Why money launderers prefer using gold for money laundering

For example, in many developing countries, gold jewelry is not only perceived as an adornment but also as an effective savings vehicle. Even now, the Gold reserve of the country determines its creditworthiness. Gold stands tall as a status symbol and has a lot of cultural values too. Hence making Gold for Money Laundering as a perfect choice. It is also an instrument of investment.

As the financial regulators grow strong and robust, so do the Gold for Money Laundering methods. The inventions and discoveries on Gold for Money Laundering methods and trends never end. Precious metals like Gold, Platinum, and silver were not much on anyone’s radar. So when banks tightened the noose, the money launderers resorted to precious metals like gold and platinum, and real estate, etc., to use Gold for Money Laundering.

Using Gold for Money laundering is not a new trend. This comes from history. The BFSI industry is shutting its door one by one, so money launderers will find some new trends or retrofit the old trends. One does not need a tax identity to buy gold. This paves the way for using Gold for Money Laundering in all 3 layers of Money laundering. Gold seems to be lucrative for all sides of the transaction.

12 reasons why Gold for Money Laundering is used:

1. Contango:

The gold market is mostly in Contango. This means the Future price of gold is greater than the spot price. Even during the downtimes, gold has been the prime choice for commodity trading.

2. Liquidity:

The liquidity of gold is high when compared to other modes of investments like Bank FDs, Stocks & Mutual Funds. Unlike the other investment products, you don't need a bank account to buy or sell gold. Redemption from gold is instant & we can get ready-cash instantaneously.

3. Always OTC:

Gold can be sold anywhere Over the Counter & isn't controlled by any exchange. Unlike markets, you can even sell or buy on weekends too. It is easy to find buyers or sellers for gold rather than stock. Hence they use Gold for Money Laundering.

4. Tax:

There is no tax associated with gold when you go with an investment perspective. The sales tax or VAT is all that you pay.

5. Return on investment:

Unlike Stocks/Bonds, Gold will give reliable returns depending on the market rate.

6. Attractive for tax evaded money:

Money laundering need not necessarily be done for Terrorist financing or illicit proceeds. Sometimes people launder the money that was evaded from tax. This can be rental income, Benami transactions, money coming from Hawala transactions/remittances.

7. Efficient:

Gold can be used in all 3 layers of Money Laundering. Be it Placement or Layering, or Integration.

8. Global currency:

Gold is considered a global currency. One can buy or sell gold anywhere around the globe. There is no currency conversion or loss there. One can buy it in the eastern part of the world and sell it in the west without losing the face value.

9. Complex transactions:

The transactions involving the gold or jeweller are too complex to drill down. There might be multiple persons involved on both sides of the transaction.

10. Transformable:

Gold can be changed into many forms (Jewelry) and denominations (Coins / Bars) without losing the face value. This helps money launderers to use gold for Smurfing or Smuggling and many such methods.

11. Win-win game:

The jewellers need gold for trading and manufacturing purposes. So there's always a demand for it. It's a win-win situation for dealers in precious metals and stones, and the money launderer as both of them get to trade for their benefit.

12. Lack of regulatory reporting:

Unlike Banks / FIs, they can keep their transactions under their control. In many countries, there is no periodic submission of Cash transaction report or Suspicious Transaction report. Such a multi-faceted commodity somehow missed the attention of the regulators. Even if it comes to a need for supervision, there will be a question of 'Who will regulate the gold?' Will it be the commodity market? Or the Central Bank? Or the Government?

Share via :

Our recent blogs

side bar form

Share via :

FAQs on Gold for Money Laundering

Add Your Heading Text Here

Using Gold for Money laundering is not a new trend. This comes from history. The BFSI industry is shutting its door one by one, so money launderers will find some new trends or retrofit the old trends. One does not need a tax identity to buy gold. This paves the way for money launderers to use the gold in all 3 layers of Money laundering. Gold seems to be lucrative for all sides of the transaction.

