What is Know Your Business (KYB)?

Know Your Business or KYB is the process of identifying the authenticity of a business with which the company deals. It might be suppliers, third-party consultants, intermediaries, or B2B clients or customers. KYC process would be relevant for any business organization directly dealing with the company.

Know Your Business is an essential step toward protecting an organization from financial crimes. Similar to the Know Your Customer (KYC) process, KYB is a practice followed by the companies to know with whom they are doing business. For every organization, it is very critical to be aware of their business partners. Their identities need to be verified and validated. The foundation of a business relationship with another business should be based on a proper KYB procedure.

It serves two purposes – it enables a business to know that the business it deals with is real and a lawful entity. It is not a shell company that is commonly used as a technique to launder money. Secondly, it lets the business know whether the persons controlling and running the business are involved in any criminal activities.

Therefore, KYB is a common practice in the B2B sector. Many companies rely on it to know if they are dealing with legitimate companies and lawful entities with a genuine legal structure.

Why is KYB needed?

Increased instances of money laundering have urged companies to adopt a strict approach towards safeguarding their company from being exposed to financial crimes, with procedures and methods to know the customers and business partners. Since the money laundering typologies are evolving and moving towards the use of network structure, the focus now should be on knowing the legal persons with whom the company is transacting by the “Know your Business” process.

Identifying the legal structure and its ownership is a top concern when dealing with other businesses, which is an essential process. By following the best KYB practices, the companies can identify the structure and people operational for conducting financial crime well in time and thus, reduce the possibility of financial crimes. Adequate and effective KYB procedures would keep the customers’ and stakeholders’ interest in the business intact and save from reputational and monetary damages.

Are KYC and KYB the same?

KYC and KYB are both verification processes targeted at different customer categories.

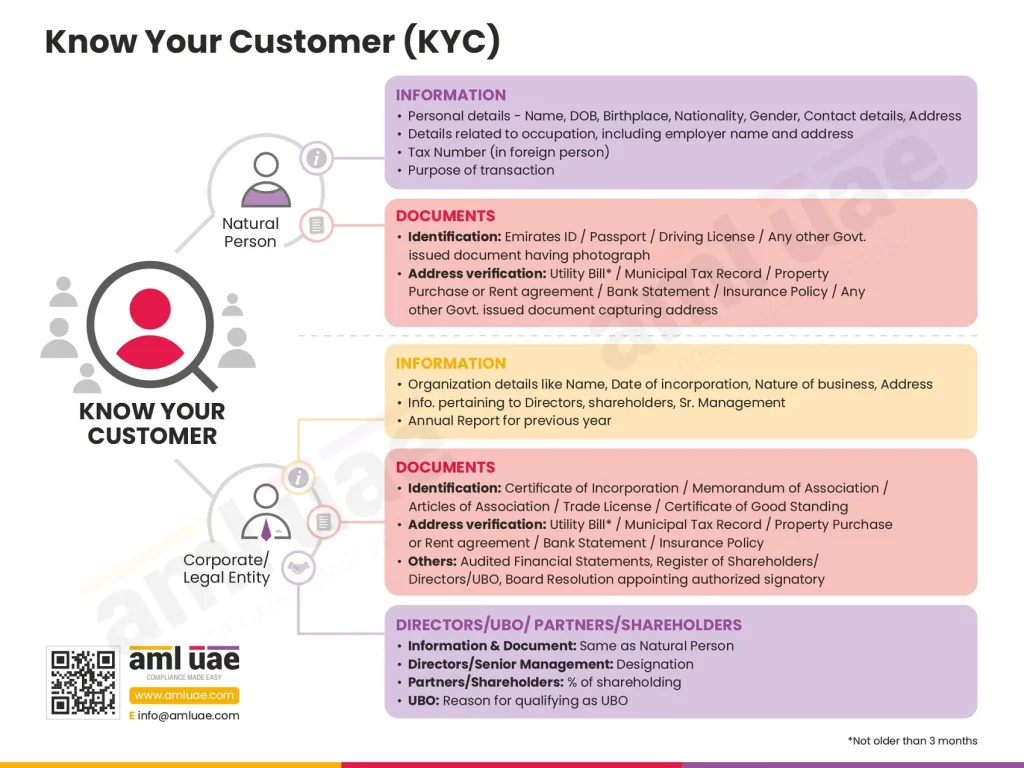

The subject of the verification differs in both cases – KYC is for verifying the identities of an individual customer or business partner (natural person). At the same time, KYB aims to assess businesses (legal persons) and those controlling, owning, and running these businesses.

