Customer Lifecycle Management and AML Compliance in the Digital World

Customer lifecycle management(CLM) has become automated, quick, and efficient in the digital world. This risk assessment environment is different from the traditional scenarios, which were characteristic of a tedious manual process working in isolation and targeting specific functions and limited to particular businesses.

However, regulated entities had to forego this approach and adopt an aggressive risk management approach with acceleration in the digital world and adoption of the digital KYC mechanism.

Customer lifecycle in the digital age has witnessed a rapid transformation. As mentioned earlier, customer lifecycle processes were siloed, labour intensive, needless to say, time-consuming, and prone to errors. The focus is on digital lifecycle management, which connects disparate systems and provides a unified solution to verify customer identity efficiently. CDD – Customer Due Diligence is the primary function that needs to be performed by Financial institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Assets Service Providers (VASPs).

Traditional approaches need to be shunned in an evolved digital marketplace

The traditional customer verification method involved an actual visit to the branch where employees would verify the hard copies of the documents. This process is becoming redundant as mobile transactions have increased drastically. Every process is completed online such as opening bank accounts, getting a loan, creating a fixed deposit, and transferring money. The customer’s verification process has too shifted online, where branch visits are not necessarily required. In a changing business landscape and evolving customer preferences, they need instant gratification, and branch visits are becoming a thing of the past. It has been estimated that the branch visit will be drastically reduced by 36%, and there will be more than a 120% increase in mobile transactions.

Digital KYC and CDD processes will take center stage. It is estimated that by 2022, 60% of the world economy will be digitised. Such unprecedented growth requires robust measures for customer identification and verification. New digital ID systems are being extensively used to mitigate the risks arising in the evolving digitised world. It is necessary to understand how digital ID systems work and help businesses identify any fraudulent financial activity in the garb of legitimate transactions.

Digital ID systems have a few basic components-

Digital KYC information collection

The deduplication process is carried out, which is a part of identity proofing. It involves collecting attributes and the evidence for the same and features about a single unique identity. The applicants’ details, such as name, age, and gender are checked, and biometrics include fingerprints, iris scans, and facial recognition images. These, along with the government-issued IDs, are verified with the information in the database. With digital verification on the rise, the documents are stored in electronic forms in databases which can be referred to as and when required. It enables to obtain the identity evidence and verification remotely.

Validation

This step verifies if the digital KYC evidence submitted is genuine and accurate. The evidence is validated by checking the information submitted against reliable sources and matching the information in the independent databases/ sources.

Verification

This step involves confirmation that the validated identity is real and the person is the same who has been identity proofed.

Authentication

Authentication ensures that the person seeking online/ offline account access is the same person who has been identified and verified earlier. The digital identification process is done when people need access to online activities such as accessing net banking, transferring money online via app, and seeking authorisation to complete the process. Authentication is also required when someone asks for in-person interaction to access the account or conduct other financial activity.

The best part about digital identity verification is that banks and financial institutions do not rely solely on the authenticators/ credentials issued at the time of onboarding in such scenarios. Obviously, at the time of onboarding, after all the KYC, CDD, and EDD processes are completed, the person will possess the credentials issued to them. Still, digital verification also depends on continuous authentication. They rely on data points collected during the online session, such as the IP address, geolocation, etc.

What is CDD?

The CDD process helps reporting entities to combat money laundering and other financial frauds and prevent the financing of terrorism. The process includes collecting customer information and monitoring it throughout the business relationship.

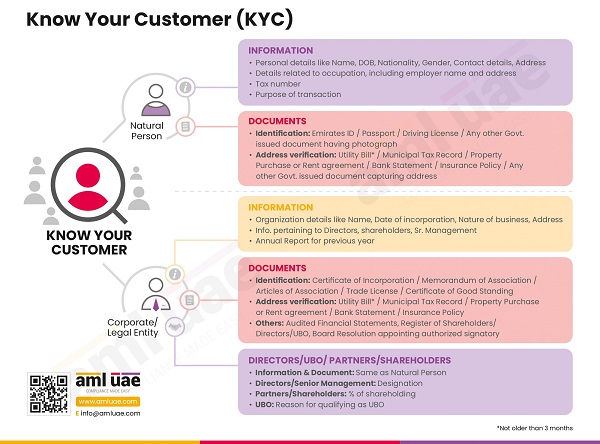

- Individual Customer Information: It collects customer information and verifies that the information submitted is accurate and that no false information has been submitted. The customer’s name, address, contact details, photo, occupation, unique ID number, and tax identification number is verified.

