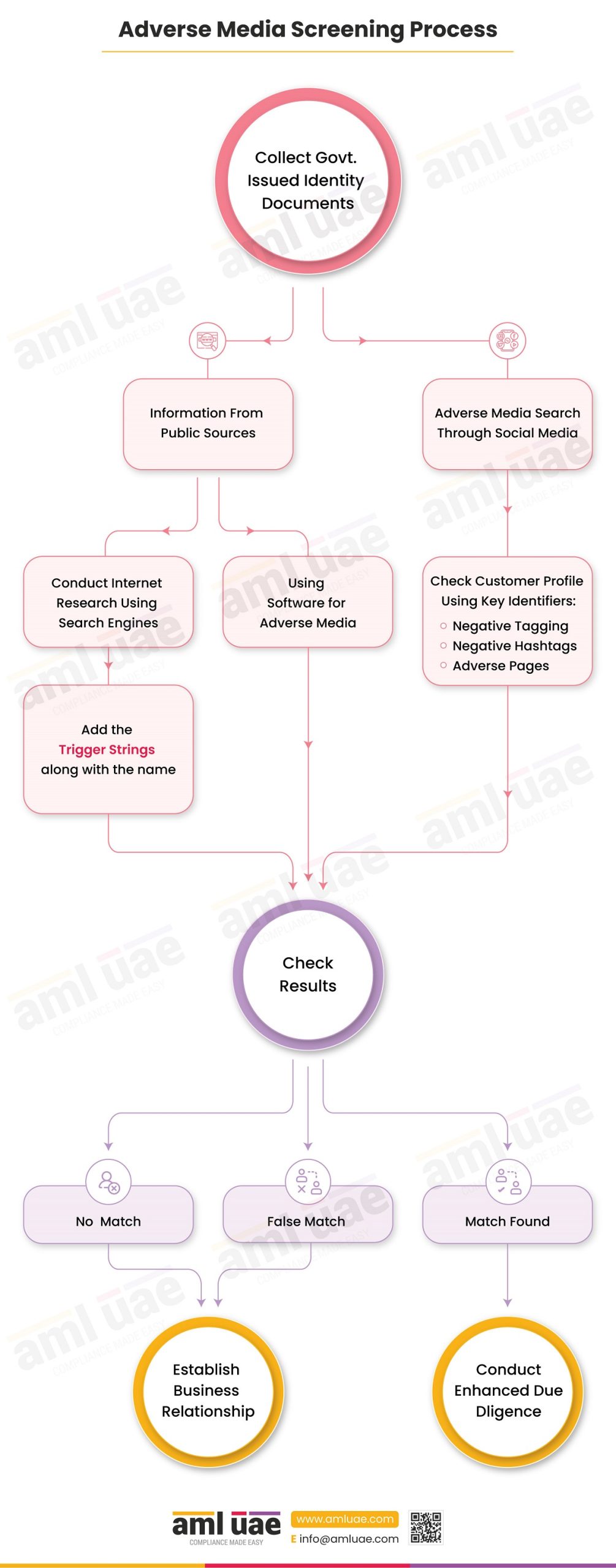

Adverse Media Screening Process

Adverse Media Screening is an important step in the customer due diligence process. It helps to provide additional information necessary to establish the prospect’s true identity and avoid onboarding the ones who are known to be involved in money laundering and other financial crimes.

Adverse media screening is all about researching; one needs to research whether there’s any negative news involving any fraud, scam or financial crime related to the prospect or existing customer. One can use information available from reliable and independent public sources for this purpose.

Conduct Negative News Research Using Search Engines

The first way to conduct the research is through multiple search engines, such as Google and Bing.

One needs to search for the name of the prospect or customer along with the word strings that contain all the relevant words necessary to confirm the existence of the negative media. Two such strings are:

- launder OR fraud OR bribe OR corrupt OR arrest OR blackmail OR breach OR convict OR court case OR embezzle OR extort OR felon OR fined OR guilty

- illegal OR imprisonment OR jail OR kickback OR litigate OR mafia OR murder OR prosecute OR terrorism OR theft OR unlawful OR verdict OR politic OR sanctions

For instance, if you want to conduct an adverse media check for a person named Mr. A, then you’ll do the following searches on the search engine:

- A launder OR fraud OR bribe OR corrupt OR arrest OR blackmail OR breach OR convict OR court case OR embezzle OR extort OR felon OR fined OR guilty

- A illegal OR imprisonment OR jail OR kickback OR litigate OR mafia OR murder OR prosecute OR terrorism OR theft OR unlawful OR verdict OR politic OR sanctions

By conducting these searches, employees gain results having any of these trigger words associated with a person having the same name.

Using Software for Adverse Media Research

You can also use software applications for conducting adverse media screening. While using software, you only need to put the name, and it will provide you with the adverse media details related to the person and associated sources. Then, one can check these details and conclude the customer’s identity and the involvement or connection with financial crimes.

Adverse Media Search Through Social Media

Another way is to conduct research through social media websites such as LinkedIn, Facebook, and Instagram. You can search the name of the person and verify the profile details based on the key identifiers of the customer and the social profile popped up. Then, check if the person is tagged in any negative posts. You can also check adverse hashtags and pages running against them, which gives rise to the suspicion that the person has committed fraud, scam, or a financial crime.

Actions on Adverse Media Check Outcomes

If you find a match while conducting adverse media screening, you must thoroughly evaluate the details and classify the customer as “high-risk,” considering all other risk assessment parameters and applying Enhanced Due Diligence measures.

In case of no match or false match, the business can onboard the customer and establish a business relationship. This onboarding decision does not solely depend on adverse media screening but takes into account the other identification details and the transactional parameters.