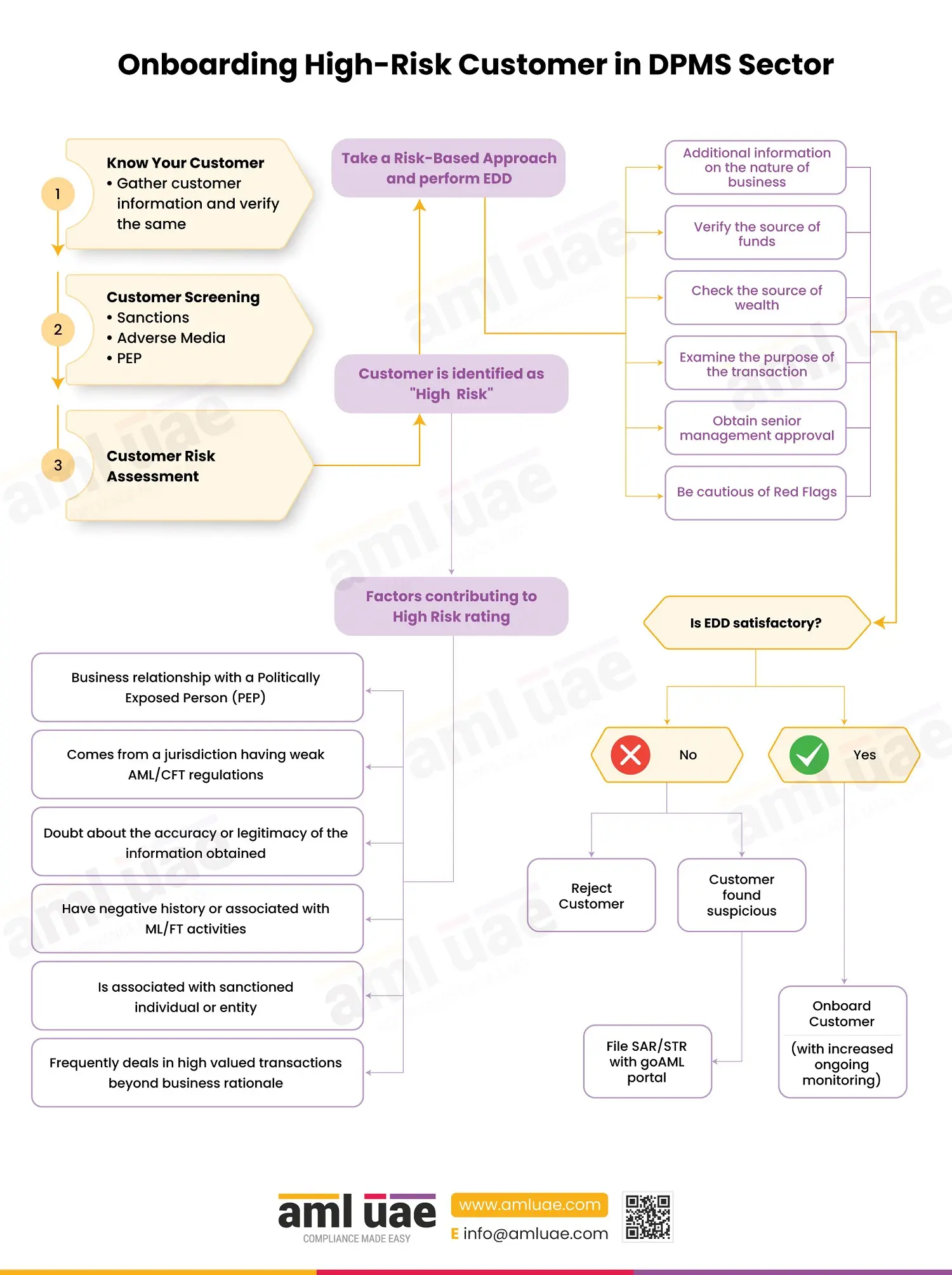

Onboarding high-risk customers in DPMS

Onboarding high-risk customers in DPMS

Dealers in Precious Metals and Stones (DPMS) are more vulnerable to financial crimes, given the inherent nature of the precious metals and stones. Transactions in precious metals and stones are misused as a medium for criminals engaged in financial crimes like ML/FT to easily invest and transfer proceeds from illicit activities. Thus, the DPMS must be watchful of the customers, identify the ones posing a higher risk of ML/FT, and apply adequate risk mitigation measures, adopting a risk-based approach.

A customer may be classified as a high-risk customer due to the following reasons:

- Customer is or has a business relationship with a Politically Exposed Person (PEP).

- Customer regularly associates itself with a high-risk country, such as a customer from a jurisdiction having a weak regulatory framework for AML/CFT or a customer closely connected with a country known for its nature for money laundering or terrorist financing activities

- When there is doubt about the accuracy or legitimacy of the information about the customer obtained earlier.

- The customer frequently engages in high-value transactions beyond business or economic rationale, making it challenging to identify whether the proceeds are legitimate.

- Customer engages in unusual transaction patterns.

- Customer being associated with a designated or sanctioned person.

- Customer having adverse media suggesting past connection with financial crimes.

- When any other ML/FT risk indicator or red flag is observed.

Performing Enhanced Due Diligence and Adopting Risk-Based Approach against high-risk customers:

To perform EDD, DPMS should collect additional information and apply the following mitigating measures:

- Additional information on the nature of business – Once a customer has been classified as “high-risk,” additional information about the nature of the business must be sought from the customer to identify the reason behind the customer’s entering into a business relationship.

- Verify the source of funds – It is necessary to verify the source of funds to determine whether they are proceeds from illegal activities.

- Check the source of wealth – It is required to check the source of wealth to analyse whether a customer has been engaged in any ML/FT activities throughout his lifetime

- Examine the purpose of a transaction – Examine the Purpose of the transaction. Such information should be backed up by substantial documentation, such as obtaining bank statements or audited books for determining the source of funds/wealth, etc

- Approval from Senior Management – Before onboarding a high-risk customer, approval from the senior management is mandatory.

- Be cautious of Red Flags – DPMS should establish ML/FT red flags to identify suspicious customer activities.

On the basis of the application of EDD measures, DPMS has to analyze whether EDD was satisfactory and take action to onboard customers. When onboarding, DPMS needs to monitor the customer with increased ongoing monitoring. In case, EDD is found unsatisfactory, DPMS can reject onboarding customers. Additionally, in case the customer is found suspicious, DPMS should file a Suspicious Activity Report on goAML.

Here is an infographic highlighting factors contributing to high-risk ratings and measures to be taken for onboarding high-risk customers.