How do you do a Sanction Screening?

Customer Screening is a critical element in the AML compliance. According to the Cabinet Resolution, no 74 of 2020, financial institutions and Designated Non-Financial Businesses & Professions (DNFBPs) must conduct daily screening of their customers and match the names on the sanction lists- Local Terrorist List and the UNSC list. Companies should make themselves aware of the regular updates in the sanction lists and prevent the financing of terrorism.

The Cabinet Resolution, no 74 of 2020, applies to the Targeted Financial Sanctions (TFS). It refers to sanctions which are financial prohibitions- freezing funds or assets and preventing the customers from using them directly or indirectly.

There are guidelines provided that businesses can refer to while screening their customers, making the process highly efficient and gaining accurate results. Companies can quickly examine whether their customers are on the UN List or Local Terrorist List.

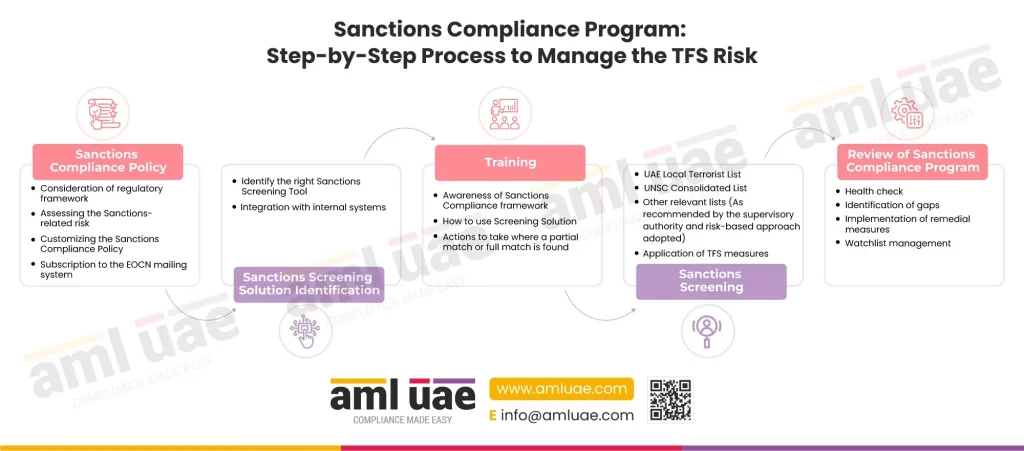

Guidelines for Sanctions Screening

Primary Requirement for TFS Screening

As per the TFS guidelines, organisations obligated to conduct the screening must continuously monitor their customer databases to identify any possible match with names on the sanction list issued by the UN or in the UAE Local Terrorist List.

Companies under obligation include financial institutions and DNFBPs like accountants, auditors, lawyers and real estate agents. Other business persons include dealers of precious metals & precious stones. The trust & corporate service providers are also obliged to conduct the sanction screening.

When should the Initial Sanction Screening be conducted?

The companies have to conduct the initial screening before the customer onboarding process and/or carry out an occasional transaction. After that, they need to conduct screening daily. They need to update themselves on the changes in the sanctions list, which is regularly updated, so they need to check the website of the Executive Office or the UN website to go through the updated lists.

Which Databases should be checked for screening?

Companies under obligation should check different databases to conduct the TFS Screening:

- Existing customer databases and names of parties to any transactions.

- Potential customers.

- UBOs.

- Names of individuals or entities who are directly or indirectly related to them.

- Customers before conducting any transactions or establishing a business relationship with any Person.

- Individuals- Directors and/or agents acting on behalf of customers and persons authorised to act on behalf of the customers with a power of attorney.

