High-Risk Country Reporting – HRC and HRCA

With increased monitoring emphasized on transactions with persons or entities hailing from high-risk countries, the Ministry of Economy provides for filing of a separate report capturing details about such transactions. These reports are:

- High-Risk Country Report or High-Risk Country Transaction Report (HRC)

- High-Risk Country Activity Report (HRCA)

The reports mentioned above are to be filed by both – Financial Institutions and Designated Non-Financial Businesses and Professions (DNFBPs).

When is HRC/HRCA to be filed?

High-Risk Country Transaction Report: If at the time of establishing or in the course of the customer relationship or when conducting transactions on behalf of a customer, a reporting entity observes transactions related to high-risk countries subject to a Call for Action (access the list of jurisdictions here), then the entity is required to submit an HRC.

High-Risk Country Activity Report: If during the establishment or course of the customer relationship or when conducting an activity on behalf of a customer, a reporting entity identifies activities related to high-risk countries subject to a Call for Action (access the list of jurisdictions here), then the entity should submit an HRCA.

What activities or transactions are to be reported in HRC/HRCA?

Any cross-border transaction involving the transfer of funds through a banking channel or any remittances, either originating from, destined to, or passing through a high-risk country, would be subject to reporting in HRC/HRCA.

It does not necessarily require the physical presence of the person (transferor or transferee of funds) in the high-risk country at the time of remittance or receipt of funds. Instead, association by nationality or place of residence in high-risk countries would also be considered in the case of a natural person. While in the case of a corporate entity, the company’s place of incorporation or operation, as well as the association of the UBOs or authorized signatory or senior management with high-risk jurisdictions, must be considered.

Accordingly, any transaction or activity about transferring funds into or from high-risk countries would be subject to reporting to FIU. Please note that such reporting is irrespective of the amount involved or the currency.

How and to whom is HRC/HRCA to be filed?

As the Financial Intelligence Unit (FIU) is the reporting authority for all AML matters in the UAE, the HRC and HRCA must also be filed with FIU.

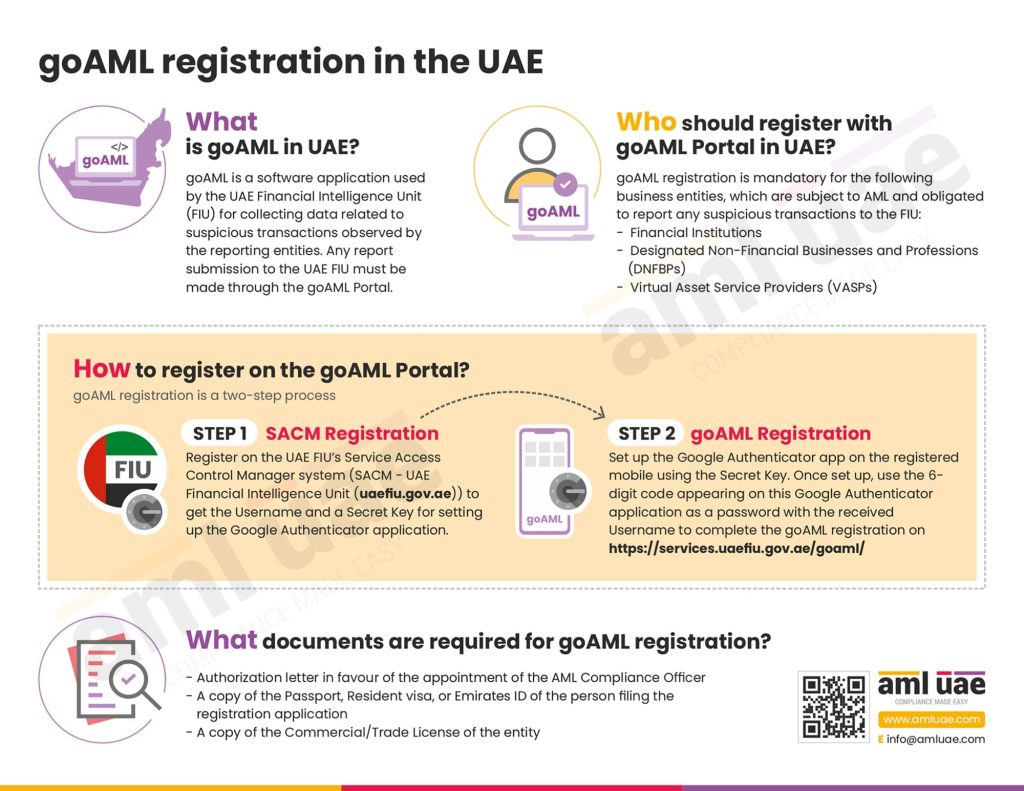

Like all other AML reports (such as STR, SAR, DPMSR), HRC and HRCA are also reported through the goAML Portal. While submitting the reports on goAML, the appropriate report type must be selected by the reporting entity. FIU does not accept any report either through physical mode, via email, or as a message on the Message Board available on the goAML Portal.

