Exploring unusual transaction trends for VASPs under UAE AML Regulations

With the growing acceptance of virtual assets (used to store the value, medium of exchange, for investment purposes, etc.), criminals have also started exploiting the sector for laundering illicit funds and financing terrorist activities. The launderers’ preference towards cryptocurrency and non-fungible tokens (NFTs) is owing to the nature of the product – easy to transfer across countries within a few seconds, and that too without disclosing the identity in most cases. This calls for the Virtual Asset Service Providers (VASPs) to stay alert to detect unusual trends or suspicious virtual asset transactions indicating the use of criminal proceeds or intended to conduct a financial crime.

For the same reason, the VASPs have been put under anti-money laundering (AML) regulatory regime, mandating the VASPs to develop and implement appropriate AML programs to curb the potential vulnerabilities.

This article will discuss the unusual activities involved in virtual assets, the financial crime red flags for VASPs, and the best practices that a VASP may adopt to detect and manage financial crime risk.

Identifying Unusual Transaction Patterns

Generally, the Virtual Asset Service Providers are entities conducting activities related to virtual assets in the course of routine business activities, which involve conversion of the virtual assets to fiat currencies or vice versa, transferring virtual assets from one wallet to another, providing virtual asset custodial services, etc.

The UAE AML regulations mandate the VASP to implement a comprehensive AML compliance program to combat money laundering and terrorist financing by deploying solid processes and systems to identify and prevent financial crime attempts involving crypto and NFTs. Given the vast volume and the pace of transactions, the VASPs must continuously monitor and report any unusual activities related to virtual asset transfers suggesting potential financial crime.

The VASPs must understand some common characteristics indicating the virtual asset transaction to be a potential risk of financial crime, and the monitoring rules and systems must be designed bearing these characteristics in mind to ensure timely identification and curbing of unusual transactions.

Some of the Common Characteristics of Unusual Transactions related to Virtual Assets

The following are some of the unusual transaction patterns related to virtual asset transfer that can serve as the key risk indicators for VASPs:

Persons attempting to avoid Customer Due Diligence requirements or providing false information

The person who tries to avoid the Customer Due Diligence process conducted by the VASP to evade the identification or the person who provides fake documents or false identification information is one of the biggest red flags that require the VASP to take immediate action.

Large-value transactions without any apparent economic purpose

One of the risk indicators is that the person is making a large value transfer of virtual assets to one or multiple wallets without any logical or legal rationale. Such transactions require detailed inquiry from the VASPs to understand the actual intention and purpose of the transactions.

Person making multiple large-value virtual asset transfers in a short period

Frequent movement of funds between two virtual asset wallets

Transactions with counterparties in high-risk countries or jurisdictions with weak AML controls over VASPs

Frequent transactions with counterparties in countries with no or weak AML regulations or countries known for money laundering can be treated as suspicious transactions, warranting examination by the VASP.

Virtual asset transfers to known criminals or involving the dark web

One of the critical risk indicators suggesting the transfer to be unusual is when the parties involved are known to have criminal connections or the transfers are routed using the dark web marketplaces.

Conversion of one type of cryptocurrency to multiple virtual assets

Frequent conversion of large amounts of one type of cryptocurrency into multiple virtual assets within a short period suggests a suspicious pattern of transactions.

Conversion of fiat currency to virtual asset and immediate withdrawal in another jurisdiction

With the easy conversion process of fiat to crypto, the launderers have started converting the illegal cash into virtual assets in one country, followed by immediate withdrawal of such virtual assets into fiat in some other jurisdiction. This is one of the nature of unusual activities, specifically when such other jurisdiction is under the “high-risk” category.

Managing the Unusual Transactions related to Virtual Asset transfer

The UAE AML regulatory regime requires the VASP to establish and maintain robust monitoring systems and controls that can effectively detect suspicious activities and generate timely alerts for the VASP to act and prevent.

Considering the volume and nature of virtual asset transactions, the VASP must consider deploying emerging technologies and tools like Artificial Intelligence, Machine Learning, or Blockchain that use advanced algorithms and data analytics techniques to identify inconsistencies and unusual patterns.

Best AML Practices for VASPs to Detect and Report Unusual Transactions Related to Virtual Assets