However, both the processes have a common aim: to identify and verify the identity of the person with whom the company is transacting to deter criminals from misusing a business’s financial structure for money laundering and other financial crimes. Both methods help comply with the AML rules and regulations and safeguard an institution from reputational damage caused by being vulnerable to financial crimes.

The increasing importance of KYB

KYB is a new entrant into the framework of risk mitigation and prevention of financial crimes. KYC has been in place for a long time to help organizations protect themselves from financial crimes but was focused more on the customer segment. Now, realizing the growing importance of dealing with all the business associates and the spread of money laundering networks, one glaring gap has attracted everyone’s attention – verifying a business’ identity. Now with KYB, business relationships are monitored with the same effectiveness as the assessment of individuals as per the KYC process.

The US Financial Crimes Enforcement Network (FinCEN) introduced the KYB regulations to implement a standard procedure for verification of the legitimacy of a business. KYB is vital because criminals may use different ways and create various sources to launder money, such as shell companies, which exist only on paper and are used to transfer illicit money.

Moreover, criminals also use legitimate businesses to launder money and fund terrorism and other criminal activities. Considering this aspect, US FinCEN introduced the KYB regulations. When carrying out the Due Diligence process, KYB has also become a standardized procedure that businesses employ to verify the identity of the organization they work with.

Who should conduct KYB?

KYB is fast gaining acceptance, and businesses realize its importance. Companies should conduct KYB to identify and prevent financial crimes timely. They can comply with the regulations and protect their business from criminals who often target legitimate businesses for money laundering. It should be a common practice for banks, financial institutions, and companies to conduct KYB procedures.

Wholesalers, manufacturers, and suppliers who deal with other companies must know their counterpart’s identities.

KYB will let a business know that their associates are legitimate, and they will not have to face legal repercussions while doing business with them.

Steps to Conduct KYB

Verification of Business

KYB helps determine that the business is not a shell company and exists in reality. It also verifies that the activities and operations the business is conducting are lawful and the business per se is legitimate. It assures a business that the organization is genuine and is not involved in any unlawful activity.

Different documents should be sought and reviewed to establish the authenticity of a business, such as:

- Registration documents and certificate of incorporation

- Ownership structure

- Constitution of the management or board of directors

- Financial statement, if possible

Verification of business owners

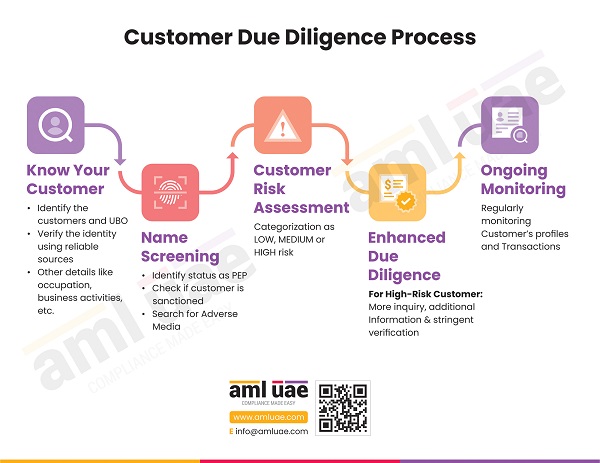

After knowing that the business activities and operations are legitimate, the next step is to verify the authenticity of the business owners and the controlling parties. The verification will reveal if the owners and stakeholders are law-abiding citizens with no criminal records.

