AML Compliance with robust Transaction Monitoring Rules

AML Compliance with robust Transaction Monitoring Rules

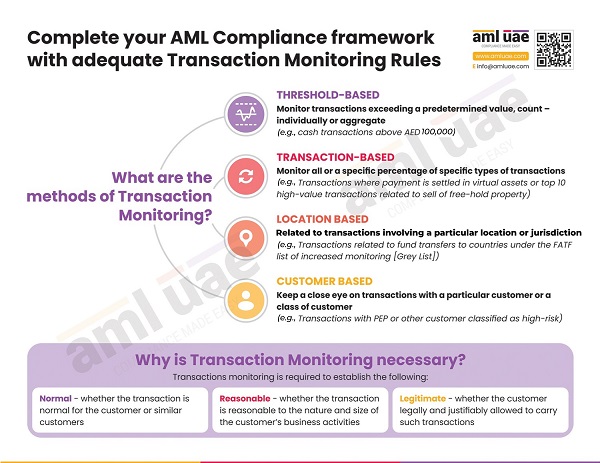

The Transaction Monitoring program is one of the critical aspects of a practical AML Compliance framework, focused on continuous review of the financial transactions and the customer’s profile to identify any suspicious or unusual activities or customer behaviour. To enhance the efficiency of the transaction monitoring program, it is essential that the regulated organization design and implement the relevant monitoring rules aligned with the organization’s overall ML/FT business risk.

Transaction monitoring is essential to ensure that the transactions the customers are executing are normal and reasonable to the customer’s profile and the nature of business activities they are involved in, including the legitimacy of the transactions.

Monitoring rules must be defined considering the regulated organization’s customer base, the jurisdictions in which it operates, and its customers are hailing from, the peculiarities of the transactions, etc.

Here is an infographic highlighting the significance of the transaction monitoring program and some primary methods for developing the monitoring rules.

AML UAE is an AML consultancy firm providing a comprehensive range of AML services to clients in the UAE – whether Financial Institutions, VASPs, or DNFBPs. We assist the regulated entities in developing robust AML/CFT policies, procedures, and controls, including identifying the right AML Transaction Monitoring system and customizing the monitoring rules and logics to detect suspicious transactions and customer behaviours.