KYC Transformation

The significance of customer due diligence measures has increased more than ever because of the government’s strict stance and the emphasis on adherence to the AML laws. The regulation has become broad to combat money laundering and counter-terrorist financing. Business organizations may find it hard to keep pace with the evolving AML laws and regulations, control related costs, and offers a seamless onboarding experience to ensure high customer satisfaction.

Entities must follow the AML regulations to avoid penalties and fines and protect their organization from being exploited by criminals for illicit gains. The criminals are adopting new ways to launder money and are using technology rampantly to make their illegal proceeds appear legal and later use the same to fund criminal and terrorist activities.

As the money laundering typologies are changing, there is a need to upgrade the KYC process to deal with the new challenges posed by criminals smartly. Let’s discuss how the KYC process – the essential requirement of the AML laws – can be improved and how this can help combat the rising money laundering cases.

We live in a constantly evolving digital space where digitization has seeped into business operations so deep that we cannot imagine the business landscape without it. But there is still some reluctance on the part of the companies that rely mainly on human resources to solve business problems. AML compliance will not succeed if it solely depends on human resources and manual efforts. Therefore, it needs technology as its foundation to construct the robust AML/CFT framework.

Employees can leverage the technology to help the business comply with the evolving AML rules and regulations. The best way to keep pace with the AML rules and protect the organization from being vulnerable to criminals is to rely on appropriate AML software. AML consultants can help you with the proper AML software selection.

AML Software

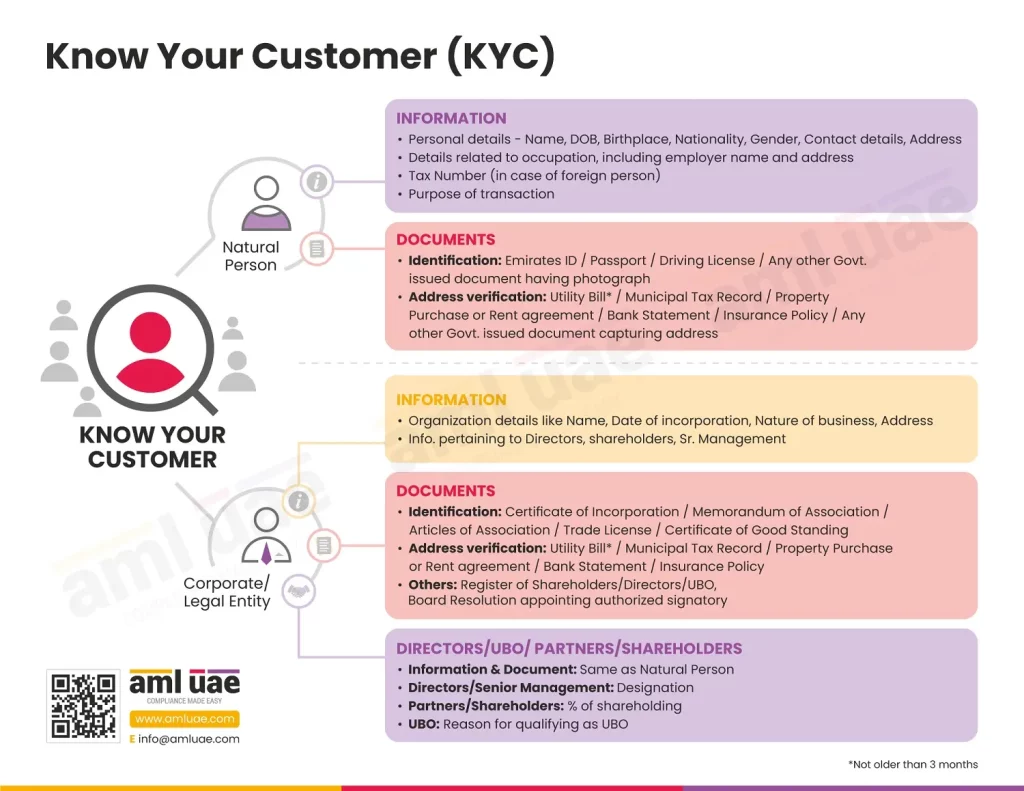

A beneficial owner can be described as a person who is the owner of a business or a person who controls it. Knowing the legal entity and the person who manages the company is likely to get the maximum benefit from the transaction with the business organization. It will help correctly assess the customer-specific risk of associating with the business and the management of the same. Knowing the UBO will allow the company to effectively carry out the KYC process and comply with the AML laws by knowing the person’s identity who is to be benefitted the most from the business relationship.