A. Adopting a Comprehensive AML Program

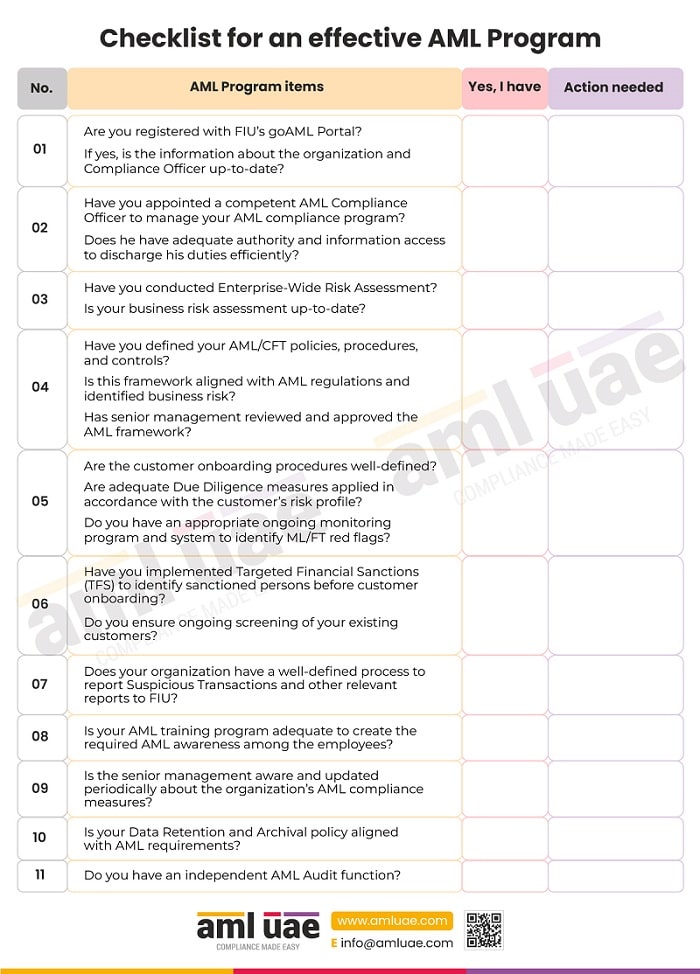

The primary AML responsibility of any VASP operating in the UAE is to assess the potential financial crime vulnerabilities it may face and accordingly design the AML Compliance Program. The AML framework must include the AML policies and procedures navigating and guiding the VASP to manage financial crime exposure and prevent money laundering, terrorist financing, and financial crimes damaging the virtual asset ecosystem.

These AML policies and procedures must include the following:

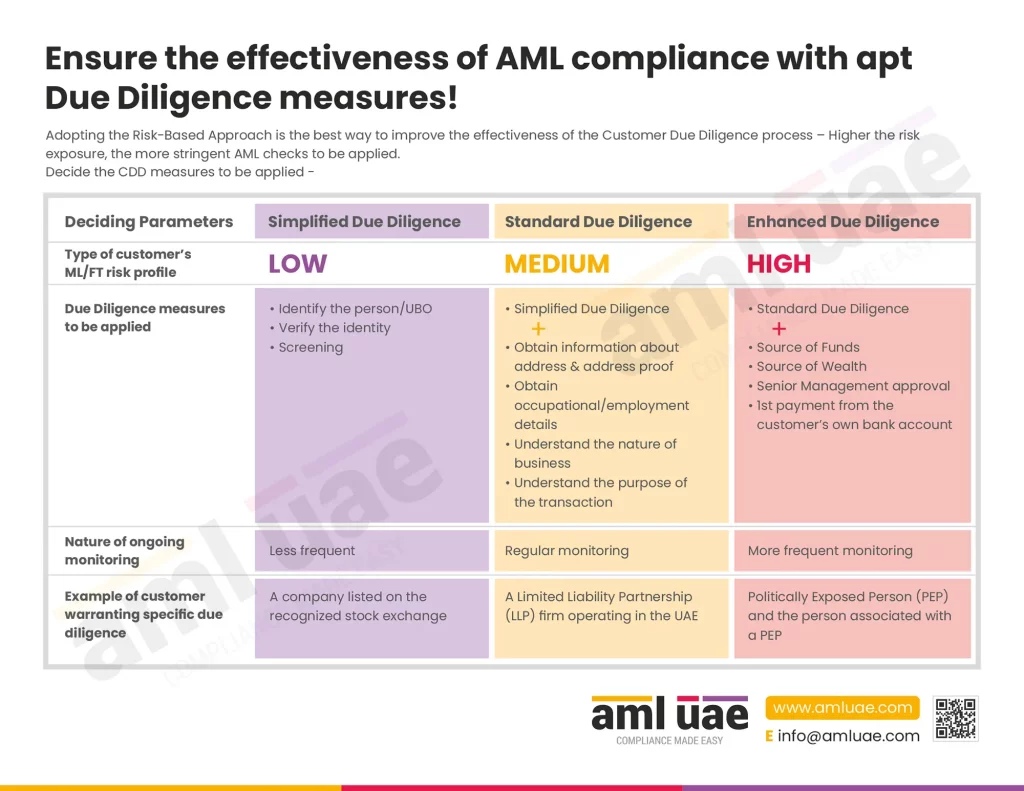

- Robust customer onboarding process – strong Customer Due Diligence, covering the Know Your Customer (KYC) and Know Your Transactions (KYT) measures to identify the virtual asset wallet holder and assess the customer’s risk profile.

- Effective measures to identify the corresponding VASP (Know Your VASP)

- Implementing the Targeted Financial Sanctions to refrain from the entry of the sanctioned individuals.

- Mechanism to identify and report suspicious activities.

- Adequate AML training program to ensure the team is well-aware and well-trained to detect and report unusual transactions.

- Appropriate Management Information Systems (MIS) to track the virtual asset activities.

