Dubai International Financial Centre (DIFC) Entities Subject to AML Compliance

Dubai International Financial Centre (DIFC) Entities Subject to AML Compliance

The Dubai International Financial Centre (DIFC) is the world’s one of the most popular financial centers, where thousands of international businesses, including banks and financial institutions, function. The designated entities operating in the DIFC are subject to AML compliance, including effective implementation of the proper measures as prescribed under DFSA issued AML Rulebook to fight money laundering and terrorist financing.

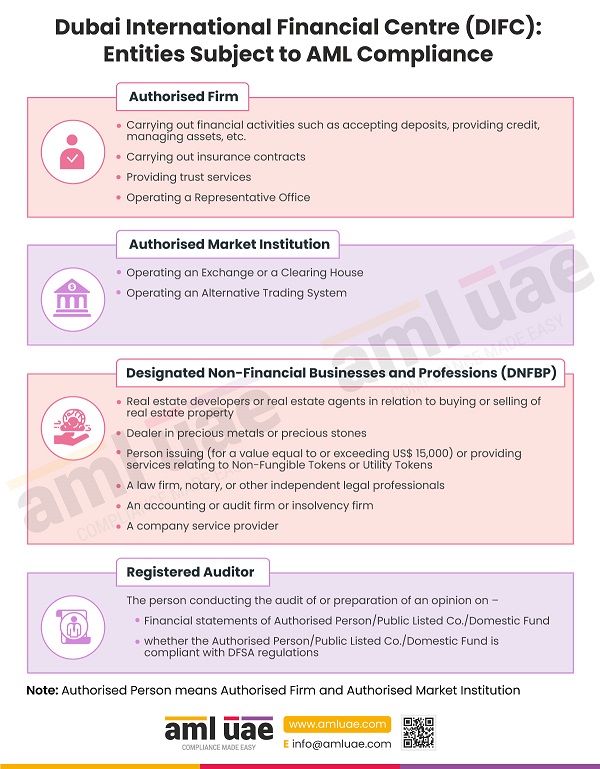

The below-added entities are subject to AML compliance:

- Authorised Firm: When you are engaged in financial activities such as accepting deposits, providing credits, and managing assets, you fall under this category. Besides that, if the business carries out insurance contracts, operates a representative office, and provides trust-related services, they are also considered an authorised firm subject to AML compliance.

- Authorised Market Institution (AMI): If you operate an exchange or clearing house or an alternative trading system, you are an AMI.

- Designated Non-Financial Business and Professions (DNFBP): DNFBPs are subject to AML compliance owing to their connection with ML/TF typologies. To mitigate this risk, DNFBPs such as real estate developers and agents, dealers in precious metals or precious stones, people engaged in NFT-related services, lawyers and law firms, accounting firms, and company service providers must follow all AML compliance rules and regulations.

- Registered Auditor: Registered auditors who conduct the audit of or prepare an opinion on financial statements and compliance with DFSA regulations of various people and entities are also subject to AML compliance.

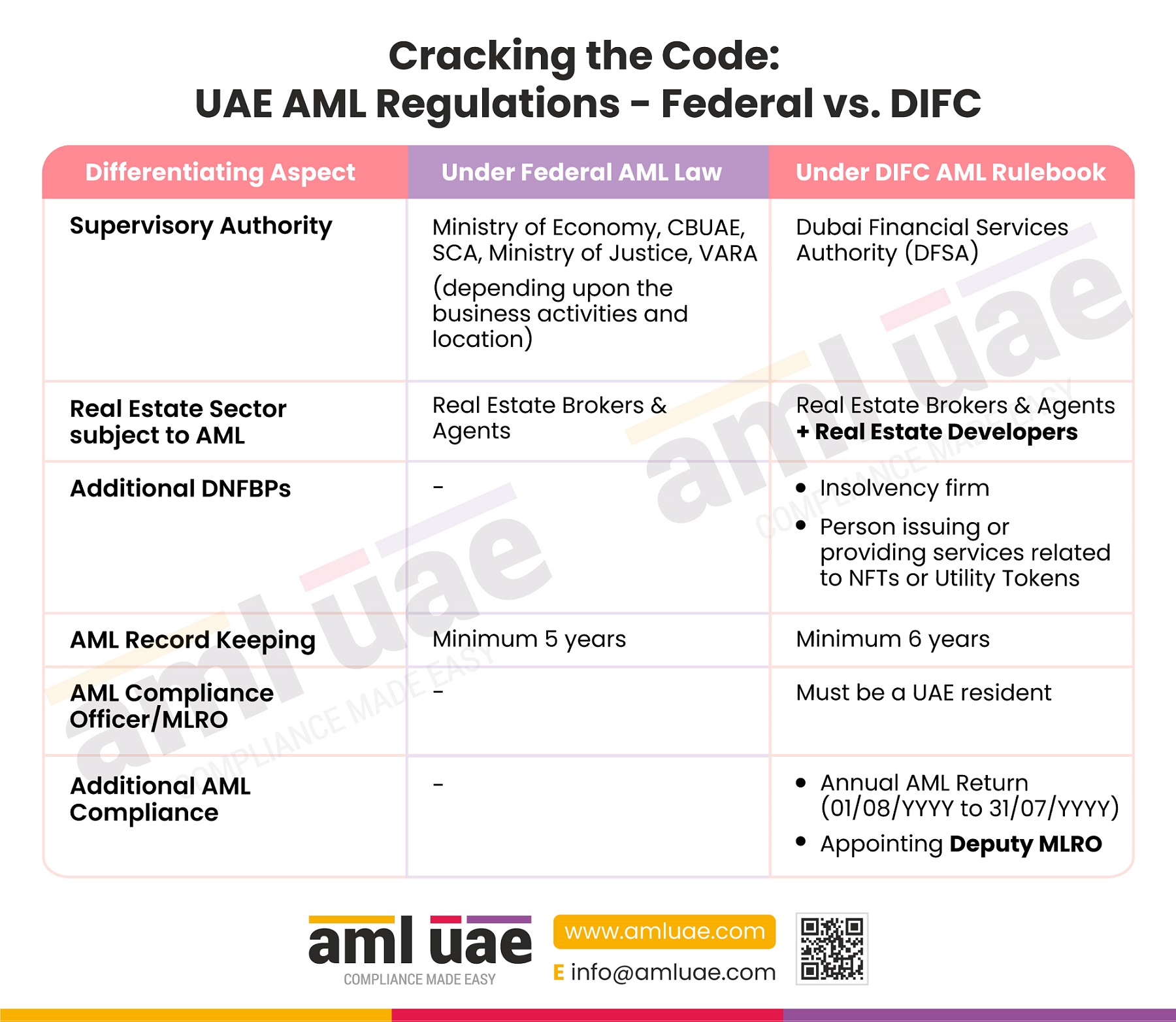

DIFC entities are regulated by the Dubai Financial Services Authority (DFSA). DFSA has issued AML/CFT laws and regulations to guide the DIFC entities around identifying and mitigating financial crime risks. It is essential for all the entities and professionals mentioned above that they follow the AML rulebook issued by DFSA.

AML UAE is one of the top anti-money laundering consultants in the UAE. We have an in-depth understanding of DIFC AML laws and how to implement them for various entities.