Applying Enhanced Due Diligence measures under UAE AML Regulations

Applying Enhanced Due Diligence measures under UAE AML Regulations

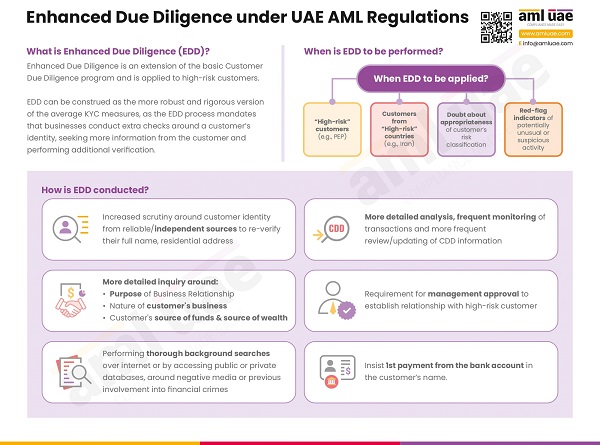

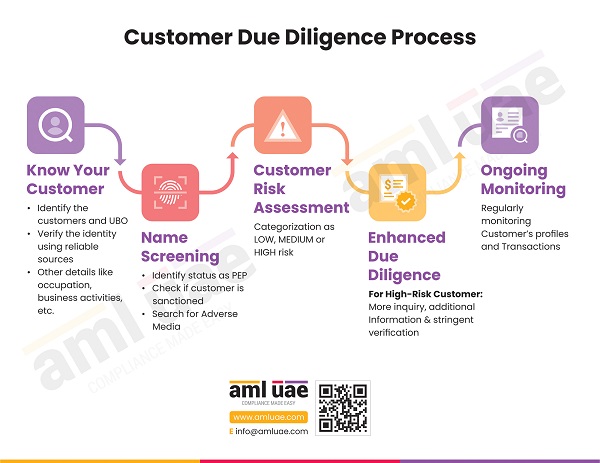

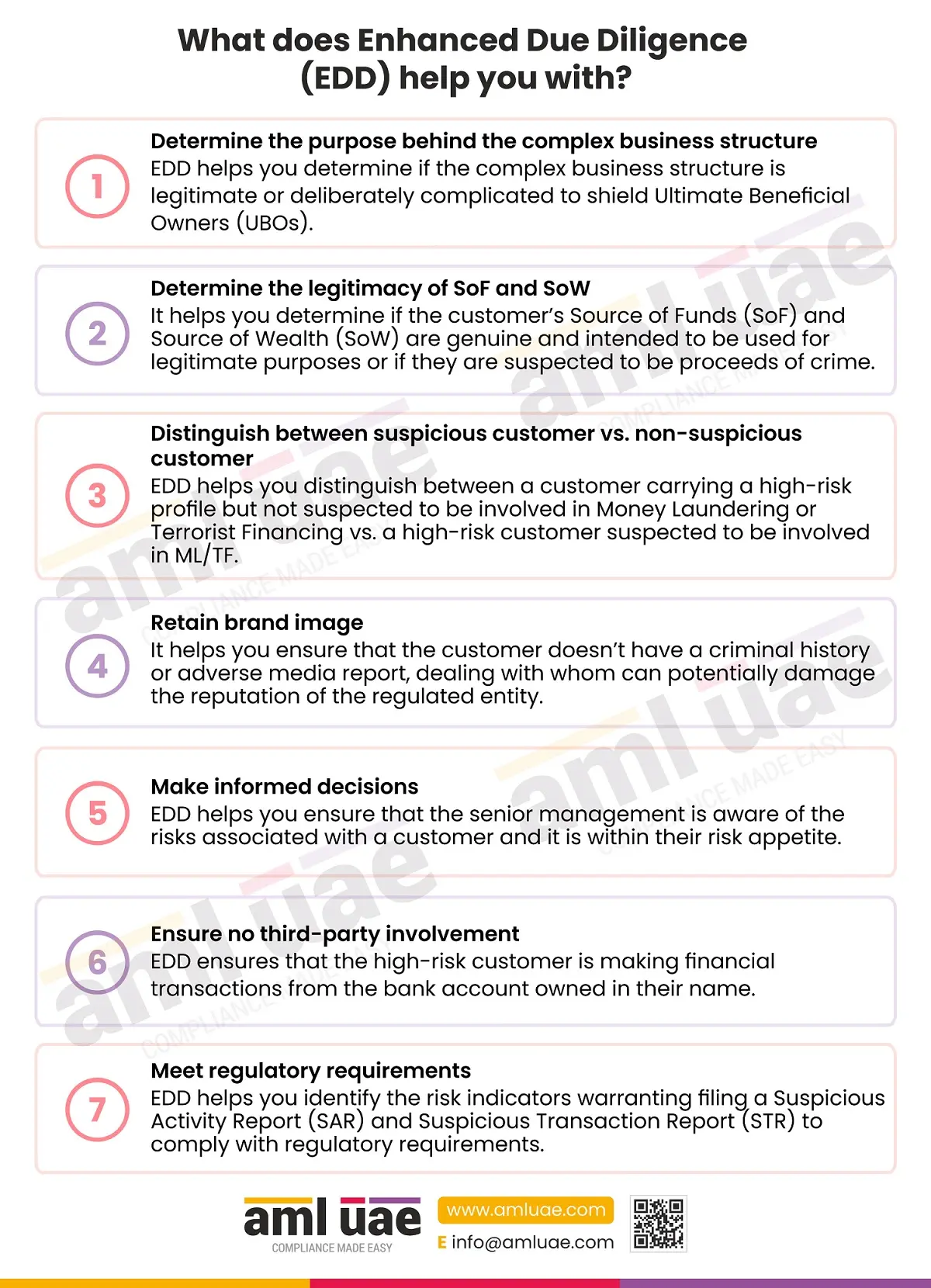

Enhanced Due Diligence (EDD) is a set of additional customer verification measures applied by the regulated entities (Financial institutions, DNFBPS and VASPs) while dealing with high-risk customers or transactions, posing increased money laundering or terrorist financing vulnerabilities.

EDD measures include seeking additional information about the customer’s identity, their controlling parties and beneficial owners, establishing the source of funds and source of wealth, more frequent monitoring of transactions, etc.

The infographic here presents a brief overview of circumstances warranting the performance of Enhanced Customer Due Diligence and measures to be applied as part of EDD to the enhanced ML/FT high risk, following UAE AML regulations.

AML UAE is a leading AML Compliance service provider, offering handholding support to Financial institutions, Designated Non-Financial Businesses and Professions and Virtual Asset Service Providers in their entire AML Compliance journey.