Key Benefits of Conducting Independent AML Audit

Key Benefits of Conducting Independent AML Audit

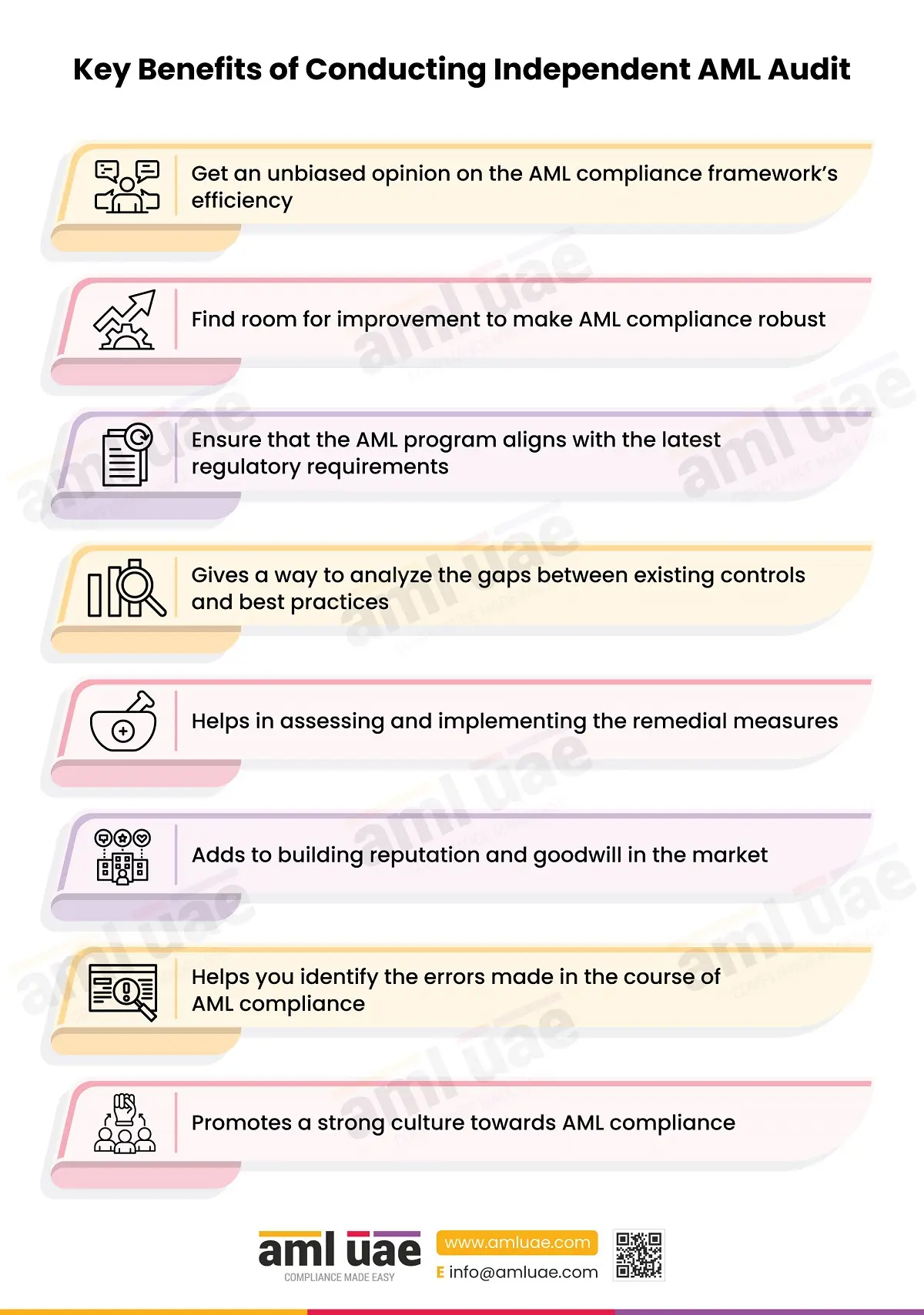

An independent AML audit is necessary as per the UAE’s anti-money laundering laws. While the business is obliged to conduct an AML audit, there are several benefits it provides to the entity.

When you conduct an internal AML audit (which is not independent of the AML function), there is a chance that the internal AML compliance department will miss out on covering all aspects and be influenced by internal factors. On the other hand, independent AML audits provide the business with an honest view that is free from any internal influence.

Based on the independent AML auditor’s opinion, the AML compliance department can make changes to the existing policies, procedures, and controls. This also allows the business to update the AML compliance framework with the latest regulatory requirements. For instance, if the government has introduced a change in record-keeping requirements, periodic AML audits will bring it to notice, according to which the business can make the required changes.

Moreover, you can analyze the gaps between the current and recommended ML/FT risk mitigation measures and learn how to enhance AML efforts to better identify and manage financial crime risks.

Senior management-backed independent AML audit function helps build an AML compliance-oriented culture and a seriousness about combating financial crimes.

When you take such focused actions to elevate AML compliance, you earn goodwill in the market and stand out as a reputed regulated entity, committed to combating financial crimes.

Overall, an independent AML audit not only supports AML compliance but also helps the business build a robust framework, the right environment, and boost the business stakeholders’ confidence in the business.