Managing the AML Inspections under UAE AML Laws

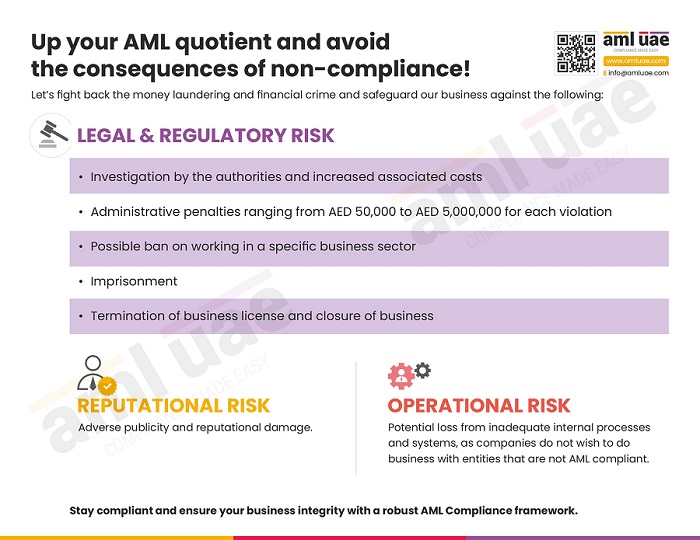

The authorities are making various efforts to combat financial crimes – money laundering and terrorism financing and safeguard the stability and integrity of the national and international economy. To create awareness and enforce strict implementation of the AML measures by the regulated entities, the AML supervisory authorities in UAE (e.g., Ministry of Economy, Ministry of Justice, ADGM’s Financial Service Regulatory Authority, etc.) have started inspecting the quality and level of entities’ AML efforts and regulatory compliance status.

This article will discuss the significance of AML inspection and how to effectively respond to the AML inspection notices issued under the UAE AML regulations.

All About AML Inspections

As mentioned above, AML inspection is one of the AML measures adopted by the regulatory authorities to assess the regulated entities’ compliance with the regulations. Not limited to this, the inspection is a powerful tool that assists the authorities in detecting any AML deficiencies in the government’s legislative framework to take immediate remediation measures and to identify any emerging ML/FT vulnerabilities rising in the country.

AML inspection demonstrates the government’s commitment to combating financial crimes. The same attitude towards AML compliance is expected from the regulated entities, and thus, these inspections serve as a signal to the entities that authorities are proactively keeping a watch on the business and their AML efforts.

