How To Find The Best Anti-Money Laundering Software?

Anti-Money Laundering software is a technological solution that facilitates organizations to meet their AML obligations. In recent years, technological advancements have enabled business enterprises to utilize the power of anti-money laundering software instead of manual methods in the process of anti-money laundering compliance. Companies want to use the best Anti-Money Laundering Software to automate their AML Compliance.

As a result, anti-money laundering solutions have multiple advantages as compared to the manual way of operations. Hence, in the current modern times, with an ever-evolving state of technology, AML software is gradually starting to come into the limelight.

What Is The Need for An Anti-money Laundering Software?

The financial service industry and Designated Non-Financial Businesses

and Professions (DNFBPs) have evolved exponentially in the last few decades and are expected to grow in the coming years as well

substantially. Because of this, the AML software industry has also evolved

along with the same. However, the success of any financial service industry depends upon the level of customer satisfaction.

Hence, financial institutions (FIs) primarily focus on developing and offering

solutions that will amplify the overall customer experience and satisfaction.

In addition, financial institutions have to provide for these services by clearly meeting their anti-money laundering obligations. Therefore, financial institutions can offer solutions and services under anti-money laundering obligations with the respective AML solutions that they use.

Several financial crimes such as money laundering or terrorist financing continue to pose significant risks across the globe. Accordingly, the audits and regulations of anti-money laundering regulators have increased substantially in recent years.

Business enterprises that fail to meet their anti-money laundering obligations have to bear hefty amounts as penalties or fines. This is the primary reason why anti-money laundering compliance has become vital

for all types of business enterprises, especially financial institutions.

Anti-money laundering software solutions play a huge role in ensuring the AML compliance of the companies.

Checklist for AML Software

While buying AML software, you must check on the availability of the following functionalities and supporting features:

Functionalities:

- Individual Name Search

- Bulk Name Search

- Individual ID Search

- Bulk ID Search

- Search scheduler

- Categorization/scoring of screened person basis the database searched and results found

- Maintains historical records and audit trail

- Allows capturing of comments – Individually as well as in multiple search items

- Easy downloading of search results with captured comments

- Real-time update of the database

- Email notification for changes in historical search results, basis the update in the database

- Intelligent algorithm to minimize the False Positive outcome

- Customer-wise case management

Database

- Local/National Terrorist or Sanctions or Alert List

- International Sanctions

- Global Watchlists

- Global PEP database

- Negative media information

- Global shelf company database

- Law and Regulatory Enforcement

Other Support

- Easy set-up or onboarding

- Mandatory training on software

- Online support for ongoing query resolution related to software

Compliance. Trust. Transparancy

Customized and cost-effective AML compliance services to support your business always

Benefits of an Anti-Money Laundering Software

Initially, the business enterprises used to leverage the power of manual controls for anti-money laundering compliance. However, with the constantly evolving state of technology, manual controlling methods have

become obsolete and an insecure method of AML controlling.

Manual processes have always been unreliable, and the companies adopting these methods were wasting a lot of money and time. With the development of Anti-money Laundering (AML) software solutions, you can now perform all the manual processes in a more accessible and quicker manner. In addition to that, the entire process is now a lot safer and more secure. The best AML Software will not only make you more efficient but will also help you take timely decisions.

Data Is Quite Crucial For AML Solutions

One of the obligations of all the DNFBPs and Dealers in Precious Metals and Stones (DPMS) when it comes to the customer onboarding process is implementing the risk assessment. Anti-money laundering name screening

software aids the business houses in implementing risk assessments for their customers.

AML name screening software screens the name of their potential clients in sanction lists, PEP (politically exposed persons), and adverse media

screening to check whether it is safe to onboard a particular client or not.

The level of risks is being determined at this stage.

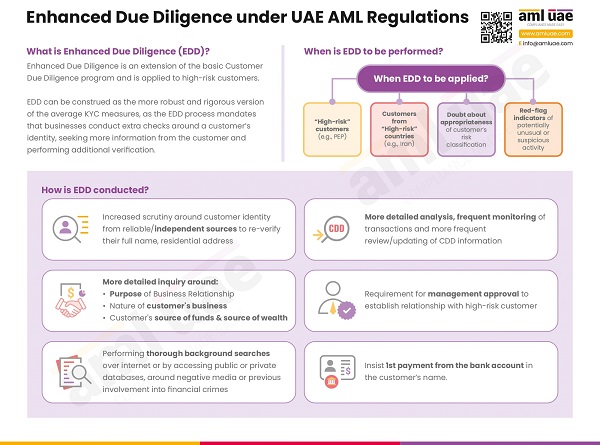

If required, enhanced due diligence (EDD) can be conducted along with the

filing of an STR in case if you detect any type of suspicious activities or

transactions. The primary function of such software is to provide the companies to scan their potential clients in sanctions, PEPs, and adverse media data that is published by several countries on a regular basis.

