How to conduct AML Business Risk Assessment?

How to conduct AML Business Risk Assessment?

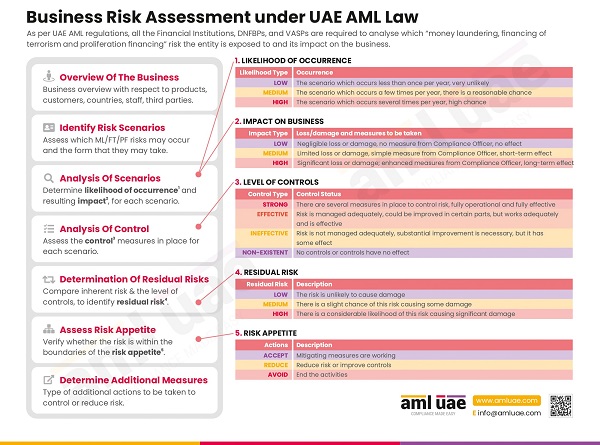

It is challenging to develop and deploy the necessary mitigation measures without understanding the inherent risk connected to your nature of business, the products, and services you offer, the geographies you are targeting, etc.

Once you understand your business risk, you can adopt the Risk-Based approach to optimally utilize your resources to effectively implement the controls and safeguard your business against financial crime risk. The infographic here captures the detailed business risk assessment procedure under UAE AML regulations.

Factors triggering review of Enterprise-wide Risk Assessment (EWRA)

- Change in National Risk Assessment (NRA)

- Change in AML regulations

- Introduction of new product or service

- Implementation of new technology in delivery of services or complying with AML regulations

- Onboarding a new class of customers that presents risks not addressed by Entity-wide Risk Assessment

- Merger of business

- Operating in a new jurisdiction

- Changes in management or group structure of the company

AML UAE is your one-stop solution for all your AML requirements in UAE, starting from goAML registration to conducting the business risk assessment and defining your AML checks and controls to fight money laundering and terrorism financing.