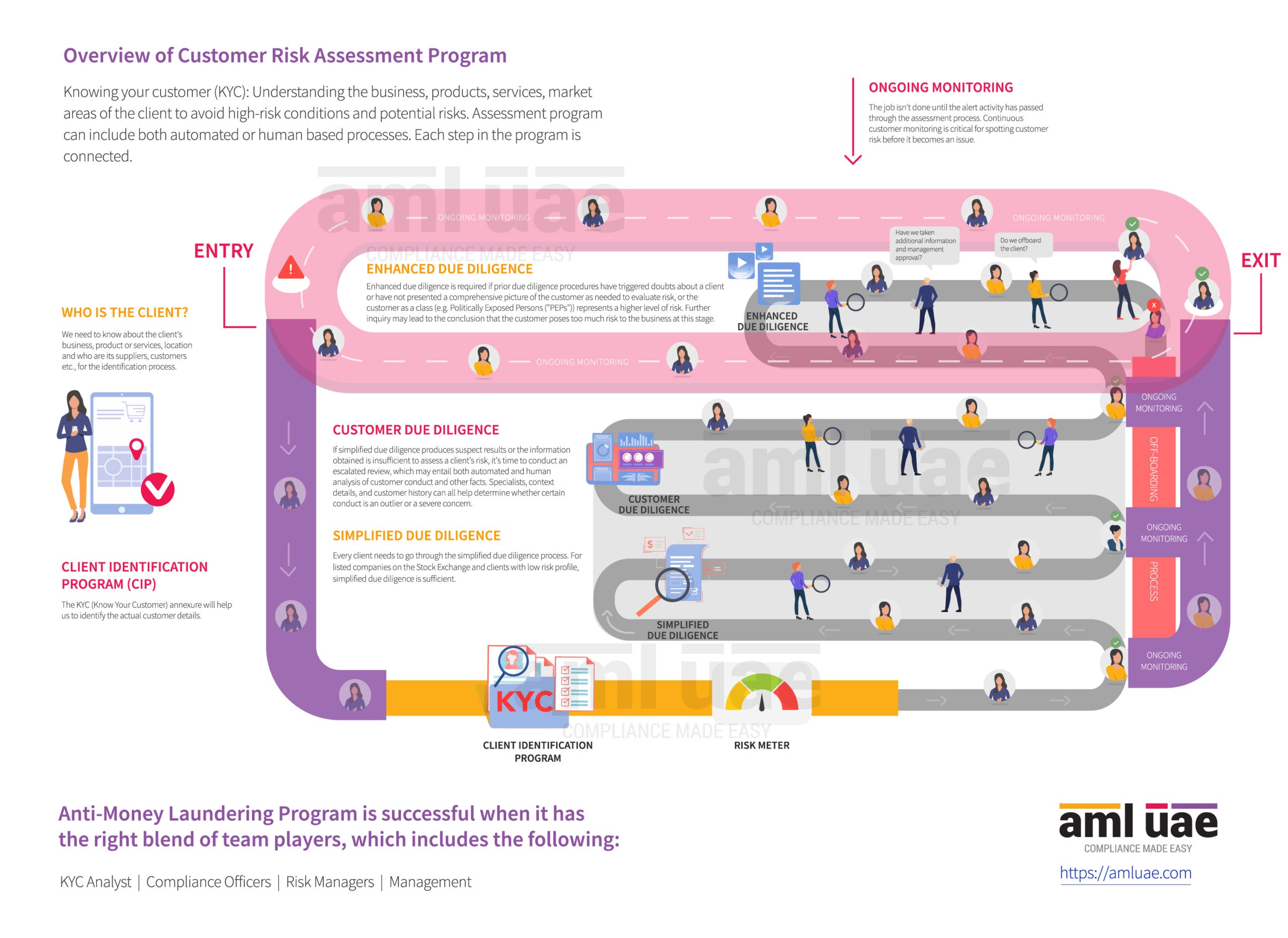

Customer Risk Assessment Program

Customer Risk Assessment Program Detailed Illustration

All the DNFBPs must identify, review, and understand the Money Laundering/Terrorism Financing risks to which they are exposed. The Customer Risk-Based Assessment is carried out to ensure that adequate information is collected from the prospective customer before providing services/goods. It will help the organisation understand if the associated risks are within its appetite. Read more about risk-based approach in AML Compliance.

Customer Risk Assessment is based on various factors like:

- Type of transaction/products/services

- Delivery Channel

- Place of Business

- Mode of payment

- Source of Funds

- Customer Profile

The customer risk assessment must be carried out periodically as per the policy set forth by the organisation.