- Business information: It includes the name of the business, the type, and nature of the company, ultimate beneficial owners, source of funds, etc.

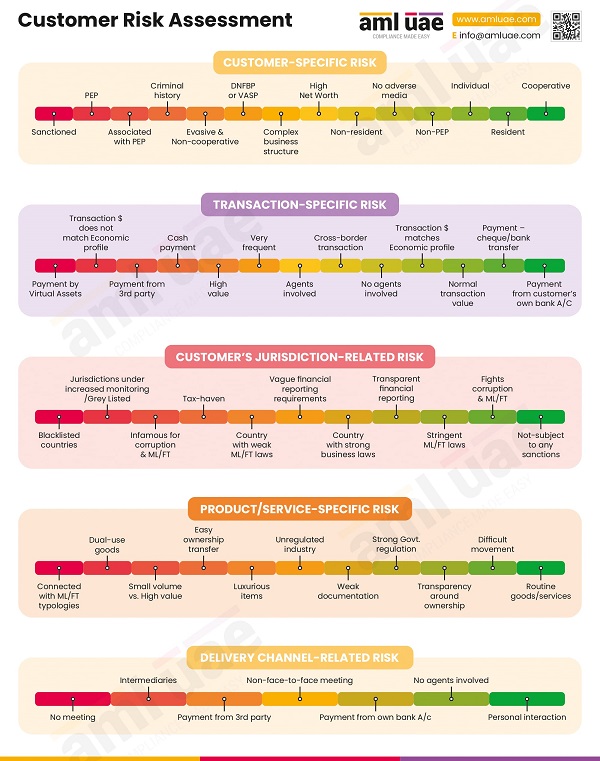

- Risk Assessment: After the verification process is completed, the customers are categorised as low, medium, or high-risk customers. This categorisation is done after considering different factors such as the customer’s identity, location, nature of the business, and identifying PEPs and UBOs. High-risk customers require enhanced due diligence compared to the low or medium-risk profiles. The risk assessment process provides clarity on the due diligence process that needs to be followed to follow the AML compliance process correctly.

- Continuous Monitoring: The ongoing monitoring keeps a tab on the customers’ transaction patterns and changes in customer profiles and identifies unusual transactions.

The CDD process becomes automated and more reliable in a digital landscape with emerging technologies such as Artificial Intelligence and Machine Learning. The introduction of biometrics has also made a massive difference in accuracy levels in identifying customers and has streamlined the process.

How is the customer lifecycle managed with greater efficiency with tech?

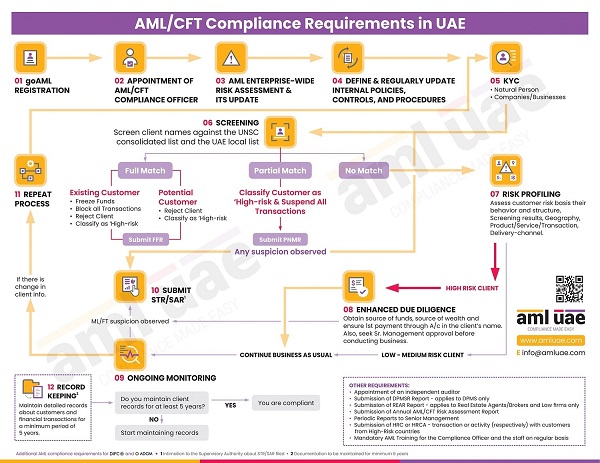

Regulatory compliance and serving customers with excellence have kept businesses on their toes as they need to fulfill both purposes with equal efficiency. They need to follow the AML rules and regulations and meet the evolving customers’ expectations. So, they choose to rely on AML software to instantly identify suspicious activities, which provides timely notifications that alert them in case of any fraudulent/ unusual transaction.

New and emerging technologies are being used in the customer lifecycle management landscape, often referred to as RegTech. They have been in use for a while and focus on solving only a part of the more significant compliance problem rather than serving as a complete solution that can take over the compliance issues and risk assessment scenario and reduce the false positives. However, with better technology and the emergence of advanced AML software, financial institutions have solved compliance issues and safeguarded their reputation from being maligned by unknown risks. It is vital to adopt a risk-based approach as money launderers find innovative ways to launder their illicit money.