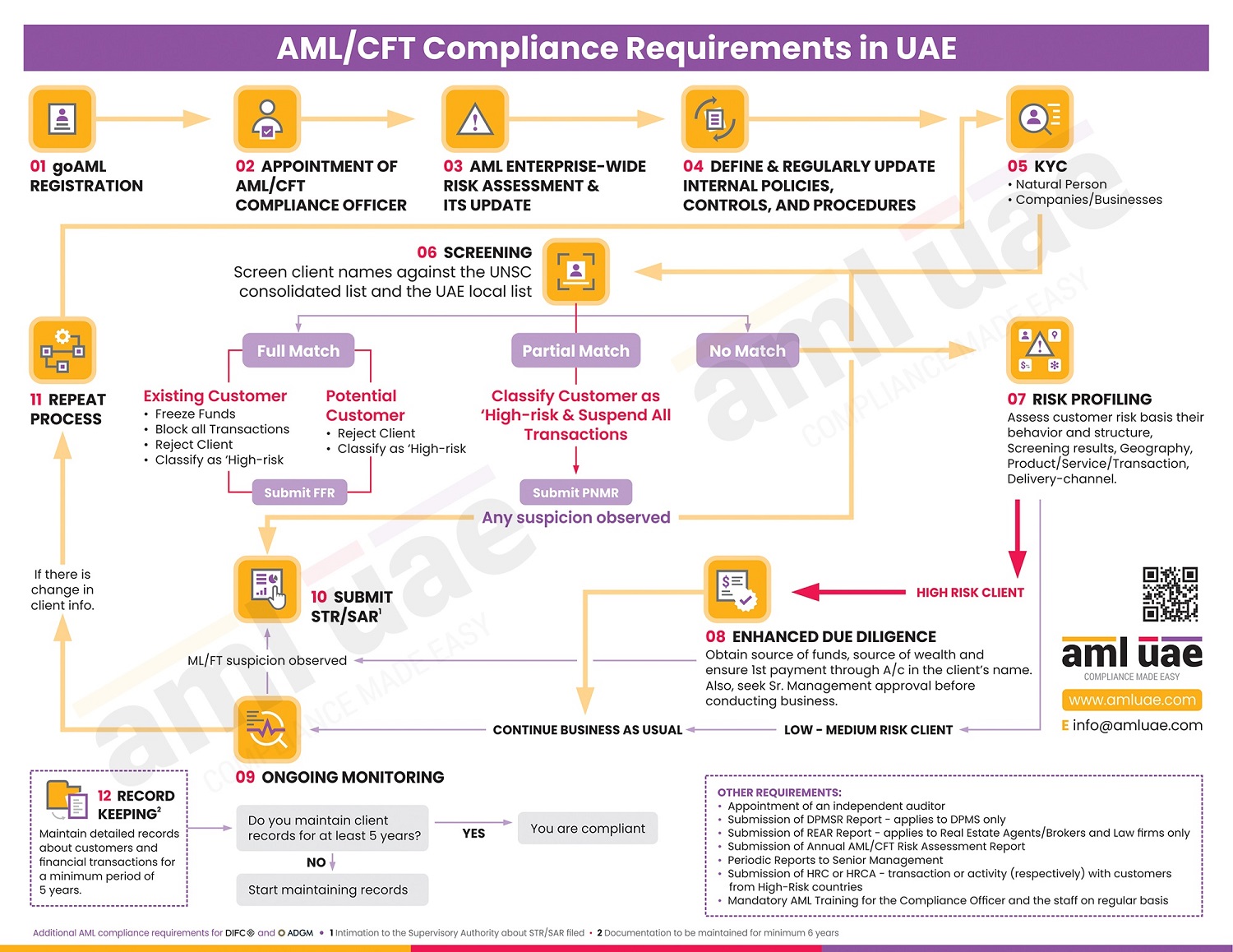

As part of the AML inspection, the UAE authorities focus on the review of the following:

- entity’s assessment of the exposure to the ML/FT risks

- completeness and effectiveness of the AML policies, procedures, controls, and systems implemented, including Customer Due Diligence measures

- AML awareness amongst the team

- Senior management’s support to AML structure

AML Inspections help regulatory authorities check the AML health of the businesses, guide them in improving the AML measures to protect the business and ensure the financial integrity of the entity as well as the country’s financial system.

Being AML Inspection Ready

The AML compliance is not a bridge-gap arrangement, where the Compliance Officer put stretched efforts to develop the AML program and create the documents and information on a post-facto basis, merely to manage the AML inspection.

Instead, the regulated entity must always be inspection-ready. This is possible when there is a well-crafted AML framework for the business, which is seamlessly followed every day by every employee during regular business operations to ensure that the business is protected against potential money laundering and terrorism financing threats and is adhering to the required legal obligations.

The regulated entities must consider the following points to stay compliant and without worrying about the AML inspection:

Maintaining the AML/CFT policies, procedures and controls

The entities must develop customized AML/CFT policies and controls to manage the assessed business exposure to financial crime. This framework must be aligned with the applicable laws and regulations.

This AML program must be periodically reviewed to check its effectiveness in identifying and mitigating the risks. This shall assist the entity in identifying the policies or procedures that need immediate attention.

Periodic review of the AML compliance

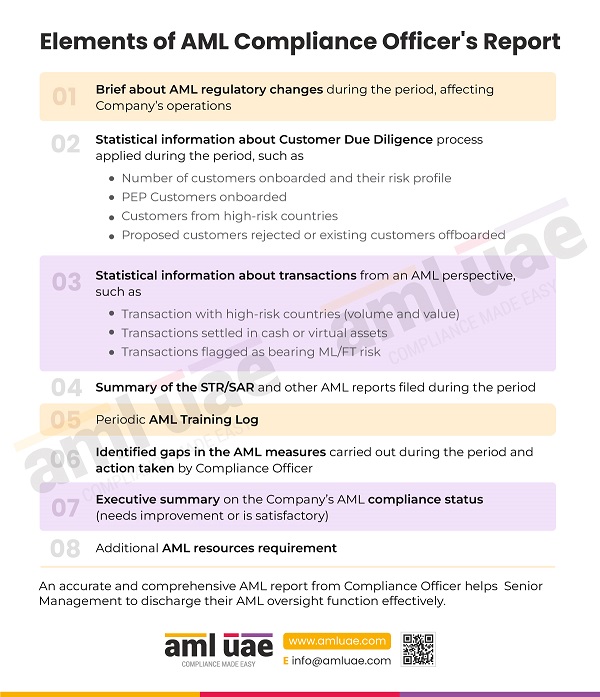

The AML Compliance Officer regularly checks the comprehensiveness and quality of the entity’s AML measures and controls deployed. This review should examine the Customer Due Diligence process, ongoing monitoring program, identifying and reporting suspicious transactions, etc.

This review shall allow the AML Compliance Officer to detect any compliance instances or AML loopholes, offering required guidance in enhancing the necessary measures, implementing new controls, or modifying/upgrading the systems.

