Elements of AML Compliance Officer's Report to Senior Management under UAE AML Regulations

Elements of AML Compliance Officer's Report to Senior Management under UAE AML Regulations

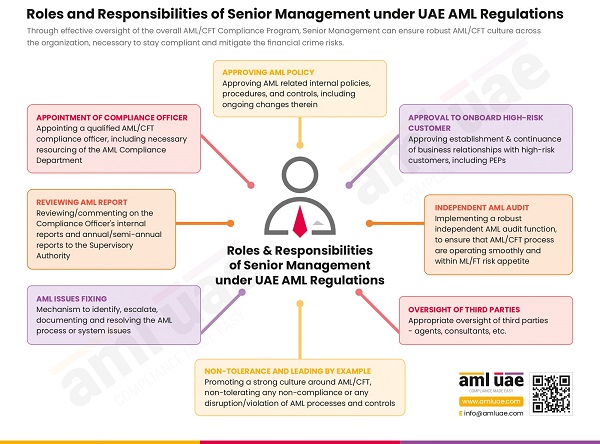

Though the Senior Management of the regulated entities does not get involved in routine AML/CFT tasks but is responsible for ensuring the implementation of the AML/CFT program across the organization. In this context, to ensure that senior management is aware of the organization’s AML/CFT measures, the UAE AML regulations mandate an AML Compliance Officer of all the regulated entities – Financial Institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Assets Service Providers (VASPs) – to prepare and submit a periodic AML/CFT Compliance Officer’s report to the senior management.

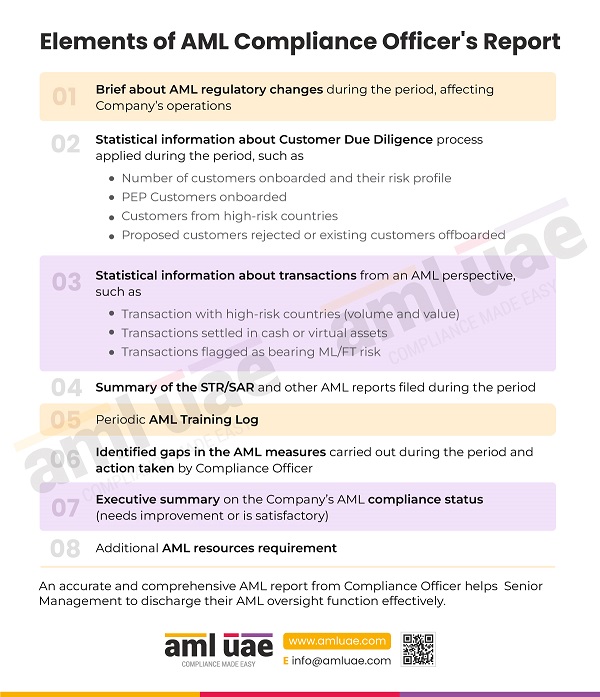

The periodic AML Compliance Officer’s Report must cover a brief about the customer due diligence measures performed during the period, the number of high-risk customers onboarded, customers rejected, and any matches found with sanctions lists. Further, the Compliance Officer must also provide a statistic related to the reports field on the FIU’s goAML portal and an overview of the suspicions observed. The report must also include any AML/CFT gaps or weaknesses identified by the Compliance Officer and the action taken. The Compliance Officer must also capture any additional resources required for AML/CFT compliance.

Here is a visual note of what all elements must be covered in the AML Compliance officer’s periodic report to the organization’s senior management.

AML UAE is a leading AML Consulting firm assisting AML Compliance Officers of various regulated entities to implement an effective and robust AML/CFT program. We help design and prepare the periodic AML Reports to ensure management understands and is up-to-date on the organization’s and Compliance Officer’s AML/CFT efforts.