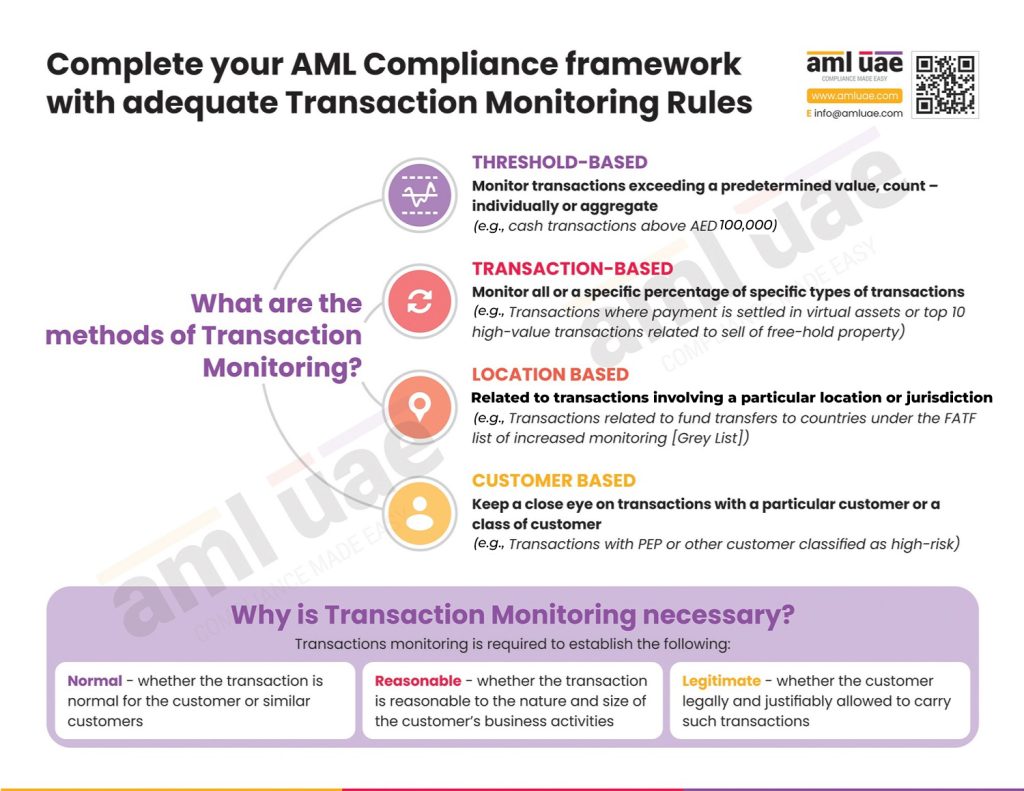

In addition to the above, the AML program must lay down the procedures and controls around continuous monitoring of the transactions to track the legitimacy, accuracy, accuracy, and consistency of the virtual asset transfer with the originators and the beneficiary’s risk profile. The monitoring program must consider factors like the nature of the customer, location, risk rating of the person, etc.

These AML frameworks – policies, procedures, and controls- serve as a foundation for the VASP’s AML compliance structure, shielding the virtual asset industry from being misused by money launderers and other financial criminals.

B. Leveraging the technology to reinforce the AML program

Ongoing and real-time transaction monitoring is essential to identify unusual transactions or customer behavior inconsistent with their profile. Managing large transfers, where millions of virtual assets are exchanged in a second, would not be possible without utilizing automated systems that support data analysis, detect anomalies, and highlight the same to the concerned person for due inquiry and resolution.

The solution for real-time monitoring must handle enormous amounts of data and be compatible with blockchain technology. This will allow the VASP to stay ahead of the criminals and possibly prevent the exploitation of the virtual assets before concluding the transfer.

The system must be configured to manage the VASP’s specific risks, using logical monitoring rules based on threshold amount, frequency of transactions, the wallets involved, detection of blacklisted wallets or restricted cryptocurrencies, high-risk jurisdictions, etc.

The tools should not be restricted to detecting red flags or inconsistencies, but the intelligent algorithms should help the VASP to predict the trends and risk vulnerabilities that may impact the operations in the near future. This will enable the VASP to adopt a proactive approach to get ready to fight financial crime.

Thus, the role of technology in monitoring transactions to identify unusual transactions and suspicious patterns cannot be overruled. Only by leveraging the automated tools and techniques supporting real-time monitoring can the VASPs strengthen the quality of their AML program to timely identify uncommon and suspicious activities and maintain integrity and transparency in the virtual asset domain.

With AML UAE, enhance your AML program to shoot down the suspicious activities

Awareness of the red flags and risk indicators related to virtual assets is essential to detect unusual transactions and suspicious patterns suggesting money laundering. Leverage the experience and knowledge of AML UAE’s professionals in building a robust AML program customized to VASP-specific risks. We help VASPs develop the AML controls ongoing monitoring rules, define the red flags that trigger prompt signals, and are backed by our support in identifying and implementing the right tools and software.

Let’s come together and safeguard the virtual assets industry.

Make significant progress in your fight against financial crimes,

With the best consulting support from AML UAE.

Our recent blogs

side bar form

Share via :

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.