Data plays a crucial role in PEPs, sanctions, and adverse media screening solutions. Hence many anti-money laundering software vendors who offer real-time and globally comprehensive data should be preferred.

Furthermore, it is extremely important to have access to real-time data because the sanction lists, PEPs, and adverse media screening are highly dynamic and volatile and simply keep changing with every single second

passing by.

Hence, business enterprises need to control their clients in real-time data to achieve the sole purpose of the control process. In addition to that, with the development of several financial technologies, most financial institutions (FIs) started to provide international services. Hence, these business enterprises must apply spherical risk assessment is comprehensive and complex global data in order to protect themselves from potential risks.

Database coverage

Though the Federal law provides for screening through the UNSC Consolidated List and the UAE Local Terrorist List, it is ideal to have a comprehensive database covering the following, as such additional sanctions lists come handy when you are dealing with people from different countries and the respective countries’ list needs to be screened:

- Argentina RePET

- Australia DFAT

- Azerbaijan FMS

- Bahrain Terrorist List

- Bangladesh CBB

- Belgium FPSF

- Canada Autonomous Sanctions

- Canada Public Safety

- Canada RCMP Crypto Freezes

- Canada United Nations Act

- China MFA

- EU Sanctions

- France Tresor Registre de Gels

- India MHA

- Indonesia DTTOT

- Iran MFA

- Japan MOF

- Kazakhstan KFM

- Kyrgyzstan FIU

- Latvia FIS

- Malaysia MHA

- Nepal MHA

- Netherlands Terrorist Sanctions

- New Zealand Designated Terrorist Entities

- Pakistan Proscribed

- PMA Freezing List

- Qatar NCTC

- Russia Rosfinmonitoring List of Terrorists and Extremists (Current)

- Russia Rosfinmonitoring List of Terrorists and Extremists (Included)

- Saudi Arabia PSS

- Singapore MAS

- South Africa FIC

- Switzerland SECO

- Tajikistan FMD

- Thailand AMLO

- UAE National List of Terrorist Individuals and Entities

- UK HMT OFSI Sanctions

- Ukraine SFMS

- United Nations Sanctions

- US OFAC Non-SDN

- US OFAC SDN

- US OFAC SSI

- US State Department Cuba Restricted List

- US State Department Non-proliferation Sanctions (ISN)

- US State Department Terrorist Exclusion

- Vietnam MPS

- EU Europol Most Wanted

- Interpol Red Notices

- Turkey MOI Wanted Terrorists

- US DEA Most Wanted

- US FBI Most Wanted

- Regulatory Enforcement: US FRB Enforcement Actions

- Regulatory Enforcement: US OCC Enforcement Actions

Compliance. Trust. Transparancy

Customized and cost-effective AML compliance services to support your business always

Advanced Search Algorithms in AML Software

Advanced search algorithms are required in order to reduce both the false positives as well as negatives in customer monitoring and the customer screening process.

During the course of the customer account opening process, a few errors might occur in the name and surname of the customer. Missing information or incorrect information can lead to a few unintended errors in knowing your customer (KYC) and customer due diligence (CDD) processes.

Hence, you should pay close attention to whether there is an advanced search algorithm in the PEPs, sanctions lists, or adverse media search data solutions that you have selected.

API Integration feature in AML Software

AML software solutions actually automate the anti-money laundering compliance process of companies. API integration is the feature that facilitates automation.

By integrating the project of your client and anti-money laundering software with API, business enterprises can ensure that all the scanning processes are taking place automatically without having any workforce working actively in the background.

For instance, you are a financial institution that encounters over a thousand clients each day. It would require a massive workforce in order to query all of these customers manually. But the API integration eliminates this

problem, resulting in the conduction of all of such processes in the background automatically, quicker, and safer.

AML Compliance officers should take the required steps in order to ensure that the software is updated to its latest version and is perfectly fit to serve its baseline purpose.

In addition, anti-money laundering compliance officers should also consider the unique training needs of the employees within their financial institution. Finally, the employees who will be using this software have to get through with the processing of the entire technology.

Finding the Best Anti-Money Laundering Software

If you take all of these factors into consideration while selecting the AML software, there is not a single doubt that you will not get the best one. However, if you are still facing hardships, we, AML UAE, are at your rescue, always and forever!

Our recent blogs

side bar form

Share via :

Frequently Asked Questions (FAQs)

Here are a few frequently asked questions about the socio-economic impact of money laundering activities.

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.