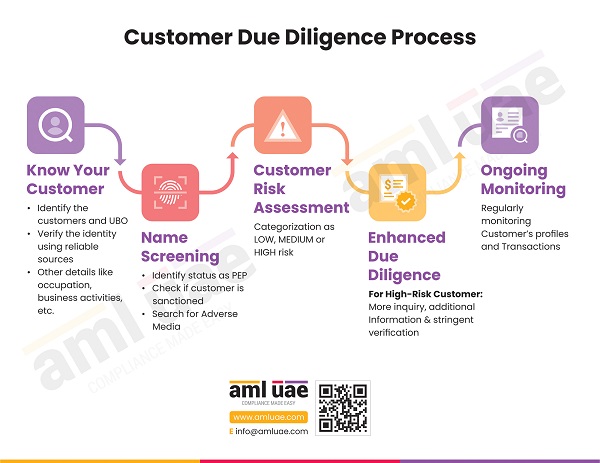

Elements of the Customer Due Diligence Process

Elements of the Customer Due Diligence Process

Customer Due Diligence process is a key element of the overall AML Program, requiring the regulated entities to identify the customers and assess the risk each customer poses to the business.

To ensure the effectiveness of the CDD under the AML program, the regulated entities in UAE must follow the below-mentioned approach:

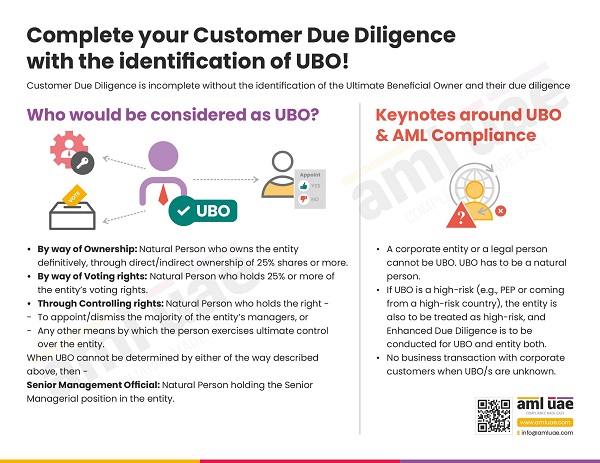

- Know Your Customer: The KYC process aims at identifying the customers, including the Ultimate Beneficial Owners (UBOs), and verifying their identity using reliable, independent sources. KYC also covers understanding other key information about the customer, such as their occupation, associated geographies associated, etc.

- Customer Name Screening: Screening includes compliance with the Sanctions regime, identification of the customer’s connection with Politics or Politically Exposed Persons (PEP) and scanning the customer or the UBOs to check for the presence of any negative media against the customer.

- Customer Risk Profiling: Assessing the level of risk the customer poses and determining the customer’s risk profile. Basis the risk classification, the regulated entities must determine the nature of overall Customer Due Diligence to be applied.

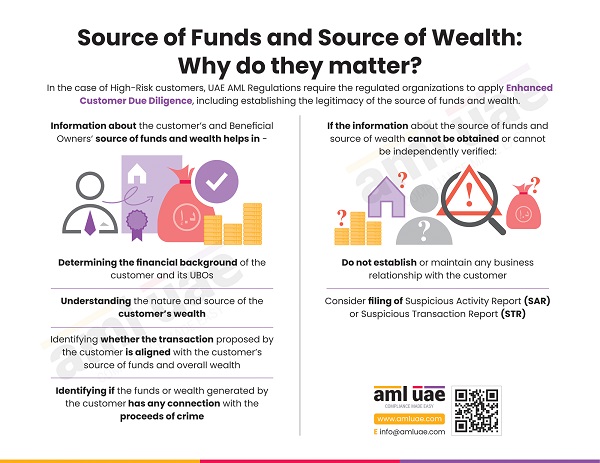

- Enhanced Due Diligence: For customers identified as posing higher ML/FT risk, the regulated entities must adopt Enhanced Due Diligence measures, covering additional inquiries about the customers’ identity, purpose of transactions, customer’s financial position, and the source of funds/wealth.

- Ongoing Monitoring: Customer Due Diligence is an ongoing activity requiring regulated entities to monitor the customer’s information and their transactions with the entity to identify any suspicious activities or inconsistencies in customer behaviour.

Here is an infographic to help the regulated entities in the UAE to develop and maintain an effective Customer Due Diligence process, covering the core components of managing the risk during customer onboarding and ongoing business relationships.

Let AML UAE be at your service in designing the CDD program for your business, highlighting the best practices to stay AML compliant and safeguard the business from being exploited by money launderers and other financial criminals.