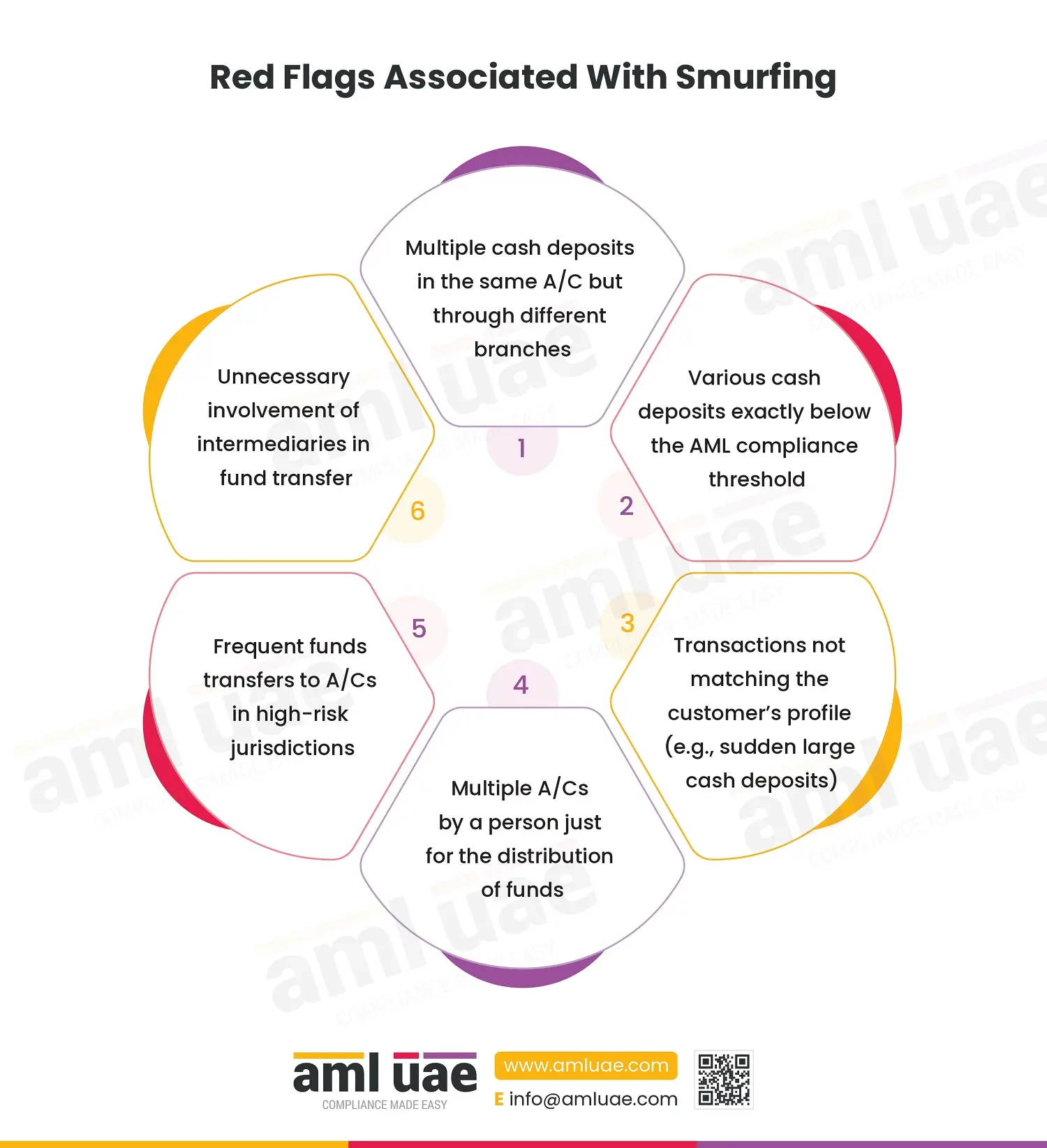

Red Flags Associated With Smurfing

Red Flags Associated With Smurfing

Smurfing is one of the widely used money laundering techniques. In this technique, the money launderer fragments the large cash amount into smaller amounts to keep it below the threshold level set for AML checks (such as applying Customer Due Diligence measures, ongoing monitoring and reporting) and then deposits it into financial institutions.

AML laws and regulations mandate that reporting entities take the right measures to identify and prevent smurfing activities. They are obliged to maintain red-flag indicators that indicate suspicious transactions and activities related to potential smurfing attempts and submit the necessary report with the Financial Intelligence Unit (FIU) by filing a Suspicious Transactions Report and Suspicious Activity Report, as the case may respectively.

Such risk indicators may include multiple cash deposits of equal amounts from one or more persons from various locations to the same bank account or multiple accounts opened by a single person who does not have any apparent business transactions through these accounts but is merely used for the distribution of illegal funds.

This infographic provides a list of red flags associated with the smurfing technique that you can implement in your AML program. These red flags relate to transactions, customer behaviour, and account activity.

By implementing these red flag indicators in your anti-money laundering compliance program, you can shield your business from smurfing and related financial crime activities.