AML Compliance Journey for VASPs in UAE

AML Compliance Journey for VASPs in UAE

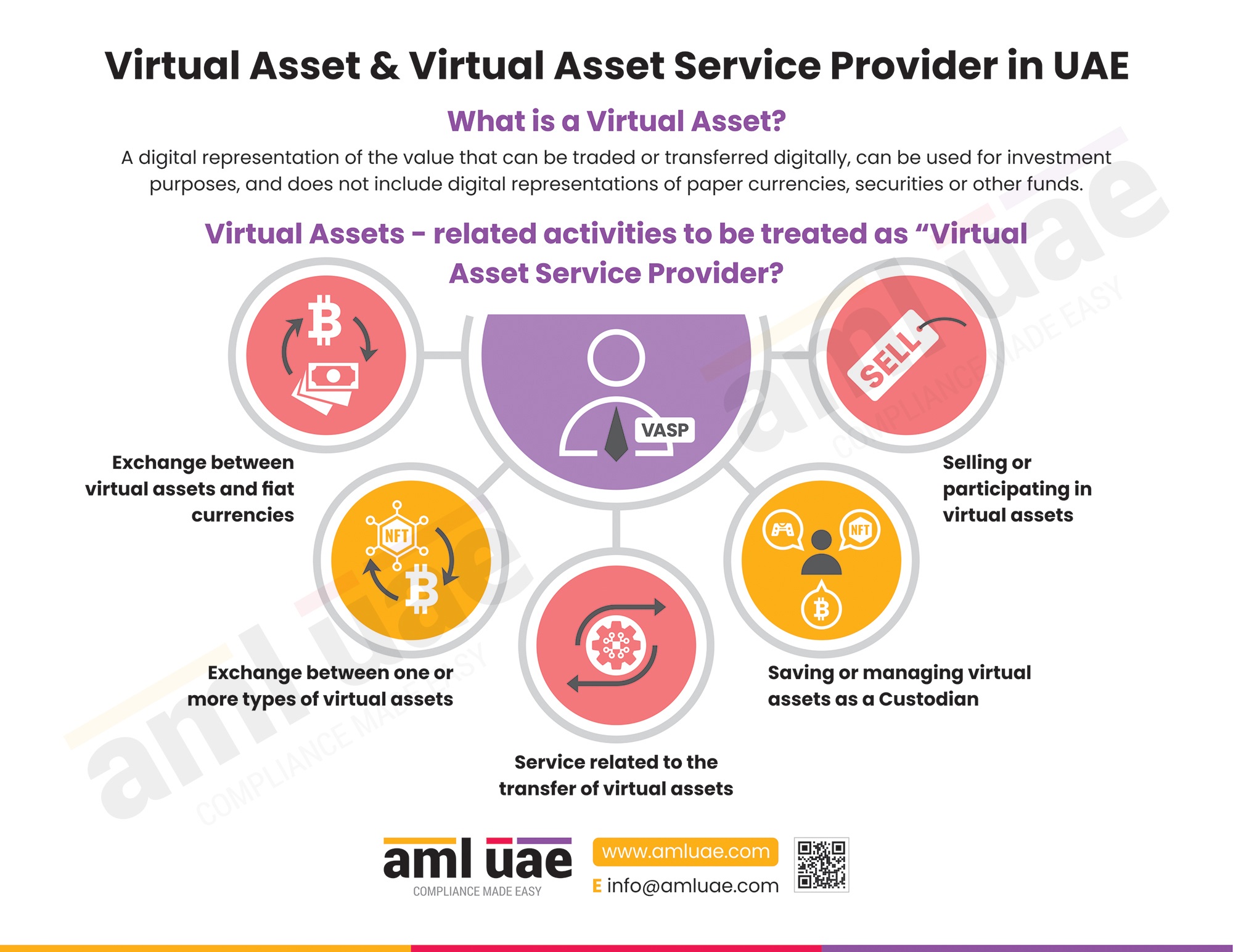

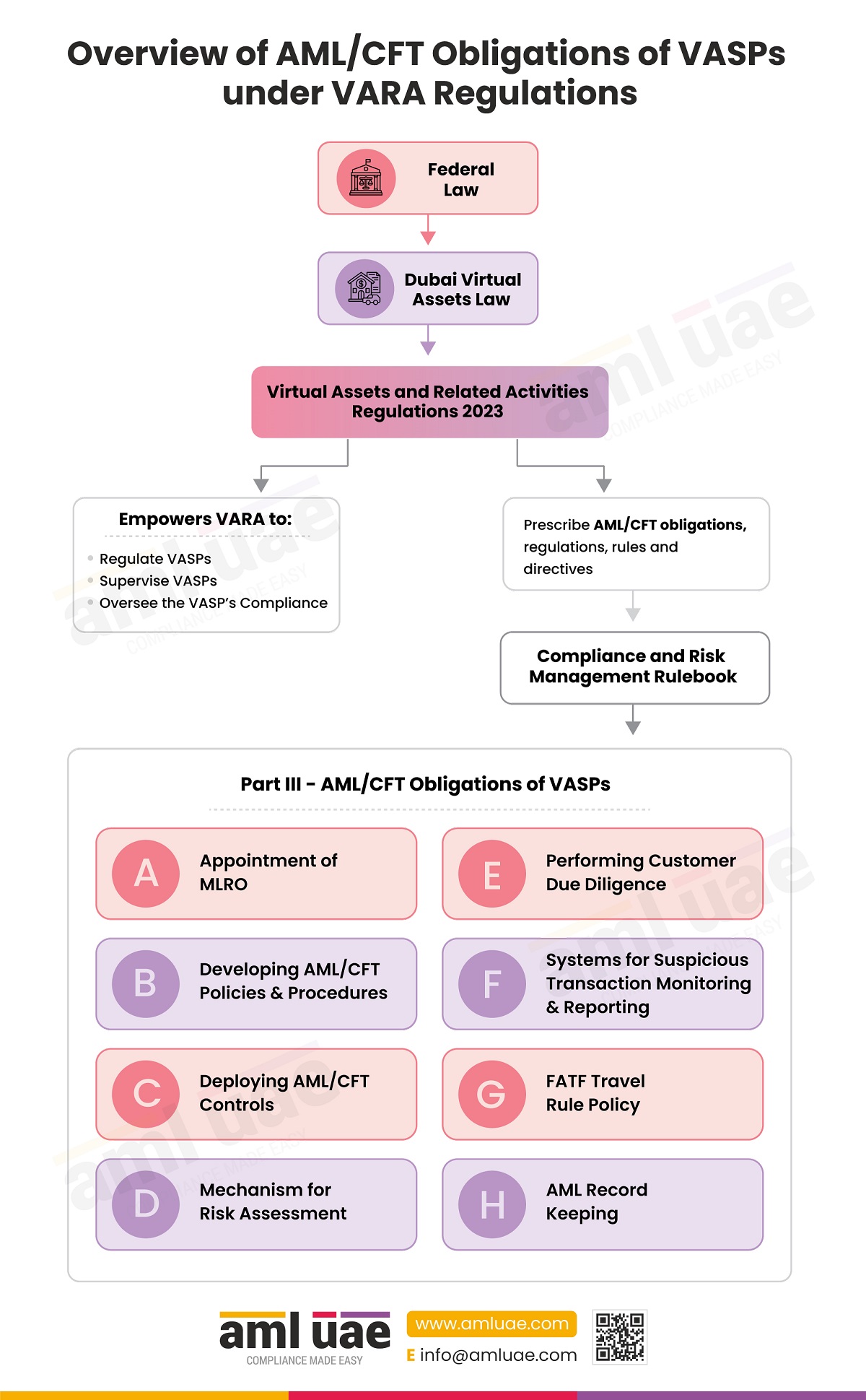

With the UAE’s focus on developing the country as a virtual asset hub, the Government has introduced various regulations to supervise the crypto segment. This includes anti-money laundering and combating of terrorism financing (AML/CFT) regulatory framework governing the Virtual Assets Services Providers (VASPs).

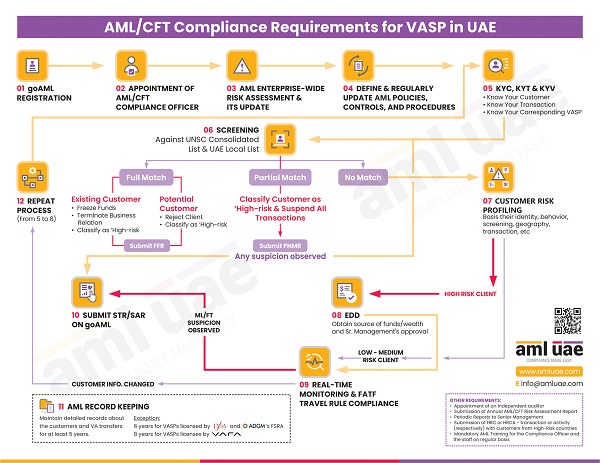

The AML/CFT regulations mandate the VASPs to implement robust internal policies and procedures to identify and report ML/FT suspicious activities involving virtual assets. The VASPs must ensure adequate customer due diligence processes, including KYC and Know Your Transactions measures. To detect the unusual pattern of virtual asset transfers, the VASP must implement a strong transaction monitoring system and controls. Further, VASP must comply with FATF Travel Rule requirements, ensuring a smooth and real-time exchange of information between the VASP about the originator and beneficiary of the virtual asset transaction.

Here is an insightful roadmap showcasing the AML compliance obligations of the Virtual Assets Service Provider in the UAE, starting from goAML registration to the STR/SAR reporting and AML documentation requirements.

AML UAE is one of the leading AML consultancy service providers in UAE, assisting clients across different business segments, including VASPs, to streamline their AML compliance framework. AML UAE helps the VASP design and implement a comprehensive set of AML policies, procedures and controls to timely identify the exploitation of the virtual assets for financial crime activities and immediately report to the FIU through goAML Portal. AML UAE also frames a robust AML training program for the VASP’s employees and imparts the comprehensive training necessary for AML compliance by VASP.