and staff.