Adequate Customer Due Diligence when Dealing with Non-Profit Organizations

Adequate Customer Due Diligence when Dealing with Non-Profit Organizations

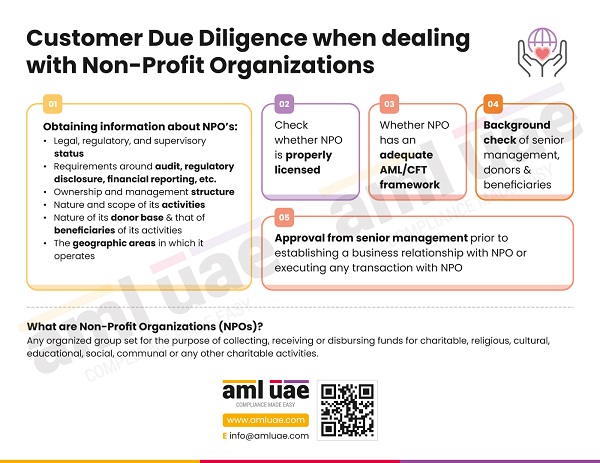

The Financial Action Task Force has observed that Non-Profit Organizations (NPO) are increasingly exploited by terrorist organizations for terrorism financing or propagating their agendas. Funds raised by NPOs for charitable purposes are redirected toward terrorist activities (diversion of funds). Considering the FATF recommendation in this context, even UAE AML regulations provide for adopting the Risk-Based Approach and applying adequate customer due diligence measures when dealing with NPOs.

UAE AML regulations mandate the reporting entities – Financial Institutions, Virtual Asset Service Providers (VASPs), and Designated Non-Financial Businesses and Professions (DNFBPs) to assess the ML/FT risks associated with the NPO and apply necessary due diligence measures to identify and mitigate these risks. The regulated entities must check whether the NPOs are adequately registered and licensed. Information about NPO’s jurisdiction and donor base must be obtained.

Apply adequate due diligence measures when dealing with NPOs to prevent the risk related to the diversion of NPO funds toward terrorist organizations.

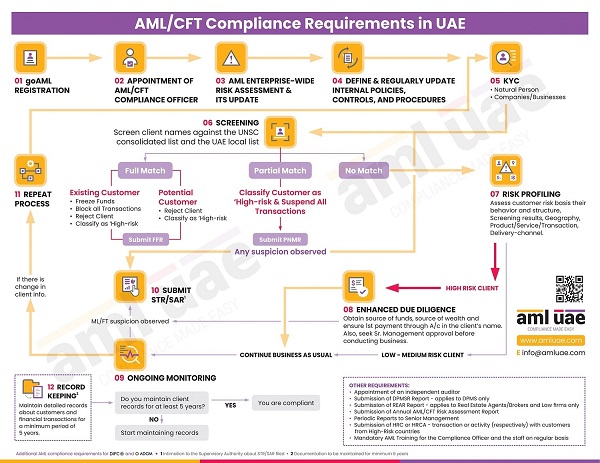

AML UAE is a leading AML consulting firm providing end-to-end AML support to regulated entities. We support clients in designing robust AML/CFT policies and procedures to mitigate business risks, including developing an adequate process to identify and manage the risk arising from business relationships with NPO.