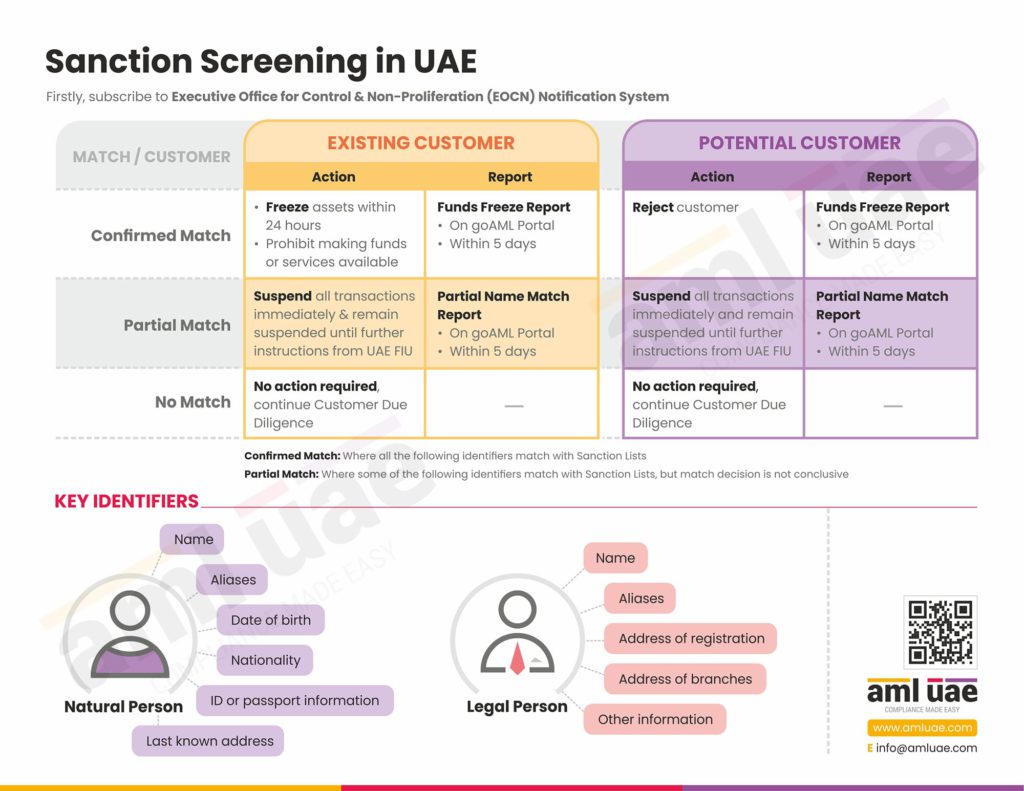

Identifying a match to fulfil Targeted Financial Sanctions Requirements

Companies should conduct the screening process every day to determine any possible match to the names appearing on the Local Terrorist List or UN List. They can get the following information for screening purposes-

- For Entities- information such as the Name or Names, Aliases, and Address of Registration and Address of branches.

- For individuals, the screening information consists of the Date of birth, ID or passport information, and Last known address.

Potential Matches, Confirmed Matches & False Positives

During the screening process for the TFS, there might be a potential match to a name on the sanction list, a confirmed match, or a false positive.

A potential match refers to a match between data in the Sanctions Lists with any name in the databases. However, it does not mean that the potential match is always subjected to Targeted Financial Screening.

A confirmed match is when a potential match has been confirmed to be the individual, group, or entity subject to TFS. Also, if there is suspicion that the potential match may match an individual, group, or entity subject to TFS, it is considered a confirmed match. The company has to immediately freeze the funds and share the information with the FIU via goAML Portal in such a case. The company must notify within five days from freezing the funds or attempts to do so.

If there is no matching result found in the sanctions list, then the company is free to conduct business as usual. Similarly, companies can enter into a business relationship with clients who were false positives.

AML Sanctions Screening Software

FIs and DNFBPS would be better off if they utilise AML Sanctions Screening Software. Such AML Software helps carry out screening, identifies PEPs and keeps the record of such screening. Further, it is updated regularly with the UAE local sanctions list and UNSC Sanctions list. It gets easy to comply with AML regulations as AML Software automatically screens the entire database of customers and suppliers on a daily basis.

Sanction Screening in UAE

Expert AML Compliance Assistance

It is mandatory to abide by the guidelines for the TFS. AML UAE is one of the top consultants in the UAE, with a team of AML compliance experts. We offer a wide range of services such as AML Training, AML/CFT Health check, AML software selection, AML/CFT Policy Controls, and Procedures Documentation. Other services include Annual AML/ CFT Risk Assessment Report and in-house AML/ CFT compliance department set up. Rely on high-quality consultancy services and get help complying with the detailed TFS requirements. Contact the expert to abide by the sanctions screening requirements and avoid penalties.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.