In the case of a transaction with a person from a high-risk country, if the reporting entity does not have the necessary details related to the transactional attributes mandatory to be captured on goAML, then the reporting entity may choose to file an HRCA. Here, the reporting entity must ensure that all the adequate details of parties, value involved, etc., are adequately captured.

What is the Financial Institution’s and DNFBP’s obligation post-filing HRC/HRCA?

Once HRC or HRCA has been filed with FIU, reporting entity must withhold the execution of the transaction for three (3) days from the date of reporting to FIU, as the FIU is expected to respond to such HRC/HRCA during these days. If, during these three (3) days, FIU does not object to or respond to filed HRC/HRCA, then reporting entity can conduct the transaction basis the due diligence performed for the subject party and the transaction. Such transaction execution will be at the judgment of the reporting entity only.

If the FIU issues any instructions concerning filed HRC/HRCA within the prescribed time, the same needs to be adhered to by the reporting entity.

Transactions and the parties reported in HRC/HRCA should be subject to frequent ongoing monitoring by the reporting entity

Is there any exemption from filing HRC/HRCA?

HRC/HRCA reporting requirement is applicable only in cases of cross-border transfers.

Accordingly, transactions like domestic cheques, payment of domestic utility bills using a card issued in UAE or cash by a person hailing from a high-risk country, etc. are exempted from HRC/HRCA reporting requirements, as no banking or remittance channels have been used for the international transfer of funds.

Illustration:

A. Assume you are a TCSP and a corporate entity with a place of incorporation in the high-risk jurisdiction approaches you for assistance in setting up a branch in UAE. For such a transaction, the person has traveled to UAE from another country. The payment for the said services would be remitted to your account from the company’s account with a bank in another high-risk country.

Since there is cross-border movement of funds by bank transfer, the proposed transaction must be reported in HRC/HRCA. Here, DNFBP shall ensure that the reported transaction shall only be executed if the FIU does not object to the transaction and after three working days after filing an HRC.

B. An individual from high-risk jurisdiction has visited a non-banking financial institution in UAE to get the US Dollars converted to AED. Here, the currency exchange transaction occurs in UAE without any funds transferred through banks. Accordingly, the financial institution would be exempt from reporting this transaction with FIU.

AML UAE

With every increasing reporting requirement and risk of money laundering to businesses, it is always good to have a team of professionals at your resort to safeguard your business from being vulnerable in the hands of launderers and stay compliant with regulatory requirements. If you are looking for such assistance, AML UAE is there for you – your trusted partner for AML Compliance.

Our timely and accurate AML consulting services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

FAQs About High-Risk Country Reporting

Yes, DNFBPs and Financial Institutions are required to file HRC with FIU.

The DNFBPs and the Financial Institutions must file HRC or HRCA using their goAML registration credentials. Third parties can assist you in filing these reports with FIU, using the reporting entity’s credentials for the goAML portal.

While establishing business relationships or conducting business activities, if you identify any activity or transaction with a person or entity having an association with high-risk countries, then as DNFBP, you are required to submit the HRC or HRCA with FIU UAE via the goAML Portal.

HRC or HRCA reporting requirement is for high-risk countries classified as “High-risk jurisdictions subject to a Call for Action” by FATF.

FATF has classified the below-mentioned countries as high-risk jurisdictions subject to a “call for action”:

- Democratic People’s Republic of Korea (DPRK)

- Iran

There is no threshold amount prescribed for filing HRC and HRCA. Every transaction involving high-risk countries must be reported in HRC and HRCA, irrespective of the transaction value.

Transactions not involving any cross-border transfer of funds to or from the high-risk countries are exempted from HRC/HRCA reporting requirements, like domestic cheques, payment of domestic utility bills using a card issued in UAE, cash by a person from a high-risk country, etc.

Once an HRC or HRCA has been filed with FIU, the reporting entity shall keep the execution of the subject transaction on hold for three days from the date of submission of HRC/HRCA.

No, domestic transactions which do not involve any international transfer of funds to high-risk countries are not required to be reported.

The transactions related to trading shares/stocks, forex, crypto assets, bonds, mutual funds, commodities, etc., would also be subject to HRC/HRCA if these transactions are cross-border.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.