Micro money laundering: The New Kid on the Block

Micro-money laundering has made it even more challenging to identify the fraudulent transactions carried out in small amounts several times.

Governments worldwide have implemented stricter rules and regulations for AML compliance. There’s also increased awareness on the part of the financial institutions as they are being urged by compliance authorities to follow the AML rules and regulations.

The government is monitoring the traditional financial transactions. But the criminals are now adopting new ways to launder money. With the advent of technology and a massive increase in online transactions, it has become difficult to trace the source of the funds obtained from criminal proceeds.

What is Micro Money Laundering?

Micro money laundering involves frequently laundering money in small amounts using digital channels. The small amounts are transferred to prevent detection, and transactions are made to appear regular. The illicit money is not transferred via big or small projects, but they are spread in smaller digital transactions done every day. It makes it difficult for governments to trace every small transaction and identify the risk of money laundering.

Digital channels are evolving and available in abundance. Multiple payment channels are available today, making it easy for companies to do business and making it effortless for consumers to make payments and buy goods and services online. But criminals have found this evolving digital space attractive, and they are devising new ways to launder money, and the new kid on the block is micro money laundering.

The digital landscape is continuously evolving, and criminals keep pace with the new technology to devise new ways to launder money. Micro money laundering is on the rise as the criminals take advantage of the loopholes in the AML compliance framework and target online users who are entirely unaware of the fraudulent activities that the criminals resort to launder their money.

They unknowingly fall prey to the criminals who target them to launder money online.

But the fact is that the regulators and authorities are now coming to terms with how criminals are adopting new ways to launder money and indulge in terrorist financing. They need to identify the emerging risks and thwart the challenges arising out of online transactions, which remain mostly anonymous.

The criminals have been using traditional mechanisms for money laundering, such as regulated financial systems, offshore accounts, and shell companies. But now, they have diverted their attention towards online transactions, with transfers in small amounts done multiple times to evade government scrutiny.

Criminals always take advantage of the anonymous nature of the internet and commit fraud. They carry out massive volumes of micro-transactions every day. Each small transaction goes unnoticed, but the overall amount is a cause of worry as criminals become successful in gradually laundering vast amounts of money in multiple transactions.

How is micro-money laundering done?

The new digital frauds have become a favourite of the criminals who are continuously devising new ways to launder their ill-gotten money. Today it is common to buy and sell in-game currencies, and criminals think of it as an opportunity to launder money.

An instance of micro money laundering came to light when the criminals targeted Fortnite- a highly popular game. They used the game for money laundering with stolen credit cards to buy and sell the in-game currency.

They created Fortnite accounts using stolen credit cards, bought the currency, and made it available to other players to sell them at a lower price within the game. To evade the regulators’ attention, they sold them on C2C sites, eBay, or transacted on the dark web.

Another example is of using online job portals such as Fiverr. The criminals create an account on such websites to make fake job requests. They search for services that are offered at a particular fee. They log on to the same site with a different user account and a different IP address to reply to the same job offer.

The amount is paid to an escrow account of the website, and then the first account creator authorises the second account holder (which is the same person) to perform the task advertised. After the work is completed (as shown by the job seeker), the first account authorises the platform to release the payment, and the second account receives the payments. The sender and the receiver are the same, and this modus operandi is rampantly used by criminals in online job markets.

Reason

One reason criminals are flourishing in micro money laundering is lack of awareness as it is a new method that criminals have adopted. AML training should include creating awareness about it and preventative measures. Businesses and enforcement agencies should work together to identify such emerging threats and combat them successfully.

One of the primary reasons is that AML compliance is put on the backburner as companies have other core activities to ensure business continuity. The online marketplace is continuously evolving, and companies are scrambling to get new products to augment business growth. But all in this hustle, they forget the security of their businesses. Equally enthusiastic technology-savvy criminals jeopardise it. The only difference is that they abuse technology for their unlawful gains.

The Way Forward

Technology can come to the rescue of the authorities, regulators, and business organisations that should use it to combat money laundering and terrorist financing. The AML software can automatically identify unusual transactions, irregular patterns, or unusual consumer behaviour, letting the business know that it needs attention and investigation. Manually it is impossible to track the billions of microtransactions, and the criminals get a free run. However, technology should be used daily and right from the beginning – while verifying customers during the onboarding process. It can go a long way in preventing money laundering.