Adequate AML Record Keeping

The time and resources put into AML compliance can be substantiated only when these documents are presented to the authorities in a legitimate and easy-to-understand way. Only when the information and records are maintained in an organized manner can the same be made available to the inspecting authorities as and when requested.

Immediate submission of the requested documents demonstrates the entity’s ongoing AML activities and dedication to combating financial crime.

Support from employees and senior management

The contribution and support from the employees and the senior management is a must for the successful implementation of the AML Program. The employees, including management, must be trained on the AML policies of the business and made aware of their duties and AML responsibilities. This will ensure that the AML measures are diligently adopted in day-to-day business operations, help the Compliance Officer to strengthen the AML regime and be inspection ready.

Responding to an AML Inspection Notice

It has been observed that the UAE AML supervisory authorities issue an inspection notice over a registered email, generally addressed to the AML Compliance Officer of the regulated entity.

The notice captures the critical information about the inspection officer, the expected inspection date, the records and documents to be submitted for the authority’s desk review, the documents and information that must be made readily available when the inspecting officer visits the premise, etc. The team must respect and adhere to the timelines and data requests mentioned in the inspection notice.

The quality of the inspection notice and the level of clear and transparent communication with the authorities indicates the entity’s commitment to AML compliance.

The following steps must be followed to respond to the AML inspection notice effectively:

1. Nominating the team to handle the inspection

The regulated entity must identify the responsible person who shall manage this inspection – ideally an AML Compliance Officer and, if needed, any team member having adequate AML knowledge to assist the Compliance Officer. The senior management must be intimated about the proposed AML inspection.

If required, assistance from third-party AML professionals and consultants must be sought to avoid misinterpretation of the notice and respond to the notice to the authorities’ satisfaction.

2. Understanding the scope and requested information

The AML Compliance Officer must peruse the inspection notice thoroughly and map the same with the entity’s records. The inspection scope shall assist the Compliance Officer in understanding the areas authorities propose to review and the information to be furnished.

3. Collating the information and drafting the response

The AML Compliance Officer must begin collecting and organizing the requested information in one place. The documents and information must be arranged systemically, which assists the authorities’ review process.

The response to the questions in the inspection notice must be adequately captured, with explicit reference to any attachments.

Here are some of the best practices that must be followed to ensure a smooth AML inspection journey:

- The documents to be made available to the authorities must be restricted to the ones requested. Dumping unnecessary files or information may confuse the authorities, creating hardships in concluding the inspection effectively.

- There shall be cross-referenced with the serial numbers mentioned in the data request in the notice and the files submitted for review.

- The naming of the files, folders and other records must be done appropriately, which enables the authorities to identify the required data set.

- Unnecessary delays in submitting the reply or waiting for the deadline must be avoided. Once the requested details are all arranged, they must be promptly shared with the inspecting officers.

4. On-premise inspection

The authorities may choose to physically visit the regulated entity’s office and have first-hand experience with AML measures implemented by the entity. If requested, the Compliance Officer must demonstrate the systems and controls implemented in such cases.

The entity must also ensure that its employees are available and prepared to answer the AML questions posed by the inspecting officers during the interview.

Post-Inspection To-Do

Once the AML inspection is concluded, the authorities identify and document the findings and corresponding recommendations in a report submitted to the regulated entity. The regulated entities must comply with this inspection report to foster the AML program, maintain the reputation and authorities’ trust and avoid regulatory penalties.

The AML Compliance Officer must review the inspection report prepared by the inspecting authorities, understand the authorities’ observations and implement the remedial measures, considering the recommendations, if any, suggested by the officers. This can be related to updating the policy or deploying new AML tools and systems. The AML Compliance Officer must assess the need for AML training in specific areas and design a robust training program.

The senior management must also be involved in this finding resolution exercise. The management must set a deadline by which the gaps must be addressed. A periodic follow-up must be made with the AML Compliance Officer, and a progress report must be sought. If necessary, AML experts must be appointed to enhance the AML program and help implement the authorities’ feedback.

The regulated entity must not leave any stone unturned in ensuring that its AML compliance is absolutely in sync with the law, its business risk and there is no further AML non-compliance.

How can AML UAE be your legal guide to smoothly respond to the AML inspection notices?

With our years of experience and subject knowledge, we at AML UAE can offer valuable end-to-end support around AML regulatory compliance, starting from assessing the business, designing and hand-holding the implementation of the AML framework, periodically reviewing the status of the AML program implementation, imparting AML training to the team.

We help you identify gaps immediately, rectify compliance flaws, and assist in managing the required AML records in an organised manner. With this, we ensure that you stay 100% compliant, smoothly handling the AML inspection notices, building authorities’ trust and confidence in your AML efforts.

Let’s make our AML compliance ever-ready for inspection!

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 6 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.