Key factors for Customer Risk Assessment under AML regulations

Key factors for Customer Risk Assessment under AML regulations

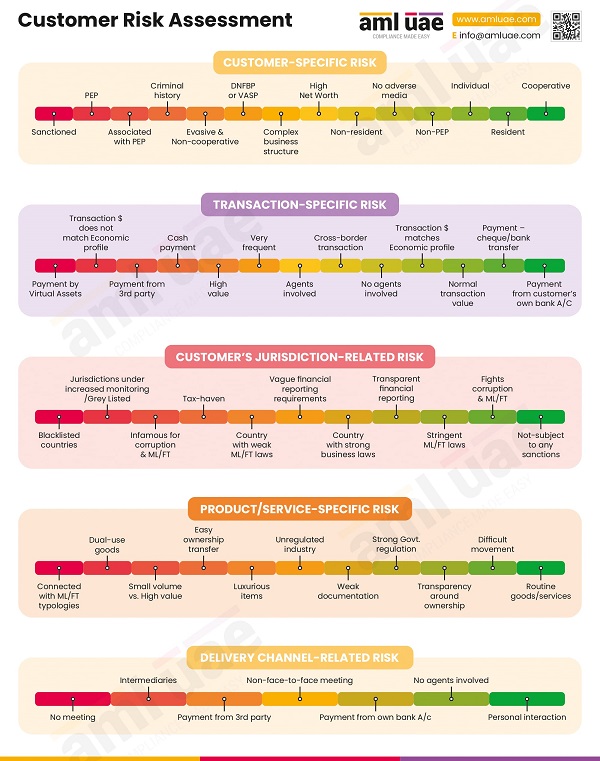

AML Regulations in UAE provide for adopting a Risk-Based Approach to mitigate financial crimes, which calls for performing Customer Risk Assessment. Adequate due diligence measures should be deployed considering the extent of a particular customer’s ML/FT risks to the business. Enhanced due diligence measures are to be conducted for high-risk customers, while standard due diligence measures are good enough for low-risk customers.

Thus, it is essential to categorize every customer from their ML/FT risk quotient to detect and prevent such risks effectively.

The companies need to factor in a bundle of risk parameters to create customers’ AML risk profiles, such as the geographies they are hailing from, their legal structure, customers’ behavioural traits, etc. To help you efficiently assess the ML/FT risk posed by each of your customers (as Low, Medium, High, or Unacceptable), we have designed an infographic illustrating the factors to be considered to perform Customer Risk Assessment from an AML perspective.

Further, for practical implementation of customer risk profiling methodology, here is the AML Customer Risk Assessment template.

AML UAE is committed to assisting Financial Institutions, VASPs, and DNFBPs in detecting and mitigating the money laundering/terrorism funding risks by offering end-to-end AML Consultancy services, including designing Customer Risk Profiling processes for the company and extending managed Customer Due Diligence support.