Consequences for Non-compliance with UAE AML Regulations

Consequences for Non-compliance with UAE AML Regulations

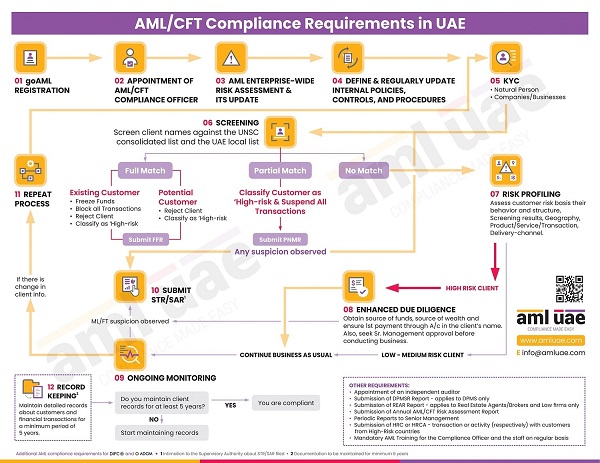

Non-compliance with the UAE AML regulations has severe consequences on the regulated entities subject to AML, i.e., Financial Institutions, Virtual Asset Service Providers (VASPs) and Designated Non-Financial Businesses and Professions (DNFBPs).

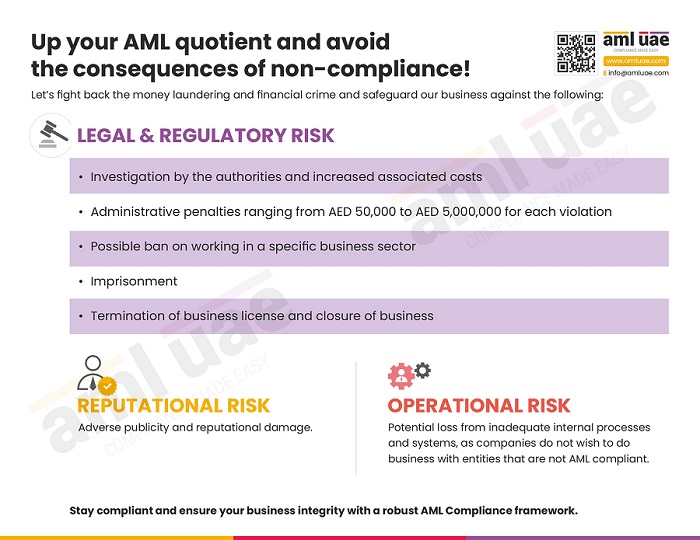

The penalties and consequences of violating the UAE AML regulations’ requirements vary depending on the nature of the violation, Supervisory Authority in charge, etc. However, these include administrative penalties of up to AED 5,000,000 and termination of business license. Further, it also causes reputational damage to the organization, including operational risks like losing clients and incurring commercial losses.

Here is an infographic highlighting the consequences of AML non-compliance in the UAE, motivating the regulated entities to stay 100% AML compliant.

AML UAE is an AML compliance service provider, offering end-to-end AML support to organizations, from drafting the AML/CFT framework and assisting in its effective implementation organizations, ensuring AML compliance, and safeguarding the business against it all non-compliance odds and reputational damage.