As per the FATF, the ultimate beneficial owner is the person who ultimately owns or controls the business or a person on whose behalf transactions are carried out. The FATF also says that the UBO includes people with ultimate effective control over a legal person or arrangement.

As per the regulations, the ultimate beneficial owner UAE is defined as a

- natural person, who directly or indirectly owns or controls a company,

- Individuals who own at least 25 % share or voting rights in a company,

- Individuals with the power to dismiss and appoint a majority of a company’s directors.

KYC Automation Advantages

With automation, there are several benefits that businesses can get, and they can achieve complete AML compliance. Technology will improve the KYC process drastically and help the company comply with the AML rules at every stage of the customer relationship journey.

Better CX:

Businesses streamline the customer onboarding process, and with continuous monitoring, they can keep a tab on the customer profile and track any changes in it.

With AML compliance at the software’s core, businesses can ensure that they make the customer onboarding process much faster and cost-efficient without bothering the customers. They can drastically reduce the onboarding durations and get complete insights into the customer profile in a short period.

Quick customer onboarding with minimal correspondence creates a good impression in customers’ heads. Moreover, the compliance team can efficiently handle high-risk customer profiles and avoid errors with the help of AML technology.

Efficient Risk Management:

A business must thoroughly evaluate the customer profile before commencing business relationships. They also have to continuously monitor the customer profiles throughout the business relationship to monitor the customer behavior and track any changes.

The AML software will help businesses in accurate and efficient risk management. Technology-based KYC processes reduce human intervention and the errors from it. With correct risk management with the help of tools, businesses can achieve full AML compliance and protect their organization from being sabotaged by criminals. With access to a broad set of customer data points, companies can track customers’ changing profiles more efficiently and identify money laundering instances in real time.

Improved Efficiency:

Automation saves a lot of time and resources for a business. Often AML compliance is considered a financially draining process, and companies find it overwhelming too because of the several complexities and changing AML guidelines.

AML regulations are updated based on the current economic and worldwide political scenarios. Therefore, businesses must update their AML compliance process and keep pace with the amendments. By relying on AML technology, companies can instantly improve their efficiency in AML compliance and make their process more accurate and result-oriented, aligned with ever-evolving laws.

Boost Productivity:

Manually managing the AML compliance process is a time-consuming process. Businesses must allocate human resources dedicated to collecting, organizing, storing, and retrieving customer data. Verifying the customer’s identity will not help the AML compliance process if done manually.

Technology will automate all the functions and bring more efficiency into compliance. The technology empowers a business to manage the compliance steps seamlessly with more accuracy and comparatively less time. It speeds up the customer onboarding process, helps in accurate risk management of individuals and entities, and monitors the changing customer behavior throughout the customer journey. Further, the time saved by switching to technology can be diverted to more critical business operations.

Cost-efficiency:

One of the most significant advantages of AML compliance technology is that it offers substantial financial improvement. Businesses can drastically cut compliance costs and provide a smooth onboarding process.

Let AML UAE; the AML compliance experts help you build a strong business case for AML and KYC compliance transformation.

- KYC is a crucial part of an organization’s structure. If you need to carry out the KYC transformation successfully, you must consider several factors. You should outline the objectives and the requirements for your KYC improvement process. The goals should define what you should achieve and the effect you want to have on the current KYC process. It is crucial to have clear expectations from the KYC transformation process and set a budget for it.

- Other factors that businesses should consider are resource allocation, such as the number of resources required to manage the KYC transformation process.

- You must also decide on the technology you will use for KYC improvement. Several AML software available in the market can help you make the KYC compliance process robust and help identify any fake or forged identity documents at the very onboarding stage.

- The business also needs to keep track of the progress made in the KYC improvements with well-defined KYC processes. With specific timelines and goals, the management of the KYC transformation journey becomes easy and smooth.

Conclusion: KYC Automation is the key

If you need more information about automation in the AML compliance process, you can contact AML UAE. We are one of the leading AML compliance services providers in UAE. We have helped many businesses adopt technology and streamline their AML compliance process. With automation, they have cut compliance costs and achieved full AML compliance with substantial improvement in their KYC process and overall AML framework.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.