AML Controls and Proactive Risk Management

AML Controls and Proactive Risk Management

To effectively combat financial crimes like money laundering and terrorism financing, the regulated entities must implement necessary controls and risk mitigation measures. Of all the AML controls, some could be general in nature, while some could be specific to target a particular type of risk.

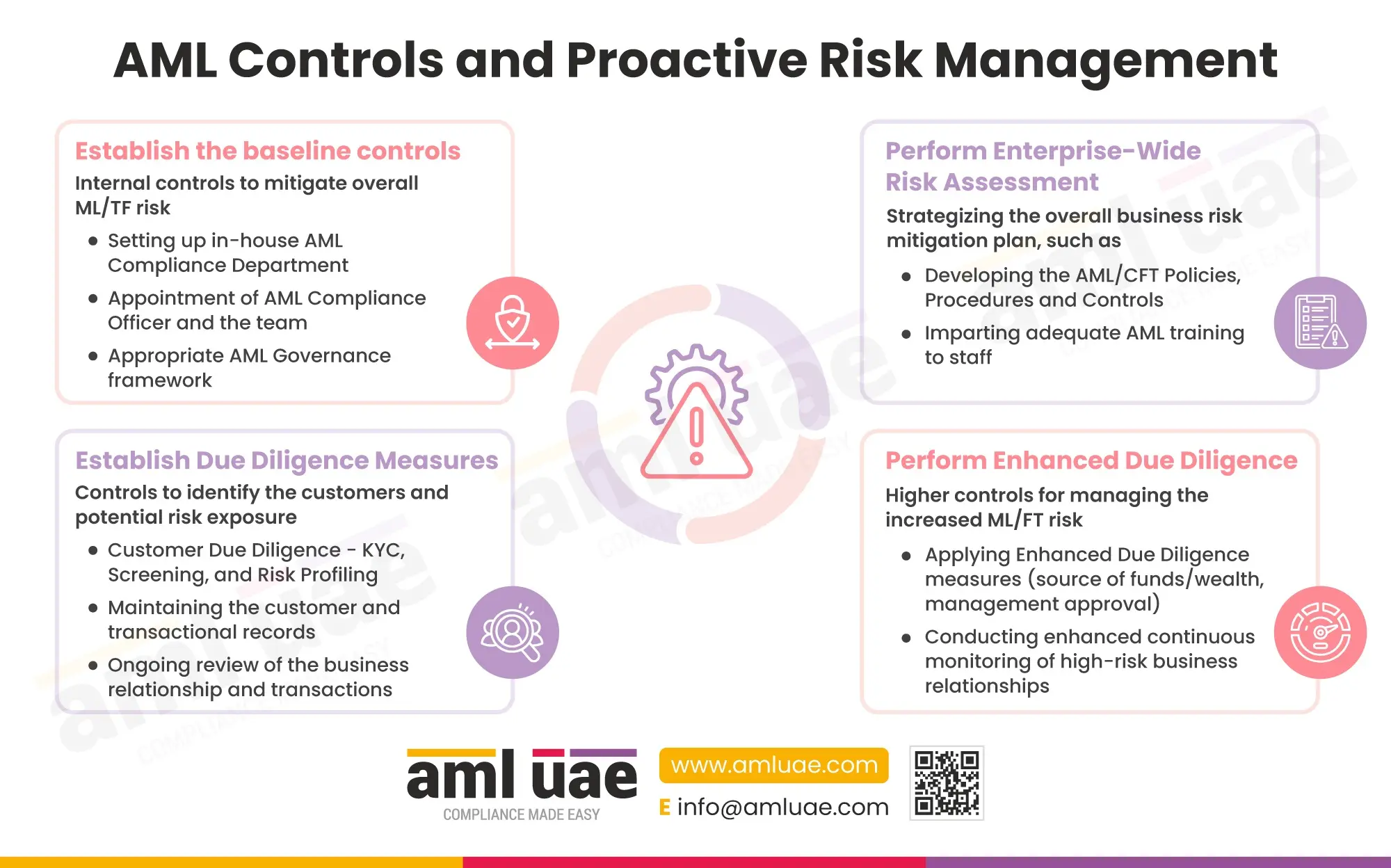

Here is the infographic discussing the controls a regulated entity must develop and deploy as part of a financial risk management framework.

- Establish baseline controls: Some controls are general in nature, yet important to implement to identify and manage the financial crime risk the business may face. These controls are important from adherence to the AML regulations perspective as well. This includes setting up an in-house AML compliance department and appointing a competent AML Compliance Officer to ensure an effective and comprehensive AML program. Developing an appropriate AML governance structure is also critical to baseline AML controls. All these controls work in tandem with the risk-specific controls, managing each task under the entire AML compliance framework.

- Performing Enterprise-Wide Risk Assessment: To overcome the risk the regulated entity may be exposed to owing to the nature of its business operations, geographies, and the customers it is associated with, etc. it is essential to conduct the Enterprise-Wide Risk Assessment. EWRA empowers the entity to develop the business’s risk profile and determine the controls and resources for managing these assessed ML/FT risks. EWRA helps the regulated entity adopt a Risk-Based Approach. Based on the outcome of the EWRA, the regulated entity must develop an internal set of AML/CFT policies, procedures, and controls, targeting the timely identification of the risk indicators and efficiently managing the risks. These internally developed business-specific procedures and controls must be discussed with the staff, and necessary AML training must be imparted. EWRA, documented AML policies, and AML training is robust controls at the entity’s disposal, focusing on restricting the ML/FT attempts.

- Establish Due Diligence Measures: It is the best process to identify the risks at the early stage and curb them before penetrating the business. For this, the regulated entity must establish and maintain robust Customer Due Diligence procedures that enable it to identify the customers and the risks they pose to the business before getting into a business relationship. As part of the AML Program, the entity must define the CDD process, including Know Your Customer (KYC), Screening, Customer Risk Profiling, etc. that shall be followed. Further, once the customer is onboard, the entity must monitor the customer’s profile and activities to ensure that the customer’s risk assessment is valid, and that the business relationship or transactions are not posing any newer risks to the business. This calls for maintaining accurate and complete data about the customer transaction and continuously monitoring the same to find any gaps or suspicions.

- Perform Enhanced Due Diligence: Higher risk posing business relationships warrant stringent controls. For managing the customer identified as “high-risk”, the regulated entity must implement Enhanced Due Diligence measures, focusing on making more rigorous verification of the customer’s identity and overall profile, including understanding the customer’s source of funds and wealth. Such customers must be put to an increased ongoing monitoring program to make sure that the risk does not beyond the one assessed, and if required, additional checks and measures can be immediately implemented.

Developing a wholesome AML risk management framework is crucial to protect the business against vulnerabilities and comply with regulations.

Worried about defining the right AML controls and risk mitigation measures for your business? AML UAE is here to help you out. With years of experience and understanding of the AML regulations, we assist the regulated entities in developing the customized AML controls and risk mitigation measures, thriving to protect the business from any potential ML/FT threats.