Customer Due Diligence Process Chart

Customer Due Diligence Process Chart

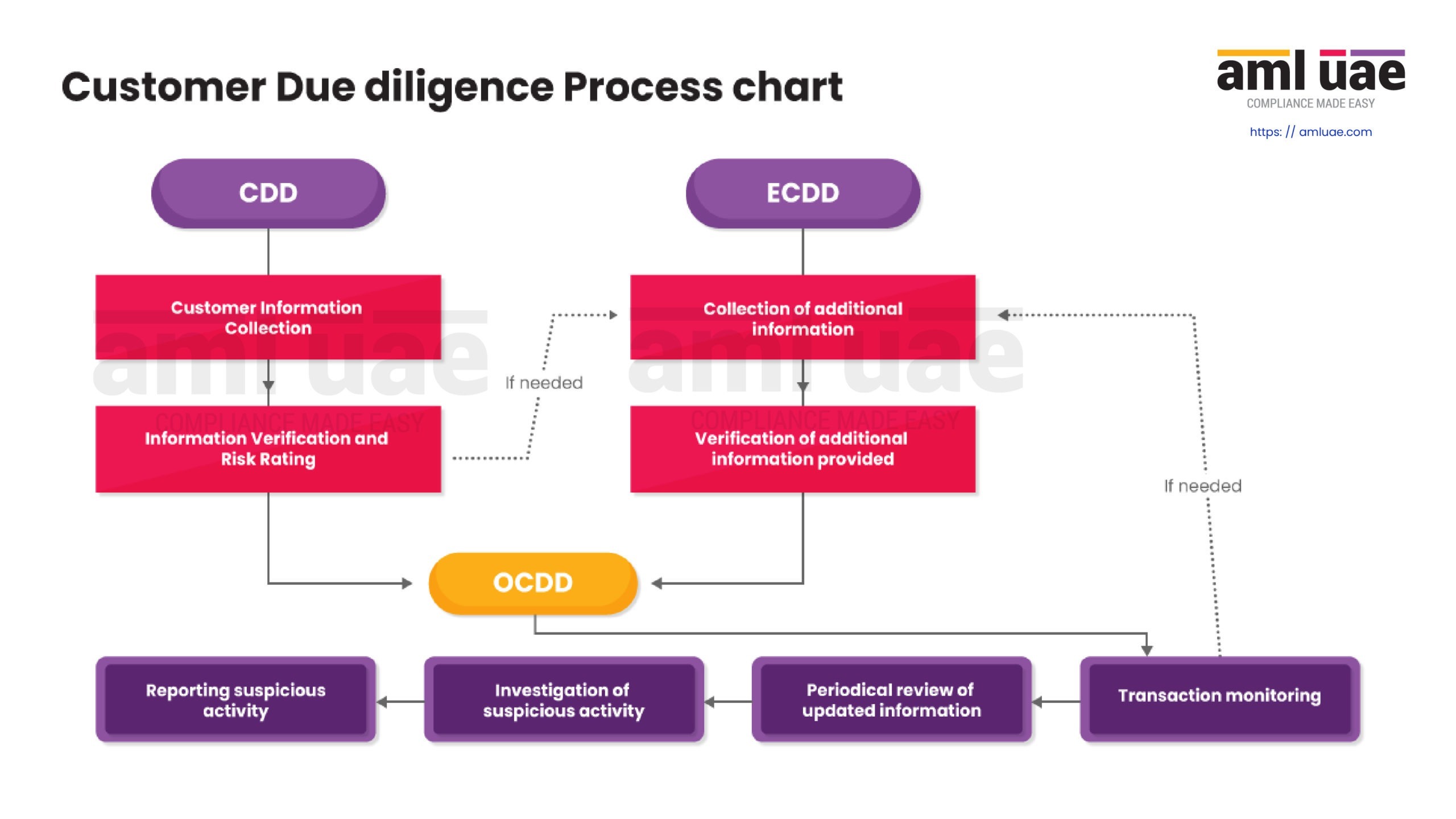

KYC and Customer Due Diligence are the most critical part of the entire AML compliance framework. Designated businesses are required to collect the necessary details about their customers and carry out the risk categorization basis the same. If the risk rating indicates involvement of HIGH risk, then Enhanced Customer Due Diligence is called for, wherein specific additional details are sought from the customer. Once a customer relationship is established, the customer profile and transactions must be monitored regularly to be alert around the updates in customers’ profiles and the possibility of money laundering activities. If any suspicion is observed, the customer and the transaction/activity should be immediately reported to the FIU.