AML Compliance in the Digital world

Digital acceleration has changed the course of AML compliance for businesses as they need to brace themselves up to fight financial fraud and provide customers with the best experiences. Digital payments have witnessed exponential growth. So there is increased pressure on the regulated entities to overhaul their client Lifecycle management process.

Financial and other regulated entities have to mandatory follow the AML compliance requirements. They have to follow the KYC diligently- Know Your Customer, CDD- Customer Due Diligence, and the EDD- Enhanced Due Diligence collect, verify and continuously monitor customer identity, evaluate risk profile and keep themselves AML compliant. Apart from following the AML rules and regulations, financial institutions must focus on enhancing customer experience.

FATF guidelines on Digital ID

The FATF regularly provides guidelines for AML compliance. It is advisable to follow the procedures as it helps reporting entities brace themselves against challenges in a digitally enhanced landscape. Client verification remotely has become a prominent trend in the recent past, especially during pandemic times.

- Verify the customer’s identity

- Understand and verify the type and nature of the business relationship

- Continuous monitoring.

Where deemed necessary, the reporting entities should perform background checks for criminal records and politically exposed persons and determine the customers’ citizenship. These verification processes depend on the risk profile of the customers or the risk posed by the business transaction.

Digital KYC- Customer Lifecycle Management and KYC

Digital KYC is an online process that involves video-based KYC. It is a must to have an audio-video-enabled device.

The reporting entity will remind the person of the online appointment for the KYC process. The customer must ensure that all the required documents are furnished for the KYC process. The institution will send a video link via message or email. The customer, with the help of an interactive online application, completes his Digital KYC. In this process, the application will capture the live video/photo and the documents to complete the verification process. It will ask for age, address, occupation, nature, type of business, political association, etc. That will be verified with the documents submitted for verification.

Why is AML Training Important?

Employees need to be acquainted with updated knowledge on the software and methods with which they can identify fraudulent transactions and prevent financial frauds such as money laundering. It is not easy to spot fraudulent transactions such as layering, and so the employees need to be provided with technology that can aid them in strict transaction monitoring.

So, what is the solution for the increased risks in identifying the AML risks?

Digitalization has urged financial organisation to improve their customer identification programs and sync with the evolved customer identification requirements. The digital AML process is automated at every step of the customer verification, right from the customer onboarding process, customer due diligence, risk assessment m identification of UBOs, PEPs, and Enhanced due diligence process- the entire spectrum of the customer verification process.

When digital channels have become a passage for money laundering and financial fraud, it is better to be equipped with advanced technology—emerging technologies such as AI and ML. AML software has built-in technologies that help identify financial scams and reduce false positives. The software helps combat money laundering and empowers financial institutions and other regulated entities to improve AML detection and thwart risks in a digitally accelerated world.

Benefits of the AML Software

The AML software is a crucial element in the AML compliance strategy. It efficiently collects the customer information- KYC, CDD, and EDD which are the foundation of an efficient AML compliance program. The software stores the data with customer identity verification processes such as KYC- Know Your Customer, CDD- Customer Due Diligence, and EDD- Enhanced Due Diligence. It efficiently verifies the customers’ identity and makes the financial institutions and other regulated entities aware of any fraudulent identity or transaction.

It evaluates the risk of being associated with a customer/ entity. So, the institution can follow appropriate measures while establishing a business relationship and continuously monitor the customer lifecycle. Moreover, the software scans the customers against a sanction list and identifies potential risks. Financial Institutions can extract more information about PEPs- Politically Exposed Persons and the UBOs- Ultimate Beneficial Owners and correctly evaluate the risk of establishing and maintaining customer relationships.

AML UAE – A forerunner in helping organisations in being AML Compliant

AML UAE is a leading and highly reliable AML consultant operating in the UAE and serving thousands of businesses to keep pace with the fast-evolving digital world and improve their customer identification process. It offers an array of services, including AML software selection. For further information, feel free to contact us.

Our Timely and Accurate AML consulting Services

For your smooth journey towards your goals

Our recent blogs

side bar form

Add a comment

Share via :

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 25 years of experience in compliance management, Anti-Money Laundering, tax consultancy, risk management, accounting, system audits, IT consultancy, and digital marketing.

He has extensive knowledge of local and international Anti-Money Laundering rules and regulations. He helps companies with end-to-end AML compliance services, from understanding the AML business-specific risk to implementing the robust AML Compliance framework.