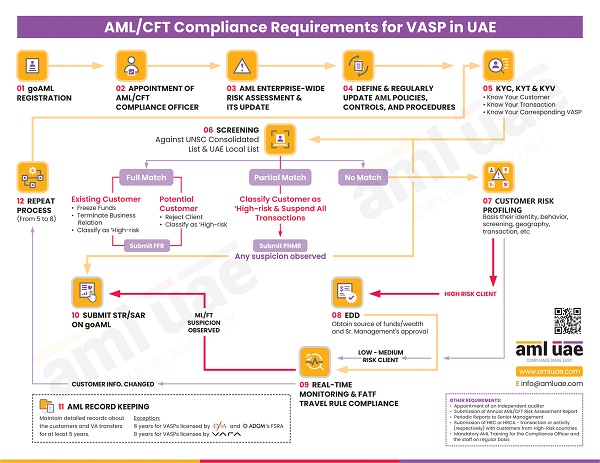

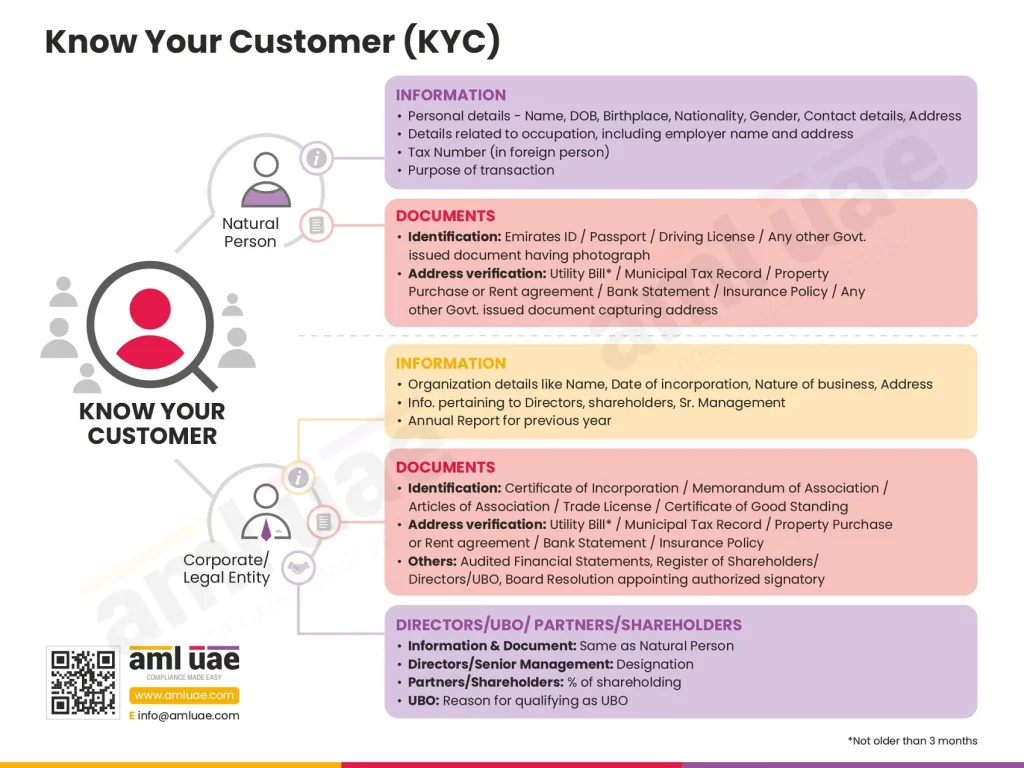

The KYC process- Know your Customers, CDD-Customer Due Diligence, EDD-Enhanced Due Diligence, and all other procedures part of the AML compliance program should be diligently followed using technology. It will drastically reduce the number of money laundering cases. Training is also necessary to identify unusual transactions and take the appropriate actions to prevent them.

A collaborative approach is required to prevent criminals from resorting to money laundering. Joint efforts by the government, regulators, compliance authorities, financial institutions, and other regulated entities can help identify criminals and prevent money laundering.

It would be best to rely on AML consultants to improve the AML compliance program and identify money laundering risks. Some measures include choosing the right AML software, AML Training, and setting up an in-house AML compliance department. Businesses can also outsource other AML compliance activities to stay AML compliant and be ahead of the curve.

Directors and/or senior management demonstrate overall responsibility and awareness of AML/CFT matters within the entity. The companies must also mention whether the Board and/or senior management receive regular AML/CFT reports from the Compliance Officer.

Check out our guide on establishing an effective AML/CFT Framework in your business.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.