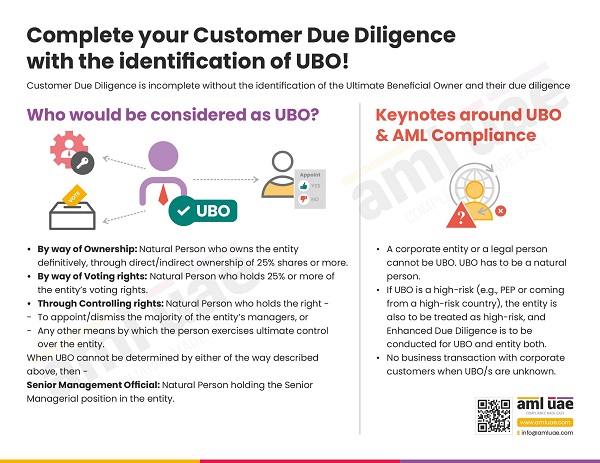

An essential aspect of the verification of business owners is also termed Ultimate Beneficial Owners (UBO) verification. The process consists of identifying UBOs and evaluating if they are genuine natural persons, not merely names existing on paper. Moreover, businesses should verify whether any of the UBOs are on sanction lists.

With such a thorough verification process, a company can make informed decisions about maintaining or continuing a business relationship with the entity.

Simplifying Know Your Business

KYB is an essential process that businesses should follow to know the authenticity of their associated companies. It may be suppliers, manufacturers, wholesalers, logistics partners, or intermediaries. The KYB process is laden with several challenges, which businesses can simplify with the help of experts. The significant challenges in the KYB process are:

- Collation of different documents and information from various sources

- Verifying the information collected from varied sources and screening them against different databases to establish the authenticity

- Compilation of the KYB procedure – its proper documentation

Given the critical factors involved, it is recommended to rely on technology to implement the KYB procedure correctly to avoid the risk of non-compliance. Technology and advanced software would ensure accurate results and streamline the process to yield faster and more comprehensive outcomes. Automated verifications with the help of software are an ideal solution for any business that wants to diligently comply with the KYB regulations. Outsourcing may also help conduct the manual verification process seamlessly, without the need to invest in technology and own workforce.

Implement Know Your Business (KYB) processes with professional support

AML UAE is a team of expert advisors offering AML Compliance services on a wide range of services such as KYC & KYB, AML Policy, procedures and controls documentation, AML training, etc.

We help businesses in the B2B segment to understand the authenticity of the organizations they are doing business with. KYB will help companies to comply with the verification rules and regulations, safeguard the interest of their customers and stakeholders, and protect their reputation from being tarnished by criminals for their illicit gains.

By outsourcing the AML compliance services and KYB procedures, you can benefit from the expertise of compliance experts who will seamlessly handle KYC and KYB procedures.

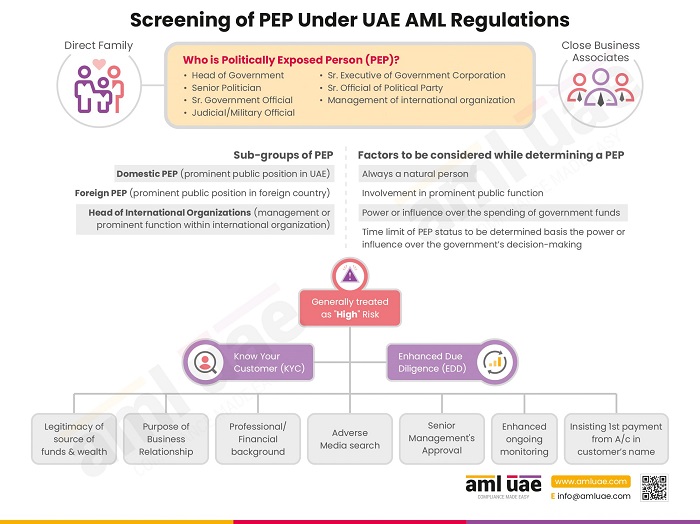

Our experts use technology to deliver accurate results. Get a complete check on your customers and companies you are doing business with – be it KYC, KYB, business or customer Due Diligence, Enhanced Due Diligence, identification of PEP or UBO, and sanction screening results.

Get peace of mind with our professional identity verification, authentication, and validation approach. It will allow you to concentrate on business growth rather than getting caught up in the KYC and KYB regulations. Get in touch with our expert team and how they can help you with the KYC and KYB processes.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.