Difference between suspicious activity and suspicious transaction under UAE AML regulations

Difference between suspicious activity and suspicious transaction under UAE AML regulations

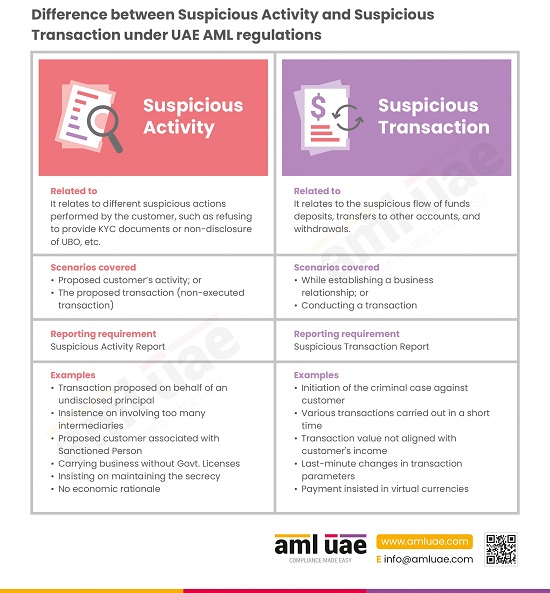

Depending on the nature of the red flags and the stage of the customer relationship when such red flags are observed, the reporting is done to the FIU either in Suspicious Transaction Report or Suspicious Activity Report. It is pertinent to understand the difference between Suspicious Transaction and Suspicious Activity.

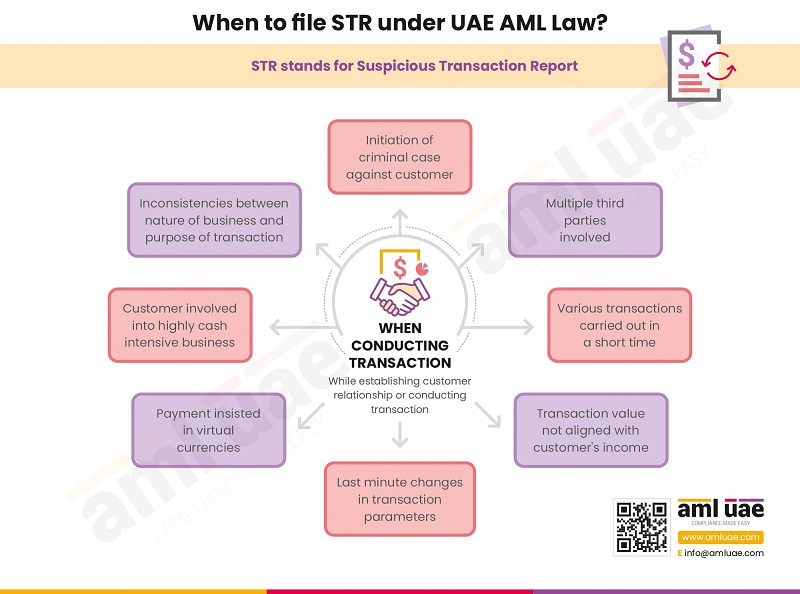

When the suspicion is related to the flow of funds or an already executed transaction, the regulated entities must file a Suspicious Transaction Report (STR). However, when the potential customer is suspected of being involved in money laundering or financing of terrorism, basis their behaviour while applying the Customer Due Diligence process or any other factor, it warrants the Suspicious Activity Report (SAR) filing.

This infographic lets us understand how to distinguish between Suspicious Activity and Suspicious Transactions and a few illustrations of each of these potential red flags.

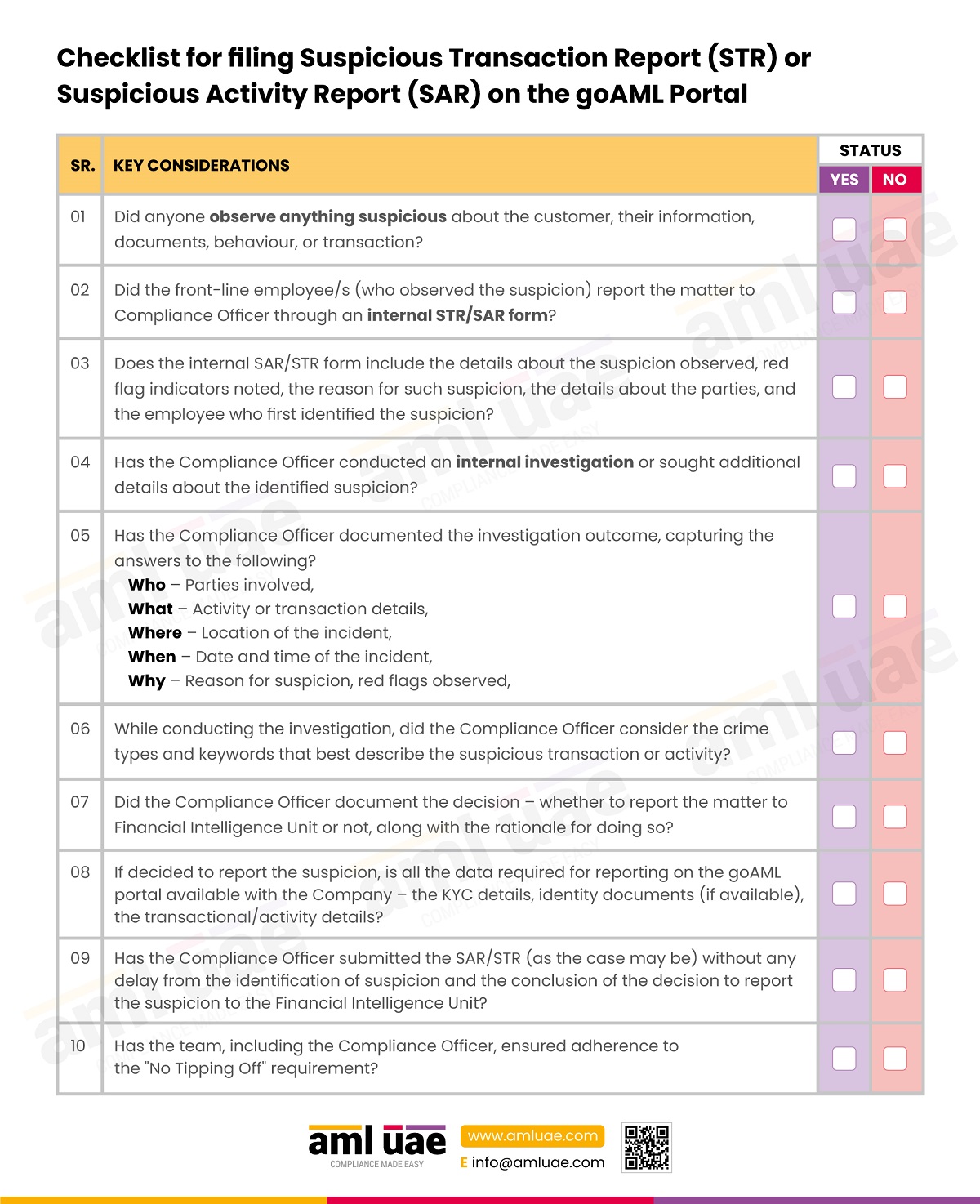

AML UAE is an AML consultancy service provider, offering comprehensive AML Consultancy support to clients in UAE around documenting tailor-made AML policies and procedures, importing AML training, and assisting in regulatory reporting, including filing Suspicious Transaction Reports and Suspicious Activity Reports on the goAML Portal.