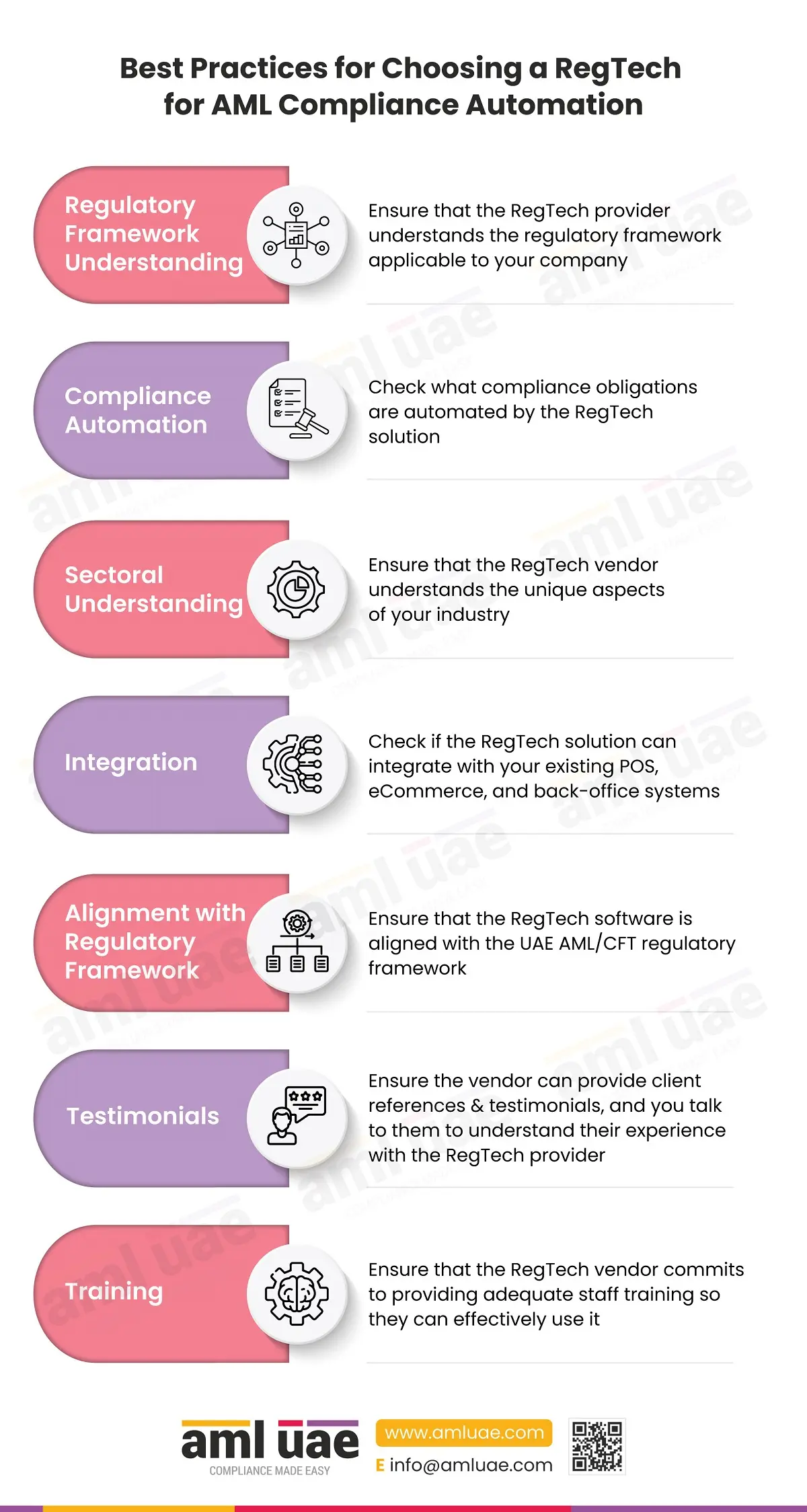

Best Practices for Choosing a RegTech for AML Compliance Automation

Financial Institutions (Fis), Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset Service Providers would benefit immensely from technology adoption. It will help them automate their AML compliance and save costs. This infographic provides valuable insights into choosing a RegTech for automating AML Compliance.

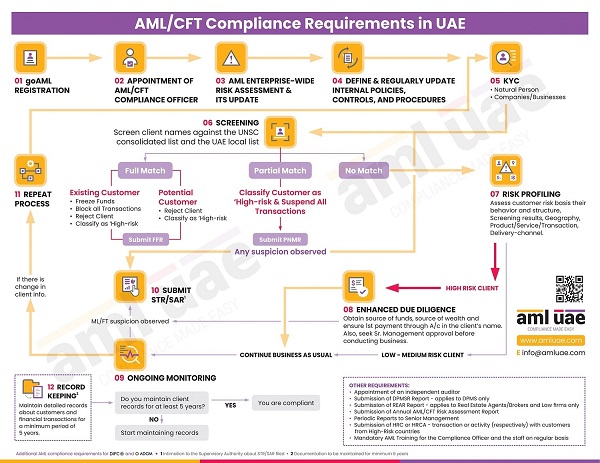

There are a variety of compliance processes that regulated entities in the UAE look to automate. These may include the following:

- Enterprise-Wide Risk Assessment

- AML/CFT Policies and Procedures Management

- Customer Identification and Verification

- KYC Record Management

- Sanctions Screening

- Customer Risk Assessment

- Transaction Monitoring

- goAML Reporting

- Case Management

- AML Record-Keeping

- AML/CFT Training

- AML/CFT Audit Automation

While choosing the best RegTech solution and the solution vendor, the reporting entities must be very careful so that their essential requirements are automated and the RegTech Software can be easily implemented in the company.

It requires a thorough check on the RegTech solution and the solution vendor to ensure that compliance automation is ensured and the key objectives are achieved.

Best Practices for Choosing a RegTech for AML Compliance Automation

Understanding of the regulatory framework

Ensure that the RegTech provider understands the regulatory framework applicable to your company.

Automation of compliance obligations

Check what compliance obligations are automated by the RegTech solution

Understanding of your sector

Ensure that the RegTech vendor understands the unique aspects of your industry.

Integration with existing systems

Check if the RegTech solution can integrate your existing POS and back-office systems.

Alignment with UAE AML/CFT Regulatory Framework

Ensure that the RegTech software is aligned with the UAE AML/CFT regulatory framework

Testimonials

Ensure the vendor can provide client references and testimonials, and you talk to them to understand their experience with the RegTech provider.

Training

Ensure that the RegTech vendor commits to providing adequate staff training so they can effectively use it.