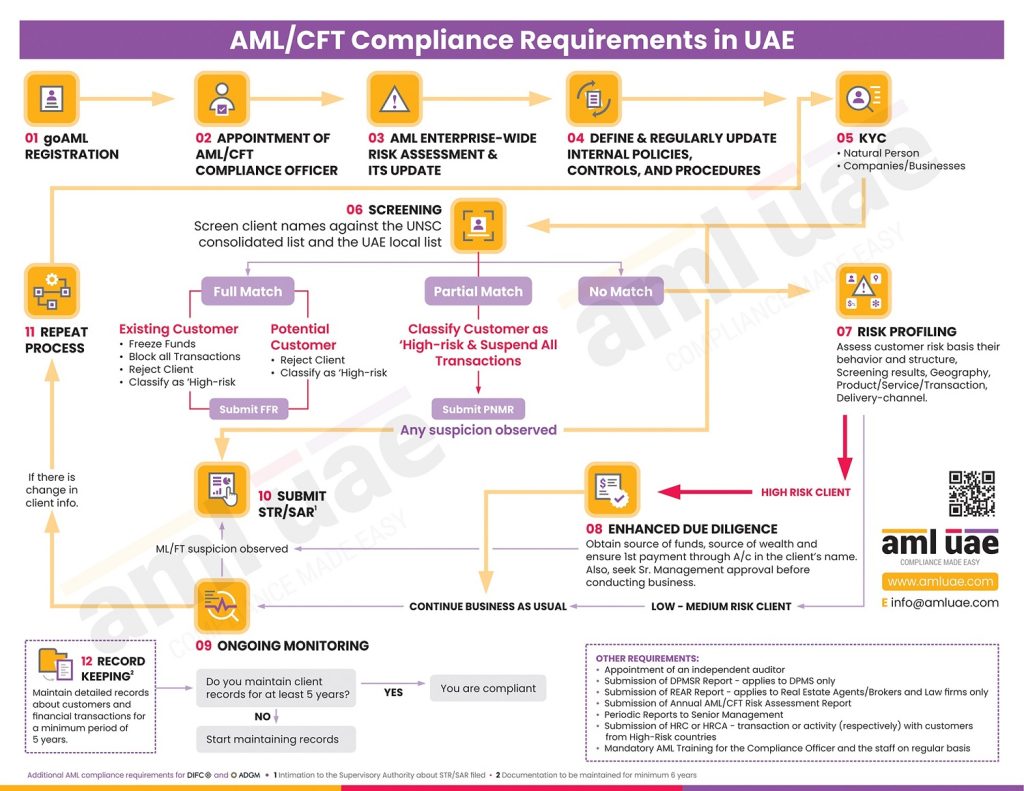

The regulatory authorities identified this trend, and it started monitoring the precious metals sector by bringing it under the preview of the AML law by terming them as Designated Non-Financial Businesses and Professions (DNFBPs).

12 reasons why gold is used for money laundering purposes:

1. Contango:

The gold market is mostly in Contango. This means the Future price of gold is greater than the spot price. Even during the downtimes, gold has been the prime choice for commodity trading.

2. Liquidity:

The liquidity of gold is high when compared to other modes of investments like Bank FDs, Stocks & Mutual Funds. Unlike the other investment products, you don't need a bank account to buy or sell gold. Redemption from gold is instant & we can get ready-cash instantaneously.

3. Always OTC:

Gold can be sold anywhere Over the Counter & isn't controlled by any exchange. Unlike markets, you can even sell or buy on weekends too. It is easy to find buyers or sellers for gold rather than stock.

4. Tax:

There is no tax associated with gold when you go with an investment perspective. The sales tax or VAT is all that you pay.

5. Return on Investment:

Unlike Stocks/Bonds, Gold will give reliable returns depending on the market rate.

6. Attractive for tax evaded money:

Money laundering need not necessarily be done for Terrorist financing or illicit proceeds. Sometimes people launder the money that was evaded from tax. This can be rental income, Benami transactions, money coming from Hawala transactions/remittances.

7. Efficient:

Gold can be used in all 3 layers of Money Laundering. Be it Placement or Layering, or Integration.

8. Global Currency:

Gold is considered a global currency. One can buy or sell gold anywhere around the globe. There is no currency conversion or loss there. One can buy it in the eastern part of the world and sell it in the west without losing the face value.

9. Complex transactions:

The transactions involving the gold or jeweller are too complex to drill down. There might be multiple persons involved on both sides of the transaction.

10. Transformable:

Gold can be changed into many forms (Jewelry) and denominations (Coins / Bars) without losing the face value. This helps money launderers to use gold for Smurfing or Smuggling and many such methods.

11. Win-win game:

The jewellers need gold for trading and manufacturing purposes. So there's always a demand for it. It's a win-win situation for dealers in precious metals and stones, and the money launderer as both of them get to trade for their benefit.

12. Lack of Regulatory Reporting:

Unlike Banks / FIs, they can keep their transactions under their control. In many countries, there is no periodic submission of Cash transaction report or Suspicious Transaction report. Such a multi-faceted commodity somehow missed the attention of the regulators. Even if it comes to a need for supervision, there will be a question of 'Who will regulate the gold?' Will it be the commodity market? Or the Central Bank? Or the Government?

Add a comment

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.